How are the sales of new cars that aim to "beat" Tesla Model Y doing now?

![]() 10/24 2024

10/24 2024

![]() 466

466

Last month, multiple automakers launched offensive attacks on the mid-sized new energy SUV market, with almost every product targeting Tesla's Model Y. Amidst this wave of "sieging" Model Y, will there emerge a product that can break Model Y's undefeated myth?

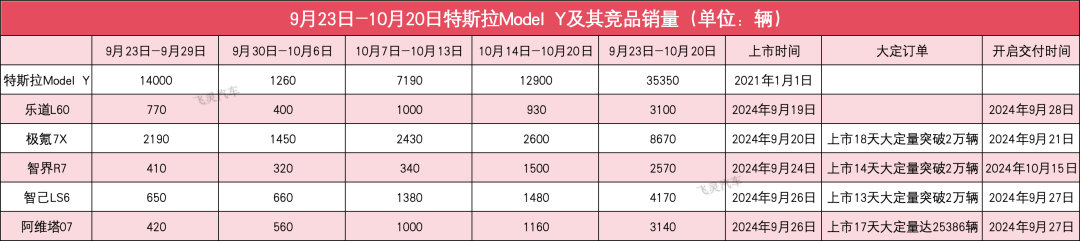

Judging from the order performance announced by various automakers in the early stages, it seems that each product has the potential to become a hit. For example, Zhidie R7 surpassed 20,000 cumulative orders within 14 days of its launch; ZEEKR 7X surpassed 20,000 cumulative orders within 18 days of its launch; AVATR 07 reached 25,386 cumulative orders within 17 days of its launch; and the all-new IM Motors LS6 surpassed 20,000 cumulative orders within 13 days of its launch.

Let's take a preliminary look at the weekly sales performance of these models since their launch. From October 14th to October 20th, ZEEKR 7X had the highest sales among these models, with 2,600 units sold, making it the only model with weekly sales exceeding 2,000 units. Zhidie R7 and the all-new IM Motors LS6 followed closely with weekly sales of 1,500 and 1,480 units, respectively. AVATR 07 sold 1,160 units in the same period, being the only model among the five that offers both pure electric and extended-range dual-power options. Ledo L60, on the other hand, had the lowest weekly sales among the five models, selling only 930 units.

When we extend the weekly sales data to cover the period from September 23rd to October 20th, ZEEKR 7X emerges as the strongest-performing model. Excluding the National Day holiday period from September 30th to October 6th, ZEEKR 7X has maintained weekly sales above 2,000 units since deliveries began and continues to climb. From September 23rd to October 20th, ZEEKR 7X sold a total of 8,670 units. With an end-of-month sales push, ZEEKR 7X is likely to surpass 10,000 units in sales for the month. Additionally, according to ZEEKR, the company has delivered over 10,000 units in just 25 days since its launch (September 20th to October 15th).

In terms of cumulative sales during this statistical period, ZEEKR 7X is followed by the all-new IM Motors LS6 and AVATR 07. Both of these models were launched on September 26th and began deliveries on September 27th. Looking at weekly sales, both models have shown a steady upward trend. From September 23rd to October 20th, the all-new IM Motors LS6 sold a total of 4,170 units, while AVATR 07 sold 3,140 units. Based on current sales trends, the all-new IM Motors LS6 and AVATR 07 are expected to sell around 5,000 and 4,000 units, respectively, this month.

Although Ledo L60 was the first of the five models to be launched, it only began deliveries on September 28th. While NIO has not disclosed the order volume for Ledo L60, senior executives have mentioned that the backend server, which was expanded fivefold to accommodate the orders, was overwhelmed, suggesting impressive order performance.

From September 23rd to October 20th, Ledo L60 achieved weekly sales exceeding 1,000 units in one week and sold a total of 3,100 units during the statistical period. Ledo has mentioned that they do not maintain large inventories like some of their competitors. Production began with the first mass-produced vehicle rolling off the line on August 15th, and by late September, a total of over 2,000 vehicles had been produced.

However, this is all within NIO's plan, as the company expects monthly sales to increase gradually, with the goal of exceeding 20,000 units next year.

Currently, NIO is fully committed to increasing Ledo's monthly production to over 20,000 units. The company's vehicle manufacturing plant has already shifted to a two-shift operation and is gradually ramping up production. NIO Chairman William Li noted that the key to increasing production capacity lies in improving supply chain quality, which "takes some time." According to plans, NIO aims to produce over 5,000 units in October, 10,000 units in December, at least 16,000 units in January next year, and 20,000 units by March next year.

Similarly, although Zhidie R7 was launched on September 24th, it only began deliveries on October 15th, making it the last of the five models to commence deliveries. Therefore, its weekly sales data is only available starting from October 14th, with only the most recent week's data providing a reference point. Longer-term sales performance remains to be observed.

In the previous round of "sieging" Model Y, only Xpeng G6 remains active in the market, with other products either eliminated or marginalized. Xpeng G6 sold 4,033 units in September and 1,130 units in the week from October 14th to October 20th. Notably, the recent popularity of MONA M03 has led to a significant increase in store traffic, which in turn has boosted orders for products like Xpeng G6.

Meanwhile, Model Y continues to perform well in sales. From October 14th to October 20th, Model Y sold 12,900 units, almost double the combined sales of the other five models. From September 23rd to October 2nd, Model Y sold a total of 35,350 units, seemingly unaffected by the competition.

However, it is important to consider that Model Y is already in stable production, while the aforementioned five products have only recently begun deliveries, especially Zhidie R7, which has only been in delivery for a week and is still in the crucial stage of ramping up production capacity. Based on the cumulative orders announced by these automakers, the primary challenge for these products currently lies in production and delivery.

Sales data after full production capacity is reached will provide a more meaningful reference for assessing the impact on Model Y, which will become apparent towards the end of the year and early next year. For example, Ledo plans to produce 5,000 units in October, 10,000 units in December, 16,000 units in January next year, and 20,000 units by March next year.

In addition to production capacity, it is essential to be vigilant against the phenomenon of fleeting popularity. In recent years, many newly launched vehicles have quickly climbed sales rankings in their early stages due to accumulated orders, only to see sales plummet after 2-4 months when initial demand and orders are exhausted.

Clearly, maintaining the sustainability of this initial popularity is crucial. For instance, Model Y has remained a top-selling model for years despite facing intense competition and without undergoing significant redesigns. Among new energy vehicle (NEV) brands, only a handful of models, such as Wenjie M9 and Lixiang's L Series, have been able to sustain high sales volumes for individual models.

For Tesla, the Model 3 has already been dethroned by competitors like ZEEKR 001 and Xiaomi SU7. This round of domestic automakers' assault on Model Y is more intense and better-equipped than ever before. In this context, significant redesigns for Tesla's two flagship models should be high on the agenda.