"Singles' Day" is quiet, and car prices are unlikely to drop significantly further?

![]() 10/24 2024

10/24 2024

![]() 511

511

With limited room for price cuts, automakers have remained mostly quiet during the first 10 days of "Singles' Day" 2024.

The Buick GL8 Land Business Class has a limited-time price reduction to 197,900 yuan, and the Nissan Qashqai Honor Edition has a one-time discounted price of 99,800 yuan. Since the start of the "Singles' Day" promotion period around October 14, 2024, these are the only two products from automakers that have actively responded to the event.

"How dare the automotive industry participate in this year's Singles' Day?" Due to the intense competition, the 2024 Singles' Day promotion started earlier than ever, kicking off as early as October 14th. Immediately after the National Day holiday, consumers were bombarded with a succession of festivals designed to stimulate spending.

Around 2018, automobiles began to play an increasingly important role in the "Singles' Day" promotions on major e-commerce platforms. However, when asked about the participation of automobiles in e-commerce festivals in 2024, Zhang Ting responded that automobiles were not really qualified to participate this year, or that it would be difficult for them to make much of an impact.

To capitalize on the end-of-year sales season, and especially to grab as much of the sales bonus from trade-in subsidies as possible in 2024, China's top five e-commerce retail platforms have already engaged in a fierce price war, with a primary focus on electronics, clothing, food, and other sectors. In contrast, the automobile industry has seen a stagnation in price declines due to an 18-month price war that began in 2023. More and more automakers have shifted their short-term goals from maximizing profits to simply surviving in the market or grabbing market share, even if it means taking a loss.

Therefore, the relative calm and restraint shown by automakers during the nationwide promotional season has sparked questions and discussions about whether car prices will continue to decline in the short term and whether buying a car at the end of the year will be cheaper.

Most sales targets are difficult to achieve, and there is limited room for further price reductions

"This year, we felt that the excitement around car sales during Singles' Day arrived early, during the National Day holiday. And it's hard to say whether there will be a year-end sales rush like in previous years," said Liang Fei, the sales champion at a BYD dealership during the National Day holiday. During the holiday, the dealership was bustling with car shoppers, with foot traffic up by more than 30% compared to 2023. However, in terms of actual sales, there was only a slight increase compared to the previous year.

While there were many people browsing, there were relatively few buyers, with many still on the fence. This sentiment is not hard to understand, as the mindset created by the 18-month price war is unlikely to dissipate soon, and many believe that car prices will continue to drop if they wait a bit longer.

Moreover, as automakers compete fiercely with each other in terms of new product launches and R&D, consumers are faced with a plethora of options. For example, the introduction of the Geely Xingyuan model, with a price range of 69,800 to 98,800 yuan and a driving range of 310-410 km, and the pricing of the BYD Seagull, which offers similar performance to the BYD Dolphin, has left many who recently purchased the Wuling Bingguo PLUS feeling like they may have made an impulsive purchase.

Compared to previous years' Singles' Day promotions, while this year's pre-sale period was advanced from October 24th to October 14th, only Dongfeng Nissan and Buick have announced any matching activities so far, with no other automakers officially announcing their participation. However, there is still room for change, as automakers may suddenly join in early November, as they have in previous years.

In 2020, 50 mainstream automakers participated in Singles' Day, with one e-commerce platform reporting sales of 330,000 vehicles from November 1st to November 11th. In 2021, participation waned, despite activities like half-price car grabs and direct discounts of up to 10,000 yuan, as the number of models available for purchase dropped to just over 50. In 2022, the number of participating brands fell to around 26. By 2023, the number of models involved in Singles' Day promotions on major e-commerce platforms had dwindled to just a few dozen. There was even an instance in 2023 where an automaker participated in a promotion and offered discounts, only for Tesla to subsequently raise the prices of its Model 3 and Model Y by 1,500 and 2,500 yuan, respectively.

The overarching conclusion is that the promotional stimulus of Singles' Day has limited results, and that the automotive market is already highly competitive and profit margins are tight. As a result, automakers' willingness to participate in such events is diminishing, and there is limited room for further price reductions.

For Liang Fei, as BYD faces constant challenges from competitors, they regularly review the upgrade and facelift schedules of competing products during internal training. The conclusion is that the most intense phase of product launches by mainstream brands in 2024 has already passed. While many new and important models will be unveiled in 2024, most of them will not be delivered until 2025.

In short, BYD dominates several key market segments with its top-selling models. Not only does it have pricing power, but it also defines the market. Every new move and reaction it makes to consumers is a reflection and judgment of the broader automotive market trends.

