BMW falters! BBA collectively loses its way

![]() 10/31 2024

10/31 2024

![]() 689

689

Author: Lushiming

Editor: Dafeng

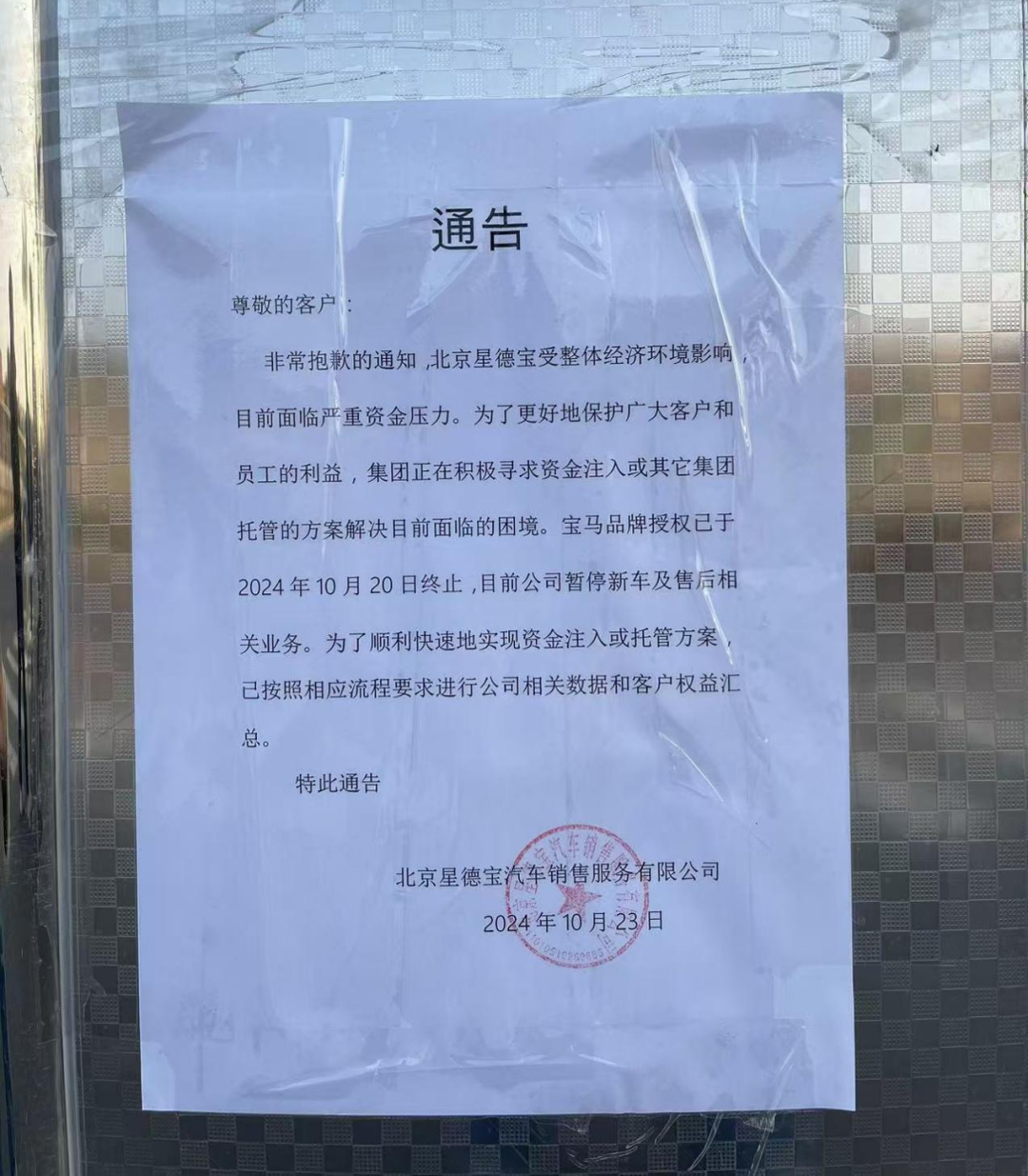

Once upon a time, BMW was seen as a symbol of wealth and success, becoming the dream car of countless consumers. However, who could have imagined that within just a few short years, this 108-year-old luxury automaker would encounter an unprecedented winter in the Chinese market. Recently, BMW's first global 5S dealership, Beijing Xingdebao Automobile Sales and Service Co., Ltd. (hereinafter referred to as "Xingdebao"), closed its doors. According to a notice posted outside the store, Beijing Xingdebao stated that due to the overall economic environment, it is currently facing severe financial pressure. The group is actively seeking funding injections or other group trusteeship solutions to address the current difficulties. BMW's brand authorization ended on October 20, 2024, and the company has temporarily suspended new car and after-sales related businesses.

