Orders in the tens of thousands, but monthly sales are less than a thousand! Why are there so many watered-down orders in the automotive industry?

![]() 10/16 2024

10/16 2024

![]() 563

563

The recent concentrated launch of new vehicles has once again sparked a trend of showing off orders. On the first day of the Paris Motor Show on October 14, Xpeng P7+ opened for pre-sale, with a starting price of 209,800 yuan. In less than two hours after the pre-sale began, it received over 30,000 orders. This led the outside world to believe that the P7+ would be another hit in the mid-to-large sedan market.

According to incomplete statistics from Mingjing Pro, among the models launched since September, the official orders of the following models have been announced:

The Zhi Jie R7 has surpassed 20,000 firm orders within 14 days of its launch; the Zeekr 7X surpassed 20,000 firm orders within 18 days of its launch; the Ji Yue 07 surpassed 5,000 firm orders within 2 days of its launch; the Avatar 07 surpassed 25,386 firm orders within 17 days of its launch; the Lynk & Co Z10 surpassed 5,000 firm orders within 1 day of its launch; the all-new Lantu Dreamer surpassed 18,000 firm orders within 17 days of its launch; the Denza Z9 GT surpassed 5,000 firm orders within 36 hours of its launch; and the all-new IM Motors LS6 surpassed 20,000 firm orders within 13 days of its launch...

Many of these models launched during the same period are competitive with each other, such as the Zhi Jie R7, Zeekr 7X, and Avatar 07, which all belong to the "7" series. For automakers, announcing order numbers to create a sense of popularity for their models serves two main purposes: boosting confidence and intimidating competitors.

Boosting confidence here refers to both giving confidence to existing and potential consumers, as well as to partners and the market. However, there have long been doubts within the industry about order volumes. For example, NIO's CEO Zhang Yong once joked, "Nowadays, when a new car is launched, if it doesn't announce over 20,000 orders within 2 hours/24 hours/72 hours after going on sale, it's embarrassing to even greet people on the street."

Informed sources claim that order fraud is rampant in the automotive industry, with automakers falsifying orders through internal operations to create the illusion of abundant demand. However, there is a Clear flow among them - NIO, which has never released order volume data. Regarding the recent popularity of the L60, NIO executives simply stated, "It exceeded expectations."

01 How deep is the water in order volumes?

There's quite a bit of nuance when it comes to automakers announcing order volumes. Generally speaking, the order data announced by automakers can be divided into two types: small firm orders and large firm orders. Small firm orders are typically placed before the official launch of a vehicle, where customers pay a certain amount to secure benefits during the pre-sale period. If they ultimately decide not to purchase the vehicle, this amount is usually refundable. Large firm orders, on the other hand, are placed after the official launch of the vehicle, when customers select their desired configuration and pay a certain amount. Based on these large firm orders, automakers schedule production and delivery, and these deposits are non-refundable.

Since these order volumes do not represent actual sales, automakers have some room for manipulation. It's not uncommon to see new vehicles receive 18,000 orders in a day but only sell 1,800 units a month. For example, the Seres SF5 received over 10,000 orders in its first month on the market, but based on public data, sales did not exceed 10,000 units by the end of 2021, when production ceased.

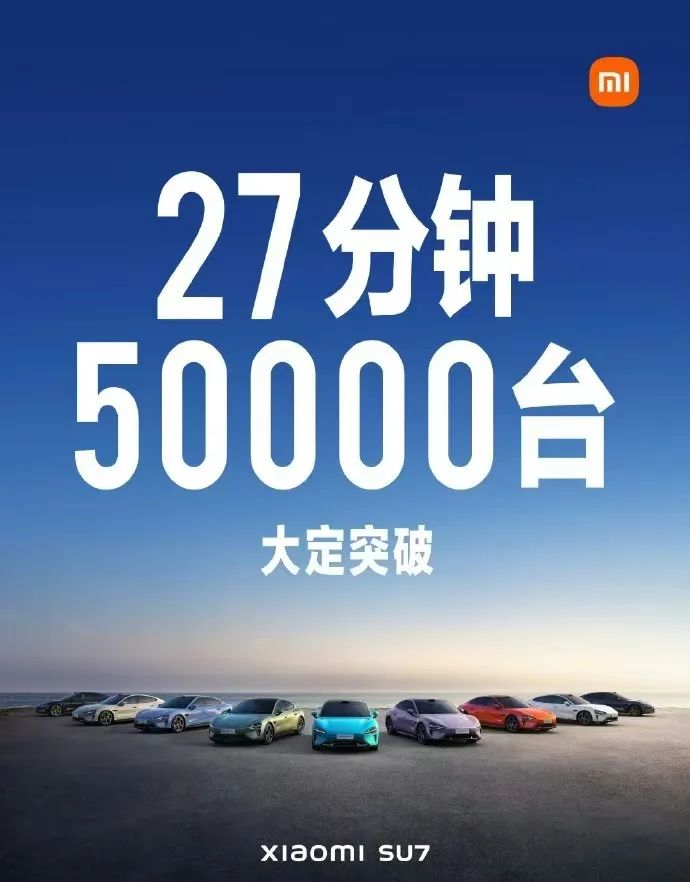

Apart from the lack of oversight over the data itself, some automakers also play word games when announcing order volumes. For instance, Xiaomi's SU7 received 50,000 large firm orders within 27 minutes of its launch in March this year. However, it's worth noting that these were technically small firm orders, as customers had seven days to cancel and receive a full refund before locking in their orders. Similarly, Dongfeng Fengshen faced accusations of order fraud due to its claim of 210,000 blind orders for the Yixuan MAX. Public backlash eventually forced the company to clarify that the figure referred to registered fans on the blind order mini-program, not actual orders.