Analyzing BYD's sales outlook for the remaining two months of 2024, the conclusion is roughly as follows:

Geely will be targeting BYD's Song Pro DM-i, Song PLUS DM-i, Qin PLUS DM-i, Qin L, and Haibao 06 DM-i models, replacing their powertrains with the new-generation Leishen electric hybrid system. This is expected to result in fuel consumption figures of 2-3L/100km and a driving range of over 2,000km on a full tank and charge. However, BYD has a trump card up its sleeve in the form of the rumored second-generation Blade Battery, so it is not overly concerned.

Changan has already unveiled its new models in the civilian sector, including the Shenlan S05, an extended-range electric vehicle with a starting price below 140,000 yuan. Its main focus, however, is on luxury brands such as the Avita 11 and Avita 12 extended-range electric vehicles. In response, BYD remains unfazed, as the Denza N9 is already on its way, and in the luxury segment, it will be going head-to-head with models like the AITO M9 and LIXIANG L9.

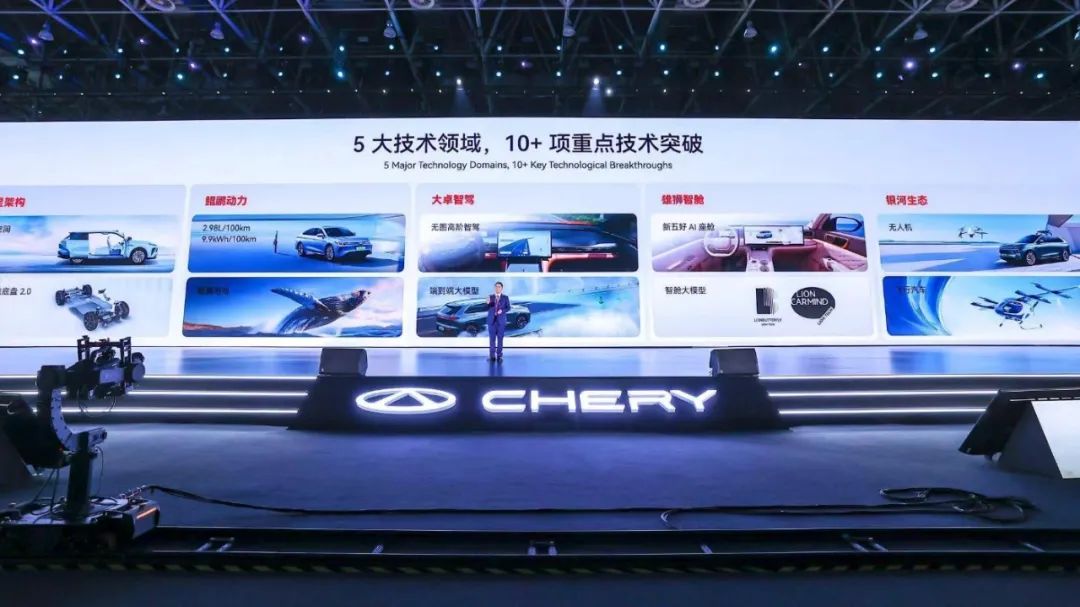

Chery and Great Wall will also be launching new models towards the end of the year, but these models are not expected to enter mass production until early 2025, so they are unlikely to offer significant promotions in the short term. From the perspective of new energy vehicle startups, around the Guangzhou Auto Show, NIO will unveil the Firefly, LIXIANG will introduce a new pure electric vehicle, XPENG will launch the P7+, and AION will officially release the AION RT, the strongest competitor to XPENG's M03.

There are rumors that Tesla will begin trial production of a new model at its Shanghai factory in the final week of October, which could be the low-cost Model 2 or an updated version of the Model Y. ZEEKR has mostly played its hand, while most new models from joint venture brands, apart from those from GAC Toyota that are quickly embracing plug-in hybrids and intelligent driving, are not expected to be released until at least 2025.

In the short term, there are no clear triggers for a new round of price wars. Meanwhile, as most automakers are unlikely to meet their 2024 sales targets, OEMs are adjusting their sales strategies, and a year-end sales rush may not materialize as it has in the past. Therefore, the prospect of further price reductions is uncertain.

Three new ways prices may drop in the remainder of 2024

"We'll definitely be pushing for sales at the end of the year, but many of our competitors won't be able to keep up, as it won't make much sense for them." Salespeople on the front lines have a keen sense of market changes, and for the remaining two months of 2024, most automakers are unlikely to have much incentive to boost sales volumes.

