Abandoning "beloved son" Ultium, will GM rely on Chinese batteries to compete in the new energy market again?

![]() 10/10 2024

10/10 2024

![]() 500

500

New energy vehicles from traditional automakers are often prejudiced as lagging behind, with labels such as "oil-to-electricity conversion" lingering. However, upon closer inspection, one discovers that some traditional automotive groups possess impressive new energy technologies, exemplified by GM's Ultium.

Ultium's new energy technology is highly representative in the industry, with its platform architecture showcasing the pragmatism of traditional automotive groups. Many of GM's new energy models, especially electric vehicles from luxury brands like Cadillac, utilize the comprehensive Ultium solution.

However, GM recently discovered issues with Ultium's platform technology, which has hindered the popularity of its new energy vehicles and hindered the development of low-cost products. Consequently, GM decided to abandon its "Ultium complex" and introduce an external supply system.

Faced with sales pressure, GM has adjusted its production and sales targets for 2024. The original goal of producing 400,000 electric vehicles by mid-2024 has been revised downwards to 250,000. Despite Ultium's capabilities, it has not been recognized by the market. GM has announced that it will no longer be tied to the Ultium battery brand and plans to adopt lithium iron phosphate battery technology to expand the types and chemistries of batteries used in electric vehicles, thereby reducing costs.

With a strategic shift, can GM successfully transition to new energy this time around?

Ultium supports GM's electric vehicles, but batteries hold them back

To facilitate marketing and create memorable points for consumers, new automotive forces often name their core technologies such as power batteries and chassis. GM is no exception, with Ultium serving as its "personal IP" in the new energy vehicle sector.

