Geely's ambition remains to be fulfilled

![]() 10/12 2024

10/12 2024

![]() 495

495

Author | Xu Zhi

Editor | Wang Pan

In 1982, 19-year-old Li Shufu invested all his savings of 120 yuan into the business world without hesitation. Every day, he rode a bicycle and used a domestic Seagull camera to take photos of tourists at various scenic spots in Taizhou.

At that time, no one would have imagined that this unremarkable young man would eventually establish a vast Geely automotive empire, diversifying from photography supplies, home appliances, and building materials to automobiles.

While Geely may not be the most prominent player in the current new energy wave, it boasts the most extensive system layout in China.

From gasoline-powered vehicles to new energy vehicles, from affordable commuters to multi-million-dollar supercars, and from the European and American markets to Southeast Asia, Geely's influence is ubiquitous. They have even ventured into satellite manufacturing, chip development, and supersonic flying cars. Some say Geely aims to become the Volkswagen of China, but in reality, Geely's diverse layout and technological prowess far surpass Volkswagen's.

Unlike the flashy BYD, Geely's strength lies in its low-key demeanor. It could be argued that Geely is potentially the most underestimated mobility giant globally.

The 'Money Power' Auto Alliance

At the outset of automobile manufacturing, Li Shufu primarily relied on piecing together various components and leveraging financial resources for acquisitions, despite having little technical experience. For instance, Geely's first mass-produced car, the Haoqing, incorporated the chassis and exterior of a Xiali, the front fascia of a Mercedes, the engine of a Toyota, and the transmission of a Fiat, truly a product of many masters.

The straightforward strategy of 'buying, buying, buying' has characterized Geely's development for a long time.

In 2010, Geely acquired 100% ownership of the Swedish luxury automotive brand Volvo in a move reminiscent of a snake swallowing an elephant, marking the beginning of a spree of mergers and acquisitions. It's worth noting that in 2009, Geely's operating revenue was just 14 billion yuan, whereas Volvo's revenue in 2007 was 10.6 billion USD, indicating a significant disparity in brand recognition and corporate scale.

In 2017, Geely expanded its international footprint by acquiring Proton, a renowned Malaysian automaker, and its subsidiary, the British luxury brand Lotus.

In 2019, Geely partnered with Mercedes-Benz to acquire a 50% stake in the SMART brand, further solidifying its presence in the luxury automotive market.

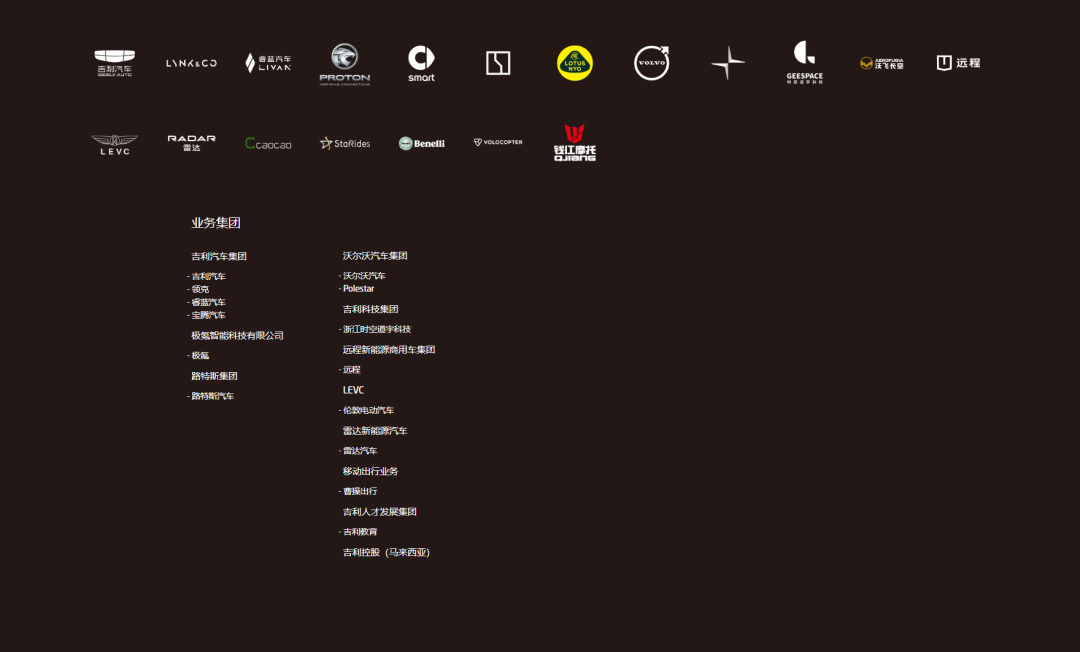

Through long-term development of its own brands and continuous mergers and acquisitions, Geely has established an impressive automotive business scale. Specifically, the Geely empire can be broadly divided into three segments: the Geely Auto Group encompassing numerous proprietary and subsidiary brands, automotive brands established through acquisitions or partnerships (including Volvo), and automotive technology services and cutting-edge technology businesses represented by Geespace and Ecarx.

