Is Musk really going to scrap the Model 2?

![]() 10/29 2024

10/29 2024

![]() 664

664

After the U.S. stock market closed on October 23, Tesla released its third-quarter earnings report (for details, please refer to "The Pie-Baking King Tesla Has Finally Returned as a Champion!"). Due to the automotive business's gross margin exceeding expectations and the early announcement of a new, cheaper version of a model expected to be delivered in the first half of 2025, which is projected to drive a 20%-30% increase in sales volume in 2025, both the delivery timeline and contribution to sales growth in 2025 exceeded market expectations. Consequently, Tesla's share price surged 21.9% overnight.

Furthermore, during the earnings call, Musk stated that simply releasing a $25,000 vehicle (without advanced autonomous driving capabilities) would be meaningless. He also mentioned that the Cybercab, previously announced at the Robotaxi conference, would enter mass production in 2026 with an annual production capacity of 2 million units across multiple gigafactories, ultimately reaching a total production of 4 million units.

Upon hearing these announcements, many were taken aback: What exactly is this vehicle scheduled for 2025, and is there still a chance for the ultimate $25,000 budget model? Here, Dolphin Research sorts through the timeline and shares our understanding:

(As the cheaper model scheduled for release in the first half of 2025 has not been named yet, Dolphin Research will temporarily refer to it as Model 2.5 to avoid ambiguity in subsequent statements.)

Let's first recall Tesla's statement during its first-quarter earnings report this year (refer to "FSD: The Masterstroke That Proves Tesla Isn't Just 'Paper-Thin'"):

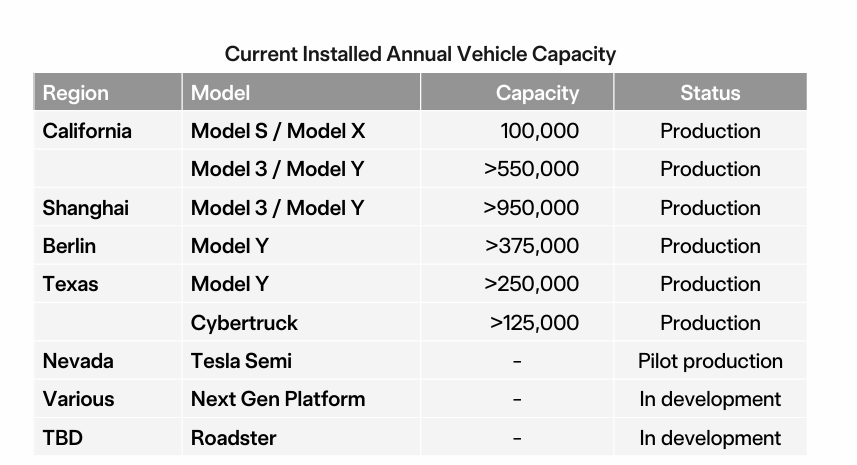

"These new models, including cheaper versions, will utilize our next-generation vehicle platform and current platforms, manufactured on existing production lines. This update may result in a reduction in the anticipated cost reduction, but it allows us to prudently increase sales growth during uncertain times with higher capital utilization efficiency. It also enables us to maximize our current maximum annual production capacity of nearly 3 million units and ensure production exceeds 2023 levels by over 50% before investing in new production lines."

The latest earnings call confirmed our assessment:

Unlike Tesla's revolutionary and globally popular Model 3/Y, which disrupted the market through relentless technological cost reduction, the upcoming Model 2.5 scheduled for 2025 is likely a transitional model bridging the two major growth cycles of Tesla (a period of transition without a clear successor). It is not a revolutionary model driven by Tesla's technological cost reduction, such as the X/S pioneering the electric vehicle era or the 3/Y heralding the era of electric popularity.

Our reasoning is as follows:

① The Model 2.5 is expected to be based on Tesla's existing vehicle platforms:

Initially, Tesla had high hopes for the Model 2 as a super hit, even preparing a production capacity of 5 million units (2 million in Mexico, 1 million each in China and Europe, with a potential 1 million more at future sites).

However, based on Tesla's current production capacity, the Mexico gigafactory, originally scheduled to commence production in 2025, has delayed progress and may not start until late 2026 or 2027. Therefore, the Model 2.5 will utilize Tesla's current factories/capacities and platforms (those of the Model 3/Y).

According to our information, the production cost of a vehicle is directly linked to its manufacturing platform (Tesla's Model S/X and Model 3/Y use different platforms). Using an existing platform implies limited cost reduction potential for the Model 2.5, aligning with Tesla's statement about a reduced cost reduction compared to initial expectations.

② Roadblocks in technological cost reduction: Tesla's approach with its hit models, the Model 3/Y, has been to achieve more affordable pricing through technological cost reduction while maintaining technological superiority, thereby creating blockbusters. This included pioneering cost-effective production techniques like integrated casting and CTC.

For the Model 2.5, Tesla initially had a similar strategy:

a. In electric vehicle battery technology, Tesla aimed to enhance battery performance (increasing density and range) through in-house development and production of 4680 batteries, while maintaining control over upstream battery manufacturer profits for cost reduction.

However, the 4680 battery has been plagued by production process issues, resulting in low yield rates and uneconomical production. Tesla's progress in 4680 battery production remains slow, with most batteries still sourced externally.

b. Cost reduction through more efficient production processes: Tesla previously disclosed its revolutionary 'unboxed manufacturing strategy,' where car bodies are assembled simultaneously in specific areas before final assembly. However, the latest product roadmap in the third-quarter earnings report indicates this technology will be used for Robotaxis, not the Model 2.5, suggesting it will take time before this process is implemented.

