Who are the popular Galaxy E5 and XPENG M03 squeezing out?

![]() 10/09 2024

10/09 2024

![]() 565

565

Introduction

Introduction

As the energy form gradually shifts from gasoline to pure electricity, the discourse power in the 100,000-yuan family car market has quietly shifted.

After 40 years, Volkswagen has decided to cease production of its Polo model in Europe, freeing up production lines for the production of lower-cost pure electric compact cars, expected to be the ID.2. Undoubtedly, pure electric compact cars like the ID.2 will replace the Polo's position.

In fact, this does not mean that Volkswagen will abandon the classic Polo model in the global market. After the closure of European production lines, orders for the European market will be produced at the factory in Caliga, South Africa, with no impact on other global markets. However, this also reflects some issues. In today's rapidly evolving electric vehicle landscape, even celebrity family cars like the Polo are gradually edging towards the sidelines.

There is no doubt that the pace of the electric vehicle transition is accelerating, leaving traditional automakers suddenly at a loss. Whether it's the Wuling Hongguang MINIEV, BYD Dolphin/Sea Gull, or the recently popular Geely Galaxy E5, XPENG MONA M03, or the upcoming Geely Xingyuan, which is expected to be another hit family car, there are no familiar joint venture brands in every segment from A00 to A-class.

This situation is suddenly reflected in a profound way in a car selection story.

A few days ago, a friend told me, "I want to buy an electric car recently, but nothing seems suitable after looking around."

Upon hearing this, as an automotive journalist, I immediately perked up. "What are your requirements?" I thought to myself, this shouldn't be too difficult. Little did I expect that after she finished saying "preferably a joint venture car," I could only say one thing after thinking for a while: "Nowadays, domestic brands dominate, and there don't seem to be many suitable joint venture models. But if we look at the gasoline car market, that's a different story."

Joint venture family cars struggle to regain past glory

What do young people look for when buying a small car? Firstly, the car shouldn't be too big. A small car is more maneuverable for urban commuting, making turns and lane changes easier and parking stress-free. Secondly, the configuration doesn't need to be too high, but it should meet basic requirements, preferably with active safety features like AEB.

"With a budget of 100,000-150,000 yuan, finding a suitable model shouldn't be difficult," I thought. It seemed like there were only a few options available, most of which were domestic brands. Where have the joint venture brands gone?

In the A0-class sedan market, once-popular stars like the Volkswagen Polo and Honda Fit consistently sold over 10,000 units per month. In the A-class hatchback segment, models like the Nissan Tiida and Volkswagen Golf were also market stalwarts, continuously attracting consumer attention.

For a smaller-sized vehicle, it's an excellent choice for both families looking to add a second car and young consumers buying their first car soon after obtaining a driver's license. Small hatchbacks are more convenient for urban driving and parking due to their compact size, making them ideal for daily commuting.

On the other hand, hatchbacks typically come equipped with small-displacement engines, which means they offer better fuel efficiency and significantly reduce vehicle operating costs. In the past, policies like halving the vehicle purchase tax for cars with engines up to 1.6L further fueled the development of this market segment.

Thus, these factors contributed to the widespread acceptance of A-class and A0-class family cars in the past, making more consumers willing to purchase a small car as their daily commuting vehicle.

However, as the electric vehicle transition continues to advance, everything seems to have changed. In the current joint venture brand lineup, finding a smaller-sized pure electric car seems limited to options like the Volkswagen ID.3. The delayed electric vehicle transition has forced joint venture brands to compete with electric cars in the same segment using gasoline vehicles, gradually losing a significant market share.

From January to August this year, the top five sellers in the A0-class sedan market were all domestic brands, and all were pure electric vehicles. The once-popular Volkswagen Polo remains the top seed among joint venture brands but ranks only sixth in its segment, with cumulative sales of 12,243 units this year, less than one-twentieth of BYD Dolphin's sales in the same segment.

What does this mean? It implies that the combined sales of once-familiar hatchbacks like the Polo, Golf, Fit, Life, and Tiida are inferior to those of a single BYD Dolphin. Even more harshly, none of these models have undergone an electric vehicle transition or shown any signs of electrification.

The only connection might be the ID.3, which could be considered a "pure electric Golf." In terms of sales, the ID.3's performance is decent, with cumulative sales of 55,148 units this year, making it the top-performing electric vehicle among joint venture brands.

In terms of product capabilities, the ID.3's driving performance undoubtedly meets the requirements of most consumers, but when it comes to intelligence, which everyone cares about, it might fall short. Although the ID.3's Smart Edition, introduced this year, primarily upgrades the infotainment system, it still lags behind domestic brands and new-energy vehicle startups, highlighting a weakness of joint venture brands.

Overall, Volkswagen still has the ID.3 as a pillar product, while Japanese brands lack a similarly positioned pure electric model. As the pace of the electric vehicle transition accelerates and domestic brands begin to focus on this premium compact car route, the market space left for joint venture brands may indeed be limited.

The next red ocean in the 100,000-150,000 yuan pure electric vehicle segment?

Nowadays, with the proliferation of new models, a slew of vehicles with "7" in their names are dazzling consumers. Models like the Xiaomi SU7, Zeekr 007, Geely Vision 07, Lynk & Co 07, and Zhidie S7 target the B- and C-segment new energy sedan markets, offering increasingly attractive prices that have thrilled consumers. "Competition" has become the buzzword in this segment.

In addition to these new models, there are also established products like the XPENG P7, IM Motor L7, Feifan R7, and NIO ET7. It seems that new energy vehicle companies have fallen into a vicious circle: to carve out a niche in the market, they must first establish themselves in the mid-to-high-end sedan segment.

