Lei Jun wields the knife towards Xiaomi Motors

![]() 10/23 2024

10/23 2024

![]() 676

676

In order to avoid the detours taken by the "predecessors," Xiaomi Motors is actively and quickly responding to organizational structure upgrades.

On October 21, Xiaomi Group announced a major adjustment to its automotive sales system, incorporating the automotive sales and delivery service department into the China region to strengthen synergy with mobile phone sales channels. This adjustment aims to promote the implementation of the "people-car-home full ecosystem" strategy, further integrate automotive sales, delivery, and service work, and create a "people-car-home" new retail system.

According to Xiaomi's organizational adjustment notification, automotive sales, delivery, and service work have entered a stage of steady development. Guided by the strategy of the "people-car-home full ecosystem," the automotive sales and delivery service department needs to further integrate with the new retail in the China region to achieve more efficient collaboration. To this end, after research and decision-making by the group's management, the automotive sales and delivery service department has been incorporated into the China region.

Why did Lei Jun, the founder, chairman, and CEO of Xiaomi Group, choose to adjust the organizational structure during the peak period of continuous delivery has also sparked discussions among a large number of netizens.

In September of this year, Xiaomi Motors continued to deliver over 10,000 vehicles. Deliveries began in April, and for four consecutive months from June to September, over 10,000 vehicles were delivered each month. Earlier, Lei Jun revealed in a live broadcast that "Xiaomi Motors is expected to complete the annual delivery target of 100,000 vehicles ahead of schedule in November, with a new target of sprinting to deliver 120,000 vehicles this year."

Currently, Xiaomi Motors' adjustments are more focused on expanding organizational capabilities and adapting to industry changes in advance of the upcoming delivery of a large number of new vehicles.

It is worth mentioning that Xiaomi Motors is not the first new-energy vehicle enterprise to adjust its organizational structure. After a series of crises in the past, many new-energy vehicle enterprises, including NIO, XPeng, and Li Auto, have all restructured and optimized their matrix organizations internally.

Anxiety and Hope

Lei Jun had to wield this "knife" because the competition in China's automotive industry continues.

At present, Xiaomi Motors has initially won widespread market recognition and praise. According to the September new energy passenger vehicle wholesale sales data released by the China Passenger Car Association, Xiaomi Motors' estimated wholesale sales in September were 13,500 vehicles. This is also the first time that official detailed sales data for Xiaomi SU7 has been disclosed.

According to Lei Jun, Xiaomi Motors plans to achieve a delivery volume exceeding 20,000 vehicles this month. Judging from the current sales data, this goal seems within reach.

Specifically, Xiaomi Motors has delivered at least 14,000 new vehicles in the first three weeks of October. Among them, 3,800 vehicles were delivered from September 30 to October 6, 4,600 from October 7 to 13, and 5,600 from October 14 to 20. This means that in the next 11 days, Xiaomi Motors only needs to deliver an additional 6,000 new vehicles to achieve its delivery target for the month.

Against this background, ensuring delivery will also become an urgent issue for Xiaomi to tackle.

According to disclosed information, Xiaomi Motors has currently established 128 stores in 38 cities nationwide, with 17 Xiaomi Motors service centers and authorized service centers already open. It is expected that in October, Xiaomi Motors plans to add 11 new stores to enhance its market coverage and brand influence.

As the new-energy vehicle brand with the highest sales volume, as of January 31, 2024, Li Auto had 474 retail centers nationwide, covering 142 cities. Li Auto delivered a total of 376,000 vehicles in 2023. Roughly estimated, Li Auto supported sales of nearly 400,000 vehicles with fewer than 500 stores.

In contrast, for Xiaomi Motors to achieve even greater sales volumes, it must accelerate the expansion of its network.

On the other hand, strengthening synergy with the existing Xiaomi Home mobile phone sales network has become an inevitable choice. According to Xiaomi Motors' plans, the number of stores will expand to 20,000 within three years. In the future, if these 20,000 sales networks can be synergized, it will undoubtedly be a significant boost to Xiaomi Motors' reach in third- and fourth-tier cities.

In this regard, Huawei, which is also building a "people-car-home" full ecosystem, has already taken the lead. Currently, Huawei has established independent HarmonyOS SmartRide stores. It is expected that in 2024, the number of new HarmonyOS SmartRide stores built by Huawei will reach around 800, with a target of 1,000 in 2025.

However, the reality facing Xiaomi Motors is that it has not yet emerged from the quagmire of financial losses.

In the second quarter of this year, Xiaomi Motors' business was listed separately in its financial report for the first time, with revenue from innovative businesses such as smart electric vehicles reaching 6.4 billion yuan, of which 6.2 billion yuan came from smart electric vehicles. A total of 27,307 Xiaomi SU7 series new vehicles were delivered in a single quarter, with an average selling price of 229,000 yuan. As of the end of the reporting period, Xiaomi Motors' overall gross margin was 15.4%.

Based on this calculation, Xiaomi Motors lost more than 60,000 yuan per vehicle.

In the view of industry insiders, this change in the sales system will help strengthen the linkage between the automotive business and the China region, further integrate automotive sales, delivery, and service work, and achieve more efficient collaboration, thereby promoting the development of Xiaomi Motors in the Chinese market.