The core Geely brand includes familiar models like the Emgrand, Boyue, and Xingyue, which still occupy a significant share in the current gasoline-powered vehicle market. The sub-brands Geometry and Yinhe bear the responsibility of tapping into the new energy vehicle market. Geely has also introduced Radar Auto and Yuancheng Auto, targeting the pickup truck and commercial vehicle segments, respectively.

Among them, Zeekr is undoubtedly Geely's most prized 'son' and carries the heaviest burden.

In 2015, Li Shufu unveiled the 'Blue Geely Action Plan,' aiming to have new energy vehicles account for 90% of Geely's sales by 2020. However, the current reality falls far short of this ambition. On the one hand, Geely's primary strategy at the time was to convert gasoline-powered vehicles to electric, which did not resonate with the market. On the other hand, the new energy sub-brands Geometry and Yinhe struggled with sales, leaving Geely without a benchmark model to showcase its technological prowess.

Zeekr represents Geely's 'second battle' in the transition to new energy, which it cannot afford to lose, especially following the disappointing performances of Polestar and Jiyue. As a pure electric brand based on a new architecture, Zeekr boasts impressive product strength. Data shows that from January to September this year, Zeekr has achieved sales of over 140,000 vehicles, firmly establishing itself at the forefront of new energy automakers.

More importantly, Zeekr serves as Geely's vanguard in the premium and luxury new energy vehicle segment. While its sales lag behind those of Wenjie and Lixiang, they are roughly on par with NIO, opening up new avenues for Geely, which has long been constrained by its low-end positioning.

Beyond Geely's proprietary brands, its acquisition and partnership portfolio is even more extensive. In the case of Volvo, in addition to its purebred Nordic gasoline-powered vehicles, two new brands, Lynk & Co and Polestar, have emerged. Furthermore, Geely's acquisitions of Lotus and LEVC (London Electric Vehicle Company), as well as its joint ventures with Mercedes-Benz (Smart), Baidu (Jiyue), and Lifan (Ruilan), contribute to the Geely empire's diverse landscape, with each entity leveraging its unique strengths to flourish in various sectors.

Volvo holds significant importance for Geely. The initial acquisition, financed through various loans, has proven to be a shrewd investment. Volvo's Interior Air Quality System (IAQS) and GX7 safety technology were quickly integrated into Geely models, enhancing Geely's brand reputation in the domestic market. Subsequently, the jointly established CEVT (China Euro Vehicle Technology) research institute developed the CMA and SEA platforms, laying the foundation for successful models like the Geely Xingyue and Zeekr 001.

