Huawei's tutelage of Thalys: Who is the super player in the capital market

![]() 10/16 2024

10/16 2024

![]() 629

629

Author: Poetry and Starry Sky

ID: SingingUnderStars

Recently, Huawei launched HarmonyOS NEXT, also known as the legendary 'pure-blooded HarmonyOS,' stirring up the capital market and boosting many concept stocks.

Fortunately, Huawei is not listed, as its listing would undoubtedly cause chaos in the capital market.

According to incomplete statistics, Huawei has invested in 14 listed companies through its investment arm, Harbor Technology Investment.

SH688629 Huafeng Technology, SH688515 Yutai Micro-US, SH688535 Huahai Chengke, SH688048 Everbright Photonics, SH688498 Yuanjie Technology, SH688110 Dongxin Semiconductor, SH688182 Canqin Technology, SH688141 Jahwa, SH688458 Maxscend, SH688536 Siray, SH688167 Everbright Photonics, SH688234 Topsil Semiconductor, SH688261 Dongwei Semiconductor, SH688153 Weijie Innovations

Judging from Harbor Technology's investment route, most of them are related to the chip industry chain.

However, what I want to remind you is Huawei's automotive supply chain. Although there is no clear sign of capital investment, through capital operations, Huawei is playing a masterful game.

Taking WENJIE as an example, Huawei's cooperation with Thalys (formerly Dongfeng Xiaokang) originally involved earning commissions per vehicle sold. However, as Thalys' assets and capital scale expanded, it turned around and invested 2.5 billion yuan to acquire the WENJIE brand.

Shortly thereafter, Thalys made another move, proposing to acquire 100% of the equity of Longsheng New Energy, the owner of the "Super Factory" in Chongqing where WENJIE series models are produced, for a total price of 8.164 billion yuan. This acquisition aimed to further extend the industrial chain and consolidate supply chain security. Upon completion, Longsheng New Energy will become a wholly-owned subsidiary of Thalys, granting Thalys ownership of the Super Factory, while several local state-owned enterprises will become significant shareholders of Thalys.

Thalys' capital operations are even more intriguing than anticipated.

01

Huawei-tutored Thalys

On October 14th, the Paris Station opened with three WENJIE vehicles that had driven all the way from China.

How powerful is Huawei?

Here's how Thalys' (Chongqing Xiaokang) market value has changed in recent years:

Starting the cooperation in 2020, the market value surged from 8 yuan to over 100 yuan, a more than tenfold increase.

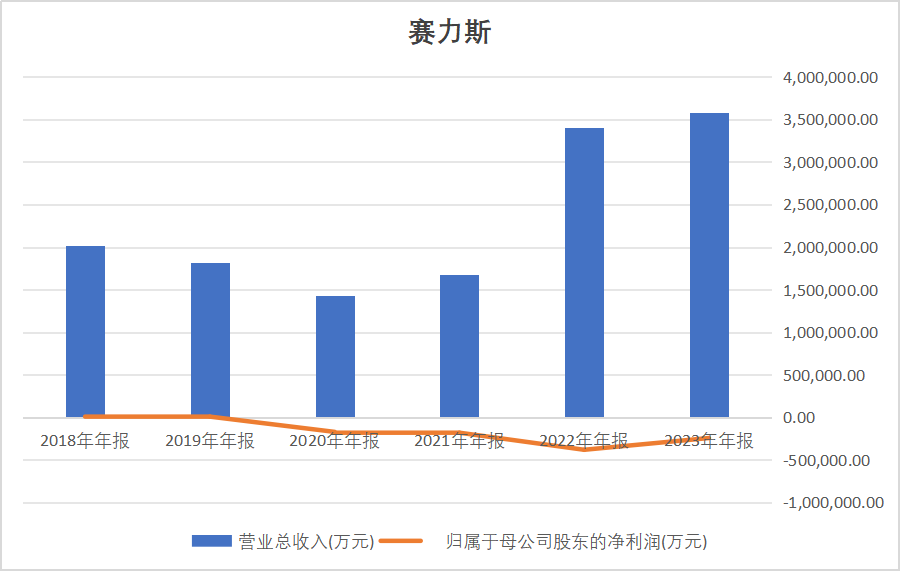

Let's take a look at Thalys' financial performance:

Data Source: iFind

Changes in market value reflect investors' expectations, while changes in performance (especially revenue) represent the company's operating conditions. The highly convergent curves of these two indicators suggest a mutual reinforcement.

The only regret is that net profit remains in the red.

The good news is that the company's net profit significantly improved in the fourth quarter of 2023.

In its 2023 annual report, the company stated that the net profit attributable to shareholders of listed companies was -2.45 billion yuan, primarily due to high R&D investments in models like M9 and M7, resulting in elevated R&D expenses, labor costs, and overall costs. To boost sales, the company increased investments in sales channel development and marketing. As sales grew, the company's profitability strengthened, with a year-on-year reduction in losses of 1.382 billion yuan and a fourth-quarter gross margin increase to 13.54%.