BMW's rapid sales decline is not unjustified. Initially, it announced its withdrawal from the price war, only to subsequently backtrack and significantly reduce prices. This back-and-forth behavior has severely damaged BMW's brand value.

Of course, the decline of traditional luxury brands is not limited to BMW alone. As the "price war" in the automotive market continues and domestic luxury brands continue to rise, traditional luxury brand dealers are generally facing severe losses. It is clear to see that the landscape of the luxury car market in China is undergoing dramatic changes.

Back and forth, BMW returns to the price war

Globally, the competition in China's automotive market is unparalleled. To capture market share, major automakers have resorted to price cuts and promotions in recent years. Traditional luxury giants such as BMW, Mercedes-Benz, and Audi have also been forced to engage in price wars to consolidate their market positions. However, amidst the ongoing price war, BMW's strategies this year have been puzzling, making it hard to believe they came from a century-old automaker. In May this year, the BMW i3 35L model underwent a significant price reduction. Its original official price was 353,900 yuan, but after a series of discounts, the bare car price quickly dropped to 189,500 yuan and continued to decline to 170,000 yuan. This huge price difference sparked a rush of consumer purchases, with vehicle reservations even extending into August.

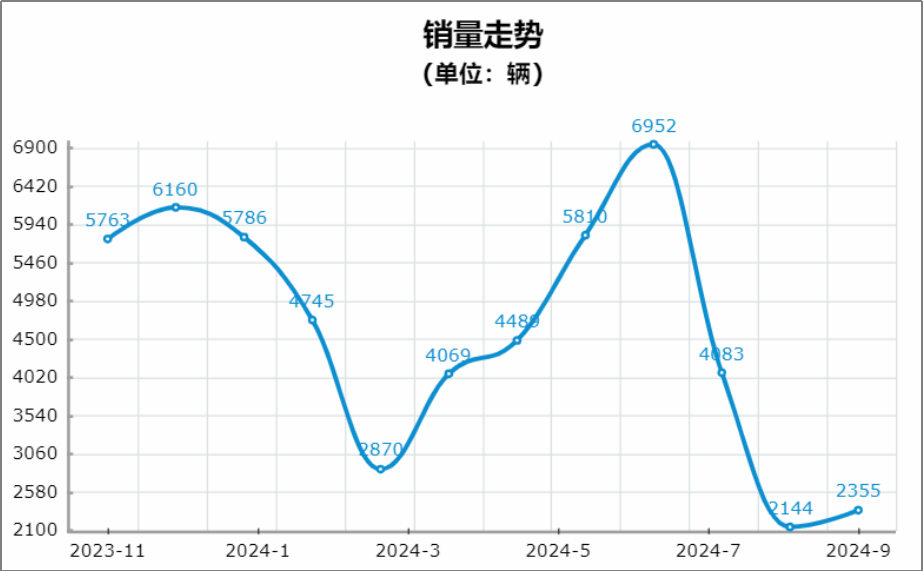

Perhaps feeling confident again, or as the official statement claimed, to ensure profits and maintain brand value, BMW boldly announced in July that it would withdraw from the price war and choose to reduce production volumes to maintain prices, with price increases of tens of thousands of yuan for multiple models. It turned out that BMW greatly underestimated the market's reaction, resulting in even more lost sales. Taking the BMW i3 as an example, when large price cuts were initiated in June, terminal sales reached a high of 6,952 units, but only 2,144 units were sold in August, a dismal figure. In addition, according to data released by BMW China, BMW sold a total of 34,800 units in China in August, a staggering 42% drop from the 60,000 units sold in the same period last year.

BMW i3 sales trend in the past year Source: Owner's Guide

Interestingly, when BMW announced its withdrawal from the price war in July, it received support from peers such as Mercedes-Benz and Audi, who expressed their intentions to raise prices as well. However, these were merely verbal expressions of support, as discounts remained in place, and prices even dropped further. Looking back now, it's hard to say whether BMW was stubborn or misled by Mercedes-Benz and Audi.

By September, BMW's sales situation had not improved, with a total of 44,800 units sold that month, a year-on-year decline of 30.82%. Many BMW 4S stores across the country, such as Tianjin Tianbao, Xuzhou Mingzhibao, and Shanghai Baoxin, also faced difficulties in delivering vehicles and closed temporarily, leaving customers in limbo. Faced with such immense pressure, BMW had no choice but to return to the price war, albeit more discreetly this time. According to Zn Finance, the price reductions for BMW's flagship electric model, the i7, have reached 38% in many 4S stores across China, with the maximum reduction reaching 555,000 yuan, bringing the bare car price to 663,300 yuan. As for the 2024 BMW i3 eDrive 35 L version, the on-road price has again come down to around 190,000 yuan. Will this renewed price reduction boost sales and stabilize the dealer network? The outlook for BMW is unclear, as the era of easily securing sales based solely on the car logo in the Chinese market is long gone.

