"Increasing the Huawei factor": AVATR faces both pain and joy

![]() 10/09 2024

10/09 2024

![]() 460

460

AVATR's brand strategy is not clear enough. Its launch of cost-effective models overlaps with the market positioning of other Changan brands like SL03, leading to resource allocation issues and internal competition between brands.

@TechNewKnow Original

With a cluster of new energy vehicles in September, AVATR also joined the fray.

On September 26th, the AVATR 07, priced between 219,900 and 289,900 yuan, was officially launched, adding another member to Changan's premium lineup. Shortly after its launch, AVATR eagerly announced that it had secured 11,673 pre-orders within 20 hours, reassuring the market. Throughout September, AVATR delivered 4,537 vehicles, a year-on-year increase of 47%, with the new model significantly contributing to sales volume.

With Changan's investment in AVATR, its strategic partnership with Huawei is clear. However, this is not AVATR's first foray into vehicle launches with Huawei's backing, and its performance has been lackluster for years. In 2023, AVATR set a sales target of 100,000 vehicles but only achieved 23.5% of that goal. This year, through August, it delivered just 36,400 vehicles towards its 100,000-unit target.

Clearly, Huawei has not been AVATR's savior in the past. Despite significant investments from Changan, AVATR has been loss-making for years. Finding a way to turn things around has become a pressing question for Changan AVATR.

Part.1

Boosting Sales with Huawei's Support

The launch of AVATR 07 attracted significant attention.

At the end of August, after nine months of negotiations, Changan Automobile and Huawei signed an agreement to upgrade their strategic cooperation and invest in AVATR. Changan's AVATR officially became the second-largest shareholder in Huawei's subsidiary, Yingwang Intelligent Technology Co., Ltd., with a 10% stake and a transaction value of 11.5 billion yuan. Changan also became the first automaker to invest in Yingwang.

Changan has high expectations for AVATR 07 and even higher hopes for Huawei's support. When Changan launched the AVATR brand in 2020, it introduced Huawei as a strategic partner. However, Huawei's empowerment did not meet AVATR's expectations. Over a year later, in August 2022, the first model, AVATR 11, arrived late, and deliveries were further delayed by four months. In the first 38 days after its launch, only over 2,000 units were delivered, embarrassing AVATR, which aspired to compete with models like Tesla.

In reality, the relationship between Huawei and AVATR is intriguing. Ren Zhengfei, Huawei's rotating chairman, once referred to AVATR as "the son of Huawei and Changan." However, AVATR's CEO, Zhu Huarong, has not hesitated to subtly criticize Yu Chengdong, Huawei's consumer business CEO, expressing concerns about basic values, social responsibility, and not misleading consumers. He even lamented, "Why is this industry so terrible? A car worth hundreds of thousands of yuan is hyped up to be worth tens of millions!"

Despite these verbal disagreements, they ultimately stem from differing cooperation models. Zhu believes that the HI mode (Huawei Inside), which involves deep technical cooperation, is the best way for traditional automakers to partner with Huawei. In contrast, the Smart Selection mode, which involves deeper involvement in production and management, does not conform to automotive industry norms or national industrial policies.

However, while AVATR's sales have struggled, Huawei has successfully revived its struggling AITO brand through the Smart Selection mode. While AVATR watches its competitors bounce back with significant investments, its own brand remains stagnant, frustrating the company.

Nonetheless, AVATR has little choice but to accept Huawei's preferential treatment. Among traditional automakers, Volkswagen, Great Wall, BYD, SAIC, and GAC have all made layouts in intelligent driving, but Changan has lagged behind in technological advancements. In the rapidly evolving new energy market, AVATR aims for the premium segment and must rely on external forces to iterate its models. This is the root cause of Changan's deep partnership with Huawei through AVATR.

Faced with sluggish sales, AVATR launched its new model at a price point of around 200,000 yuan. In the automotive market, price directly correlates with sales volume. To boost sales by leveraging Huawei's influence, AVATR even invited "Huawei's second princess," Yao Anna, as the global spokesperson for its new model, demonstrating its earnest efforts.

Part.2

CATL and Huawei Are Not Cover-Ups

As a joint venture between Changan, Huawei, and CATL, AVATR naturally attracted high expectations. However, in practice, AVATR has not achieved the 1+1+1>3 effect. The root cause lies in AVATR's status as Changan's "son," while Huawei and CATL's empowerment is not exclusive to AVATR.

