Taihong Wanli IPO: Planning to Inject Huge Funds After Continuous Dividends!

![]() 10/18 2024

10/18 2024

![]() 457

457

Zhejiang Taihong Wanli Technology Co., Ltd. (hereinafter referred to as "Taihong Wanli"), an automotive components enterprise, submitted its IPO prospectus in May 2023 and recently completed its second round of responses to the review inquiry letter. Currently, its IPO progress is suspended and awaiting the listing committee meeting.

Public information shows that Taihong Wanli is a comprehensive automotive components supplier integrating R&D, production, sales, and services. Its main business involves the R&D, production, and sales of automotive structural and functional components, which are the primary components of automobile bodies and chassis. The company has become a tier-one supplier for renowned automakers such as Geely Automobile, Great Wall Motor, and Volvo.

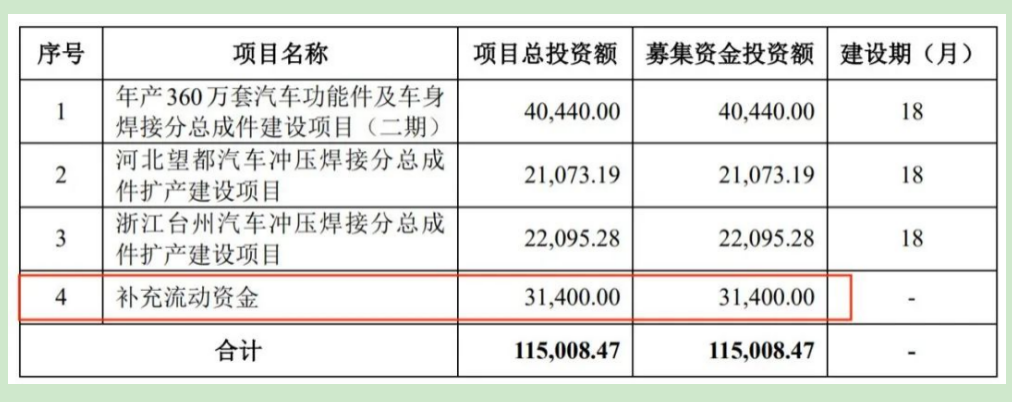

According to its IPO plan, Taihong Wanli intends to raise RMB 1.15 billion, which will be used for projects such as the construction of an annual production capacity of 3.6 million sets of automotive functional parts and body welding sub-assemblies (Phase II), the expansion of automotive stamping and welding sub-assemblies in Wangdu, Hebei, and Taizhou, Zhejiang, as well as for replenishing working capital. However, Caixin News has discovered issues such as illegal fund acquisition, embellishment of financial performance through off-balance-sheet funds, non-compliant financial indicators, potential non-conformance with main board requirements, and major shareholders' desire to raise funds for liquidity replenishment despite already receiving substantial funds, which may affect its listing process.

Illegally Obtained Funds of Nearly RMB 700 Million, Suspicion of Embellishing Performance through Off-Balance-Sheet Funds

Upon reviewing relevant materials, Caixin News found that Taihong Wanli initially drew attention due to issues related to its illegal financing. Public information reveals that between 2020 and 2022, Taihong Wanli obtained a total of RMB 677 million through loan transfers and bill discounting. These operations have raised suspicions that the company may have embellished its performance through the circulation of off-balance-sheet funds and is suspected of illegally obtaining funds.

