"Once-popular 'legendary cars' are collectively retreating

![]() 10/12 2024

10/12 2024

![]() 485

485

"

Back in the day, they dethroned the first generation of 'national legendary cars' like Alto, Jetta, and Santana with their innovative vehicle designs and rich feature configurations. Now, they are being surpassed by 'new forces' in a similar manner. It's not that these automakers aren't putting in the effort; it's just that no product can remain invincible forever, as determined by the product cycle.

Cover Image Source: Unsplash"

What constitutes a 'legendary car'? In the era of gasoline-powered vehicles, it must possess the following characteristics at a minimum.

First and foremost, it must be 'easy to drive,' particularly in terms of driving handling. From the budget-friendly Fit to the luxurious Prado, a good car is one that can be effortlessly maneuvered by experienced drivers, regardless of its price point.

Secondly, it must enjoy high market recognition, reflected in its pricing and resale value. A car deemed 'legendary' does not rely on price cuts to boost sales but consistently ranks high on sales charts. Its used car prices remain sturdy, and new models are often in such high demand that buyers have to pay a premium to secure one.

Lastly, it has cultivated a symbolic image among its owners. Mentioning a modified Fit evokes images of stylish young men in Guangdong, while Audi A6 conjures up images of formidable Northeastern businessmen. Passat, in Shandong, commands respect from in-laws, and driving a Land Cruiser or Prado necessitates a journey along the Sichuan-Tibet Highway.

These so-called 'legendary cars' once dominated the gasoline-powered vehicle market for over a decade. However, in the face of the fierce competition from new energy vehicles, with their lower prices and more comfortable ride experiences, these once-mighty 'legendary cars' seem to have lost their invincible edge.

1

Once-popular 'legendary cars' fall from grace

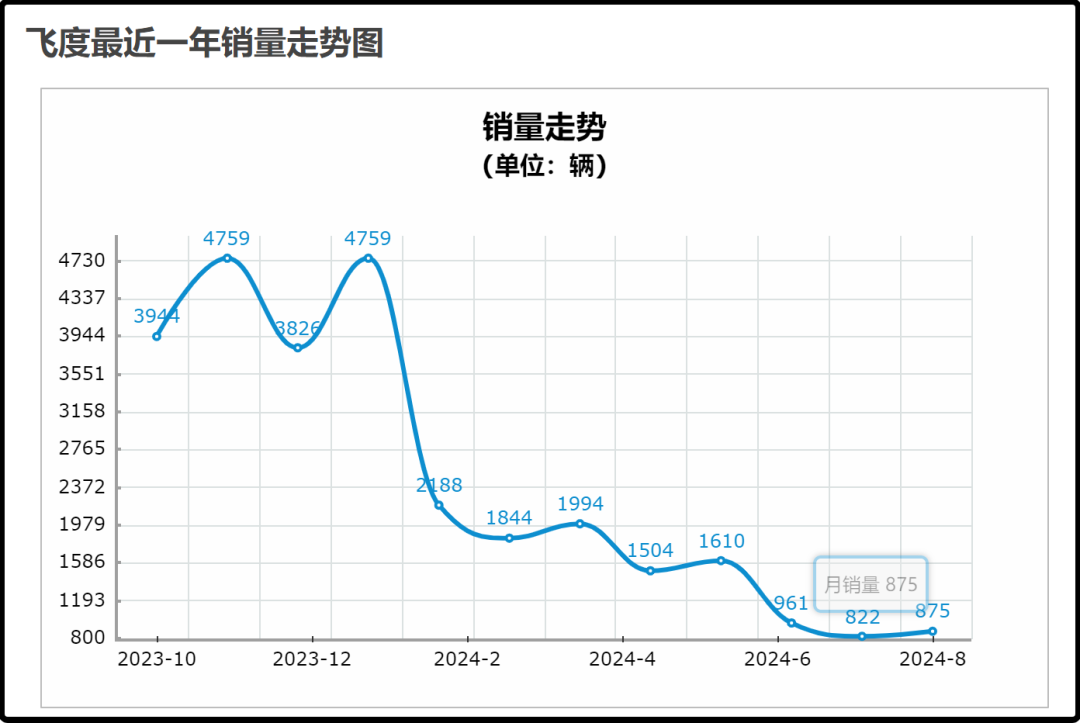

Starting in June this year, Honda's Fit, once a 'legendary car,' experienced a historic monthly sales drop below 1,000 units, maintaining a level of around 800-1,000 units since then, virtually disappearing from the mainstream buying radar.

This compact car, renowned for its economy, durability, flexibility, and convenience, once thrived in the Chinese market, peaking at 15,000 monthly sales. It also garnered popularity among young people due to its strong modification potential and fun driving experience, earning it nicknames like 'value-retaining legend,' 'commuting marvel,' 'space magician,' and 'affordable supercar.'