Frequent Organizational Structure Adjustments Among New-Energy Vehicle Enterprises

In the first three quarters of this year, new-energy vehicle enterprises have shown a competitive landscape where the strong grow stronger while the weak seek breakthroughs, with a growing polarization between enterprises. As the traditional peak sales season of "Golden September and Silver October" approaches, new-energy vehicle enterprises are going all out to sprint and achieve their annual sales targets.

Prior to this, various automakers have tried their best, including adjusting their organizational structures internally, in the hope of standing out in the fierce market competition.

Taking Li Auto as an example, as the first new-energy vehicle enterprise to achieve profitability, in April, Li Auto issued an internal announcement announcing an upgrade to its existing matrix organization, involving organizational structure adjustments across multiple departments. This organizational change primarily focused on Li Auto's CEO office department, transforming it from its original structure encompassing brand, product, commerce, strategy, and supply departments into a "Product and Strategy Group," weakening supply chain and commercial sales functions.

This organizational upgrade followed the efficient and rapid implementation of corrective measures after Li Auto CEO Li Xiang issued an internal letter on March 21, focusing on solving the problem of excessively long value delivery chains and avoiding overly complex processes that reduce decision-making quality and efficiency.

In March of this year, Li Auto's sales, which had just completed the launch of new products and upgrades to older models, fell short of expectations at only 29,000 vehicles. According to a memo, Li Auto has adjusted its aggressive annual sales target of 800,000 vehicles set at the beginning of the year to 560,000 to 640,000 vehicles.

XPeng Motors has also made significant organizational structure adjustments this year.

In March, XPeng Motors President Wang Fengying led a new round of organizational structure adjustments at XPeng Motors, involving multiple departments such as marketing, human resources, intelligent data, production and manufacturing, and product planning.

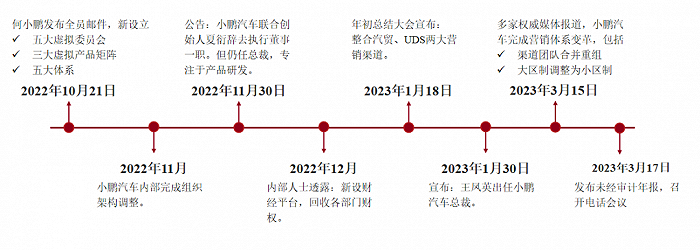

In fact, among new-energy vehicle enterprises, XPeng Motors has relatively frequent organizational structure adjustments. As early as October 2022, XPeng Motors underwent a large-scale organizational structure adjustment due to the underwhelming performance of the first-generation XPeng G9 after its launch, exposing management issues at XPeng Motors. This adjustment focused on product, sales and service, marketing, and supply chain departments.

In March 2023, XPeng Motors once again completed a round of changes to its marketing system. In terms of internal organizational management structure, the automotive trade and UDS channel teams were merged; in the sales system, the two major sales regions nationwide were abolished and replaced with a smaller regional system.

Data shows that in 2023, XPeng Motors delivered over 140,000 new vehicles, an increase of 17.26% year-on-year. From the data, it can be seen that since Wang Fengying took over as President of XPeng Motors, she has effectively led cost reduction and efficiency improvement as well as channel reforms, boosting XPeng Motors' sales. However, within the "NIO-XPeng-Li" camp, XPeng Motors has shown signs of falling behind.

For comparison, in 2023, Li Auto delivered over 370,000 new vehicles, an increase of 182.21% year-on-year; NIO delivered over 160,000 new vehicles, an increase of 30.66% year-on-year.

NIO has also made relevant structural adjustments based on business and organizational development needs. The innovative business clusters of "Strategic New Business I," "Strategic New Business II," "Strategic New Business III," and "Strategic New Business IV" have been renamed "Ledao Business Unit," "Chip Research and Development," "Firefly Business Unit," and "Mobile Phone Business," respectively."

In addition, NIO will establish sixteen regional companies within the Ledao Business Unit, positioned as secondary departments, responsible for promoting Ledao brand, channel layout, daily store management, and achieving sales results within their respective regions. The general managers of these regional companies will all report to Xia Qinghua.

Leapmotor has also made changes to its marketing system, including consolidating sales operations and abolishing the overseas expansion department. This structural adjustment is Leapmotor's first "surgery" on its marketing system since the joining of Huawei executive Xu Jun.

It is worth noting that the merger and integration of departments is a common approach to organizational adjustments in automotive companies, but Leapmotor's uniqueness lies in its new overseas business layout. With the support of the joint venture Leapmotor International, Leapmotor's overseas business will be able to leverage more external forces to achieve faster and broader market coverage.

"Organizational upgrades are the most important exam question for enterprises entering larger and more challenging stages. More than 90% of failed enterprises do not have problems with their business per se; rather, business issues are only symptoms, and the essence lies in the inability of organizational capabilities and scale expansion to adapt to industry changes," Li Xiang once said.

Therefore, the organizational structure adjustments played a significant role in Li Auto, NIO, and Leapmotor achieving rapid sales growth in the second half of the year. This also illustrates the fact that new-energy vehicle enterprises have flatter and more efficient management structures, particularly when facing fierce market competition or a series of crises, enabling them to quickly adjust and optimize their matrix organizations internally.

Undoubtedly, in order to avoid the detours taken by "predecessors," Xiaomi Motors is actively and quickly responding to organizational structure upgrades. However, in China's highly competitive automotive market, how to continue adjusting its strategic posture in the pure electric vehicle market is even more crucial for Xiaomi Motors to move towards the next stage.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.