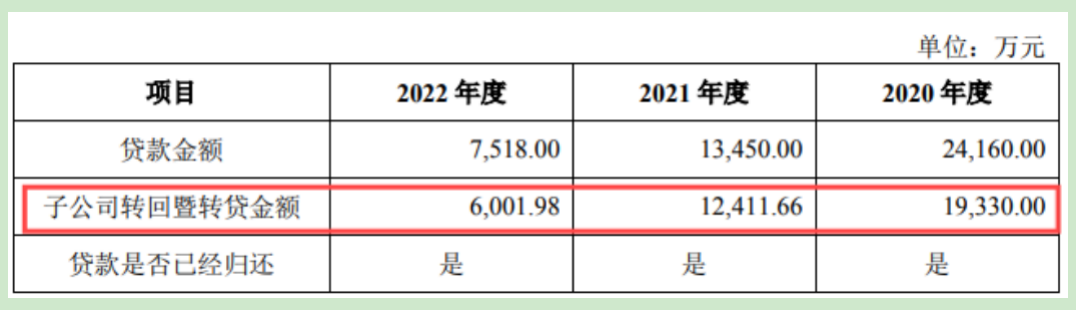

Specifically, Taihong Wanli obtained RMB 377 million through loan transfers. These funds were facilitated through loan transfers between companies. According to the prospectus, during the reporting period, there were instances where bank loans obtained by Taihong Wanli were transferred through subsidiaries for capital circulation and ultimately used by the company as working capital. From 2020 to 2022, the loan amounts were RMB 241.6 million, RMB 134.5 million, and RMB 75.18 million, respectively, while the amounts transferred back by subsidiaries were RMB 193.3 million, RMB 124.12 million, and RMB 60.02 million, respectively, totaling RMB 377 million.

In response, Taihong Wanli explained that the bank loans obtained through subsidiary circulation were used for daily production and operation, and no new loan transfers occurred after October 2022. As of the date of the prospectus signing, all the aforementioned loans have been fully repaid.

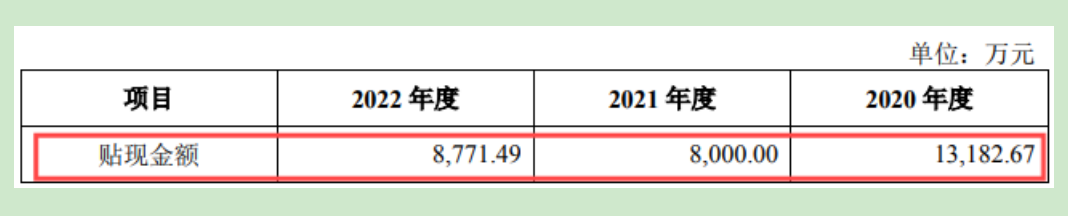

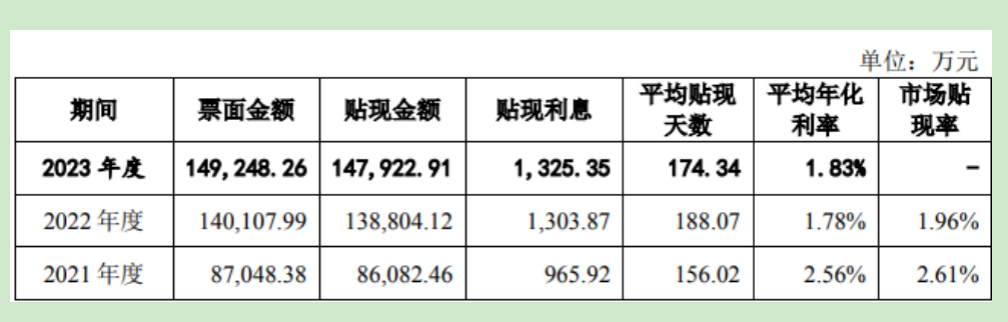

Additionally, during the same period, Taihong Wanli also obtained RMB 300 million through bill discounting. The prospectus shows that from 2020 to 2022, Taihong Wanli issued bank acceptance bills and letters of credit to its subsidiaries Jinan Taihong and Baoding Taihong, which were then discounted and used as working capital. The discounted amounts were RMB 87.71 million, RMB 80 million, and RMB 131.83 million, respectively, totaling RMB 300 million.

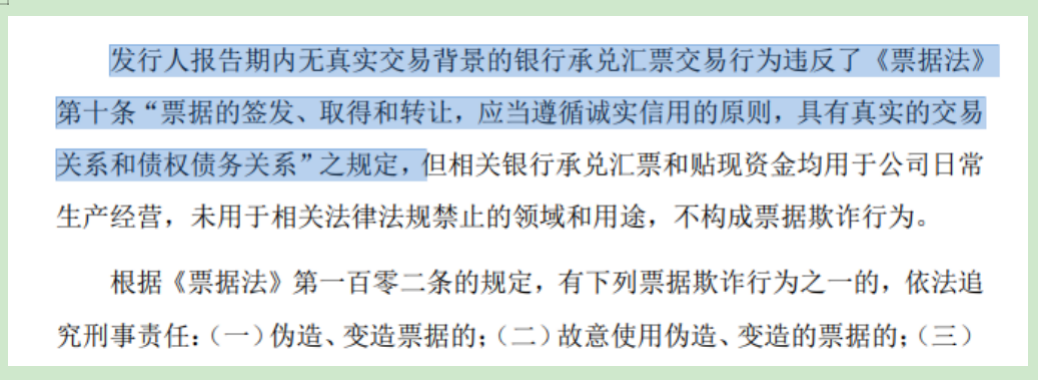

According to Caixin News, bill discounting typically involves a company transferring its unmatured commercial bills to a bank or other financial institution in exchange for cash, which is a common financing method to improve cash flow. Taihong Wanli stated that the funds obtained through bill discounting were used for daily production and operation and did not constitute bill fraud, nor did they warrant criminal liability or administrative punishment.

