"Chery's 100-Day Intensive Push": The "Life-or-Death Battle" Amid the Intensifying Competition in the New Energy Vehicle Market

![]() 10/08 2024

10/08 2024

![]() 528

528

With the peak of market growth looming and the ongoing price war in the new energy vehicle (NEV) sector, Chery Automobile's anxiety is palpable. However, merely relying on strict attendance management to boost employee productivity and narrow the gap with BYD, which relies heavily on a large workforce, is not a quick fix.

Original @ New Entropy

The American Ford Motor Company, a star enterprise of the industrial era, was the first in the world to adopt the assembly line model for mass automobile production. Henry Ford, the founder, once famously said, "Why is it every time I ask for a pair of hands, they come with a brain attached?"

On modern automobile production lines in the 21st century, Ford's dream has almost become a reality. At Xiaomi's car launch event, it was announced that "a Xiaomi car can be produced in just 76 seconds," thanks to a smart factory with an overall automation rate exceeding 91% and a critical process automation rate of 100%.

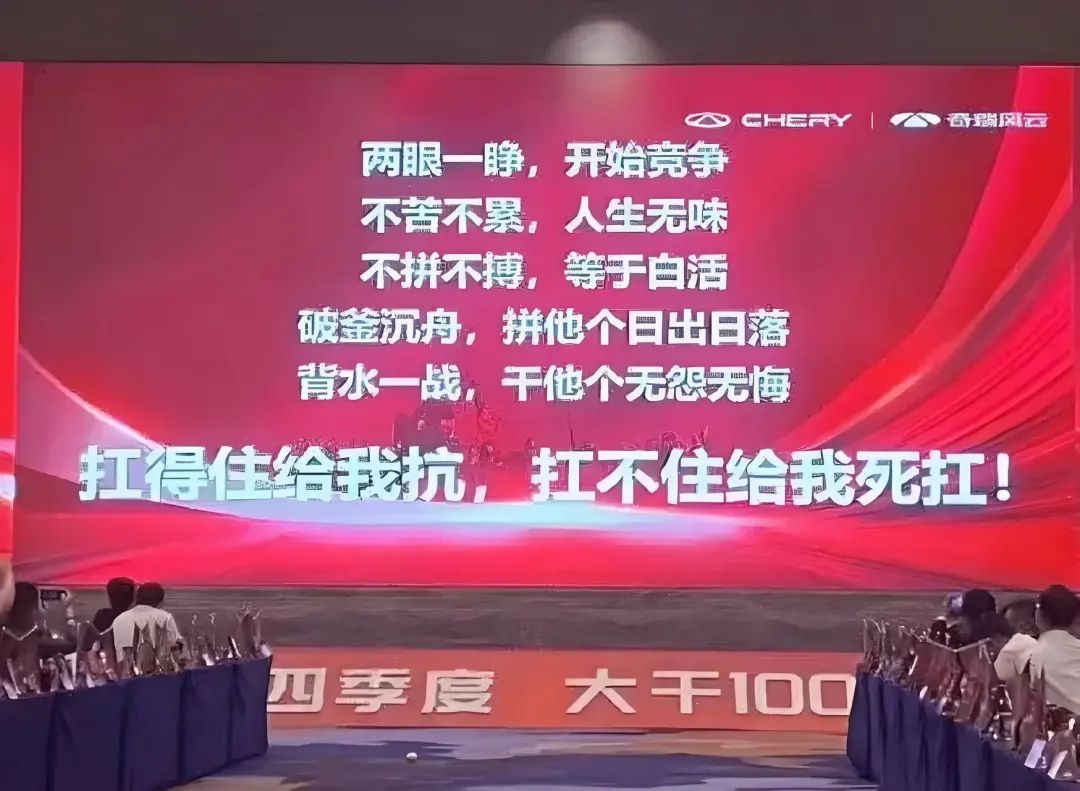

However, as automakers strive for ultimate production efficiency, the pressure naturally trickles down to branding, sales, and other aspects. Chery Automobile, which recently made headlines again, did so due to slogans like "Work Hard for 100 Days in Q4," "Open your eyes and start competing," and "Hold on tight, or die trying" at its South China regional mobilization meeting.