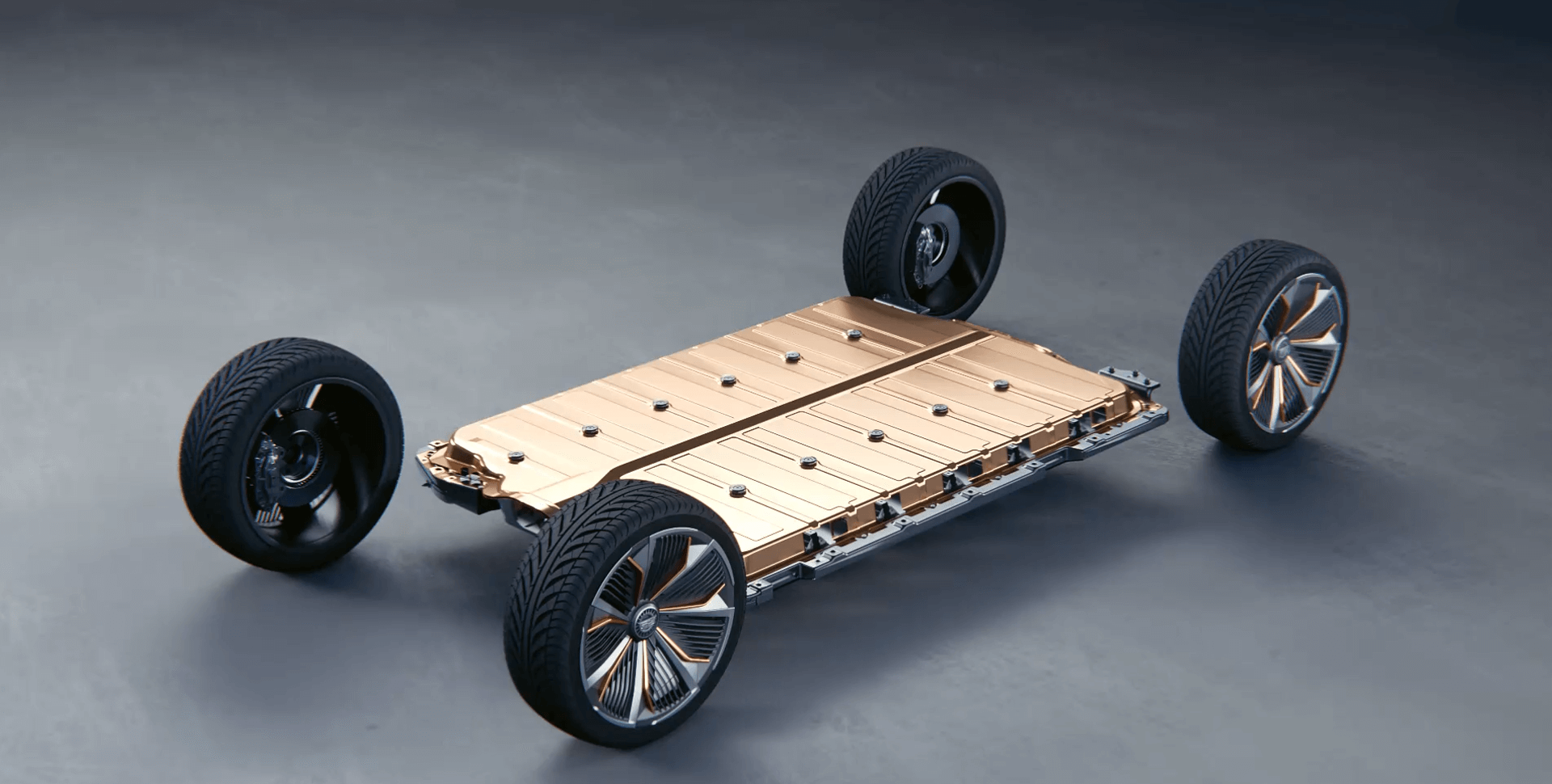

In layman's terms, Ultium is GM's modular platform designed for the next generation of electric vehicles. Modularity offers flexibility, accommodating various vehicle types of different sizes and positioning, achieved through combinations of different numbers of battery modules. This platform is shared across SUVs, MPVs, and sedans.

The Ultium platform supports multiple electric products across price ranges within the GM group, including the Cadillac LYRIQ, CELESTIQ, Chevrolet Blazer EV, Silverado EV, and GMC HUMMER EV. This demonstrates Ultium's scalability, flexible definition space, and cost savings in development.