However, for Taihong Wanli, which was in dire need of funds, these two operations collectively brought in RMB 677 million, which was indeed a timely infusion. This large-scale fund operation has aroused suspicions, not only due to suspected illegal financing but also because some believe the company may have exaggerated its financial performance through the circulation of external funds, presenting a better-than-actual performance on its financial statements.

In its prospectus, Taihong Wanli detailed its financial condition and operating results in its financial reports. While these reports did not directly mention the use of off-balance-sheet funds to embellish performance, the notes to the financial statements contain detailed explanations of the company's financial position, including balances and changes in accounts receivable, other receivables, inventories, and related provisions for bad debts and impairment losses, which are crucial indicators for assessing the existence of off-balance-sheet fund circulation.

The financial statements show that Taihong Wanli has made provisions for bad debts on accounts receivable and other receivables, as well as for impairment losses on inventories, reflecting the company's assessment of potential credit risks and asset impairment risks.

Caixin News understands that pre-IPO companies like Taihong Wanli must comply with relevant laws and regulations regarding financial operations, such as the Negotiable Instruments Law and relevant judicial interpretations on private lending cases, and make appropriate disclosures in their financial statements. Any violations may expose the company to significant legal risks, investigations, and penalties from regulatory authorities, affecting its reputation and investor confidence.

Moreover, these issues have also attracted regulatory inquiries. The stock exchange requested Taihong Wanli to clarify the specific amounts and time nodes of its loan transfers and bill financing activities, the repayment or redemption timelines of related loans and bills, the actual flow and use of funds, and whether there were instances of embellishing performance through off-balance-sheet fund circulation. Additionally, the stock exchange twice inquired about Taihong Wanli's accounts receivable in the second round of inquiries, specifically requesting clarification on the issuers and reasons for the high amount of bank acceptance bills with high credit ratings issued in 2020.

In response, Taihong Wanli provided relevant financial data and explanations to justify the rationality of its fund operations. Furthermore, the company's actual controllers, Ying Zhengcai and Ying Lingmin, made commitments to unconditionally bear any expenses, fines, or other economic losses incurred by Taihong Wanli due to administrative penalties, ensuring that the company would not suffer any losses as a result.

However, based on observable phenomena, Taihong Wanli did indeed obtain substantial funds through loan transfers and bill discounting from 2020 to 2022, raising suspicions of illegal activities. Whether there were instances of embellishing performance through off-balance-sheet fund circulation remains to be determined by further investigations by regulatory authorities and detailed disclosures by the company.

Multiple Indicators Below Industry Standards, Potentially Ineligible for Main Board Listing