This echoes Chery's previously exposed "345" work model (three people doing the work of five, for the pay of four), which precisely stepped on the landmines of today's working class.

Slogans like "Work Hard for 100 Days" were once common in civil engineering and real estate companies. While they produced a short-term motivational boost, they paled in comparison to the normalized "996 work culture" of the internet industry in previous years.

Now, the competition has shifted to the upstream and downstream supply chains of NEV manufacturers. The intensifying competition has even prompted CATL, the near-monopolistic battery giant, to launch a "100-Day Push" campaign in June. It's no surprise that Chery, caught in the vortex of the downstream market, is ramping up the intensity.

In fact, in August this year, Changan Automobile already hung banners in its factories proclaiming "Fight for 130 Days, and Resolutely Fulfill the Annual Task." Chery's sprint conference, therefore, lagged behind its peers. Statistics show that nationwide retail sales of narrow-sense passenger vehicles have totaled 13.45 million units so far this year, up just 2% year-on-year.

With the peak of market growth looming and the ongoing price war in the NEV sector, Chery and other automakers are visibly anxious. However, the "100-Day Push" can only be seen as a politically correct response.

A Battle for Survival During the Peak Season: The Elusive Hit Model

The automotive industry has long adhered to the saying "Golden September, Silver October," as consumers prepare for winter travel and automakers intensify promotions to meet year-end targets.

Li Jinyong, Vice Chairman of the China Automobile Dealers Association and Chairman of the New Energy Vehicle Committee, previously analyzed that based on past experience, annual automobile sales tend to follow a "low in the first half, high in the second half" pattern, with a more pronounced trend in the NEV market.

