Volkswagen and Tesla, different recipes but the same taste

![]() 10/08 2024

10/08 2024

![]() 553

553

At the peak of Volkswagen's electric transformation, then-CEO Herbert Diess and Tesla CEO Elon Musk shared an unusual bond, often praising each other's achievements in the automotive industry.

Diess praised Tesla as a benchmark of success, while Musk even declared that Volkswagen's boss "has done more and better than any other major automaker in the electric vehicle field."

If mutual praise could drive a company forward, it would be wonderful.

But now,

Volkswagen's Diess was fired in 2022; far from being a competitor to Tesla and BYD in the mass-market electric vehicle segment, Volkswagen is scaling back its electric vehicle plans, even going so far as to close a German plant for the first time in its history and terminate employment protection agreements dating back to 1994 to further cut costs.

Meanwhile, Tesla's sales in China declined by 5% in the first half of this year, despite the country's continuing rise in new energy vehicle penetration. Moreover, Tesla's five-year interest-free loan policy has been extended yet again, this time until the end of October. Tesla's profits fell by up to 45% year-on-year for two consecutive quarters in the first half of the year. Musk is also planning the next story growth point on October 10th.

The driving force behind Tesla's troubles and Volkswagen's nightmare is the same: China's smart electric vehicles.

But it wasn't always this way.

Automotive giants and the Chinese speed

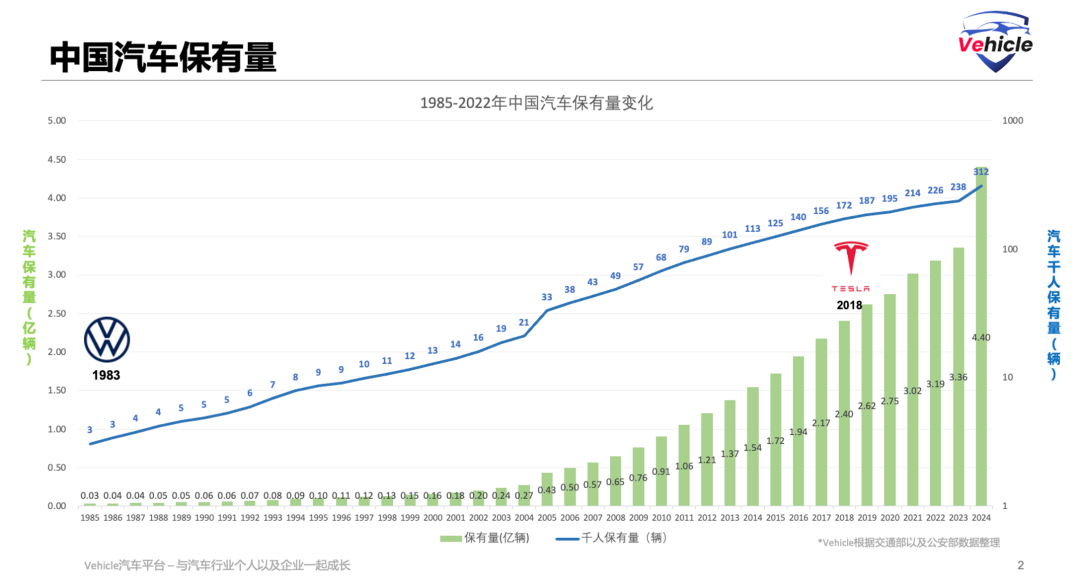

With a population of one billion, China is home to diligent and ambitious people. At the peak of global car sales in 2017, almost all global automakers had operations in China, making it the most profitable and fastest-growing automotive market in the world.

China is the largest market for most European and American automotive brands outside their home markets, especially for German brands like Volkswagen. In 2017, Volkswagen Group sold 10.74 million vehicles globally, with 4.18 million sold in China, accounting for nearly half of its total sales. However, last year, Volkswagen sold only 3 million vehicles in China, representing just one-third of its total sales.

In the first half of this year, Volkswagen's sales in China declined by nearly 7% compared to the same period in 2023. Even more concerning is that, as mentioned in our previous article "Volkswagen Group Faces Tough Times - H1 2024 Financial Report," the company's Chinese joint ventures saw revenue decline by 30% year-on-year, with an 80.1 million euro loss.

Volkswagen was one of the first foreign automakers to enter China in the 1980s, when the condition for foreign automakers to enter the market was to form joint ventures, leading to the current landscape of 49:51 joint venture automakers that are now struggling.

