Volkswagen's largest layoff in history, leaving 120,000 employees in fear

![]() 10/31 2024

10/31 2024

![]() 504

504

Introduction

Introduction

I witnessed the collapse of an era.

An explosive news came from Volkswagen's headquarters in Germany.

At the Volkswagen Group's headquarters meeting in Wolfsburg, Germany, on October 28th, Daniela Cavallo, chairperson of the Volkswagen Group Works Council, revealed to the outside world that Volkswagen plans to close at least three German factories, affecting tens of thousands of employees. Cavallo stated, "All German factories may be affected by the closure plans, and no one is safe."

Cavallo said that the board had carefully considered the plan, and all German factories may be affected. Employees at other factories that are not closed will also face salary reductions, and the company has informed employees of the plan.

It is reported that Volkswagen Group has approximately 650,000 employees worldwide, with nearly 300,000 of them in Germany, accounting for half of the company's global workforce. The planned factory closures involve Volkswagen's core brand, Volkswagen Passenger Cars.

Currently, Volkswagen has ten factories in Germany, employing approximately 120,000 people. If the closure plan is successfully implemented, it will mark the first time Volkswagen has closed a factory in Germany. This news has not only caused significant unease among Volkswagen employees in Germany but has also drawn industry attention to this German automotive manufacturing giant.

Unprecedented layoff scale, alarming the German government

Prior to this announcement of the largest layoff in history, Volkswagen had already issued a statement indicating its intention to consider closing one of its automobile manufacturing plants and one of its component factories in Germany. Additionally, it was considering ending a 30-year-old job protection agreement that promised no layoffs until the end of 2029.

Obviously, Volkswagen intends to address market challenges by streamlining its workforce and improving production efficiency, as both Volkswagen and the Volkswagen Group are currently at a competitive disadvantage in the market.

According to Volkswagen Group's financial report, due to declining automobile sales and increased restructuring costs, the Group's net profit for the third quarter of 2024 was only 1.58 billion euros (approximately 11.6 billion yuan), a year-on-year decline of 64%. The gross margin of its core brand, Volkswagen Passenger Cars, was only 2%, further highlighting Volkswagen's dire profitability situation.

Last month, Volkswagen revised its full-year earnings forecast downward for the second time. The Group's management stated that it expects full-year operating profit for 2024 to be only 18 billion euros. Oliver Blume, CEO of Volkswagen Group, has also stated that the current strategic focus is on addressing declining profits through a series of cost-saving measures.

According to Blume, Volkswagen will implement a large-scale cost-cutting plan to improve the profitability of its core brands. As part of this plan, Volkswagen Group expects to close at least three German factories and lay off a significant number of employees, potentially affecting tens of thousands of workers.

Blume once said, "In the long run, it is realistic to reduce the German workforce by 10%." This percentage represents approximately 30,000 Volkswagen employees working in Germany.

Currently, Volkswagen employs approximately 120,000 people in Germany, with more than half concentrated in the headquarters in Wolfsburg. Additionally, Volkswagen has ten factories in Germany, six in Lower Saxony, three in Saxony, and one in Hesse. Although it is not yet clear which factories will be closed, the Works Council has mentioned that the Volkswagen factory in Osnabrück, Lower Saxony, is the most likely candidate, as it has just lost an order from Porsche Automobil Holding SE, a subsidiary of Volkswagen Group.

In response to the layoffs, Volkswagen workers protested at the factory on October 28th, stating that their demands were reasonable and fair and announcing plans for intense resistance, potentially culminating in the occupation of the factory. Relevant organizations expressed strong opposition and called for more comprehensive cost-cutting measures beyond layoffs and factory closures. Even German Chancellor Olaf Scholz intervened in the matter on October 28th, stating that correcting past mistakes should not come at the expense of the workforce and urging the retention and protection of jobs.

Obviously, the factory closures and layoffs are a significant psychological blow to the Works Council, as they are currently negotiating a new collective bargaining agreement with Volkswagen, originally seeking a 7% pay raise. However, in preliminary negotiations, Volkswagen rejected the union's wage increase request and instead proposed a 10% pay cut, with no future wage increases for the next two years.

In the face of Volkswagen's hardline stance, some argue that the company's workforce is bloated, with employees working for decades and earning above-average salaries. They believe that the layoffs are merely delaying the inevitable, as the bloated workforce must eventually be reduced.

Interestingly, others contend that as long as Volkswagen thrives in the Chinese market, with its subsidiary Audi profiting handsomely from its premium strategy and Porsche maintaining sales records to support revenue, Volkswagen does not need to lay off a significant number of employees in Germany.

However, the problem is that Volkswagen is not faring well in China either.

"No more checks from China"

In early October, multiple media outlets reported on layoffs at Volkswagen China. The layoffs primarily affected the import vehicle business and involved Volkswagen Group China Import & Sales Co., Ltd. (VGIC), with nearly 100 affected employees.

It is reported that Volkswagen China offered employees two options during this round of layoffs: relocation from Beijing to Hefei or direct layoff with a maximum N+6 compensation package. It is important to note that not all employees are eligible for the N+6 compensation, as the primary criterion is that they must be regular employees with years of service at Volkswagen.

