Musk loves to make promises, but Tesla needs a new story

![]() 10/25 2024

10/25 2024

![]() 518

518

It's not appropriate to discuss competitiveness during the promise-making stage.

Recently, Musk's mood has been like a roller coaster.

On October 10, Tesla unveiled two new vehicles with full self-driving capabilities: the Cybercab, a self-driving taxi, and the Robovan, a self-driving van that can accommodate up to 20 people.

While Musk was enthusiastic about the new vehicles, the world was disappointed by the hastily concluded event.

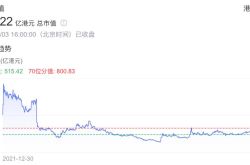

Musk was not only criticized for making empty promises but also lambasted for holding a disappointing event. The stock market reacted swiftly, erasing $67 billion from Tesla's market capitalization within just 20 minutes.

However, ten days later, Tesla experienced a remarkable turnaround.

On October 24, Tesla's share price achieved its best performance in 11 years after the release of its third-quarter financial results, surging 12% after-hours. This increase in market capitalization was seven times that of XPeng Motors, and Musk's wealth also surged by over $26 billion.

Tesla regains lost ground

How impressive were Tesla's third-quarter financial results? The industry described it with the phrase, "One financial report, Tesla surpasses two Chinese EV makers."

In reality, Tesla's revenue was not particularly impressive in this quarter. Revenue grew 8% year-over-year to $25.18 billion, falling short of market expectations of $25.5 billion. Core automotive revenue grew by just 2%, while the average selling price per vehicle declined by over $700.

However, it was not revenue but profit that fueled Tesla's stock surge.

Tesla's gross margin in the third quarter was 19.8%, exceeding expectations of 17%, with a gross margin of 20.1% for its automotive business. Even excluding carbon credit sales, Tesla's automotive gross margin still increased by 2.4% to 17.1%.

Prior to the release of the third-quarter results, Tesla's stock price had been declining and was on track for its worst monthly performance of the year. However, the financial results reversed this trend.

Piper Sandler analyst Alexander Potter upgraded Tesla to a buy rating with a target price exceeding Ives' estimate at $310. Potter praised Tesla's third-quarter results, stating that "virtually every aspect performed unexpectedly well."

Tesla's profitability improved significantly in the third quarter of this year, driven by two primary factors: cost reductions and carbon credit sales.

Key cost reductions at Tesla included declines in raw material and personnel costs. Data showed that Tesla saved an average of $2,000 per vehicle through layoffs and reduced raw material costs.

Musk's aggressive layoffs at Tesla were previously ridiculed as "cutting to the bone." By June, Tesla's total workforce had declined by over 14% from 140,000 to 121,000 employees.

Months later, the effects of these layoffs became apparent. In the first nine months of the year, Tesla's third-quarter sales slightly missed market expectations, with the Model 3 and Model Y accounting for 440,000 of the 462,000 vehicles sold.

In terms of batteries, Tesla reported significant cost reductions for its 4680 batteries. Thanks to the expanded production of these batteries, the gross margin for the Cybertruck, which began deliveries in November last year, has turned positive. However, Tesla also noted that it would continue to rely on external battery suppliers to ensure supply chain stability and diversity.

Cost advantages quickly translated into pricing advantages. In October, Tesla once again engaged in a price war, aiming to achieve its sales targets for the fourth quarter.

Cost reductions were not the only factor driving Tesla's stock surge. Two other business segments also grew. Revenue from energy generation and storage increased 52% year-over-year to $2.38 billion, while service and other revenue grew 29% to $2.79 billion, driven primarily by the continued expansion of Tesla's Supercharger network in North America, which now serves non-Tesla customers as well.

Wedbush analyst Dan Ives expressed optimism about Tesla's future potential and set a target price of $300, stating that price cuts are now firmly in the past.

"Price cuts are now firmly in the past, and we believe this is a key factor for Wall Street as Tesla continues to transition towards AI/FSD and increases profitability in the coming years. After a tumultuous 2024, profitability has achieved a much-needed boost," Ives said.

However, not everyone is bullish on Tesla. JPMorgan Chase analyst Ryan Brinkman represents the bearish camp. While acknowledging that investors may be excited about Tesla's exceptional profit growth, he argued that the catalysts driving the stock price surge are not sustainable long-term growth factors.