The recently released 2024 third-quarter earnings forecast further indicates a turnaround to profitability: The company expects to achieve revenue of 103 billion to 110 billion yuan in the first three quarters of 2024, up 518% to 559% year-on-year. The net profit attributable to shareholders of listed companies is projected to be 3.5 billion to 4.1 billion yuan in the same period, marking a turnaround from losses compared to the previous year.

For comparison, BYD, the king of domestic automakers, didn't reach 150 billion yuan in revenue and 4.2 billion yuan in net profit until 2020.

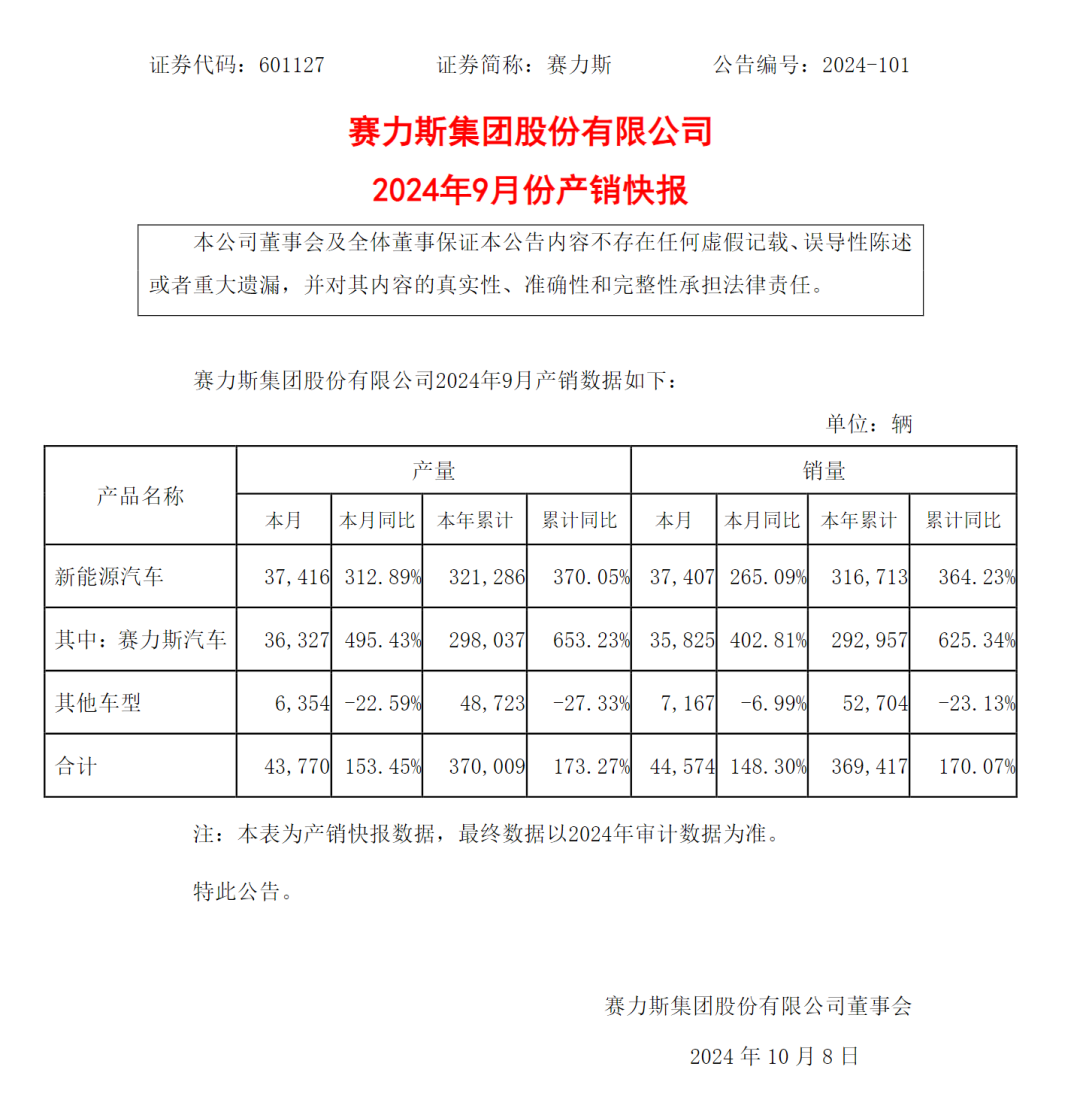

While Thalys' full-year profit remains uncertain, its production and sales reports have brought good news.

For Thalys, Huawei is like a beacon and lighthouse.