However, despite its outstanding merits, the Fit's shortcomings are equally apparent. It's hard to believe that in 2024, the available models still lack a central infotainment screen, featuring only a bare radio knob and, in some entry-level versions, no in-car audio system at all.

As a commuting tool, the Fit performs adequately, but as an automotive product, it lags significantly behind its peers in the current market landscape.

Similarly, Honda's Civic, another former 'legendary car,' also experienced a decline. Once a bestseller requiring a premium to secure, its monthly sales once surpassed 30,000 units but now hover around 4,000, even with significant price cuts.

Japanese cars, once favored for their smooth driving and fuel efficiency, have fallen from grace, and German cars, known for their durability, are also struggling in the Chinese market.

In September this year, Herbert Diess, CEO of Volkswagen Group, lamented at an employee meeting, '(We) will no longer receive checks from China.' In the first half of this year, Volkswagen's sales in China declined by 7.4%, with 1.345 million vehicles sold, falling behind BYD's 1.6 million and losing its top position.

As Volkswagen's evergreen model, the Passat, once a bestseller in the B-segment in China, is now resorting to price cuts to stay afloat. The newly launched variant of the Passat in September has an official retail price starting at just RMB 159,900.

Among the German Big Three, BMW 3 Series, Audi A6, and Mercedes-Benz S-Class are considered iconic models by Chinese car enthusiasts. However, under the siege of numerous new-energy automakers, they too have had to lower their stance.

Specifically, the Audi A6L is now priced at just over RMB 320,000, with top-of-the-line models offering discounts of up to RMB 130,000. Similarly, the BMW 3 Series and Mercedes-Benz S-Class offer discounts exceeding RMB 100,000 for some models targeted at Chinese consumers.

In niche segments, former 'legendary cars' like the Jeep Wrangler in the SUV category and the Buick GL8 and Honda Odyssey in the MPV segment are also gradually losing their competitive edge, struggling to maintain sales.

2

Who is taking a slice of the pie?

In the first six months of 2024, China's automobile sales exceeded 14.047 million units, a year-on-year increase of 6.1%, maintaining a steady growth trend.

Market demand has not diminished, yet sales of former joint venture 'legendary cars' have been declining. This lost market share has effectively been captured by domestic automakers.

The growing popularity of new energy vehicles (NEVs) has had a profound impact, offering enhanced product capabilities, smarter driving experiences, and favorable government policies from central to local levels. It is only natural that these factors have dealt a heavy blow to gasoline-powered 'legendary cars' in terms of sales.

Taking Honda Fit as an example, its enduring success in the A0-segment compact car market was largely due to its outstanding performance in power, space, fuel efficiency, and driving experience. Although it faced challenges from strong competitors like Toyota Yaris, Volkswagen Polo, and Nissan Tiida, it ultimately prevailed by capitalizing on its strengths.

However, with the emergence of micro-NEVs, the Fit's advantages in the gasoline-powered era vanished overnight, while its shortcomings in interior configuration and other aspects were magnified.

