Don't discredit oil-powered cars, don't blindly praise electric cars

![]() 10/31 2024

10/31 2024

![]() 571

571

Introduction

Introduction

Leave everything to nature.

New energy, new forces, NIO, Xpeng, Li Auto, Huawei, Xiaomi, intelligent driving, end-to-end, weekly sales...

Nowadays, car industry news with higher heat basically focuses on the top new forces, which seems to be propping up half of China's automobile industry. It's like Xiaomi using a prototype car to set a record at the Nürburgring. When you check Weibo, everyone is praising it, even though it's indeed impressive, but the praise seems a bit scary.

On the other hand, let's look at oil-powered cars. Despite occupying half of the automotive market with over 10 million vehicles, their voice is weak, and it's almost impossible to see any brands or automakers that only produce traditional oil-powered cars stirring up public opinion, making it feel like the era of oil-powered cars is about to end soon.

Moreover, under many news events related to oil-powered and electric cars, there are always those who oppose one another. They attack and insult each other, trying to defend their own cognitive choices and ideologies. He says you're stubborn and outdated, not understanding the times; you say he's a guinea pig for car factories, only seeing short-term benefits. Electric cars do save fuel, but you won't know the harm until they catch fire or crash.

The internet certainly doesn't present the true face and entirety of the world. Whether you rationally browse more comprehensive automotive sales data, visit various offline car dealerships, or chat with more acquaintances and friends who are car consumers, oil-powered cars don't seem to be dying, and electric cars don't seem to be as crazy as they're made out to be. Everything follows an unbiased and objective law.

Whether to develop gently or aggressively? This is undoubtedly determined by the circle, culture, and inner purpose. The vast and diverse Chinese automotive market, with its mix of different philosophies and consumer preferences, is the most essential and authentic aspect of the automotive market.

The trend asks, time answers

For several consecutive months, retail sales have exceeded 50% market share, and market share in many cities has surpassed 50%. Sedans, SUVs, and more segmented markets are dominated by new energy products...

These are the current achievements of the new energy market. Electric cars, as the core driver of new energy, are indeed the current trend in the automotive industry and era, and no one can stop this trend. Behind electrification, the extended smart cockpit and intelligent driving provide new possibilities for the car experience and new opportunities for the automotive industry.

Is this really driven by market demand? To some extent, yes.

