Joint venture → New force: the distance from one besieged city to another

![]() 10/22 2024

10/22 2024

![]() 607

607

Original article by New Energy View (ID: xinnengyuanqianzhan)

Full text: 2880 words, Reading time: 8 minutes

As we enter 2024, the hustle and bustle of the automotive market seems to have escalated to a new level.

According to Autohome data, in the first half of 2024, nearly 2,000 new 4S dealerships closed down.

Even if each 4S dealership has only 5 salespeople, that would still mean 10,000 salespeople losing their livelihood and having to find new jobs. The chill in the industry has spread to the in-service salespeople who are feeling the crisis.

Recently, Qi Lin (pseudonym), who has been struggling with the realities of the industry, finally made up his mind to leave the joint venture automaker and join a new force brand.

Qi Lin had worked here for five years. The reason for his departure was that the 4S dealership of the joint venture brand he served implemented a new salary standard this year, significantly reducing performance bonuses and commissions.

"Many of my former colleagues are now with new force brands, earning a base salary of around 4,000 to 5,000 yuan. The contrast with my salary is stark," he said.

In New Energy View's interactions, it was discovered that the phenomenon of "joint venture brand sales joining new force brands" is not an isolated case. It is currently taking place in many joint venture brand 4S dealerships across the country.

1. The once-profitable backbone has become a "besieged city"

In recent years, as competition in the new energy market has intensified and the "price war" in the automotive market has escalated, life has become increasingly difficult for joint venture automakers.

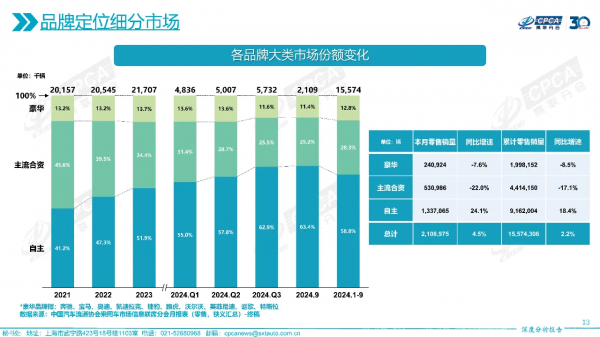

According to data from the China Passenger Car Association (CPCA), from January to September this year, mainstream joint venture brands sold a cumulative total of 4.414 million vehicles, a year-on-year decline of 17.1%, accounting for 28.3% of the total market share, a decrease of nearly 24 percentage points compared to the same period in 2020.

In contrast, Chinese brands have surged, with cumulative retail sales accounting for 58.8% of the total market share from January to September this year, an increase of nearly 25 percentage points compared to the same period in 2020.

Image/Market share of Chinese brands from January to September 2024

Source/Screenshot from CPCA New Energy View

In New Energy View's interactions, currently, nearly 70% of the 100 consumers intending to buy a new car would prioritize new energy vehicles under Chinese brands.

However, a decade ago, when it came to buying a car, 80% of ordinary consumers would first recommend a joint venture brand.

"Salespeople's income relies heavily on commissions. The more they sell, the more they earn. In the past two years, despite the apparent higher foot traffic in our dealership compared to new force brands, the final sales volume has decreased significantly compared to a decade ago," said Qi Lin.

Tang Zhe (pseudonym), who used to work at a Guangzhou Automobile Toyota dealership, left a month ago to join NIO.

"My base salary at Guangzhou Automobile Toyota was very low, only around 2,000 yuan. There is an annual opportunity to increase the base salary, but relying solely on it is clearly not feasible. One still needs to work hard to sell cars. According to this year's system, failing to meet targets results in deductions, such as 200 yuan for each missed loan, and of course, missing sales targets also leads to deductions. Accumulated deductions can even result in a negative salary for the month," he said.

Similarly, Wang Yue (pseudonym), who currently works as a salesperson at a Dongfeng Honda 4S dealership, told New Energy View that colleagues have been leaving in succession since the beginning of the year. Two or three salespeople left the dealership last month, and he is currently looking for new job opportunities.

"The automotive industry is highly competitive now. No matter which dealership one works for, there is definitely pressure. However, compared to joint venture brands, the pressure in new force brands is still much lower, and the base salary alone is double my previous one," he said.

The stress and pressure faced by salespeople at joint venture 4S dealerships are inevitably passed on to consumers. Under repeated disappointing service experiences, consumers are naturally less willing to trust such dealerships.

Mr. Huo (pseudonym), a long-time Toyota owner, recently traded in his Prado for an L9 from Lixiang Auto. "Lixiang's service is impeccable. In fact, I had a good experience with Toyota when I bought my previous three cars in 2004, 2010, and 2016. But in the past two years, I noticed that the salespeople seemed exhausted when I visited the dealership, and they weren't as enthusiastic as before," he said.

2. Escaping from one "besieged city" of joint ventures only to be trapped in another

"It used to be the mainstream joint venture brands that made easy money lying down. Now, it's the new force brands. Joining a new force brand and earning 100,000 yuan per month is not a dream," some might say optimistically.