After reviewing the sales figures released at the beginning of October, it becomes clear that only around 10 automakers and groups have achieved more than 50% of their sales targets for the first nine months of the year. In other words, most automakers will struggle to sell as many vehicles in the final three months of the year as they did in the first nine.

The completion rates can be divided into four tiers. The first tier includes automakers that have achieved over 70% of their annual targets. With three months left, they are likely to meet their full-year goals, giving them the motivation to boost sales and offer further discounts to satisfy both investors and their bosses.

BYD, for example, has sold 2.747 million vehicles from January to September. Based on two rumored targets (3.6 million or 3.62 million), its achievement rate is 76%. With 419,000 vehicles sold in September, reaching its target is all but certain. However, there are rumors that BYD is aiming for 4 million sales, which would provide additional motivation for further price cuts.

Geely and Chery are in a similar position. Geely has sold 1.4896 million vehicles in the first nine months, achieving 75% of its target, while Chery has sold 1.753 million vehicles, achieving 71%. Geely aims to regain its market share and influence from the fuel-powered era, while Chery is eager to present a stronger financial performance amidst rumors of an IPO and as its chairman approaches retirement age. This tier also includes LIXIANG, which has sold 342,000 vehicles and achieved a 71.2% completion rate, as its target has been revised downward to around 480,000 vehicles.

The second tier is dominated by electric vehicle startups and new energy vehicle brands. NIO has delivered 148,400 vehicles, surpassing 64.9% of its forecasted 230,000-vehicle delivery target for 2024. XPENG has achieved a 69.1% completion rate, delivering 172,000 vehicles towards its target of 250,000 to 300,000. Its weekly sales in China have already surpassed those of AITO, and its overseas sales have seen significant growth. Changan, meanwhile, has sold over 1.9 million vehicles, achieving a 68% completion rate.

The third tier includes brands like Lantu , Xiaomi, Shenlan, and Dongfeng Group, with completion rates ranging from 50% to 60%. Among them, Xiaomi stands out as having orders but facing production capacity constraints.

In addition to the above-mentioned clear better performance, a more common phenomenon is that the challenge of achieving sales targets is enormous. In the first three quarters, FAW-Volkswagen sales fell by 11.7% year-on-year, SAIC Volkswagen fell by 6%, GAC Toyota fell by 16.4%, FAW Toyota fell by 8.4%, Dongfeng Nissan fell by 8.9%, and SAIC GM's decline was even greater. In today's automotive market, automakers generally have less than 50% sales completion rates, and sales targets have generally been revised downwards. For example, Volkswagen's global estimated deliveries were revised downwards from 9.5 million to 9 million, BMW's global sales were adjusted from expected growth to slightly expected decline, and Mercedes-Benz expected profits to decline.

In short, there is generally insufficient expectation for the driving force behind boosting sales and profits. However, price cuts can still be expected, but only in a few sectors and brands.

In addition to the top-selling tier, which may adjust prices and promote sales in order to challenge higher targets, there are two additional expected price reduction models. First, the leading brands in the luxury car market, mainly Mercedes-Benz and BMW, will make relevant adjustments and counterattacks. The reason is that many dealers have confirmed that BMW and Mercedes-Benz officials have already begun to promote a large number of subsidies to 4S stores to ensure the health of their sales network and maintain sales vitality. Additionally, as a recent example, since the MINI electric car was priced at 148,800 yuan, many 4S stores have sold out of available vehicles and popular colors, prompting many locations to adopt a 24-hour sales model.

The third is the formal approach of major brands and groups. That is, using the same strategy as BYD's rise, with large-scale generalization and technological evolution to achieve cost and price reductions on new vehicles. For example, in Geely's latest Xingjian 7, instead of using 3DHT, it adopts the same single-gear system as BYD and manages similar aspects such as body design and exterior components with the already reported Galaxy E5, making it likely that the price of mainstream plug-in hybrid SUVs will fall below 100,000 yuan.

Closing Remarks

So, the situation is clear. During a consumption cycle like Singles' Day, it is relatively calm, which is not only about considering the effectiveness, but also about the changing strategies of automakers. The topic of price cuts is highly concerned in the consumer market, but so far, after a two-month pause in simple and brutal direct price wars, the low point of car prices has basically emerged.

In other words, due to the constraints of BOM costs, marketing costs, etc., older models like the Buick GL8 have seen prices drop by 60,000 yuan compared to 2023, the Nissan Qashqai·Honor has seen prices drop by 20,000 yuan, and the Volkswagen Passat has seen limited-time discounts of 30,000-40,000 yuan, all of which have hit the bottom of car prices.

More expected future price cuts will be on new cars, which means that if car purchases are absolutely necessary, waiting is likely to pay off.