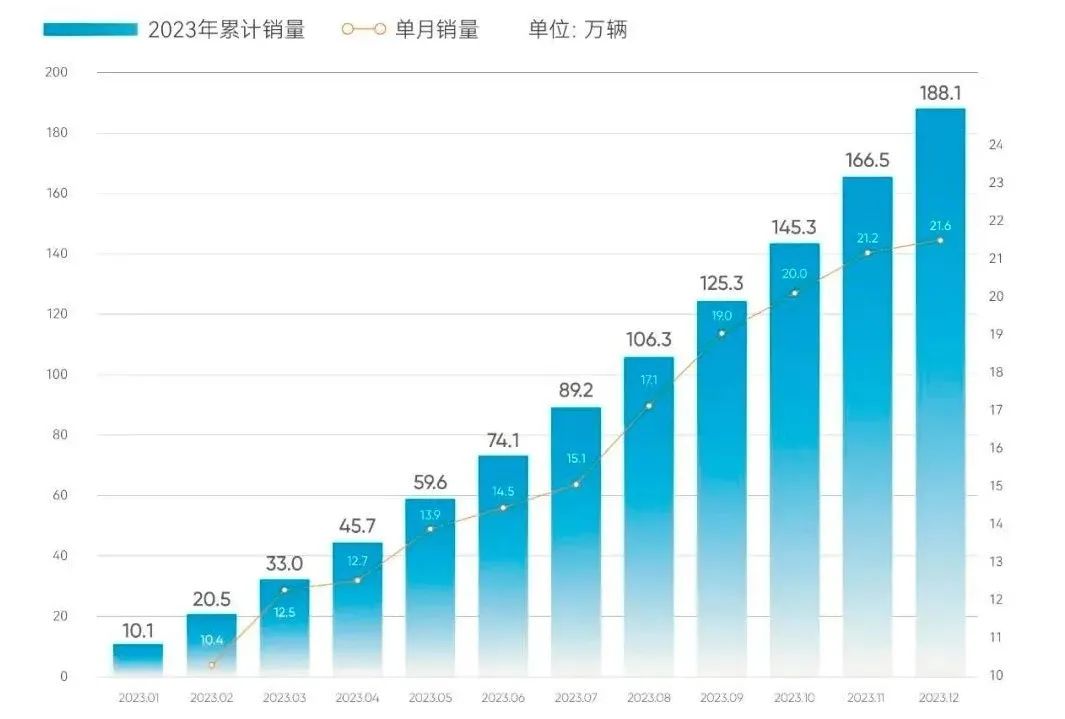

The semi-annual data for July this year also revealed that most automakers had achieved only around 30% of their annual sales targets compared to their ambitious goals set at the beginning of the year, with some even falling short of 20%. Among them, the industry leaders are still the traditional brands with a long history and a larger market presence, with Geely, Chery, BYD, and Changan ranking top in terms of target achievement.

Both Geely and Chery are close to achieving half of their annual targets. However, unlike Geely, while Chery achieved a record-high half-year sales volume of over one million units for the first time, half of these sales came from overseas markets, leaving it still catching up in the domestic market.

Changan Automobile, which announced its slogan 30 days earlier than Chery, even launched a "New Models Every Week, Changan All the Way" campaign in the final week of September, unveiling six new models, including the Deep Blue L07, Deep Blue S05 pre-order, Changan Qiyuan E07 pre-sale, fourth-generation CS75 PLUS pre-sale, AVATR 07 launch, and Changan Qiyuan A07 pre-order.

Amid the fierce competition from peers, an anxious Chery has been pushed into action. Last October, Yin Tongyue, the rarely seen founder of Chery, stated publicly, "In 2024, Chery will no longer be as modest as this year in the NEV industry rankings! We will definitely enter the top tier." However, during a live stream this year, the retired Yin admitted, "I regret that speech. It doesn't align with my past image or age. How could a sixty-something-year-old be so immature and boastful?"

Chery and BYD both ventured into the NEV sector around the same time but arrived late to the party. Until last September, NEVs accounted for only 7% of Chery's internal sales, far below its long-time rivals Geely, Changan, and Great Wall in the traditional fuel vehicle market.

Judging from this year's sales data, iCAR, Chery's independent electric brand with high hopes, sold only 25,586 units in the first half of the year, ranking low in the industry. While the total sales of all NEVs under the Chery Group increased to 180,900 units, they still accounted for less than 20% of the total. Crucially, Chery has yet to find a hit NEV model.

Internally, Chery has even predicted that in the future domestic auto market, only 3-5 Chinese brands and 3-5 joint venture brands may survive, with the consolidation period likely to occur around 2025. This fourth quarter has thus become a lifeline for automakers.

A 20-Year IPO Journey: The Unfulfilled Dream of Going Public

Chery arrived late to the NEV party, was 30 days behind in shouting slogans, and lags even further behind in its bumpy IPO journey. Unlike BYD, Geely, Great Wall, and other domestic auto giants, Chery remains the only one among them that has yet to go public.

Since rumors of an IPO first surfaced in 2004, news about Chery's IPO has been intermittent over the past 20 years, yet it has never materialized. Late last year, media reported that IDG Capital was considering acquiring shares in Chery Holding Group from existing shareholders for RMB 7 billion, with Chery Automobile, a subsidiary, considering submitting an IPO application as early as this year, with an estimated valuation of up to RMB 150 billion. Yin Tongyue himself also announced at the Yaoguang Strategy Conference that "Chery Automobile aims to complete its IPO by 2025."

With the deadline looming, whether it's the "345" work model or the "100-Day Push," there's undoubtedly pressure to boost performance ahead of the IPO. However, unconfirmed rumors suggest that to meet IPO compliance requirements, Chery has attempted to tamper with employees' overtime punch records after mandating overtime work. A recent graduate who joined Chery last year complained, "I barely see the sun these days."

There's a causal relationship between Chery's lag in the NEV sector and its repeated delays in the IPO process.

According to Chery's previously disclosed investment plans, from 2008 to 2012, the company aimed to raise over RMB 15 billion to fund expansions in NEVs, production lines, and key components.