We can see that the number of B- and C-segment new energy sedans launched in the past two years, especially this year, has grown rapidly, with most entry-level prices hovering around 200,000 yuan, leaving consumers spoilt for choice. Importantly, some of these models have wheelbases exceeding 3 meters and lengths approaching 5 meters, with "more for less" becoming a hallmark of this market.

Initially, the Tesla Model 3 set the standard, and a succession of "Model 3 killers" emerged, turning the mid-to-high-end sedan market into a red ocean with increasingly fierce competition. As a result, this market now boasts many excellent new products, both new energy and traditional gasoline vehicles, as the electric vehicle lineup expands.

In contrast, product options are not as abundant for consumers who prefer smaller and more affordable vehicles.

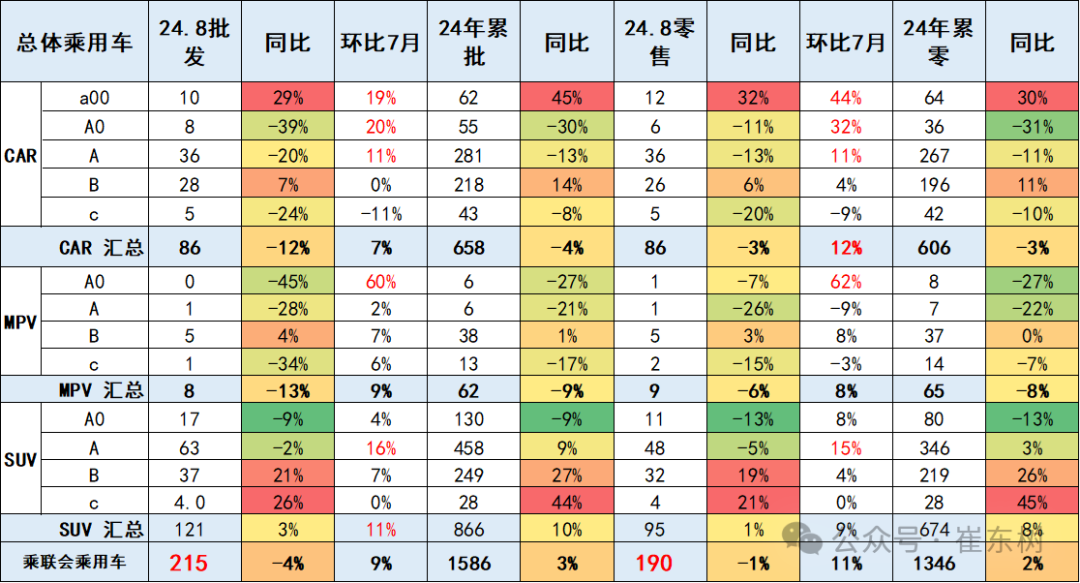

Indeed, B- and C-segment sedans better demonstrate a brand's strength, but A-segment cars dominate the market as a whole. From January to July this year, cumulative retail sales of A-segment sedans reached 2.32 million units, while those of B-segment sedans were 1.69 million units, and A0- and C-segment sedans sold 0.3 million and 0.37 million units, respectively.

This distribution is similar in the SUV market, except that A0-segment SUVs outsold C-segment SUVs in total sales, ranking third in overall sales across all segments.

Practically speaking, excluding luxury brands that prioritize individuality, a car's configuration, if basically sufficient, will be cheaper if the vehicle is smaller. This explains why A-segment cars dominate the market, with 100,000-150,000 yuan models remaining the mainstream choice for consumers.

If there's one A-segment car that has suddenly "exploded" in the market recently, it's undoubtedly the Geely Galaxy E5. This A-segment SUV achieved over 10,000 deliveries within 20 days of its launch, selling 12,227 units in August and 14,253 units in September, with demand outstripping supply.

Upon closer inspection, it becomes clear that the Galaxy E5 precisely hits consumers' preferences. With an enduring design, adequate power, mainstream range, and excellent in-car intelligence without flashy features, it maximizes practicality. Most importantly, it falls within the 100,000-150,000 yuan price range, catering to the needs of more consumers.

Of course, before the Galaxy E5's rise, this market was dominated by the BYD Yuan PLUS for quite some time. It has not only been the top choice for family SUVs in the past year but has also replaced the once-dominant SUV, the Haval H6, which reigned supreme for over a decade.

If you find the Galaxy E5 and Yuan PLUS too large, the Yuan UP, in the A0-segment SUV market, also performs exceptionally well. Since deliveries began in March, its monthly sales have climbed steadily, reaching nearly 20,000 units in August with 19,344 sold, making it a dark horse in this market.

In the A-segment sedan market, apart from the BYD Qin PLUS leading the way, the similarly positioned MONA M03 also seems poised to pull XPENG out of its struggles, a noteworthy change.

It's intriguing to ponder that as new cars gradually shift from gasoline to pure electric power, the landscape of the 100,000-yuan family car market in A0- and A-segments seems to have undergone a fundamental change, with the discourse power shifting from joint venture brands to domestic brands, including new energy vehicle startups.

Behind them, there seems to be a common characteristic unrelated to brand: designs tending towards popular aesthetics, devoid of flashy configurations and functions, and leaning towards pragmatism, all serving the user experience. Ideally, they should offer a sense of value beyond their segment or even Transcending levels products when compared. In other words, affordability is king.

More importantly, as domestic brands accelerate their electric vehicle development, the family electric car market will see an influx of high-quality products, sparking a new round of market competition. In this process, the market space available to joint venture brands may become increasingly limited.

So, could this be a new opportunity for joint ventures, if we look at it from a different angle?