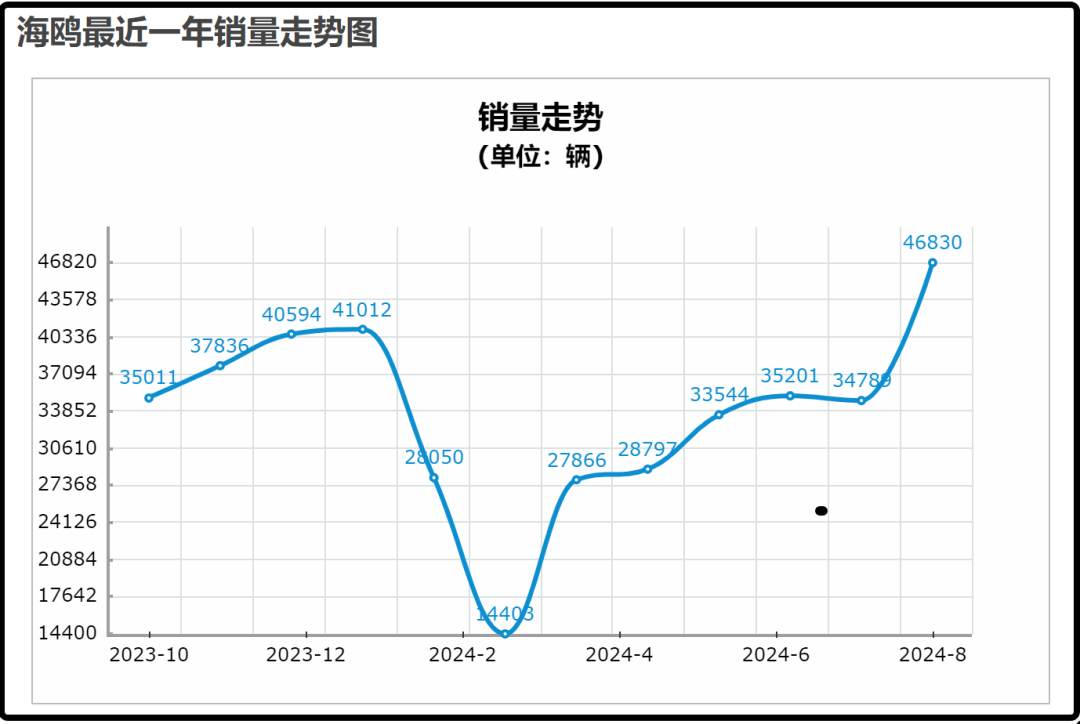

In the first eight months of this year, the best-selling compact car in China was BYD's SeaGull, with monthly sales reaching an astonishing 46,830 units in August. It has surpassed Tesla Model Y to become the top-selling pure electric vehicle in China and is poised to capture the overall market sales crown this year.

Looking at the SeaGull's price range (RMB 69,800 - 85,800 for new cars) and usage scenarios, it overlaps significantly with the Fit. However, in terms of product capabilities, it far surpasses the Fit.

The differences between the two go beyond gasoline vs. electric; they also encompass intelligence and interactive scenarios, making today's popular pure electric vehicles seem like an entirely different species compared to the gasoline-powered 'legendary cars' of yesteryear.

Under such stark contrast, the Fit's abandonment by consumers is not unwarranted. Conversely, those who continue to insist on buying the Fit in today's automotive market raise curiosity about their purchasing criteria. After all, at the same level and price point, there are multiple NEV options beyond the SeaGull.

In fact, the Fit's predicament is a shared issue among other gasoline-powered 'legendary cars.' In the B-segment market in August this year, the Passat was surpassed in sales by BYD's Qin Plus DM-i and Dolphin EV, while the luxury market dominated by German Big Three brands Mercedes-Benz, BMW, and Audi is gradually being encroached upon by new forces like NIO, Lixiang, and AITO.

3

A new generation of 'legendary cars' replaces the old

Whether gasoline-powered or electric, automobiles are ultimately a business centered around people. What disrupts 'legendary cars' is fundamentally a change in people's needs for their vehicles.

Li Bin, founder of NIO, once shared a story about a town in Boxing County, Binzhou City, Shandong Province, with over 800 NIO owners. On the local streets, it's rare to see Mercedes-Benz or BMW models. Occasionally, when a locally licensed one is spotted, the local NIO car club president even considers approaching the owner to convince them to switch to NIO.

The town Li Bin referred to is Xingfu Town, a nationally renowned hometown of kitchenware. With a registered population of only 40,000, it boasts over 3,000 commercial kitchenware processing enterprises, generating an annual output value of RMB 30 billion and accounting for 40% of the national market share. The local business atmosphere is thriving, attracting merchants from all over, and the per capita income ranks among the top in the province.

In the traditional Chinese mindset, personal wealth determines social status, which is often underscored by luxurious cars. For decades, BBA (BMW, Benz, and Audi) vehicles served as another business card for many entrepreneurs. However, when this veneer is stripped away and we return to the competitive dimension of automotive product capabilities, new-energy models represented by NIO often better align with their needs.

From another perspective, cars must ultimately serve their purpose as a means of transportation. While frills like refrigerators, TVs, and comfortable seats are undoubtedly useful, they cannot safely transport people from point A to point B. Gasoline-powered 'legendary cars,' regardless of their price range, have stood the test of time, even being joked about as 'a car that lasts three generations, outliving its owners.'

However, for today's NEVs, the endless expansion of smart devices, while endowing vehicles with more possibilities, also accelerates their iteration cycle. This year, a leading model from a certain automaker underwent three revisions within a year, leaving many owners feeling 'backstabbed.'

Under such circumstances, whether new 'legendary cars' will emerge in the electric era remains to be seen over time.

It's worth noting that these gasoline-powered 'legendary cars,' now cornered by new forces, once revolutionized the previous generation of 'legendary cars' to establish their dominance.

Back then, they dethroned the first generation of 'national legendary cars' like Alto, Jetta, and Santana with innovative vehicle designs and rich feature configurations. Now, they too are being surpassed by 'new forces' in a similar manner. It's not that these automakers aren't striving; it's just that the product cycle dictates that no product can remain invincible forever.

For ambitious domestic automakers, similar scenarios may continue to unfold in the future. Without surpassing the previous generation, there can be no progress and development in the automotive industry. How to extend the lifecycle of products and brands in the long run is perhaps a question that new-generation automakers should seriously consider.