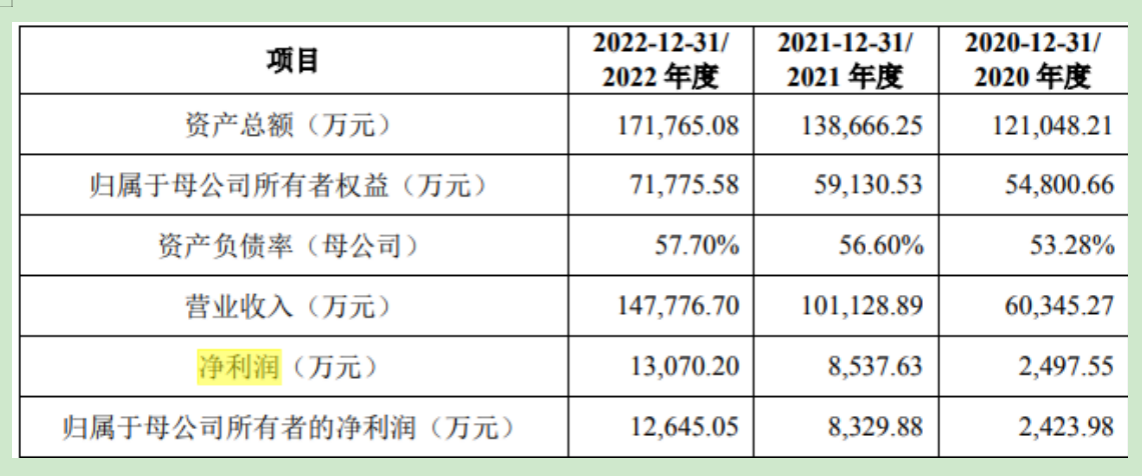

From a performance perspective, the prospectus reveals that Taihong Wanli has experienced rapid growth. From 2020 to 2022, its revenue amounted to RMB 603 million, RMB 1.011 billion, and RMB 1.478 billion, respectively, while its net profits were RMB 24.98 million, RMB 85.38 million, and RMB 131 million, respectively. After deducting non-recurring items, its net profits were RMB 21.29 million, RMB 82.02 million, and RMB 126 million, respectively. Additionally, based on the latest updated financial report, Taihong Wanli achieved revenue of RMB 1.544 billion and a net profit of RMB 161 million in 2023.

Taihong Wanli claims to be a tier-one supplier to renowned automakers such as Geely Automobile, Great Wall Motor, Volvo, SAIC Motor, GAC Motor, SGMW, Jiangling Motor, Lynk & Co, and Zeekr, and is actively expanding into new energy vehicles such as Tesla, NIO, and Xpeng Motors.

Despite Taihong Wanli's seemingly impressive financial performance, Caixin News has identified operational and financial issues that may affect its eligibility for listing on the Shanghai Stock Exchange's main board.

For instance, the company's growth rate is gradually slowing down. Although its revenue and net profit increased during the reporting period, the growth rates declined annually. In 2021, the growth rates for revenue and net profit reached 67.66% and 241.84%, respectively, but slowed to 46.19% and 53.09% in 2022. This indicates that the company's long-term growth may face pressure.

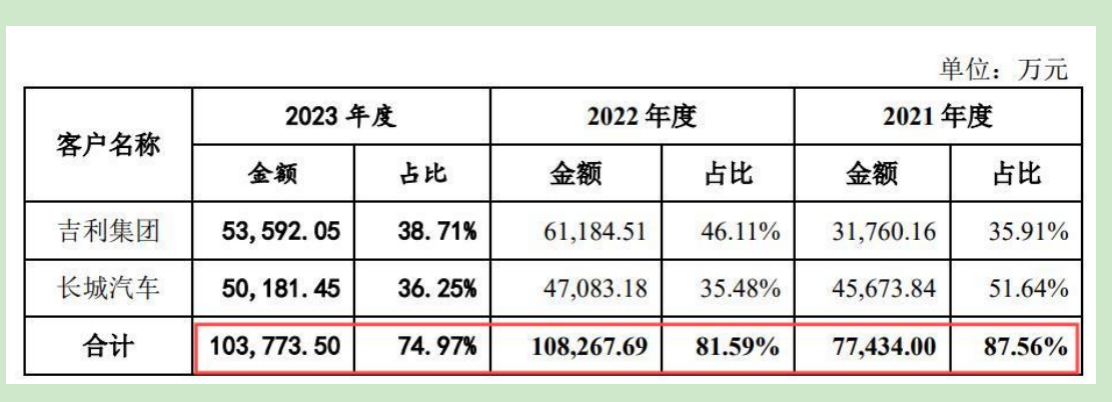

Furthermore, Taihong Wanli suffers from high customer concentration. Its primary customers are automakers and some automotive component suppliers, with a strong dependence on Geely Group and Great Wall Motor. In 2021 and 2022, these two companies accounted for over 80% of its main business revenue, and although the proportion decreased slightly in 2023, it remained high at nearly 75%. Such high customer concentration poses risks to the company's operations, as changes in the financial condition of its major customers could adversely affect its performance.

Regarding other financial indicators, Taihong Wanli's accounts receivable and inventory account for a relatively high proportion of its revenue, showing an increasing trend year by year. The high balance of accounts receivable may affect the company's cash flow, while the continuous increase in inventory may tie up substantial working capital, impacting capital utilization efficiency.

Meanwhile, Taihong Wanli's asset-liability ratio is significantly higher than the industry average. According to the prospectus, the company's asset-liability ratios during the reporting period were 53.28%, 56.6%, and 57.7%, respectively, which are higher than the industry averages of 40.14%, 38.50%, and 42.83% for comparable listed companies in the same industry during the same period. A high asset-liability ratio may increase the company's financial risks and affect its debt repayment ability.