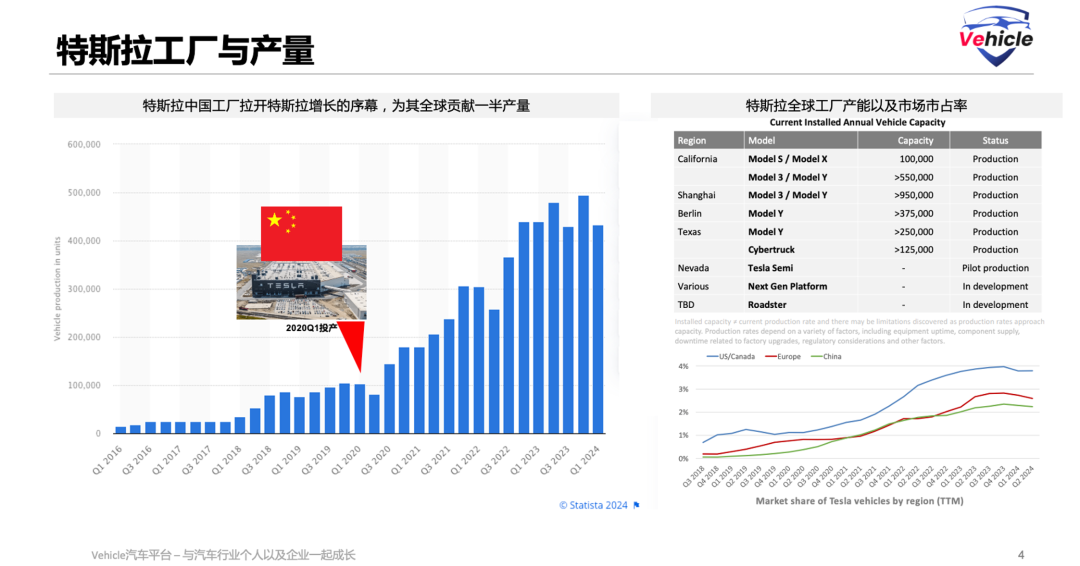

In the era of electrified and intelligent vehicles, Musk's ambitions aligned with China's development needs, and Tesla established its Chinese production operations in 2018 without any partners.

Tesla's Chinese factory often produces half or more of Tesla's global output. Tesla's entry into China, like a catfish, has thoroughly activated the Chinese electric vehicle market from supply chain to product, sparking a boom in electric/new energy vehicles in China and leaving foreign brands like Volkswagen far behind.

In 2019, new energy vehicles accounted for only 4.9% of China's total vehicle sales, but by August 2024, they accounted for 53.9% according to the China Passenger Car Association. Meanwhile, foreign brands' share of the Chinese auto market has dropped from over 60% to below 40%.

This trend is becoming a global issue for both Volkswagen and Tesla.