Currently, Volkswagen has multiple subsidiaries in Anhui Province, including CARIAD, Volkswagen (Anhui), Volkswagen China Technology Co., Ltd. (VCTC), among others. The reason for relocating employees to Hefei is that Volkswagen China's overall focus is shifting towards Hefei. Additionally, sales of imported vehicles have been poor, and layoffs have been planned for some time, as the import vehicle business has undergone multiple rounds of layoffs in the past.

On October 10th, Volkswagen China addressed rumors of layoffs, stating that the move was part of its global efforts to reduce costs. The company is continuously improving efficiency and optimizing costs across departments and projects. Depending on the situation, relevant measures may also involve direct labor costs and indirect labor costs, including administrative expenses, travel expenses, and training costs.

Simultaneously, Volkswagen China pointed out that in 2023, the Group initiated a performance program across all its brands to maintain success in a challenging industry landscape. Volkswagen Group has set a clear target of improving efficiency by 20% by 2026.

Volkswagen China, like all other departments, actively participates in and supports the global performance program. Specific measures include adjusting organizational structures, enhancing digitalization of work processes, strengthening collaboration between brands and departments in China, and localizing projects.

In fact, Volkswagen revealed last year that it plans to save a cumulative 10 billion euros in costs by the end of 2026 and increase its operating margin from 3.4% to 6.5%. However, Volkswagen Passenger Cars is still more than 2 billion euros short of its cost-saving target this year.

In mid-September, it was reported that Volkswagen China would cut hundreds of jobs to achieve its goal of reducing global administrative expenses by 20% over the next three years. In response, Volkswagen Group stated in an email that Volkswagen China needed to meet its cost-reduction KPIs, and optimization efforts "may also include direct and indirect personnel costs," such as management, travel, and training expenses.

Cost-cutting through layoffs is a microcosm of Volkswagen's struggles in China in recent years.

For example, in the rapidly growing pure electric vehicle market in China, Volkswagen has yet to engage in direct competition with Tesla, BYD, and other Chinese automakers.

Last year, Volkswagen delivered 190,000 pure electric vehicles in China, an increase of 23%. In contrast, China's overall electric vehicle market deliveries grew by 37% last year, while Tesla delivered 603,600 vehicles in China.

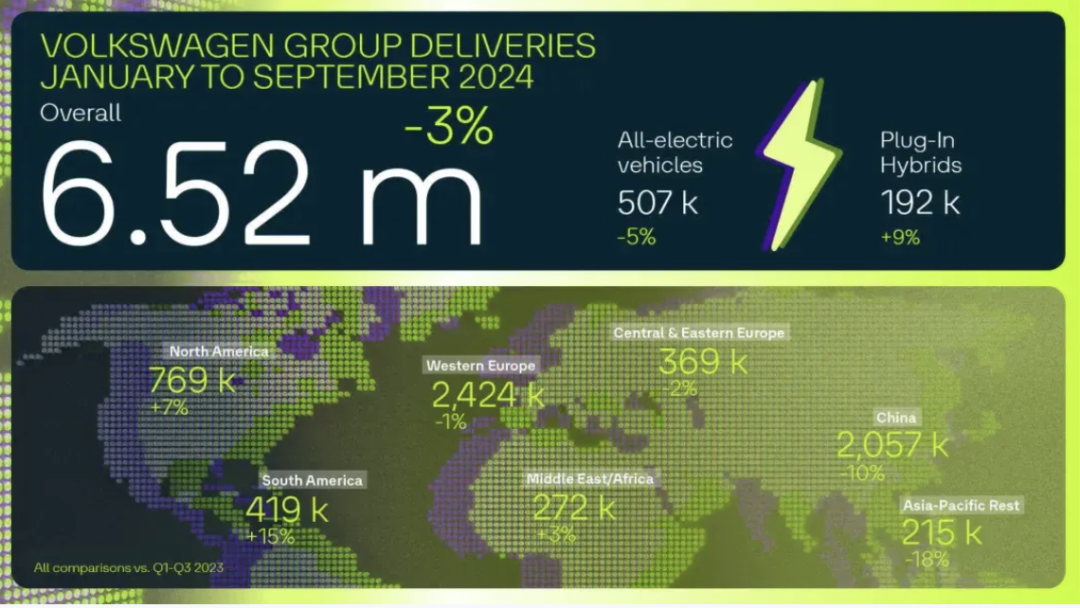

Entering 2024, as independent brands continue to erode the market share of joint ventures, Volkswagen sold only 1.35 million vehicles in the first half of the year, a year-on-year decline of 7.4%. In the third quarter, Volkswagen sold 711,500 vehicles in China, a year-on-year decline of 15%, with cumulative sales of 2.0566 million vehicles, a year-on-year decline of 10.2%.

It is important to note that these figures were achieved despite Volkswagen participating in price wars and sacrificing some profits. Based on its performance in China, Herbert Diess stated at an employee meeting held at the Wolfsburg headquarters, "There are no more checks coming from China."