Who has actually achieved who, Tesla or China's new energy industry?

![]() 10/22 2024

10/22 2024

![]() 629

629

Introduction

After six years, let's stop beating around the bush with vague concepts like the "catfish effect" and get straight to the point.

"It's said that when they first set the price, the Americans decided on 88,800 yuan, but it was vetoed by the local 'competent department' here – how can we sell our cars if you price it like that?"

In the comments section of a short video discussing China's new energy vehicles, a user suspected of being a Tesla fan left the above joke. Although it's unclear if this is a satirical provocation by a troll account, I still felt a sense of unease upon reading it.

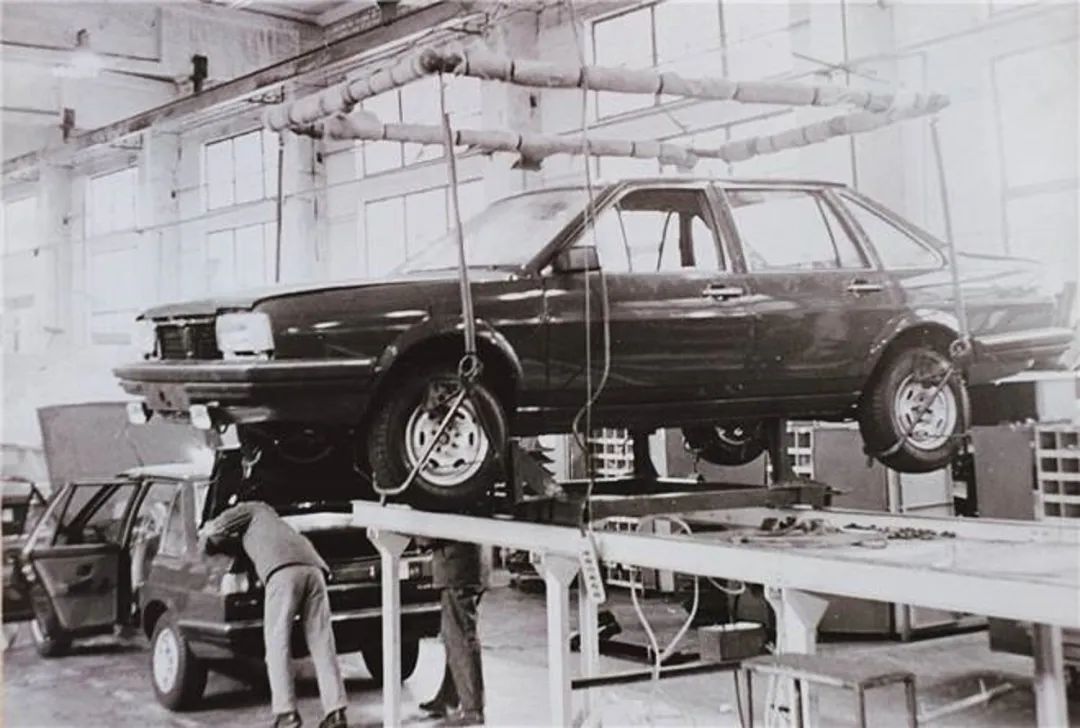

Image | The urban legend of the "80,000 yuan Santana" is essentially a simplistic and misleading summary of a series of complex events, disregarding their causes and consequences. I'll elaborate on the specifics another time.

What's particularly frustrating about this joke is that, as a Shanghainese, I immediately recognized its origin in the widely circulated rumor that the initial pricing for a Santana sedan was 80,000 yuan. This rumor dates back to the late 1980s, older than most readers of this article. It's like an old wives' tale that's been recycled and repurposed decades later.

The pricing controversy surrounding the Santana involves complex factors, including a crucial historical period known as the "price breakthrough" after China's economic reforms. I'll spare you the details and just say it was all nonsense. Instead, let's focus on Tesla's supposed 88,800 yuan pricing.

