Sales down 19.74% YoY to a new low? Even the highly anticipated Jia Mingdi cannot save Lincoln

![]() 10/23 2024

10/23 2024

![]() 573

573

Less than two years have passed since Mao Jingbo suddenly resigned at the end of September 2022 and Jia Mingdi took over from Zhu Meijun on April 1, 2024, with three presidents coming and going, yet Lincoln has still failed to shake off its difficulties.

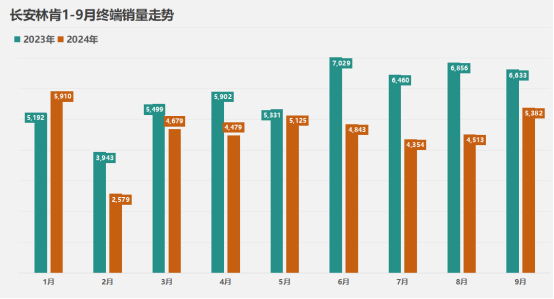

Data shows that while Changan Lincoln's sales in September increased month-on-month, they only reached 5,382 units, a year-on-year decline of 18.9%. Cumulative sales from January to September were 42,020 units, a year-on-year decline of 19.74%; imported Lincoln sales were 596 units, a year-on-year decline of 42.58%.

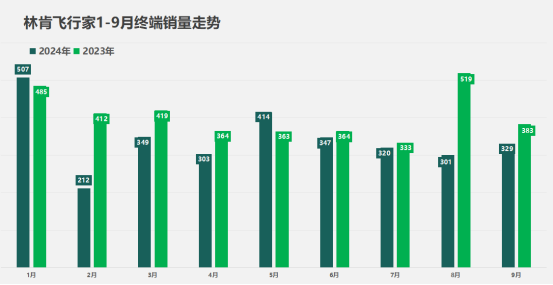

In terms of models, Lincoln Z, Corsair, and Aviator mostly sold in the triple digits each month, with the best-performing Navigator failing to exceed 3,000 units per month. Based on this trend, even adding the negligible number of imported Lincolns, Lincoln's total sales this year will fall below 70,000 units.

This puts all the pressure on Jia Mingdi, who, faced with dismal sales, finds his remarks about "the essence of luxury brands being emotional experience" and "Lincoln's unique value proposition" made during the global debut of the all-new Lincoln Navigator to be powerless. Consequently, there are many doubts about him in the industry, and there is also nostalgia for Mao Jingbo, who brought Lincoln to its peak in China.

So, is it Jia Mingdi's fault or Lincoln's?

Weakness in new energy, Jia Mingdi powerless to reverse declining sales

To be fair, as the main contributor to leading SAIC Volkswagen to surpass 2 million annual sales and achieve four consecutive championships, Jia Mingdi's abilities are widely recognized in the industry. Therefore, after taking over Lincoln on April 1, Wu Shengbo, Global Vice President of Ford Motor Company, had high hopes for him, hoping he could accelerate Lincoln's brand transformation, redefine Lincoln's representation of new American luxury, and strengthen the high-quality development of Lincoln's business.

However, Jia Mingdi seems to have failed to live up to these expectations, and Lincoln's situation continues to deteriorate, pushing it to the brink of danger.

As shown in the figure below: In the first nine months of this year, Changan Lincoln's terminal sales exceeded those of 2023 in January with 5,910 units, but declined year-on-year in all other months. Although sales in May were close to last year's performance, they followed a three-month consecutive decline, with average monthly declines exceeding 30% from June to August.

Faced with this situation, some have questioned his abilities and marketing strategies, especially since his predecessor, Zhu Meijun, was able to maintain Lincoln's monthly sales at around 6,000 units in the second half of 2023 despite similar weaknesses in new energy. However, others argue that traditional brands heavily reliant on fuel are struggling in China's new energy vehicle market, and Jia Mingdi simply cannot withstand the impact of new competitive trends.

This is evident in Lincoln's sales performance in recent years, as shown in the figure below. Like many other gasoline-powered vehicle brands, Lincoln's turning point came in 2022 - the year of China's new energy vehicle boom. Lincoln's sales shifted from positive growth of 48% in 2021 to negative growth of -13.4%. In 2024, market competition intensified further, with most traditional luxury brands declining amidst price wars and the impact of Chinese-style luxury. Among first-tier joint venture luxury brands, BMW's sales declined by 13.63%, FAW-Volkswagen Audi by 6.3%, and Beijing Benz by 8.71% in the first three quarters. In the second tier, even formerly popular brands like Porsche saw year-on-year declines of over 33%.

In other words, given the current highly competitive environment, any professional manager would struggle to revive Lincoln, which lags behind in new energy vehicle transformation. Therefore, Jia Mingdi inherited a problematic situation with both internal and external challenges. However, on the other hand, even if Lincoln, with no new energy vehicles, aims for positive growth in the short term, can Jia Mingdi, with his rich experience in gasoline-powered vehicle brand operations, first help Lincoln stabilize its position in the post-gasoline era?

Can enhancing brand value truly stabilize Lincoln's decline?

While it is undeniable that Lincoln's continuous decline is not Jia Mingdi's fault, his strategy for Lincoln's brand operations has indeed sparked controversy in the industry.

Jia Mingdi believes that Lincoln should focus on enhancing value and has outlined a three-step approach: First, create a sense of identity around "value experience" by upgrading dual flagship models to deepen the brand image and empower brand enhancement. Second, foster a sense of identity around "value optimization" by improving dealer service awareness. Third, establish a sense of identity around "value preservation" by upgrading the Lincoln Way to Lincoln Way Pro and implementing value-based marketing.

Honestly, these three points are classic tactics for traditional luxury brands to establish their tone and are well-suited to Lincoln's current conservative stance. However, there is a significant problem with this strategy: it works well for brands with strong reputations and emotional connections but struggles to impact weaker brands. Jaguar Land Rover's brand rejuvenation plan serves as a good example, where the more recognizable and emotionally connected Range Rover, Defender, and Discovery models under Land Rover have garnered more industry attention, while Jaguar remains largely overlooked.

Unfortunately, Lincoln falls into the latter category, with weak reputation and emotional connections in the real market.

On the product side, Lincoln's dual flagships - the Lincoln Aviator and Navigator - have been marginalized in the domestic market. The Aviator, for instance, has accumulated only 3,082 terminal sales from the beginning of the year to September, averaging around 300 units per month and failing to rank among the top 200 in its segment. The Lincoln Navigator is even rarer, with a clear sales figure difficult to obtain.

Therefore, emphasizing the "dual flagship" strategy with the Lincoln Aviator and Navigator may not be beneficial for Lincoln, which lacks strong reputation and emotional connections. It could backfire, as Lincoln's immediate priority is to establish a foothold in the market and survive rather than create a brand image through niche products. Conversely, Zhu Meijun's "Lincoln Way" 2.0 focused on the Navigator in 2023 seems more grounded, with this model currently driving Changan Lincoln's sales, recording 2,569 terminal sales in September...

In conclusion, the first three quarters of 2024 have come to an end, and Jia Mingdi has yet to halt Lincoln's decline. The brand strategy he has formulated has also been questioned by the industry due to Lincoln's inherently weak fundamentals. Perhaps Jia Mingdi needs to better understand Lincoln's situation and prescribe the right medicine to help Lincoln regain some breathing room.