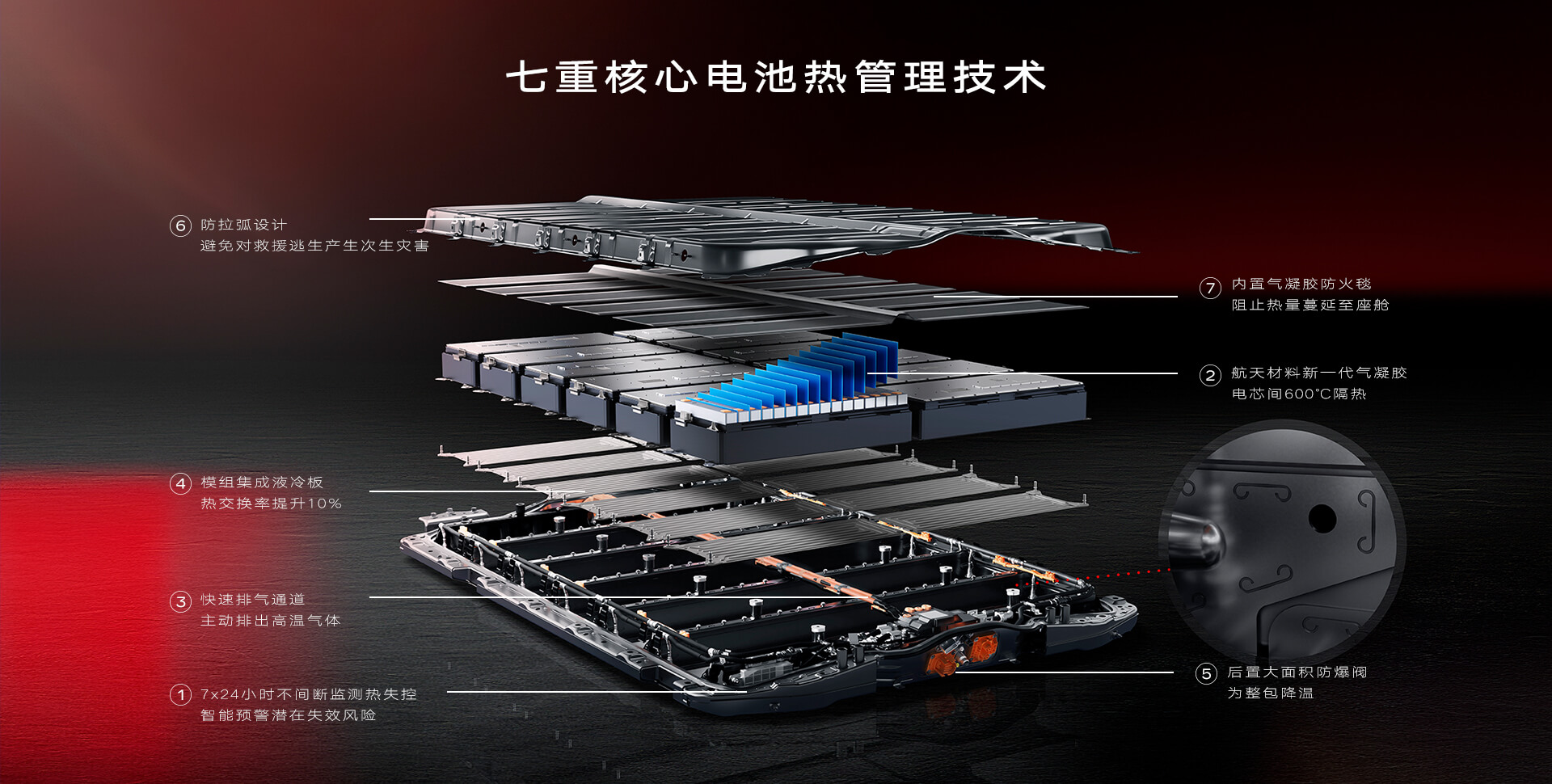

Focusing on power batteries, Ultium batteries boast various technical features, including the industry's first wireless battery management system, proprietary high-energy-density cells and electrolyte formulations, robust physical protection architecture, and vehicle-cloud battery health monitoring systems. Modularity is just the tip of the iceberg for Ultium batteries.

In terms of cell materials, GM currently uses nickel-cobalt-manganese (NCM) batteries on the Ultium platform, developed in collaboration with manufacturers like LG. These batteries offer high energy density, high operating voltage, and strong low-temperature performance. Within reasonable operating conditions, NCM batteries can provide greater capacity in the same battery pack volume and excel in charge-discharge efficiency.

These battery features are similar to those of ternary lithium batteries, commonly found in high-end or premium new energy vehicles. Even the Buick Electra E5, now priced around RMB 170,000, employs the full Ultium platform technology and power battery, showcasing GM's commitment to this area.

However, like ternary lithium batteries, NCM batteries present a "bittersweet dilemma" for automakers. While offering notable technical advantages, they also have drawbacks, such as relatively poor cycle life and thermal stability, potentially increasing the risk of thermal runaway and significant capacity degradation over time.

Crucially, NCM batteries rely heavily on precious metals, particularly cobalt, leading to high battery pack costs. Data shows that the current price of high-nickel cathode materials (NCM 8 series) is approximately RMB 170,000-180,000 per ton, which is just for the cathode material and not the entire battery cell.

This means that if GM insists on vertically integrating its Ultium battery supply, its electric vehicle products will have limited price flexibility and limited profit margins. Given the vast market for low-cost electric vehicles, there is a compelling reason for GM to enter this space. Moreover, as most of GM's premium electric vehicles fail to achieve significant volumes, cost control becomes crucial for the sustainability of its new energy vehicle business.

High costs and limited recognition prompt GM to "swap batteries for survival"

GM currently aims to address two primary issues.

Firstly, battery costs. During a recent investor event, GM announced its intention to "abandon the Ultium battery brand" and outlined its future plans. Kurt Kelty, GM's Vice President of Battery Systems and former Tesla executive, revealed plans to adopt lithium iron phosphate (LFP) battery technology to expand GM's battery supply for electric vehicles.