A quick search reveals that even though battery prices have plummeted, the cost per watt-hour for lithium iron phosphate batteries is still around 0.38 to 0.4 yuan. Let's take the lower end of that range and calculate the cost of the 75kWh battery pack in the long-range Model 3. Excluding shipping costs, the procurement cost for the battery cells alone comes to 28,500 yuan. And that's after the sharp drop in lithium carbonate prices since the beginning of this year, which has driven down battery costs.

Image | So, who has actually achieved who?

In short, the idea that Tesla's pricing is somehow unreasonable is simply not worth refuting. But behind this question, or rather this attitude, lies a clear message: it is Tesla that has propelled China's new energy vehicle industry forward, and therefore, the industry should be grateful.

And the question of who has achieved whom indeed deserves clarification.

When an individual or a company becomes too successful, it often has unintended consequences. For example, the public tends to forget about their struggles and attribute their success solely to their own abilities, even when they've received crucial help along the way.

Tesla is a prime example of this. Let's take a trip down memory lane and recall the company's toughest years: 2017 to 2018.

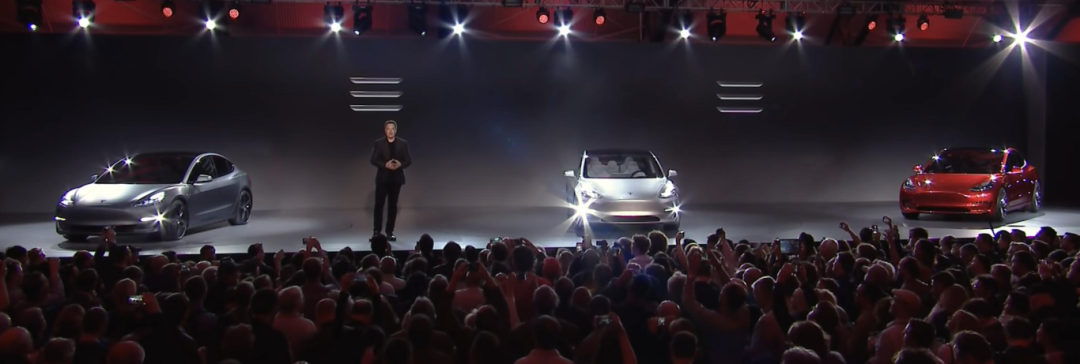

Image | While the Model Y is currently Tesla's best-selling model, it was the Model 3, unveiled on March 31, 2016, that truly changed Tesla's fortunes.

In July 2017, after more than two years of delays and setbacks, Tesla finally began global deliveries of the Model 3.

While the Model 3 eventually helped Tesla end its decade-long streak of losses and turn a profit, it caused nothing but chaos for the company in the second half of 2017.

According to media reports in May 2018, despite nearly three quarters of production efforts, the Model 3 was still struggling to ramp up production smoothly.

"The Fremont factory had a defect rate of up to 40% when assembling battery packs and electric drive systems. In other words, for every 2,500 battery packs and motor drive systems produced, 1,000 needed to be reworked. Half of those could be repaired and installed in Model 3s, while the other half had to be scrapped due to damage or poor quality."