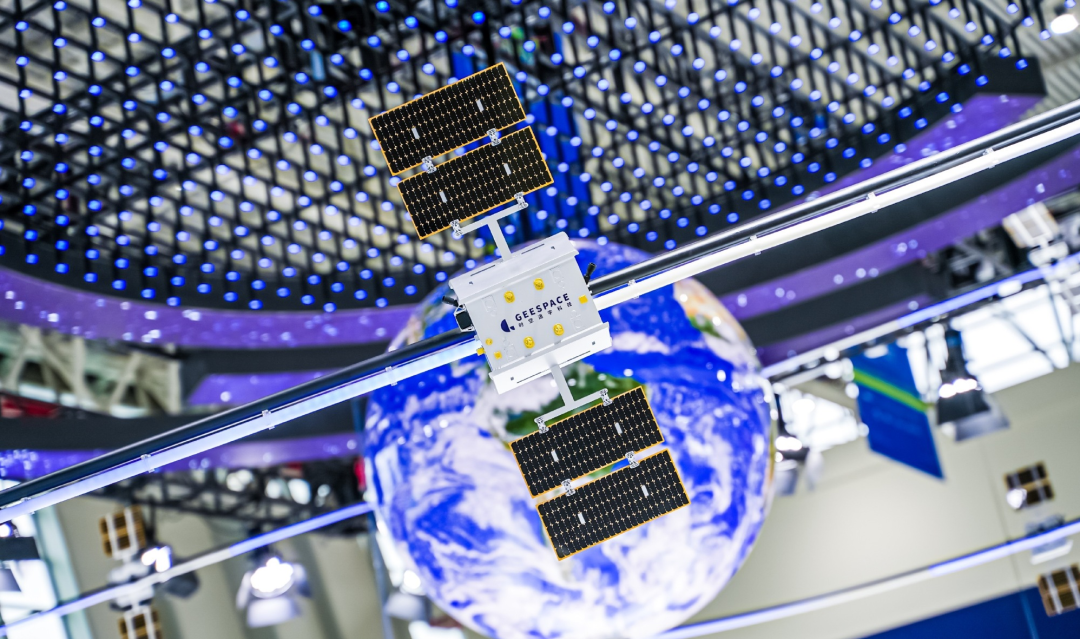

Compared to traditional automakers, Geely perhaps stands out most in its technology services and innovation sectors. Geespace (Timespace Matrix) aims to commercialize China's satellite industry chain, while Volocopter focuses on the research and commercialization of low-altitude urban air mobility solutions. Ecarx and StarTech serve as technological support, enhancing Geely's in-car infotainment systems and autonomous driving capabilities. Cao Cao Mobility, meanwhile, is a crucial component of Geely's 'new energy vehicle sharing ecosystem.'

From a certain perspective, technology has gradually become a significant moat for Geely. In 2021, Geely launched China's first self-developed 7nm automotive-grade SOC chip, the 'Longying 1,' which is comparable to Qualcomm's Snapdragon 8155, positioning Geely as one of the first automakers to break free from chip supply constraints.

Moreover, Geespace has positioned Geely as one of only two automakers globally with a space-based layout. Geely's 'Constellation Plan' has already launched 30 satellites, with plans to establish a global super Wi-Fi network by 2026. While Geespace's satellite count pales in comparison to SpaceX's Starlink, Geely's satellites boast enhanced capabilities, including two-way communication, remote sensing, and navigation functions. For instance, the Yinhe E8 has already incorporated these technologies into mass production.

At this year's Beijing Auto Show, unlike other automakers showcasing new vehicles, Geely hosted a technology conference, unveiling its Leishen hybrid system and receiving the first S-class certification from the China Automotive Technology and Research Center, underscoring Geely's technological confidence.

Facing Challenges, Geely Must Strengthen Its Internal Capabilities

The larger the empire, the greater the management challenges. Geely's diverse portfolio may expose it to unique difficulties that other automakers rarely encounter.

Firstly, internal competition leads to self-depletion. This issue surfaced early in Geely's history when it rapidly introduced numerous models to capture various market segments, resulting in intense internal rivalries. A prime example is the competition among the Emgrand, Global Eagle, and Englon brands, all competing in the same A-segment sedan market.

As Geely's automotive empire expands, such competition is only intensifying. Within the same brand, models like the Boyue, Boyue L, Xingyue L, Haoyue PRO, Vision X6, and Emgrand S all compete in the compact gasoline SUV segment. Across brands, the Zeekr 001, Jiyue 01, and Polestar 4, all produced on the same platform and of similar sizes, engage in direct competition.

Secondly, another lingering issue stems from Geely's early reliance on numerous suppliers. As the number of brands grows, unified management becomes increasingly challenging, leading to unnecessary costs and inefficiencies. Even after continuous optimization of its supply chain, this issue remains prominent, particularly in in-car infotainment systems.

Different infotainment systems are employed across Geely's portfolio, including HarmonyOS for Geometry, NOS for Yinhe, LYNK OSN and Flyme Auto for Lynk & Co, ZEEKER OS for Zeekr, Polestar OS for Polestar, and smart OS for Smart. This lack of standardization not only complicates management but also hinders the formation of complementary brand synergies.

While NIO, for instance, leverages its years of premium market experience to enhance Leto's competitiveness, translating into cost savings and fueling further innovation and quality improvements, Geely seems to lack such positive brand synergies beyond Volvo's technological support.

Recognizing these challenges, Geely issued the 'Taizhou Declaration' during the 'Shufu Public Lecture' at the Taizhou International Auto Industry Expo on September 20th, announcing a new phase of strategic transformation through various reforms.

The declaration focuses on two key aspects: firstly, clarifying each brand's positioning to reduce conflicts of interest and duplicate investments, enhancing resource utilization; secondly, strengthening collaboration and interaction between brands and business units to share basic technologies and core components.

In essence, the goal is to mitigate internal conflicts and promote resource sharing. In late August, 36Kr reported that Geely had embarked on a major R&D integration, encompassing teams from the Geely Central Research Institute, intelligent driving, cockpit, electronic and electrical architecture, electric propulsion, and vehicle platforms across sub-brands, as well as procurement and supply chain management.

This transformation can be seen as a deep squat for Geely. If it succeeds in achieving 'unity' in the future, leveraging its product portfolio, capital synergies, and technological prowess, Geely stands poised to leap to new heights, potentially delivering a significant surprise to the Chinese and global markets.