Whether due to delays in in-house battery production or the challenge of immediately implementing more efficient production processes, Tesla's path to revolutionary technological cost reduction seems obstructed.

③ Change in Musk's strategic thinking:

A crucial yet potentially overlooked point in the earnings call: When asked about Tesla's plans for a regular, non-Robotaxi model priced at $25,000, Musk stated, "Basically, I think having a regular $25K model is pointless, it would be silly, it would be completely at odds with what we believe." Implicitly, he suggests that a standalone $25,000 model is meaningless. The future of automobiles lies in autonomous driving, reflecting Musk's strategic vision:

With electric vehicle technology nearing its peak, disruptive innovations in this area may be challenging to achieve. Simply reducing costs and offering lower prices do not constitute a model's core competitiveness (and may be difficult to compete with BYD). Musk believes the true next-generation vehicle will be driven by advanced autonomous driving technology, marking a revolutionary product cycle. This vision is unlikely to materialize soon, especially not in the Model 2.5 due in the first half of 2025.

④ Sales guidance suggests a non-blockbuster model:

Tesla's sales guidance for next year projects a 20%-30% growth rate. Assuming existing model sales remain unchanged, this implies the Model 2.5 could sell 360,000 to 550,000 units in 2025, exceeding market expectations but not fitting Tesla's typical definition of a 'blockbuster model' (compared to the 4 million-unit capacity planned for the Model 2).

In summary, the Model 2.5, based on existing platforms and facing obstacles in technological cost reduction, does not align with Musk's vision for a disruptive next-generation model. It is likely intended as a transitional product to stabilize deliveries and share prices, with cost reduction not driven by technology but potentially achieved through selective de-contenting.

Dolphin Research believes Tesla's likely product rollout next year is as follows:

As the Model 2.5 will be produced on the Model Y platform, it is likely a de-contented variant priced below the Model Y. However, the price is unlikely to reach the previously mentioned $25,000. To avoid cannibalizing Model Y sales, the Model 2.5's timeline from announcement to delivery will be swift.

Meanwhile, Tesla is expected to introduce an updated Model Y (codename: Juniper) to stabilize Model Y sales. Based on current information, Juniper could be an upgraded version of the Model Y with a longer wheelbase (potentially adding a third row) and increased battery capacity.

Surprisingly, Tesla has prepared significant capacity for the Cybercab, its Robotaxi prototype: With a 2026 mass production target and an annual capacity of 2 million units across multiple gigafactories, ultimately reaching 4 million units.

Dolphin Research believes Tesla's true next-generation model is likely the Cybercab, for the following reasons:

① Timeline: With mass production in 2026, Tesla has ample time to prepare for its next-generation model.

② Capacity: The 4 million-unit production capacity planned for the Cybercab aligns with Tesla's initial preparations for the Model 2, fitting the definition of a 'blockbuster model.' This capacity seems geared not just for ride-hailing but also for consumer sales.

③ Technology: The Cybercab adopts Tesla's new 'unboxed manufacturing strategy,' potentially reducing production costs further. Its launch also signals maturity in Tesla's autonomous driving technology, aligning with Musk's vision for the next-generation model driven by advanced autonomous driving technology.

④ Pricing: The Cybercab's launch price is below $30,000, with potential for further reductions as manufacturing costs decrease. Once Tesla's hardware-software integration is complete and its technological lead consolidated, the $30,000 price point will be attractive to consumers.

In our upcoming in-depth analysis of Tesla's Robotaxi business, we will delve into its essence and Tesla's true intentions behind this venture. Stay tuned!

Tesla Historical Articles: Earnings Report Interpretations

July 24, 2024: "Tesla: The 'AI Pie' is Easy to Bake, but Reality is Harsh"April 24, 2024: "FSD: The Masterstroke That Proves Tesla Isn't Just 'Paper-Thin'"January 25, 2024: "Stripping Tesla of Its AI Veneer: Endless Price Wars and Unstoppable Bleeding"October 19, 2023: "Bubble-Bursting Moment! Tesla's Reality is Harsh"July 20, 2023: "Trillion-Dollar Tesla? Only the Most Devoted Fans Dare to Take the Leap"April 20, 2023: "Tesla: A Year of Big Promises, Little Deliveries – Long-Term Commitment is Tough"January 26, 2023: "Tesla's Story is Being Rewritten – A Test of Faith"October 20, 2022: "Critical Question: When Demand Falters, How Can Tesla Maintain Single-Vehicle Profits?"July 21, 2022: "Without the Shanghai Gigafactory Pumping Out Cars, What Can Tesla Rely On?"June 3, 2021 (In-Depth): "Tesla (Part 2): Misjudged or Overvalued? Where is Tesla's Story Heading?"April 27, 2021: "After Tesla's Unspectacular First-Quarter Earnings, What's Left to Anticipate?"July 27, 2021: "Tesla: Not Just the Best, But Even Better!"October 21, 2021: "Tesla: Cathie Wood Shouts $3,000 – The Sky's the Limit!"January 27, 2022: "Tesla, the Lone Ranger, Takes a Mid-Race Break?"In-Depth & Hot TopicsOctober 19, 2023: "Bubble-Bursting Moment! Tesla's Reality is Harsh"October 12, 2023: "FSD Autonomous Driving: Can It Sustain Tesla's Next Valuation Miracle?"September 22, 2023: "The Lion King Faces a Pack of Wolves: Can Tesla Defend Its Territory?"September 19, 2023: "Tesla: How Far is Musk's 'Trillion-Dollar Empire Dream'?"June 3, 2021 (In-Depth): "Tesla (Part 2): Misjudged or Overvalued? Where is Tesla's Story Heading?"May 21, 2021 (In-Depth): "300x Growth in 10 Years – How Long Can Tesla's Magic Last?"