For example, CATL's battery technology is not limited to domestic automakers but is also exported globally. Similarly, Huawei's intelligent driving solutions are available to both new energy automakers and traditional automakers, both as a whole and in modular form.

More importantly, AVATR, positioned in the premium market, has been criticized since its inception for lacking cost-effectiveness despite its overall quality. For instance, the first model, AVATR 11, was priced between 349,900 and 409,900 yuan, exceeding the premium benchmark set by Tesla's Model Y at the time.

Compared to domestic new energy brands, AVATR also suffers from a lack of affordability. The ZEEKR 001 offers more features like electrification and is priced nearly 10,000 yuan lower than AVATR. Similarly, AITO models equipped with Huawei's system are also more affordable. Customers may feel that they are paying an extra 10,000 to 20,000 yuan for similar features, negatively impacting AVATR's reputation.

Declining sales ultimately reflect AVATR's significant losses. After three rounds of funding totaling nearly 8 billion yuan, AVATR reported net losses of -2.015 billion yuan in 2022, -3.693 billion yuan in 2023, and -1.395 billion yuan in the first half of 2024, accumulating a total net loss of 7.103 billion yuan. As of the end of the first half of 2024, AVATR's total assets were 12.746 billion yuan, with net assets of 706 million yuan and a debt ratio of 94.46%.

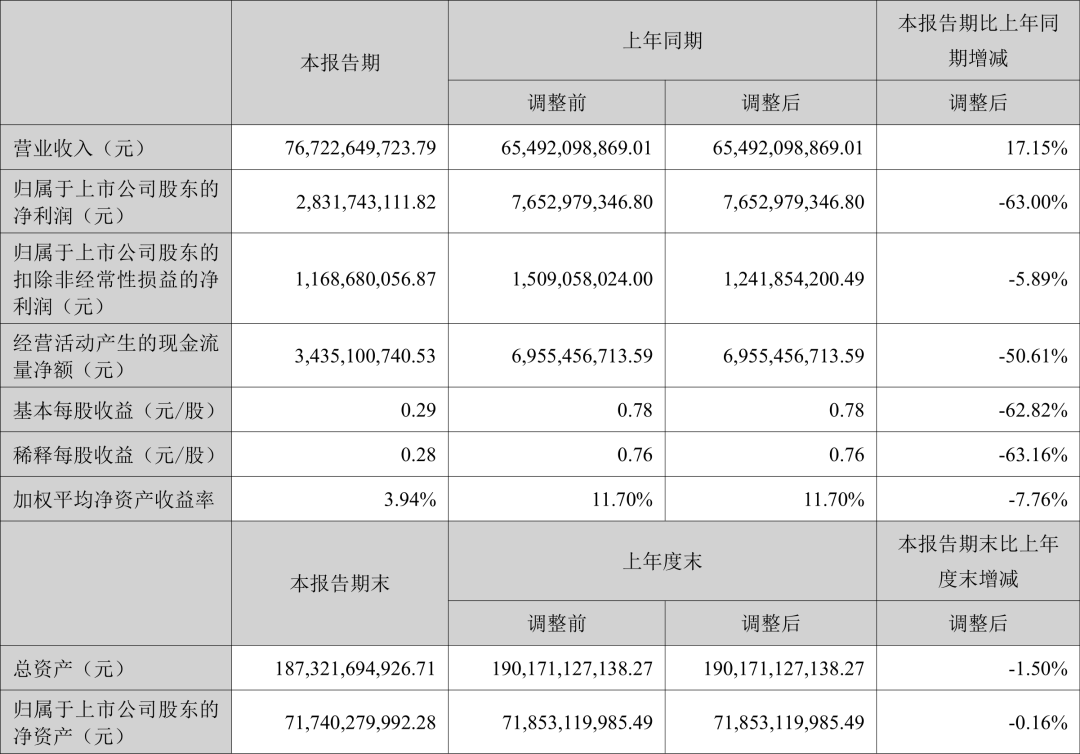

Changan is most concerned about AVATR's losses. Changan Automobile's first-half financial report revealed that the company's overall revenue increased by 17.15% year-on-year to 76.723 billion yuan, but its net profit after deducting non-recurring items declined by 5.89% year-on-year to just 1.169 billion yuan. It is clear that AVATR's losses have significantly impacted Changan's profitability.

With significant losses and tight sales, AVATR has become a hot potato for Changan. To break the deadlock, Changan's solution is to go public. AVATR's CEO candidly stated, "From AVATR's perspective, an IPO addresses funding issues, but we also aim to improve corporate governance through listing requirements, making it more compliant and standardized. This is our primary objective."