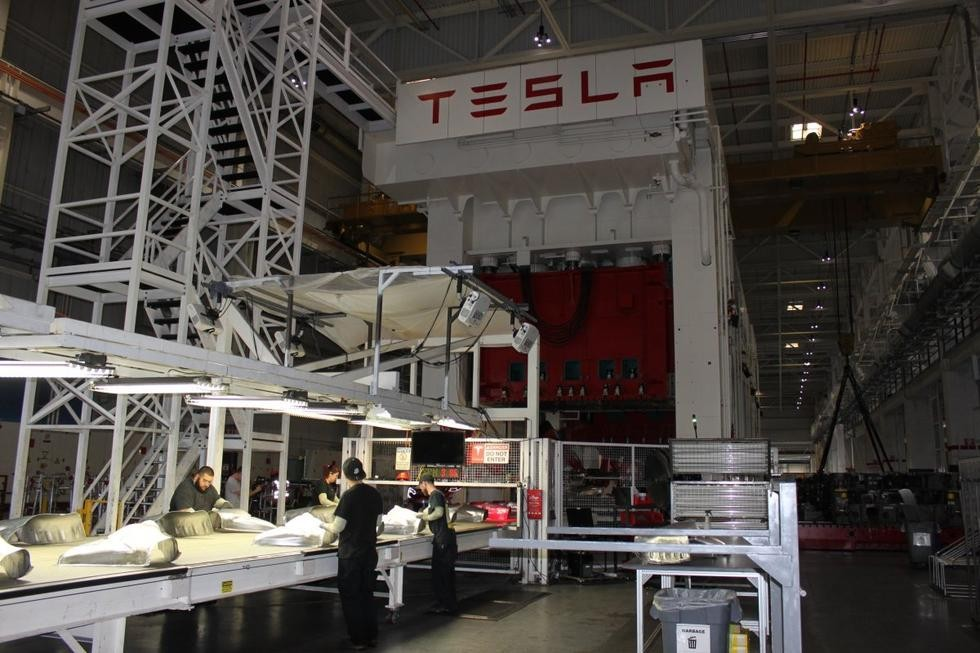

Image | In reality, the Fremont factory, as well as Tesla's other two production centers worldwide, were less efficient than the Lingang Gigafactory in China.

According to sources, the Fremont factory scrapped over $150 million worth of materials from January to April 2018, not including labor, electricity, and equipment depreciation costs. Even disregarding the scrap rate, only 9,766 Model 3s were delivered in the first quarter of 2018.

As a result, many customers who had placed orders faced long wait times of over three years. Some even feared they wouldn't receive their cars before the mid-cycle refresh, leading them to cancel their orders. Fortunately, these fears proved unfounded, as the mid-cycle refresh didn't arrive until September 2023.

On April 1, 2018, the traditional Western April Fool's Day, Elon Musk tweeted a photo of himself leaning against the rear passenger door of a Model 3, covered in a cardboard sign reading "Bankwupt!"

Image | The misspelled "Bankwupt" was intentional to avoid SEC penalties, as such a tweet could potentially disrupt the stock market.

Tesla boosters have spun this stunt as a joke, pointing out that the correct spelling is "bankrupt." But at the time, Tesla was indeed on the brink of bankruptcy, and its stock was under attack from short-sellers. The hostile short-selling environment in Western secondary markets was relentless. Elon Musk's typical strategy is to preemptively address potential criticisms and rumors.

For example, in 2020, Tesla launched the "Tesla Short Shorts" on its official website.

Image | Don't be surprised by the price of the "Tesla Short Shorts"; think of them as a creative product.

Despite Tesla's efforts to stay afloat, the promise of profitability through the Model 3 remained elusive. Tesla was truly on the brink until July 2018, when negotiations for a wholly-owned factory in China were successful. Elon Musk flew to Shanghai to sign an investment agreement with the Lingang Development Group for an electric vehicle project.

From late 2017 to October 2018, the so-called "Big Three" of China's new energy vehicle industry – NIO, XPeng, and Lixiang – each launched their first products. China's new energy subsidies, introduced in 2010, had already borne fruit, and with the rising trend of intelligent vehicles, ICT companies with expertise in information and data exchange technologies were entering the automotive industry.

Image | China's new energy/smart vehicle supply chain is formidable, with CATL as just one prominent Tier 1 supplier, but not the only one.

While the supporting supply chain was taking shape, and emerging domestic brands were showing promise, the market had yet to fully embrace them. Recall that in 2018, a major topic of discussion among Chinese automotive and social media was how to reverse the dominance of foreign joint ventures in the auto industry, given the maturity of domestic technologies and processes.

Moreover, while the eight-year-long new energy vehicle subsidy policy had fostered a promising domestic new energy supply chain, and Chinese companies were capable of leading the way in automotive intelligence, the high subsidy levels during the peak period had led to the proliferation of low-cost A00-class electric vehicles priced at around 170,000 to 180,000 yuan. This lack of confidence among both consumers and automakers was understandable.

Image | The issue of "subsidy fraud" was widespread and persistent for a long time. But as the saying goes, "Clear water has no fish."

