Revenue of RMB 17.446 billion, loss of RMB 5.046 billion, examining NIO's future from two dimensions

![]() 10/23 2024

10/23 2024

![]() 499

499

Mulinsen works with people, cars, and the automotive industry to witness the rise of China's automotive industry

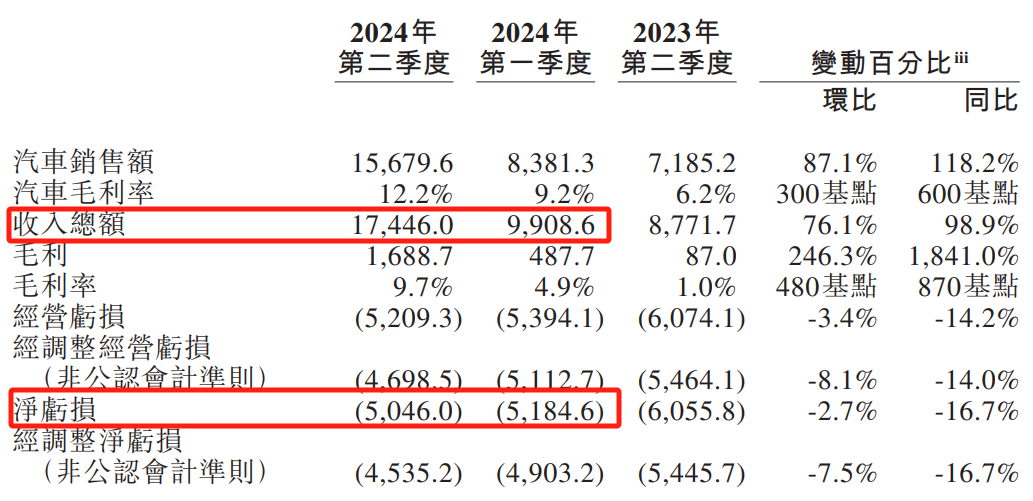

Revenue of RMB 17.446 billion, loss of RMB 5.046 billion, NIO announces its second-quarter 2024 financial results (unaudited).

The massive losses force the public to ponder: What does NIO's future hold?

With this question in mind, let's delve into NIO's financial data and examine its future from the dimensions of profitability and cash flow.

Dimension 1: Profitability (Loss) Dimension.

With a three-and-a-half-year loss of RMB 49.3 billion, when will NIO achieve profitability?

According to public data, NIO's first-quarter revenue was RMB 9.908 billion, with a loss of RMB 5.184 billion; second-quarter revenue was RMB 17.446 billion, with a loss of RMB 5.046 billion, totaling a half-year loss of RMB 10.2 billion.

In 2023, NIO recorded a loss of RMB 20.719 billion. In 2022, the loss was RMB 14.437 billion. In 2021, the loss was RMB 4.016 billion.

Over three and a half years, NIO has accumulated a total loss of RMB 49.3 billion.

Corporate losses are a common phenomenon, and it is even more prevalent among high-tech companies.

Losses are not necessarily terrifying; what is terrifying is the unpredictability of those losses. In other words, as long as there is a reliable profitability plan, capital is willing to invest. However, when it comes to bottomless pits, it's uncertain how far capital's patience will extend.

For NIO, having a clear, reliable, and executable profitability plan is crucial.