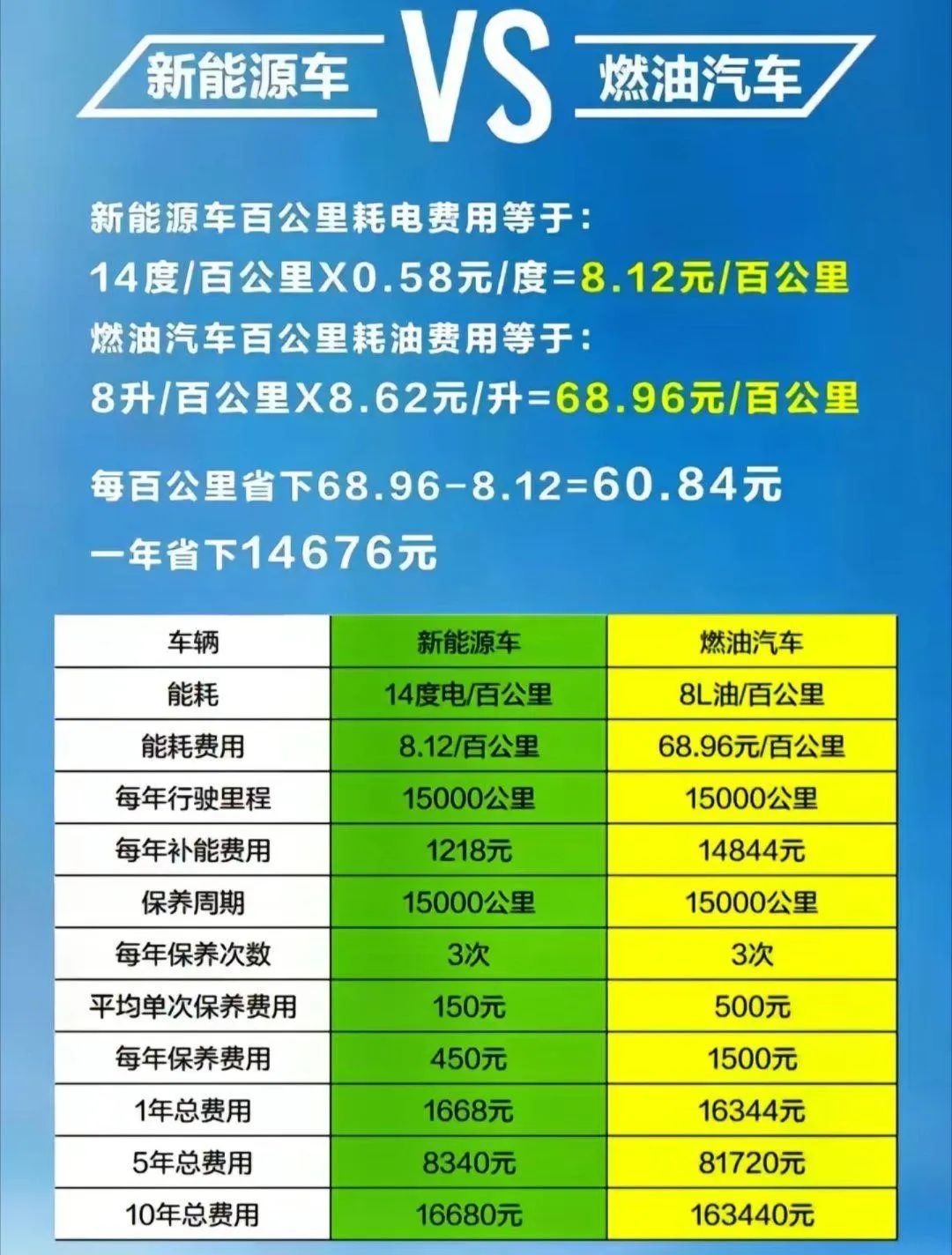

For example, electric cars do offer high cost-effectiveness, especially in terms of abundant performance and features. The experience is better, and it's understandable that they sell well in Transcending levels competition. On the other hand, electric cars are indeed economical, especially for many consumers who mainly use them for urban commuting and have long daily commutes. Driving an oil-powered car can cost over a thousand yuan a month in fuel, but after switching to an electric car, the monthly electricity bill is less than 200 yuan, making it a more economical choice.

But analyzing from another angle, the popularity of electric cars is not solely driven by market demand; there's also an invisible hand pushing them forward. As Great Wall Motor Chairman Wei Jianjun said, the core reason for China's rapid development in new energy is strategy. China is supported by strong strategic factors, including policy strategy, industrial chain strategy, and consumption strategy, which collectively drive the continuous growth of new energy and electric vehicles.

In particular, supportive policies such as purchase tax incentives and trade-in subsidies provide significant advantages for the sales of new energy and electric vehicles. These are very friendly to consumers' purchasing costs and are the most direct stimulus for sales.

This is true in any industry: the more investment and support, the more capital tilt , and the louder the voice becomes. Especially after technology companies entered the market, their strong publicity campaigns made electric cars a hot spot in the industry and consumer market. Weekly sales, booking data, and comparative adjectives are used to constantly "brainwash" consumers, telling them that this is the era of electric cars, the era of smart cockpits and intelligent driving.

Admittedly, electric cars do offer many benefits to consumers. But from a broader market perspective, as a new thing, electric cars are not perfect. There are still many areas that need optimization and time to test.

For example, due to the nonlinear acceleration and high peak fluctuations between braking and acceleration, many people feel carsick when riding in electric cars.

Another example is range anxiety. Even though many current models can achieve 800km or even 1000km of range, and even though infrastructure is gradually improving, and even with 800V fast charging that can provide 2 hours of highway range in just 10 minutes, the difference in refueling convenience between electric and oil-powered cars still concerns many consumers. This is especially challenging in the vast northern markets, where range degradation and reduced charging efficiency in cold weather are temporarily unavoidable.

Another major concern is safety hazards in electric cars. Some brands have been promoting zero spontaneous combustion, but recently, several vehicles have been reported to have caught fire on the internet. Although there's no definitive conclusion yet, according to the usual operating logic of electric car companies, the battery pack is not the problem, or the ignition point does not come from thermal runaway inside the battery.

Some brands have been claiming that their batteries are very safe and won't ignite even if punctured with a needle, but spontaneous combustion still occurs frequently in actual use. For ordinary consumers, no matter where the fire starts or whether it's spontaneous combustion, as long as an electric car catches fire, doubts about its safety will inevitably be reinforced.

Safety hazards are also evident in the cheap acceleration performance of electric cars, which leads to increasing instances of loss of control. From Tesla to Xiaomi, the more popular brands tend to have such safety incidents. Safety is also manifested in intelligent driving. Once consumers trust the so-called NOA, and it cannot provide 100% operational safety, accidents can occur if users are influenced by manufacturer propaganda and some consumers neglect the safety boundaries of intelligent driving.

Safety also extends to data, network, and privacy security. With intelligent driving, sentinel mode, and more personal information being uploaded to the car, the impact of hacker intrusions can be far-reaching. Just like many classified units ban Tesla, and like when an overseas intelligent driving company was found to use intelligent driving mapping to steal Chinese map information, these are challenges to information security in the development of electric cars.

There are also issues such as high insurance renewal costs, rapid iteration of new cars, and low resale values of used electric cars. Considering the entire lifecycle of electric cars, they may not be cheap, and this has also become a core factor influencing consumer purchase decisions.

Facts have shown that new things always need time to test, which is an unchangeable law and a rhythm and pace that no one or event can skip. The popularization and development of electric cars cannot escape this trend and law, and everything should be left to time to answer.