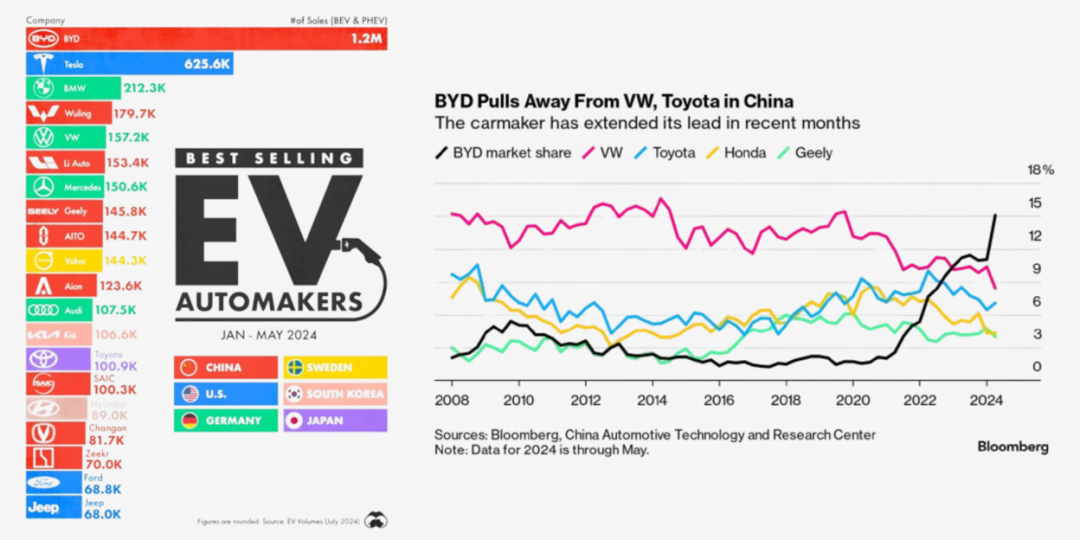

Among the top 20 electric vehicle brands globally in terms of sales in the first half of this year, Chinese automakers occupied nine spots. Volkswagen, which ranks third globally in total vehicle sales, sold only 150,000 electric vehicles, comparable to Chinese brands like Geely, WENJIE, and AION.

Cars have become the new smartphones - wheels + computers

When I first started my career, I went on a test drive with my foreign colleagues. At the time, they said that Chinese consumers were not yet mature in their car-buying preferences and would eventually care more about driving quality. But a decade later, Chinese consumers want technologically advanced cars that are more like smartphones, with large screens, intelligent voice control, and autonomous driving capabilities. Chinese automakers focus more on passenger experience than driving experience, offering amenities like refrigerators, TVs, and spacious seats in their vehicles' third spaces.

However, with the exception of Tesla, which was designed from the ground up as an electric vehicle and quickly added intelligent driving capabilities, most traditional foreign brands initially chose to convert existing models into electric vehicles or simply electrify their powertrains, which failed to excite Chinese consumers.

Volkswagen is not the only German brand struggling in China - BMW and Mercedes-Benz also face similar challenges, but their premium market positioning gives them more cushion than Volkswagen's mass-market brands with lower profit margins. However, by 2024, the trend is becoming increasingly apparent, as we discussed in our previous article "BYD Defines Luxury from Tencent Z9GT." Chinese smart electric vehicles are surging into the luxury market.

In China, success in the electric vehicle market is inseparable from software and technology. Recognizing this trend, Diess established Volkswagen's software division, CARIAD, in 2019 with a budget of several billion euros and 6,500 employees in Germany.

However, from the beginning, CARIAD has been plagued by delays and failures, jeopardizing Volkswagen's transformation from an internal combustion engine-focused company to a software-driven electric vehicle competitor. In 2023, CARIAD recorded an operating loss of 2.4 billion euros.

Volkswagen's first software-defined electric vehicle, the ID.3, was originally intended to usher in a new era for the company but faced delays and unexpectedly high costs. Similar issues plagued other Volkswagen brands like Audi and Porsche, whose models were delayed by more than three years.

With its internal divisions struggling, Volkswagen turned to partnerships, as we discussed in our previous articles "Volkswagen's Prescription for Victory in China's Auto Market by 2030 - Made in China, for China" and "The Intelligent E/E Architecture and Software of American New Force Rivian." Volkswagen invested heavily in partnerships in China and the United States to create "next-generation software-defined vehicle platforms" for its electric vehicles.

Tesla is no exception, despite its shiny halo of electric vehicles and autonomous driving. However, Chinese smart electric vehicles' third-space amenities like refrigerators, TVs, and spacious seats have earned Tesla the reputation of being a "bare-bones" vehicle, leading to a siege on Tesla's stronghold in the Chinese electric vehicle market.

As a result, Tesla has had to repeatedly extend its five-year interest-free loan program, and Musk has had to move on to the next big story.

Lagging Behind China

European and American brands are lagging behind China in the transition to electric vehicles. They lack both a competitive battery supply chain to rival China's and the necessary software platforms and chip application supply chains.

In the 1980s, China faced similar challenges in auto manufacturing, inviting foreign automakers into the market on the condition that they partner with domestic brands. Today, these Chinese automakers have the technology and experience to become fierce competitors, and China is disrupting the old model by establishing joint ventures in Europe.

Stellantis has formed such a partnership with Chinese electric vehicle brand Leapmotor, opening their first factory together in Poland.

Volkswagen has forged a series of partnerships in China, including with newcomer XPeng, to develop two electric vehicle models for the Chinese market.

Tesla's localization rate in China has reached 95%, meaning that 95% of Tesla's components are manufactured in China, covering almost all aspects of the electric drive system and, with the exception of high-end chips, intelligent features as well.

Powerful Auto Unions

Known for his opposition to unions, Musk benefits from lower labor costs at his Chinese factories. In the United States, Musk tweeted that Tesla employees would lose their stock options if they formed a union, and he successfully kept the powerful unions of Detroit's General Motors, Ford, and Stellantis at bay.