Many mainstream electric vehicle manufacturers use LFP batteries, known for their simple structure, low manufacturing costs, and independence from heavy metals like cobalt. Data indicates that LFP market prices ranged between RMB 33,500 and RMB 36,500 per ton in September 2024. Despite their relatively lower energy density, average low-temperature performance, and heavier weight, LFP batteries offer significant cost savings.

Moreover, through automakers' efforts, LFP's inherent disadvantages are being mitigated by other technologies, enhancing low-temperature performance and charge-discharge efficiency while retaining LFP's cost advantages. Increasingly, mainstream automakers are showcasing their proprietary LFP technologies as their primary battery solutions.

Kelty added that GM aims to reduce battery costs to an average of USD 60 per kWh from 2023 to 2024 and further to USD 30 per kWh by 2025 through the adoption of LFP batteries. As batteries are a critical component in electric vehicles, cost reductions will undoubtedly benefit overall vehicle manufacturing optimization.

Secondly, brand recognition. GM believes in the advanced and reliable Ultium battery technology, which powers many of its electric vehicles and even partner vehicles like the Honda Prologue SUV. However, Ultium's influence in the industry is limited, prompting GM to abandon its exclusive branding strategy and instead introduce low-cost external solutions.

Indeed, Ultium's influence in the industry can be described as "transparent," with modest production scales and limited automaker partnerships. Beyond internal use, Ultium lacks notable recognition, unable to compete with battery giants like BYD and CATL in terms of brand awareness within the new energy vehicle supply chain.

Technological features like thermal management systems and vehicle-cloud battery health monitoring are not exclusive to Ultium, as mainstream new energy vehicles inherently possess such capabilities. While the industry may not strictly require Ultium batteries, GM's cost reduction and efficiency enhancement efforts necessitate a mature external supply chain.

Nonetheless, GM has not entirely abandoned its power battery business. Kelty stated that GM will continue to collaborate with LG on battery development and build a USD 3.5 billion battery factory in Indiana with Samsung SDI.

Technologically, GM aims to reduce the number of modules in battery packs by 75% through the adoption of novel prismatic battery designs. High-performance electric vehicles will also utilize corresponding high-end cylindrical batteries. Abandoning the Ultium battery brand and embracing external suppliers marks a strategic pivot for GM, as it prioritizes sustainable growth in its new energy vehicle business over promoting Ultium as an industry benchmark.

Chinese batteries: The optimal solution for GM?

In recent years, traditional automakers have actively sought reverse joint ventures amidst China's explosive growth in new energy technologies, yielding numerous superior and mature solutions in areas like smart cockpits, advanced driver assistance systems, and the core electric vehicle components. To accelerate their electric transition, giants like Volkswagen, Audi, Stellantis, and Toyota have proactively embraced Chinese brands to collaborate on models better suited for the new energy market.

Particularly in the power battery segment, CATL and BYD have forged partnerships with multiple automakers, wielding significant industry influence and scale. Their mature solutions have become a top choice for many automakers developing electric vehicles. Perhaps GM could broaden its horizons and consider introducing Chinese battery suppliers.

Frankly speaking, Ultium's platform technology is not inferior in the industry, arguably one of the most competitive electronic and electrical technology architectures among traditional automotive groups at this stage. As platforms are crucial in assessing the strength of new energy vehicles, GM possesses the capability to "fight for the future."

Power batteries, electric drive systems, and electric control units are the core components of the new energy era. As the era of smart vehicles approaches, mastering these three pillars is a basic requirement for automakers. While power battery development is time-consuming, complex, and demanding in terms of technology and capital, mastering power battery technology is commendable. However, in the absence of breakthrough progress, seeking external supply support is also a viable strategy.

Not all automakers are equipped to serve as "solution providers."

In the era of smart vehicles, the importance of smart cockpits and autonomous driving will be amplified. As a traditional brand, GM currently lacks sufficient competitiveness in these areas, with limited Ultra Cruise coverage and a cockpit system trailing the mainstream.

Clearly, GM's pursuit extends beyond power batteries alone.

Source: Leikeji