Single store average monthly losses exceed one million, dealers are on the brink of collapse due to the price war

![]() 09/30 2024

09/30 2024

![]() 542

542

In the current Chinese automotive market, the ongoing "price war" is like a double-edged sword. While it stimulates sales in the short term, it also causes unprecedented pain for automobile dealers. This competitive strategy initiated by automakers ultimately burdens dealers at the forefront of the market with a heavy load.

On September 23, the China Automobile Dealers Association (CADA) issued a notice stating that after receiving feedback from a large number of member companies, the association quickly conducted extensive research and analysis and recently submitted an "Emergency Report on the Current Financial Difficulties and Shutdown Risks Faced by Automobile Dealers" to relevant government departments. This report not only reveals the current difficult situation of automobile dealers but also provides an important reference for government decision-making.

Tight capital chains have become the norm

Currently, automobile dealers are generally incurring large-scale losses in new car sales, with cash flow deficits becoming the norm, and the risk of capital chain ruptures is increasing. Behind this phenomenon lies the dual pressure of weak consumption and high wholesale volumes from manufacturers, leading to sustained high inventory levels among dealers. To alleviate financial pressure and reduce financing costs, dealers have to resort to low-price dumping strategies, which undoubtedly exacerbates their losses.

According to CADA data, as of August this year, the negative margin between purchases and sales of dealers reached a high of -22.8%, an increase of 10.7 percentage points from the same period last year. The overall discount rate in the new car market also reached 17.4%. Since the beginning of the year, the "price war" has caused a cumulative loss of 138 billion yuan in the new car market's overall retail sales.

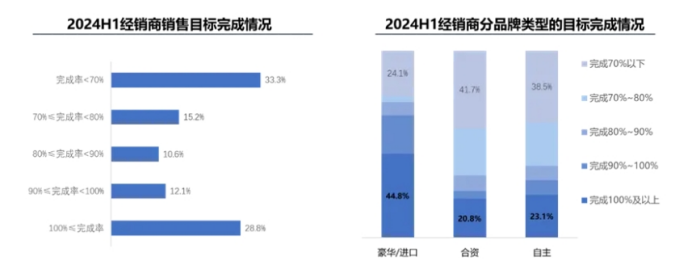

The survey revealed that only 28.8% of dealers successfully achieved their half-year sales targets by increasing sales through price cuts at the expense of profits. Meanwhile, 33.3% of dealers failed to achieve more than 70% of their targets.

Further analysis of brand performance shows that dealers of luxury and imported brands performed better in terms of target achievement, with over 40% of dealers meeting their annual sales targets. In contrast, joint venture and domestic brands performed less favorably, with only 20.8% and 23.1% of dealers meeting their annual sales targets, respectively.

These figures undoubtedly reveal the significant impact of the "price war" on the healthy development of the industry. Market analysts point out that the drastic changes in the automotive market are actually the result of multiple factors, including an imbalance in market supply and demand, intensified competition, and changes in consumer expectations. As the frontline of the market, dealers bear the brunt of these changes.

Additionally, the "2024 First Half-Year National Automobile Dealer Survival Condition Survey Report" revealed that in the first half of this year, 50.8% of automobile dealers incurred losses, while only 35.4% were profitable, marking a significant expansion of loss-making dealers compared to the previous year.

New car sales, as the "hard-hit" area of losses, contribute virtually negative gross margins and continue to expand losses. The average loss per store for new car business among dealers reached a staggering 1.78 million yuan. A management team from a luxury brand dealer revealed to "Auto Insight" that in the first half of this year, their stores incurred average monthly losses exceeding one million yuan, a tremendous pressure unprecedented in their two decades of operation.

"Currently, most of the vehicles sold in our stores are fueled by gasoline, and the price cuts are significant. Meanwhile, due to the brand's relatively slow pace in new energy development, we inevitably struggle when competing with other brands," said the executive. If the losses cannot be alleviated in the short term, the dealer may consider merging with other brands within the group or shutting down altogether.

Dealers on the brink of survival

Extreme financial stress has pushed many dealers to the brink of survival. Since the beginning of this year, there have been frequent incidents of domestic automobile dealers facing financial difficulties, involving both national and regional dealers. Most of these incidents are directly related to liquidity issues. Even large dealer groups such as Guanghui Automobile and Pangda Group have not been spared, facing the risk of capital chain ruptures and even having to delist.

As is well known, the automobile distribution industry is capital-intensive, with a high proportion of private enterprises. In the current market environment, financial stability is crucial for the vitality of distribution. Therefore, further improving financial services to support distribution, especially increasing financial support for the development of private dealer enterprises, is of great significance for expanding automobile consumption, upgrading the automobile industry, and building a new development paradigm featuring domestic and international dual circulation.

Moreover, the current predicament faced by dealers not only affects their own survival and development but also has a profound impact on the entire automobile industry chain and consumers. Under the pressure of capital chain ruptures, some dealers have to resort to unconventional means to maintain operations, such as pledging vehicles for cash flow, which not only seriously infringes upon consumers' interests but also triggers a crisis of trust in the entire automobile industry.

Faced with the current predicament of automobile dealers, CADA clearly put forward relevant policy recommendations in the "Report," calling on relevant government departments to pay close attention to the financial difficulties and shutdown risks faced by the automobile dealership sector and decisively adopt phased financial relief policies.

Experts indicate that the government's phased financial relief policies are of great significance in alleviating the financial pressure on automobile dealers. They not only help dealers tide over difficulties but also stabilize market expectations and promote the healthy development of the automobile market. Besides government financial support, automobile dealers themselves need to strengthen risk management and internal control, improve capital utilization, and explore innovative financing models and financial service products to cope with market changes and challenges.