Volkswagen has not been as lucky.

Recently, Volkswagen Group terminated a 30-year labor agreement with its workers, setting the stage for a costly and ugly battle with the union. The agreement promised job security until 2029, but these guarantees will expire in June 2025 unless management and the union can reach a new agreement.

The reason, according to an internal Volkswagen notice to employees: "Due to current economic challenges, the company is forced to take this action."

The confrontation with the auto manufacturing unions contributed to Diess's dismissal in 2022. In terms of cutting costs and putting the brand on a solid financial footing, the company's governance structure remains a significant obstacle for Volkswagen's current executives, including CEO Oliver Blume, who faces similar challenges as Diess did.

Enemies on the Home Front

Volkswagen and Tesla share one similarity: both face the challenge of overcapacity.

China's electric vehicle industry is booming, with intense price competition and a pressing need to export vehicles overseas - including to Volkswagen's home market of Europe. Naturally, lower production costs make Chinese models more attractive in terms of pricing.

In Europe, as we discussed in our previous article "Chinese Electric Vehicles Go Global - Sales Drop Sharply in First Month After Tariff Increases, Is This a Bottleneck or Waterloo?," various factors have contributed to a slowdown or even decline in electric vehicle sales, weakening the dominance of electric vehicles like Tesla's.

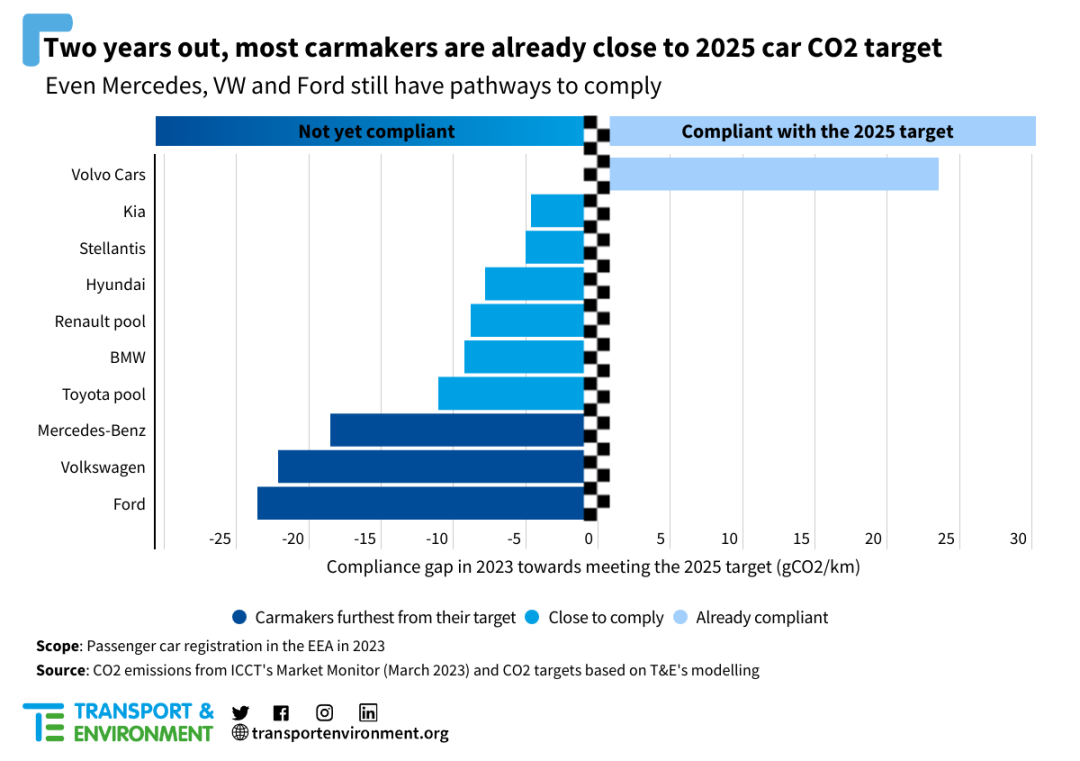

However, Volkswagen has an additional burden - it still relies on sales of internal combustion engine vehicles to support its revenue, as electric vehicles accounted for only 8.3% of its sales last year. If this situation does not change soon, Volkswagen risks hefty fines for failing to meet the new EU emissions requirements that take effect next year.