In short, we were already on the right track, but no one knew it yet. There was still uncertainty and a lack of confidence. In this delicate situation, bringing Tesla – a foreign new energy vehicle brand with global acclaim and market recognition – into the Chinese market was a strategic move.

By introducing Tesla into China, we could leverage its mature, mass-produced products to validate our new energy vehicle supply chain. At the same time, Tesla could help drive out those who were parasitically dependent on subsidies and lacked the ability to transform themselves. In essence, the locally produced Model 3 served as a "grindstone" for both the supply chain and the market.

Moreover, the wholly-owned factory format had an unexpected benefit: it fundamentally eliminated the risk of forming new interest groups within large state-owned automakers.

Image | The Lingang Gigafactory, which partially commenced production within 10 months and fully operational within a year, along with China's robust and capable new energy vehicle industry supply chain, truly saved Tesla.

This opportunity was crucial for Tesla as well. At the time, the company faced two primary challenges:

First, the domestic new energy vehicle supply chain in the United States, especially for battery production, was barely adequate to support high-end models like the Model S and X, let alone a mass-market model like the Model 3.

Second, since the deindustrialization process began in the 1980s, the qualified industrial workforce in the United States has been steadily declining, replaced by illegal immigrants from Central and South America.

However, neither of these issues was a concern in China. In fact, after fully integrating into China's supply chain, Tesla could even feed back components from China to its U.S. factories, enhancing profitability for its high-end product lines.

Image | The joy on Elon Musk's face was genuine.

Ultimately, this was a mutually beneficial arrangement based on shared interests. Both parties took what they needed. For Tesla, in particular, bankruptcy was no laughing matter in the first half of 2018...

Since 2018, the U.S. government has consistently raised tariffs on Chinese goods, erecting trade barriers. This, combined with rising labor costs in China, has forced many low-margin, mid-to-low-end manufacturing companies to consider relocating their production centers overseas.

Image | More than two decades later, low-cost garment manufacturing is once again being labeled as "industry"...

Chinese companies are expanding their global footprint. However, what was once a source of pride and celebration a decade ago has now become a contentious issue in the post-pandemic era: the perception that Chinese industries are relocating overseas, accelerating the trend.

If you subscribe to this view, it leads to an absurd conclusion: that sweatshops producing clothing for supermarkets and wholesale markets in China are somehow being reclassified as "industry" after three decades!

In today's world, setting up a factory doesn't necessarily mean relocating an entire supply chain. In fact, the supply chain itself represents the bulk of value creation. Here, we return to the example of Tesla.

According to recent data released by Tesla during the rollout of its three millionth vehicle, the localization rate of the Shanghai Gigafactory's supply chain has exceeded 95%, and nearly all employees, from administrative staff to R&D personnel and frontline workers, are Chinese nationals. Furthermore, according to secondary market data, over 200 listed companies in China are tied to Tesla, with a combined market value exceeding four trillion yuan.

Figure | Where does the unilateral kindness come from in this world? In fact, the two-way rush is the norm

Finally, there is one more point that no one should ignore or forget. In the process of the in-vogue localization of semiconductor production in the past two years, automotive-grade semiconductors have undoubtedly been one of the toughest nuts to crack. The difficulty lies not only in the extremely high requirements for reliability but also in the close tie between relevant components and suppliers, especially the lengthy and rigorous testing process.

In this process, Tesla will undoubtedly once again become an important stepping stone for domestic semiconductors to enter the global market.

And when we come to this point, I believe everyone has drawn their own conclusions. It is no exaggeration to say that without the huge benefits from China and the Lingang Gigafactory rising rapidly and putting into production, effectively resolving the production capacity crisis of Model 3 within one and a half years, by the time this article is published in 2024, Tesla's grave would be covered not just with grass, but perhaps even with towering trees.

Figure | Tesla's Berlin Gigafactory, which is currently being harassed by environmental organizations and facing widespread employee loafing

Conversely, without Tesla's example and motivation, domestic new energy vehicles would probably still be groping in the dark for many years, and the entire industrial chain that we have spent nearly a decade building would remain stagnant for a long time.

In the world, where do unilateral "achievements" come from? The essence of all cooperation is nothing more than a shared interest.