However, AVATR faces the challenge of a low valuation – less than 20 billion yuan. To increase its valuation, preserving sales is crucial. According to board requirements, AVATR strives to achieve break-even in the third or fourth quarter of 2025.

Meanwhile, continuing to raise funds is a faster way to boost valuation. AVATR plans to complete its Series C funding in the second half of this year. It can be expected that successful funding will bring AVATR closer to independent market operations.

Currently, AVATR must successfully go public to address its cash flow issues definitively.

Part.3

Channel Changes and the Urgent Need for a Safe Zone

The most notable aspect of the AVATR 07's launch is its lower price point. Known for targeting the 300,000 to 400,000 yuan market segment, AVATR has now entered the 200,000 yuan range, clearly aiming to capture the mid-to-high-end market if unable to penetrate the premium segment.

In reality, neither AVATR nor its parent company Changan has experience breaking into the premium market. Data shows that the average price per vehicle for Changan's domestic Self owned brand in the first half of the year was 62,400 yuan, with domestic auto sales gross margins decreasing by nearly 5 percentage points year-on-year to 10.1%. Clearly, low-priced models are Changan's core competency.

While the price reduction has garnered market attention, it also poses risks. SL03, Changan's tech-fashion new energy brand, targets the 150,000 to 300,000 yuan price range, overlapping with AVATR's new pricing strategy. Compounding AVATR's embarrassment, SL03, with its lower prices and stronger performance in the new energy market, is outperforming AVATR.

At the 27th Chengdu International Automobile Exhibition on August 30th, SL03 unveiled two new models: the SL03 L07 and SL03 S05. The L07 is the only mid-sized sedan priced under 200,000 yuan equipped with Huawei's Kunpeng intelligent driving system. The S05 features HUAWEI's million-pixel intelligent light system and is the first model in its price range to integrate the DEEPAL 4K intelligent camera. Deeply integrated with Huawei's technology, SL03 continues to sprint towards the mid-to-high-end market. In the first half of 2024, SL03 delivered 83,858 vehicles, a year-on-year increase of 96%, with 16,659 units delivered in June, up 107% year-on-year.

Despite underperforming SL03, AVATR consumes more resources. It is facing internal scrutiny within Changan. Furthermore, according to Chairman Zhu Huarong, AVATR plans to launch 17 new products over the next three years, including mid-to-large SUVs, MPVs, and coupes. This broad product lineup competes for resources with Changan's other brands, giving the impression of a lack of clarity in Changan's brand strategy.

While there is still time to address strategic ambiguity, lack of effort may be more difficult to rectify. Sales channels serve as a prime example.

According to reports, AVATR's store management inherits Changan's state-owned enterprise mechanism, with headquarters overseeing store personnel performance and merchandise procurement, resulting in inefficient management. Cost-wise, AVATR's first flagship store in Beijing incurs over 40 million yuan in rent expenses. With consistently low sales, operating losses have become the norm.

To boost sales, AVATR initiated a sales channel reform in April, shifting from an exclusively direct sales model to a hybrid model combining direct and dealership sales. Dealerships now handle after-sales services in parallel with SL03 and other sibling brands, with local Changan dealerships taking on this responsibility.

AVATR's channel reform progressed rapidly, completing comprehensive communication and conversion efforts across 115 PMAs (Primary Marketing Areas), 216 stores, and 1,430 sales staff within two months. While this move aimed to alleviate financial pressure, the lack of direct intervention subsequently led to a decline in monthly sales, from 5,247 units in April to 3,712 units in August, with a slight improvement in September (4,537 units).

These sales figures indicate that AVATR's reform measures may have backfired, underscoring the company's urgent need for a safe zone.

Clearly, with the launch of its new model, AVATR is in a tight spot and cannot afford any missteps.

References:

1. "Compressing Direct Stores, Focusing on Car Sales: Can Three 'Rich Dads' Fail to Support AVATR?", Phoenix WEEKLY

2. "Huawei's Efforts and Resources: Can They Save AVATR's Sluggish Sales?", Sina Finance

3. "Changan's Zhu Huarong Rebuts Yu Chengdong Three Times, Exposing Huawei's Internal 'Car Manufacturing' Dispute", Data Ape

4. "Cumulative Losses of 7.1 Billion Yuan in Three Years! Is AVATR Starting to Compromise?", Kanjian Finance