Luca de Meo, CEO of Renault and President of the European Automobile Manufacturers Association (ACEA), the European auto lobbying group, has warned that the European auto industry could face fines totaling up to 15 billion euros.

According to data from T&E, Volkswagen and Ford face the greatest challenges among European automakers in meeting the EU's 2025 CO2 targets.

In a report, UBS stated, "The Volkswagen Group (including all its brands) must double its share of electric vehicles in the EU from 13% in 2023 to 25% in 2025 to meet CO2 emission standards."

As a result, manufacturers like Volkswagen have asked politicians to relax the rules, but so far without success. Volkswagen CEO Oliver Blume has said that the EU should adjust its CO2 targets due to the slowdown in electric vehicle sales. Blume indicated that Volkswagen would seek emission pooling agreements with more efficient electric vehicle manufacturers.

Ironically, Volkswagen may ultimately have to purchase credits from Tesla to bring its CO2 emissions below standard levels. This is because the policy allows automakers to purchase carbon emissions credits from battery-only competitors to meet their targets, a rule particularly lucrative for Tesla.

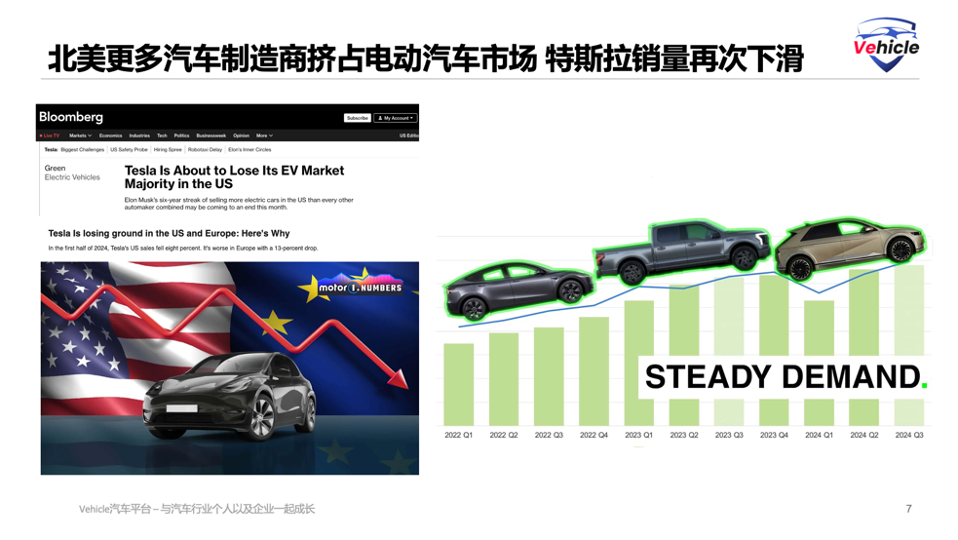

For Tesla, in addition to the challenges in China discussed above, it also faces difficulties in its home market of North America. In the first half of 2024, Tesla's sales in the United States declined by 8%. However, according to Cox Automotive, new electric vehicle sales in North America are expected to reach 338,844 in the third quarter of this year, an 8% increase over the same period in 2023. Electric vehicle sales will account for 9% of the U.S. auto market.

The new data suggests that while electric vehicle sales in North America have slowed and faced some setbacks in 2024, the market is still growing.

Although General Motors discontinued its best-selling American electric vehicle, the Bolt, which saw sales drop by 90% from a year earlier to just 14,000 units, sales of its Blazer EV and Cadillac Lyriq made up for the loss. GM continues to introduce new electric vehicle versions and expects to have 10 new electric models on the market by the end of the year.

Meanwhile, Toyota, another automotive giant, saw its electric vehicle sales in North America soar even faster, growing by 301% to reach 11,600 units.

Other traditional giants in North America are also fighting for a larger share of the electric vehicle market.

Final Thoughts

As the earliest traditional automaker to awaken and transform, Volkswagen, and Tesla, as a new force in electric smart cars, are both facing fierce competition from China's smart electric vehicles and resisting traditional constraints amidst the rapid development of smart cars this year. Both are also welcoming the awakening of more traditional gasoline-powered automakers.

Volkswagen and Tesla, different recipes, same taste.

Unauthorized reproduction and excerpt are strictly prohibited - Reference materials:

Bridging the gap: Carmakers’ progress toward the 2025 car CO2 targets - T&E