Brinkman described the earnings-driven rally as "unsustainable," citing the unsustainability of several factors behind Tesla's improved profitability and cash flow in the third quarter, including carbon credit sales and unusually high working capital gains. As a result, Brinkman maintained his underweight rating on Tesla.

In summary, JPMorgan believes that Tesla needs a new story.

Affordable Models Are Coming

Musk loves to tell stories.

Therefore, the latter part of this earnings report continues to be filled with Musk's promises.

Among these promises, the most notable is the affordable model. Tesla stated that it will launch a cheaper model with a price below $30,000 in the first half of next year. Additionally, the self-driving taxi Cybercab is expected to enter mass production in 2026, targeting annual production of at least 2 million vehicles.

To support these ambitions, Musk announced new targets during the earnings call. He predicted that thanks to lower vehicle costs and the advent of autonomous driving, Tesla's sales could grow by 20% to 30% next year under optimal conditions.

Musk seems to have forgotten the disappointment caused by the 20-minute Robotaxi event half a month ago, which shook the capital market. Nevertheless, he continues to envision the future half a month later.

"When will Tesla launch a non-Robotaxi model priced below $25,000?" This question about affordable models has become one of the top concerns for investors on Tesla's website.

The Wall Street community views a $25,000 affordable model as crucial for Tesla's further market expansion. In April, Musk hinted that production of the affordable model would begin in 2025.

Over the past few years, several Tesla models, from the Cybertruck to the Roadster, have faced delays, which have become part of Musk's persona and cast a shadow over the capital market.

During the earnings call, Musk confidently reiterated that Tesla plans to launch more affordable models in the first half of next year. However, he did not disclose many details, stating only that "these vehicles will leverage the next-generation platform as well as certain parts of the existing platform and can be produced on the same production lines as the current vehicle lineup."

Since 2018, Musk has hinted at the idea of an entry-level mass-produced car priced at $25,000. During Tesla's Battery Day event in 2020, he stated, "In about three years, we are confident that we can produce a very compelling $25,000 electric car that will also be fully self-driving."

However, three years have passed, and the affordable electric car has yet to materialize. Why?

Musk explained that the workload required to produce a low-cost car is substantial, and squeezing out a 20% profit margin from vehicle costs is more difficult than designing and building the entire factory from scratch.

Nevertheless, during the earnings call, Musk regained his confidence and announced plans to deliver new, even more affordable models starting in 2025, estimating a 20% to 30% increase in deliveries next year. Based on Tesla's 2023 global deliveries of 1.81 million vehicles, this would mean an additional 300,000+ vehicles by 2025, implying that the affordable model must achieve monthly sales of 20,000 to 30,000 units.

Clearly, the affordable model is crucial for boosting deliveries next year. However, during the post-earnings call, Musk did not directly address questions about the $25,000 model, instead stating, "In the future, using a non-autonomous gasoline-powered car will be like using a flip phone."

His focus was primarily on the self-driving taxi Cybercab, which represents the second major promise made by Musk.

Half a month ago, Tesla's stock plunged after the company first showcased the self-driving taxi Cybercab at its "We Robot" offline event. Due to a lack of sufficient technical information, the market was unable to make an accurate judgment, and investors were hesitant to believe Musk's promises.

Evercore ISI analyst Tony Sacconaghi described the event as "disappointing, with a shocking lack of detail." William Blair's Jed Dorsheimer noted that the demonstration "contained little that would pressure shorts in the near term."

The Cybercab is Tesla's autonomous taxi, featuring no steering wheel, gas pedal, or brake pedal and relying entirely on Tesla's FSD (Full Self-Driving) technology. With gull-wing doors and seating for two in the front, the vehicle is expected to cost less than $30,000.

Musk predicts that the Cybercab will enter mass production in 2026, targeting annual production of at least 2 million vehicles, with potential future annual capacity expanding to 4 million.

This time, during the earnings call, Musk learned from past mistakes and elaborated on some core developments related to Tesla's Robotaxi business, including the vision-based training of Tesla's FSD.

In the third quarter, Tesla released FSD Beta 12.5, which leverages increased data and training volume, with the number of parameters increased fivefold. Tesla noted that FSD Beta 12.5 has already been rolled out to Cybertruck owners.

However, the capital market remains skeptical. Musk's descriptions of the future have yet to fully reassure investors. While investors acknowledge that if Tesla can deliver on its promises, it would exceed expectations, they also note that delays are likely.

After all, it's not appropriate to discuss competitiveness during the promise-making stage.