But is this really the case? The answer is that while it is possible to earn such an income in some new force brands, the probability is not high. Out of all the salespeople in these brands, only a handful can actually enjoy a monthly income of 100,000 yuan.

"When new force brands first emerged, several salespeople from our dealership joined NIO. The base salary and commissions were indeed higher than those at BMW 4S dealerships, but not as exaggerated as some might think. In 2020, our top salesperson at the dealership earned around 60,000 to 70,000 yuan per month, but not every month," said Song Ziming (pseudonym), a salesperson at a NIO dealership.

According to Song, as NIO's sales have grown year after year, so have the commissions for salespeople. However, with more incentives come more pressure. In this context, even NIO's product specialists have been brought to the front line to sell cars, essentially doubling their responsibilities.

Jiang Xuan (pseudonym), who has sales experience in two new force brands, shares a similar sentiment. She joined a Leapmotor dealership in Beijing in September 2022 and later moved to Xiaomi Automobile in March this year. However, the higher salary came with increased performance pressure, which eventually took a toll on her health.

Image/Xiaomi G Park Automobile Flagship Store

Source/Screenshot from the Internet, New Energy View

In June, she decided to quit her job in automotive sales and return to her hometown to open a flower shop. "Long-term endocrine disorders and mental stress forced me to give up my job. After a period of recuperation, I feel much better now. I can sleep and eat well," she said.

"To earn more money, one has to be promoted, and to be promoted, one has to perform well. It's like working in insurance, where you try to sell to everyone you know," complained multiple salespeople at new force dealerships. "At joint venture 4S dealerships, we used to finish work at 6 p.m. Now, at new force dealerships, we have to follow the mall's schedule, work during holidays, and make endless phone calls," they added.

It is worth noting that facing the intense competition from multiple brands and models introduced this year, some new force brands that have yet to turn a profit are facing significant challenges. To reduce expenses and improve performance, they have turned their attention to their own employees.

On October 16, multiple media outlets reported that Nezha Automobile's parent company, Hetong Automobile, is adjusting salary structures and optimizing performance appraisal systems. Some employees are currently only receiving 50% of their salaries.

Therefore, while the "big pie" of new force brands may look appealing on the surface, it comes with high-intensity work pressure and difficult-to-break sales bottlenecks beneath the veneer of high base salaries and commissions.

3. Joint ventures or new force brands: Who will go further?

We may have guessed the beginning, but not the ending.

This sentiment is shared not only by automotive salespeople but also by automakers themselves.

Taking a comprehensive view of the automotive market as a whole, it is not difficult to see that while price wars have brought short-term sales benefits, they have also indirectly compressed automakers' profit margins.

For example, in 2023, SAIC Volkswagen's annual net profit was 3.13 billion yuan, a year-on-year decline of 64.12%. NIO's annual net loss reached 20.72 billion yuan, an expansion of 43.5% year-on-year. XPeng's annual net loss reached 10.38 billion yuan, an expansion of 13.6% year-on-year.

Image/XPeng's loss exceeded 10 billion yuan in 2023

Source/Screenshot from the Internet, New Energy View

To alleviate financial pressures, automakers have turned to cost-cutting measures aimed at their employees and dealers.

However, blindly cutting costs will inevitably backfire on automakers.

On the one hand, excessive pressure on dealerships can gradually erode the morale of employees, which in turn can indirectly affect consumers' recognition of the brand's service. After all, frontline salespeople are the direct representatives and core drivers of a brand, bridging the trust between the brand and consumers.

On the other hand, reducing the salaries of dealership salespeople can lead to the loss of talented employees. New hires, who lack the experience and expertise of their predecessors, may struggle to provide the same level of service.

Multiple consumers have expressed that while they may initially recognize the quality of a brand's vehicles, the overall service provided by the dealership is often the deciding factor in their purchase decision.

"Many people choose electric cars for their cost savings over gasoline-powered ones, but for me, it doesn't make much of a difference. I chose the Lixiang L9 primarily for their one-stop professional service," said Mr. Huo.

Ms. Xue, a NIO ET5 owner, shared with New Energy View, "I initially chose NIO for its battery swapping service, which takes just three minutes and is much more convenient than charging. I was also impressed by the owner events that NIO salespeople talked about. However, this year, I've noticed a noticeable decrease in such events, which is a bit disappointing. I hope they'll increase them again in the future because these events are very popular among owners."

Image/NIO reached 40 million battery swaps in 2024

Source/Screenshot from the Internet, New Energy View

Indeed, in today's market, consumers' perceptions of cars have changed. The days of owning a car for many years are over. Consumers now place more emphasis on the professionalism of pre-sales services and the attentiveness of after-sales services provided by automotive brands.

In the future, whether it's joint venture brands or new force brands, if they continue to adapt to market changes and control costs by indirectly reducing the salaries of frontline employees, they may struggle to sustain their positions in the market. After all, without frontline salespeople, a company's channel system will be rendered ineffective, and its brand will eventually collapse.