Other automakers boost their order volumes by lowering the threshold for small firm orders. For example, Qiantu Motor's K20 received over 15,000 pre-orders with a deposit of just 199 yuan. However, two years later, the car has yet to enter mass production. "The PowerPoint presentation was worth the money, and I haven't asked for a refund," wrote one pre-order customer in a car owner forum. Additionally, even if the orders are genuine, considering potential changes during the delivery wait period, they do not necessarily translate to actual sales.

02

How many of these 'explosion' orders will actually translate to sales?

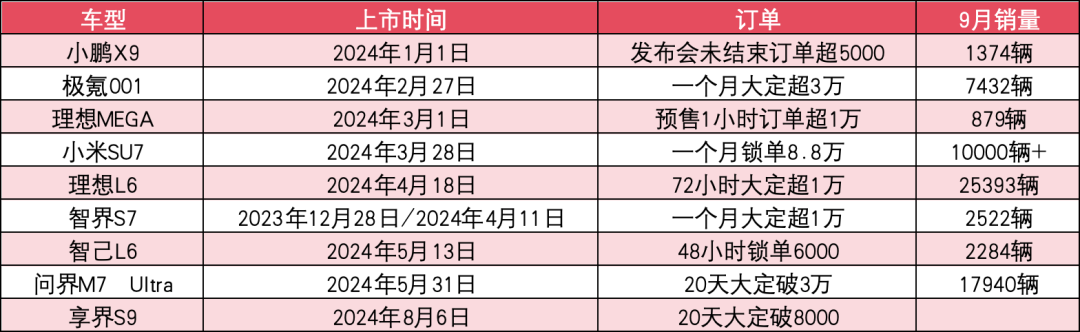

Since the models mentioned at the beginning are all relatively new, it remains to be seen whether their impressive order figures reflect genuine popularity or are simply a flash in the pan. However, we can examine the market performance of models that debuted earlier this year and became popular upon launch.

When it comes to the most popular orders in the first half of the year, Xiaomi's SU7 takes the cake. Within one month of its launch, the SU7 amassed over 88,000 firm orders. Sales have soared since its debut, and in September alone, the SU7 sold over 10,000 units for the fourth consecutive month, solidifying its position as a top player in the mid-to-large pure electric sedan market. Xiaomi Automotive aims to produce 20,000 SU7s in October and expects to deliver 100,000 units by November, ahead of schedule.

Meanwhile, the new Zeekr 001, which debuted slightly before the SU7, also received 30,000 firm orders in its first month on the market. Sales skyrocketed in the following four months, peaking at 14,383 units in May. However, as the initial surge of orders dwindled, sales dipped in July. In mid-August, Zeekr responded to market competition by introducing the 2025 model, but this swift iteration sparked dissatisfaction among early adopters.

Despite the new model's arrival, sales continued to decline, reaching 7,432 units in September and placing third in the mid-to-large pure electric sedan market. Nevertheless, Zeekr's overall performance remains impressive, maintaining a lead of around 4,000 units over its nearest competitor. Another contender vying for dominance is IM Motors' L6, which secured 6,000 firm orders within 48 hours of its launch. Initial sales hovered around 3,000 units per month but slipped to 2,284 in September, placing it lower in the market rankings.

Lixiang's L6 surpassed 10,000 firm orders within 72 hours of its launch. While this figure may not stand out compared to other L-series models, it's still impressive in the broader industry context. The more affordable L6 has since become Lixiang's flagship model, delivering over 10,000 units in its first full month of deliveries and exceeding 20,000 units per month for four consecutive months. In September, sales soared to 25,393 units, making the L6 the best-selling mid-to-large SUV.

Building on the success of the L-series, Wenjie introduced the new M7 Ultra at the end of May, amassing over 30,000 firm orders within 20 days. Due to the concurrent sale of other M7 variants, specific sales figures for the Ultra are unavailable. However, the Ultra's contribution helped boost overall M7 sales to 17,500 units in June, a 7,000-unit increase from May. Sales dipped again in August but rebounded to nearly 18,000 orders in September.

However, Wenjie's sibling brand IM Motors faces a more challenging situation with its S7. Despite securing over 10,000 firm orders within its first month on the market, actual sales were hampered by production constraints. While sales improved slightly after a second launch in April, they have since slipped back to 2,522 units per month.

Elsewhere, Enjoy Auto's S9 surpassed 8,000 firm orders within 20 days of its launch, a respectable figure in the luxury pure electric sedan market. The S9 only began mass deliveries in late August, and according to third-party data, it sold 1,109 units that month. Its market performance remains to be seen.

In the MPV segment, Xpeng's X9 received over 30,000 pre-orders before its launch. Even before the January 1 launch event ended, over 5,000 firm orders had been placed. Lixiang's first pure electric model, the MEGA, surpassed 10,000 pre-orders within an hour of its launch. However, upon its market debut this year, MEGA's performance fell short of expectations, prompting Lixiang to refrain from releasing order volume data. While initial monthly sales exceeded 3,000 units for both models, Xpeng's X9 now sells around 1,300 units per month, while Lixiang's MEGA has lingered below 1,000 units for several months.

This phenomenon highlights another trend among emerging automotive brands: with an initial surge of pre-orders, vehicles can achieve rapid sales growth upon launch. However, once the initial order backlog and launch buzz dissipate, sales often plummet, leaving these models on the fringes of the market. Recognizing this, some automakers, such as IM Motors, are adjusting their sales strategies and delving deeper into niche markets to sustain their momentum.