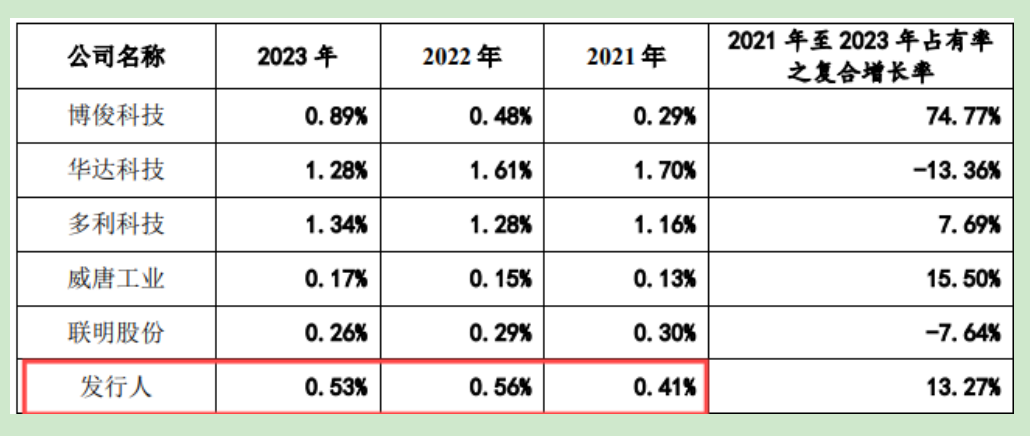

Additionally, Taihong Wanli's market share is relatively low. According to the prospectus, its combined market share for structural and functional components was only 0.53% in 2023, indicating a relatively small market presence and intense competition within the industry.

In the automotive components industry, market share is a crucial indicator of a company's competitiveness. A low market share may suggest challenges in brand influence, product differentiation, cost control, and technological innovation. In other words, Taihong Wanli's future growth may already be facing certain "bottlenecks".

Regarding R&D investment, Taihong Wanli's management and R&D expense ratios during the reporting period were lower than those of comparable companies in the same industry, while its sales expense ratio was higher. This indicates that the company prioritizes sales over R&D. Specifically, Taihong Wanli's R&D expense ratios during the reporting period were 3.14%, 3.35%, and 3.37%, significantly lower than the industry average.

Furthermore, a large number of Taihong Wanli's employees are not covered by social security and housing provident funds. According to the prospectus, in 2020, 61.27% of the company's employees were not enrolled in housing provident funds, and over 20% were not enrolled in medical, maternity, unemployment, and pension insurance. In 2021, 26.87% of employees were still not enrolled in housing provident funds, and over 15% were not covered by other insurance types. Although the company has made improvements in preparation for its IPO, it still falls short of meeting the requirements for listed companies.

According to Caixin News, companies listed on the Shanghai Stock Exchange's main board typically need to meet a series of financial and non-financial criteria designed to ensure they possess a certain scale of operation, profitability, financial stability, and good corporate governance.

These criteria encompass sustainable operation capabilities, financial indicators, corporate governance, compliance, asset-liability ratios, information disclosure, R&D investment, and social responsibility.

Currently, Taihong Wanli faces issues such as high customer concentration, high proportions of accounts receivable and inventory, an asset-liability ratio above the industry average, and R&D investment below the industry average. Moreover, if the company embellished its performance through off-balance-sheet fund circulation, it would violate the compliance requirements for listed companies. These issues may affect its eligibility for listing on the Shanghai Stock Exchange's main board.

Major Shareholders Receive Substantial Cash Returns, Yet IPO Aims to Raise Additional Funds for Liquidity Replenishment (RMB 314 Million)

From a shareholding structure perspective, Taihong Wanli's current controlling shareholders and actual controllers are Ying Zhengcai and Ying Lingmin, father and son, who collectively control 37.35% of the company's shares. Ying Zhengcai serves as the chairman and directly holds 30.49% of the company's shares, while Ying Lingmin serves as vice chairman and directly holds 6.85% of the shares, with an additional 0.01% held indirectly through Taizhou Yuanrun. Additionally, family members of Ying Zhengcai also hold shares in the company, such as Ying Zaigen with 1.88%, Ying Zhengfa with 1.18%, and Ying Youming with 0.59%.