Before 2010, most domestic auto brands focused on low- to mid-range models, with meager profits reinvested into expanding production capacity. To allocate funds for future growth, these brands had to seek public listings and other low-cost financing channels. However, Chery's IPO plans failed twice. The first attempt, driven by the Anhui Provincial Government in 2004, involved Guoyuan Securities and Guotai Junan Securities but was shelved due to Chery's complex equity relationship with SAIC Motor. The second attempt, relaunched in late 2007, was halted by the global financial crisis.

Later, in 2016, Chery's new energy division was rumored to be seeking a backdoor listing on the STAR Market, but this ended with a notice from Hailuo Profiles, the shell company, stating, "Given that Chery New Energy has not yet obtained NEV production qualifications, the board of directors has decided to abandon the acquisition."

In contrast, representative NEV startups like NIO, XPeng, and Li Auto secured capital market support even before turning a profit, rapidly overtaking traditional automakers in market presence and brand recognition.

As an engineer by training, Yin Tongyue adheres to Chery's path of independent R&D, striving for breakthroughs in cutting-edge fields like power systems and intelligent driving. Delayed by 20 years, the IPO has become a necessity for Chery.

The Overtime Controversy: A Battle for Survival Amid the Pursuit of Efficiency

Perhaps the pressure of the all-important IPO journey has compelled Chery to revisit the straightforward management methodologies of the industrial era.

Li Xueyong, Deputy General Manager of Chery Automobile, revealed to the 21st Century Business Herald that Chery has a system called "Common Battle," where all leaders must choose a location to participate in local auto shows and events during holidays. The number of visitors, publicity, and transactions in these "Common Battle" regions are reported and ranked in real-time.

What's called a "Common Battle" between leaders and employees is essentially supervision by leaders over employees. Some Chery employees have revealed online that mandatory overtime requires more than 20 hours per week, with no overtime pay but only a meager RMB 10 meal allowance per day. Additionally, employees' compensated time off for overtime is strictly limited, and the bottom performers based on overtime hours face elimination. An employee at a local Chery subsidiary in Wuhu said, "Sometimes, senior leaders stand at the gate in the morning to check who's punching in on time."

The revolution sparked by NEVs has plunged the entire automotive market into an inevitable battle for survival. Automakers compete externally in branding, new models, and low prices, stimulating consumer enthusiasm. Internally, they compete in executive livestreaming, employee overtime, and a wolf-like culture, but this doesn't necessarily boost team motivation.

The economic principle of intense competition originates from agricultural societies, where production heavily relies on land, a capital that cannot be increased in the long run. Under limited land area and population pressure, increased labor and yield per unit area can actually lead to a decrease in per capita output, stagnating overall societal development.

In today's post-industrial society, the importance of services and innovation is increasingly prominent. While service production involves face-to-face interaction between producers and consumers, innovation relies on talent clustering, where population density can enhance productivity.

According to public information, Chery Group's annual revenue exceeded RMB 300 billion in 2023, with over 80,000 employees worldwide. The automotive division sold 1.71 million units, contributing RMB 172.66 billion to the group's annual revenue. Roughly half of Chery's employees, or 44,000, work in the automotive sector, including 25,000 new recruits that year.

For comparison, BYD, which Yin Tongyue aims to "catch up with," surpassed 900,000 employees in September, with nearly 110,000 technical researchers, making it the automaker with the most researchers globally, according to Li Yunfei, General Manager of BYD's Brand and PR Department.

Additionally, veteran Chery employees have revealed that while some do retire from the company, they are mostly long-serving veterans with entrenched connections and influence. They enjoy open-ended employment contracts, allowing them to coast to retirement comfortably.

For externally recruited employees, reaching retirement at Chery is highly unlikely.

Ford once disassembled and analyzed the production line of automobile production and found that 670 jobs could be done by people without legs, 2360 jobs could be done by people with only one leg, 2 jobs could be done by people without arms, 715 jobs could be done by people with only one arm, and 10 jobs could be done by blind people.

This is also limited to the production process. Chery's dream, probably needs to build a management and sales team composed of robots without brains to achieve it.