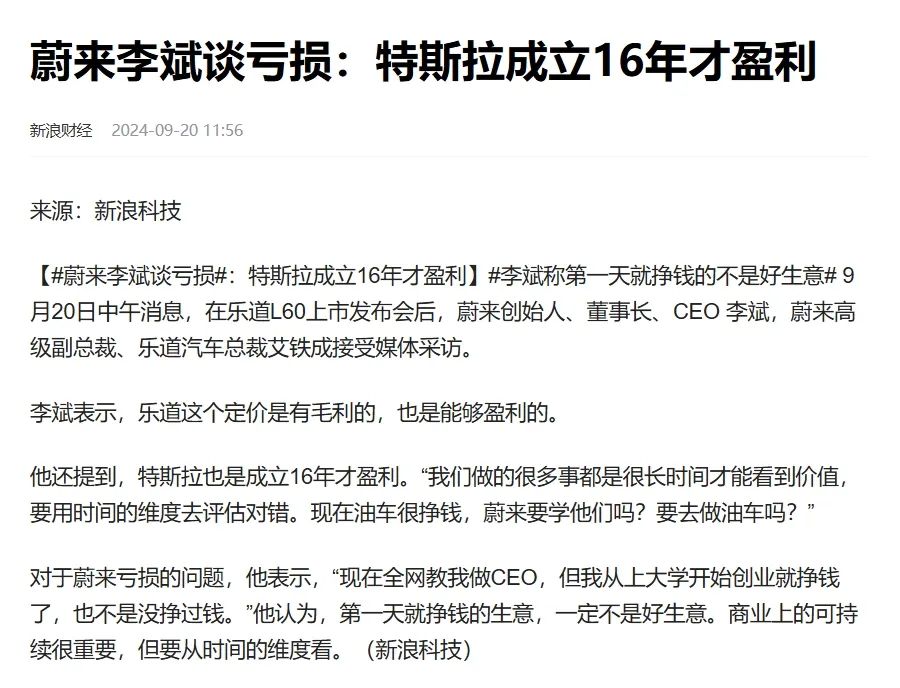

Interestingly, when Li Bin previously discussed losses, he mentioned that Tesla took 16 years to become profitable. What was Li Bin trying to convey?

Dimension 2: Cash Flow Dimension

Has NIO conducted cash flow stress tests under extreme conditions? What arrangements has NIO made for cash flow management to ensure continuity?

According to public data, on a quarterly basis, NIO's monetary funds for the past three quarters are as follows: As of December 31, 2023, cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits totaled RMB 57.3 billion (USD 8.1 billion). As of March 31, 2024, these funds totaled RMB 45.3 billion (USD 6.3 billion).

As of June 30, 2024, these funds totaled RMB 41.6 billion (USD 5.7 billion).

It can be observed that NIO's monetary funds have been declining over the past three quarters.

Monetary funds are the most liquid assets of a company and reflect the net cash flow at the balance sheet date and the opening balance. Under normal circumstances, the more monetary funds a company has, the stronger its solvency, and vice versa.

NIO's monetary funds are the result of its cash flow, and their continuous decline necessitates a closer examination of the underlying reasons. Since there is no cash flow statement for NIO's second quarter, it is not possible to comment on its operating cash flow.

3. What does NIO's future hold?

As a publicly traded company, NIO's future affects the interests of shareholders, upstream and downstream suppliers, car owners, financial institutions, and other stakeholders.

NIO's future is not solely the concern of Li Bin's family; similarly, Evergrande's future is not solely the concern of Xu Jiayin's family.

NIO's future faces two challenges

First, maintain stable cash flow and guard against cash flow disruptions.

It is well-known that corporate losses do not necessarily lead to bankruptcy, but a disruption in cash flow almost guarantees it.

Therefore, NIO must pay particular attention to cash flow management and arrangements. Some possible strategies include:

Launching low-to-mid-range products to diversify cash flow sources, such as NIO's Ledo model, which prioritizes volume over profit, similar to XPeng's MONA.

Another strategy could involve proactive planning for equity financing, bond financing, and non-standard financing from banks and other financial institutions. Even adopting a strategy of collecting payments early and delaying payments can help leverage upstream and downstream funds.

Second, reduce costs and achieve profitability as soon as possible.

Profitability is the fundamental goal of capital, and investors are willing to tolerate losses in anticipation of future profits. However, investors' patience is not infinite. Achieving profitability as soon as possible to fulfill investors' profit expectations is crucial for maintaining their confidence in the company.

In fact, the challenges faced by NIO are common among new energy vehicle (NEV) manufacturers currently operating at a loss, such as XPeng.

Currently, the NEV industry is undergoing a shakeout, with many predicting that only a limited number of manufacturers will survive. However, each manufacturer is betting that they will be among the survivors.

We will continue to monitor the outcome.