According to Tianyancha information, Taihong Wanli was previously known as Zhejiang Taihong Electromechanical Co., Ltd., established in August 2005. The company has a registered capital of approximately RMB 255 million, with Ying Zhengcai as the legal representative. Its shareholders include Ying Zhengcai, Shao Yutian, and Taizhou Huiming Equity Investment Partnership (Limited Partnership), among others.

Previously, during its rapid expansion phase, Taihong Wanli also attracted investment from Li Shufu, the chairman of Geely Holding Group. Li Shufu was once an indirect shareholder of Taihong Wanli through Geely Components. However, in 2014, Geely Components exited its shareholder position in the company. According to the prospectus, Geely remained its largest customer in both 2022 and 2023.

In addition, Zhenxin Shanghai, which was once the second largest shareholder of Taihong Wanli, withdrew in 2016 and ended up in court. After court mediation, it liquidated its holdings through equity transfers. After Zhenxin Shanghai's withdrawal, Ying Zhengcai and his son Ying Lingmin further strengthened their control over Taihong Wanli.

In terms of equity transfers and dividends before going public, Ying Zhengcai and his son cashed out to some extent by transferring shares and receiving cash dividends. In April 2022, Ying Zhengcai transferred 2.59% and 0.78% of his shares to Liang Chen and Guan Minhong, respectively, at prices of 22.77 million yuan and 6.9 million yuan, respectively, totaling approximately 29.67 million yuan in cash.

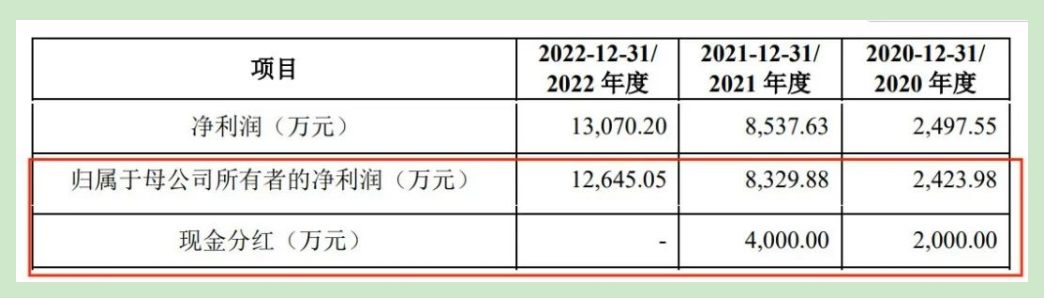

From the above and a series of actions by major shareholders, it can be seen that Taihong Wanli has actually been in a relatively cash-strapped state. However, despite significant financial pressures, Taihong Wanli still conducted two cash dividends each in 2020 and 2021. In 2020, its net profit attributable to shareholders after deducting non-recurring gains and losses was only 21.2858 million yuan, yet it distributed 20 million yuan in cash dividends, essentially distributing all of its current net profit. In 2021, it distributed an additional 40 million yuan in dividends. The majority of these dividends flowed to the company's controlling shareholder and actual controller, Ying Zhengcai and his son.

Taihong Wanli's equity structure and dividend behavior before its IPO reveal that the company's controlling shareholder and actual controller have obtained substantial cash returns through various means. These actions may impact the company's financial situation and sustainable operational capabilities, especially as large dividends amidst financial pressures may draw the attention of regulators and investors.

While major shareholders reap generous cash returns, Caiwen News notes significant cash flow pressures within the company itself. The prospectus reveals that as of the end of 2023, the company's short-term borrowings amounted to 394 million yuan, while monetary funds stood at only 188 million yuan, leaving a short-term debt gap of over 100 million yuan. So, where does the money come from? Taihong Wanli aims to raise funds in the capital markets.

According to the IPO plan, Taihong Wanli intends to raise 1.15 billion yuan, which will be used for the construction of a project to produce 3.6 million sets of automotive functional soft parts and body welding subassemblies annually (Phase II), as well as expansion projects in Hebei Wangdu and Zhejiang Taizhou. Among these, 314 million yuan will be used to supplement working capital. On the one hand, major shareholders obtain substantial cash through dividends, while on the other hand, they turn to the market to raise funds to supplement working capital, raising numerous questions about such behavior.

Overall, Taihong Wanli still faces numerous unexplained issues regarding corporate management, financial data, and IPO fundraising amounts. The company may need to actively address public concerns to pave the way for its IPO journey, which Caiwen News will continue to closely monitor.