Times are tough, but oil-powered cars aren't dead

Looking at today's automotive sales rankings, oil-powered cars are indeed facing more difficulties.

In addition to many models dominating the rankings, some traditional oil-powered cars have seen a staggering decline of 400,000 to 500,000 units in some months. Some once-popular oil-powered cars are also fading from consumers' sight, such as the Haval H6, which had been the top-selling SUV for over 100 consecutive months, and the once-popular Fit and Excelle, which have disappeared from today's rankings.

These phenomena have led some automakers' CEOs to consider issuing an ultimatum to oil-powered cars. For example, Leapmotor CEO Zhu Jiangming said that pure oil-powered cars may completely disappear from the market in three years. Earlier, NIO's Li Bin wondered why anyone would still buy an oil-powered car.

Unsurprisingly, such remarks discrediting oil-powered cars will surely be denounced by their loyal online supporters. After all, those who discredit oil-powered cars and make such statements have their own positions and self-interest, representing only those in their position cheering for their own future.

In reality, whether oil-powered cars will exit the market is determined by market and consumer demand, not by any single automaker or regional market. With a broader perspective, a global automaker will never limit itself to the narrow path of electric cars. Take Toyota as an example. Despite its lackluster electric car performance and conservative electrification strategy, it remains the world's largest automotive group and the most profitable automaker.

While it's undeniable that the share of oil-powered cars is shrinking rapidly, it must still be acknowledged that their position in the market is neither negligible nor replaceable. Otherwise, there wouldn't be so many consumers still choosing cars like the Sylphy and Lavida or looking at CR-Vs and RAV4s. There are still a significant number of households in China without cars, and when they make a purchase, they are more likely to choose an oil-powered car as their first option.

Furthermore, the fierce and brutal market competition has driven down the prices of many oil-powered cars. What was once said to be "same price for oil and electric" is now reversed, with many oil-powered cars priced lower than their electric counterparts. Especially after BYD introduced the 99,800 yuan model, the price of oil-powered cars has plummeted even further. Models like the A-segment fuel-powered Arrizo 5, Emgrand, and MG5 have lowered their starting prices to just over 50,000 yuan, offering performance and features previously found in 100,000-yuan class cars.

On the other hand, the prices of traditional fuel-powered joint venture cars like the Lavida, Sylphy, and Civic have also halved, with starting prices at around 80,000 yuan. Models like the Accord, Camry, Passat PRO, and Altima now start at 150,000 yuan, meaning that with a 100,000 yuan budget, consumers can now easily afford cars that previously cost 150,000 yuan, enjoying the experience of a joint venture B-segment sedan with the money that used to buy an A-segment one.

It's worth noting that core mainstream oil-powered cars are constantly being updated with the latest technology and features. For example, the recently launched Volkswagen Passat Pro not only has a longer wheelbase, an upgraded large center console screen, and a co-pilot entertainment screen but also comes with high-level intelligent driving capabilities, making its smart cockpit and driving experience on par with current electric cars.

Changan's fourth-generation CS75PLUS not only has an upgraded exterior design but also significant improvements in interior technology and luxury atmosphere, including the addition of zero-gravity seats and the use of AI big data models. Geely's China Star series, including the Xingrui and Xingyue L, are also constantly updated. In addition to the Flyme auto infotainment system and more powerful powertrains, the Xingyue L is now equipped with CCD variable damping suspension as standard, continuously enhancing its configuration, features, and value proposition for consumers.

I have always believed that stimulating and promoting the popularity of automotive products must come from manufacturers' investments in their products. While the decline of oil-powered cars is partly related to many automakers shifting their focus to new energy, mainstream automakers have not given up on updating their oil-powered cars, and their popularity continues.

Take Volkswagen Passat as an example. In September, it sold 23,000 units, one of its best-selling months. Similarly, Changan's fourth-generation CS75PLUS received over 10,000 orders within 10 days of its launch and has entered the top 5 of fuel-powered cars in the latest weekly sales data, with monthly sales consistently exceeding 15,000 units.

Geely's China Star series, despite the decline in the fuel-powered car market, has seen counter-cyclical growth. From January to September, Xingrui sales increased by 39%, making it the top-selling fuel-powered sedan among Chinese brands and ranking in the top five in the overall sedan market. Xingyue L sales increased by 43%, making it the top-selling fuel-powered SUV across all brands.

Behind these impressive results are continuous investments in products and technology, continuously providing consumers with more and better choices from the supply side. At the same time, adjusting product strategies and sales rhythms based on market conditions and their own positions, and considering the health of the entire system, will prevent them from being overwhelmed by the so-called new energy and competition.

Just like Ford, despite its declining market share and being overlooked or even forgotten by many consumers, its dealers and system are profitable and healthy, contributing over $600 million to Ford's earnings before interest and taxes this year, which is absolutely impressive for Ford.

It must be acknowledged that we are now in an era where oil-powered and electric cars coexist. Whether for automakers or consumers, comprehensively considering multiple factors, only the rhythm and strategy that suits them is the right choice. Only the car that meets their needs is the best one.