02

Thalys' R&D Investments

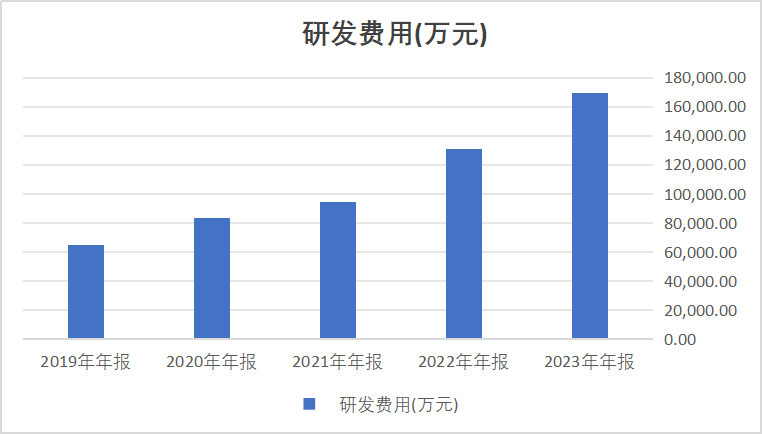

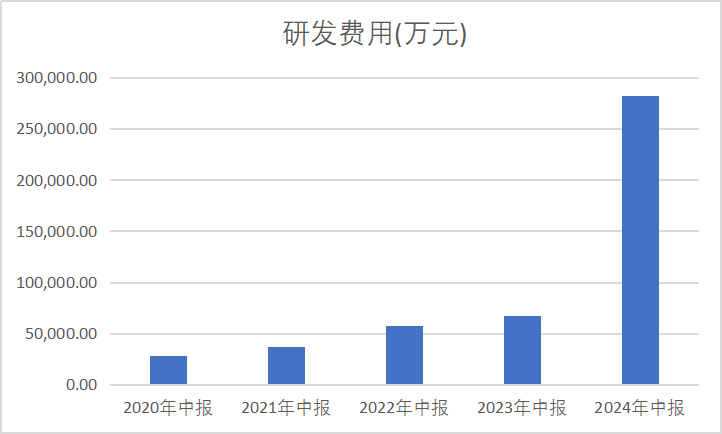

After embracing Huawei, Thalys has not abandoned its self-growth. In recent years, Thalys' R&D investments have grown significantly.

Data Source: iFind

In 2023, the company invested 4.438 billion yuan in R&D, accounting for 12.38% of its revenue and growing by 42.90% year-on-year.

According to the China Automotive Information and Communication Technology Co., Ltd., Thalys ranked first among independent automakers in patent growth, with 1,244 published patents in 2023, a year-on-year increase of 407.76%.

By Thalys' 2024 interim report, its R&D investments have surpassed the entire amount invested in 2023.

Data Source: iFind

In essence, R&D expenses are primarily composed of R&D personnel salaries.

R&D is people-oriented. R&D expenses amounted to 2.83 billion yuan, a year-on-year increase of 320.61%. Specifically, R&D expenses consist of the following components:

Employee Compensation: 640 million yuan, Testing Fees, Inspection Fees, and Process Specification Fees: 35.5 million yuan, Outsourced R&D and Design Fees: 1.023 billion yuan, Repair Costs, Depreciation Amortization, and Low-cost Materials: 984 million yuan, Prototype and Sample Purchases: 102 million yuan, Other Expenses: 42.88 million yuan

The interim report reveals that Thalys' R&D investments focus on the R&D, manufacturing, sales, and service of new energy vehicles and core components, as well as technological innovation and product upgrades for intelligent and connected new energy vehicles. Through sustained R&D investments, the company aims to enhance product competitiveness and promote high-quality development.

03

How Much Commission Does Huawei Earn?

Reports suggest that Huawei earns approximately 36,700 yuan in commission per vehicle sold (another claim is 10% commission).

However, I've been puzzled about how Huawei accounts for its WENJIE commissions. The over 1 billion yuan in 'outsourced R&D and design fees' in the first half of the year may be one avenue.

There are reports that Huawei 'assists' Thalys in selling vehicles and earns commissions. Based on this logic, Huawei might earn commissions as a general contractor. However, major customer data from 2023 shows that sales to the top five customers only accounted for 8.27% of Thalys' total sales, indicating that Huawei is not Thalys' dealer.

This model doesn't hold up.

Based on the 'Independent Financial Advisor's Report on Thalys Group's Major Asset Acquisition,' we can roughly conclude that Thalys transfers benefits to Huawei through hardware and service procurement.

In the first half of 2024, Shenzhen Yinzhi Intelligent Technology Co., Ltd. (a Huawei affiliate) sold 6.6 billion yuan worth of products to Thalys, likely its largest customer, accounting for nearly 10% of Thalys' sales during the same period.

-END- Disclaimer: This article is based on the publicly available information disclosed by listed companies, including but not limited to interim announcements, periodic reports, and official interactive platforms. Poetry and Starry Sky strives for fairness and impartiality in its content and viewpoints but cannot guarantee their accuracy, completeness, or timeliness. The information or opinions expressed herein do not constitute investment advice, and Poetry and Starry Sky assumes no responsibility for any actions taken based on this article.

Copyright Notice: The content of this article is originally created by Poetry and Starry Sky and may not be reproduced without authorization.