Joint venture luxury brands dethroned

It's not just BMW; second-tier luxury brands like Cadillac, Lincoln, Jaguar Land Rover, as well as Mercedes-Benz, Audi, and even more luxurious brands like Porsche, are all facing varying degrees of pressure. Let's set aside the second-tier luxury brands, which are on the brink of collapse. As for BBA, their overall sales have declined significantly in recent years. In the first three quarters of this year, Mercedes-Benz delivered 512,200 vehicles in the Chinese market, a year-on-year decrease of 10%. Notably, in the third quarter, Mercedes-Benz sales in China fell by 13%, with market revenue declining by 16.6% to 5.09 billion euros. As for BMW, global sales in the third quarter reached 540,000 units, a year-on-year decrease of 13%, with sales in China dropping by 29.8%, the steepest decline among all markets. For the entire first three quarters, BMW Group global sales fell by 4.5% to 1.754 million units, with China recording a 13.1% decline, still the largest drop among all markets. Compared to Mercedes-Benz and BMW, Audi, under Volkswagen, has seen a relatively milder decline. According to industry data from Autohome, Audi sold 50,130 units in China in September, a year-on-year decrease of 23.6% but a month-on-month increase of 10.47%, ranking first among BBA.

Unlike BBA, Porsche has long been hailed as one of the most valuable luxury car brands, earning substantial profits in China. However, the current Chinese automotive market no longer tolerates such a status quo.

Last year, China became the only market where Porsche experienced a decline globally in 2023, with a year-on-year drop of 15%, marking the second consecutive year of declining sales in China. Furthermore, according to official data, Porsche delivered approximately 43,300 vehicles in China from January to September 2024, a year-on-year decline of 29%. Recently, media reports claimed that a Shenzhen dealer offered significant discounts on the Porsche Macan, with the bare car price of the 2024 Macan 2.0T model reaching as low as 358,000 yuan, representing a 40% discount from its manufacturer's suggested retail price of 578,000 yuan.

In response to declining sales and compressed profit margins in the Chinese market, Porsche has also been reported to significantly reduce its dealer network in China, aiming to cut costs, improve operational efficiency, and mitigate the impact on profit margins. Since entering the Chinese market three to four decades ago, traditional joint venture luxury automakers have long dominated the Chinese premium automotive market, leveraging their overseas brand advantages to capture significant profits in the industry. However, with the advent of a new era in the automotive industry, the wave of electrification and intelligence is sweeping the globe, and the rapid development of China's automotive industry has surpassed international expectations. In particular, the rapid rise of domestic luxury brands has thoroughly dethroned traditional luxury automakers.

Accelerating encroachment, experiencing "Chinese-style" luxury

The decline of traditional luxury automakers is objectively closely related to economic conditions, but the rise of Chinese luxury car brands is also a significant factor. It is evident that consumer attitudes are undergoing fundamental changes amidst the energy transition. Once, traditional luxury brands prided themselves on their engine, transmission, and chassis technologies, which are no longer the focus of consumer attention. Conversely, Chinese automakers' expertise in electric motors, electronic controls, and battery technologies is gradually becoming the new darling of the market. With the continuous deepening of electrification and intelligence transformation, Chinese automakers are seizing the opportunity to overtake in this new era.

Since around 2022, many domestic automakers have ventured into the premium market, launching their own luxury brands or models. Both traditional automakers like BYD and Great Wall and emerging players like NIO and Lixiang have actively participated. After two or three years of development, domestic luxury cars have finally achieved impressive results. According to Gangtise Investment Research's analysis, if we define vehicles priced above 400,000 yuan as luxury cars, the domestic luxury car market was largely dominated by foreign automakers in 2022, with Porsche, BBA, and Land Rover accounting for approximately 94% of the total market share, while Chinese automakers held only single-digit shares. However, by the end of May 2024, Chinese automakers' share in the luxury car market had risen to 21%.

Especially in the SUV and MPV segments, models priced above 400,000 yuan from brands like Lixiang, Huawei Hongmeng Smart Travel, and Denza have seen rapid sales growth, becoming new favorites in the market. Specifically, Seres released its September production and sales figures, with new energy vehicle sales reaching 37,407 units, a year-on-year increase of 265.09%. Among them, the Wenjie M9, jointly developed with Huawei, recently achieved its 100,000th vehicle rollout and has consistently ranked first in sales of vehicles priced above 500,000 yuan in China's luxury market for six consecutive months.

Wenjie M9 interior Source: Wenjie official website

Furthermore, in 2023, Denza D9 sold a cumulative total of 127,840 units, surpassing established joint venture competitors like the Buick GL8, Honda Odyssey, and Toyota Sienna to become the annual sales champion in the full-category MPV segment. This achievement not only broke the monopoly of traditional fuel-powered MPVs but also set a new benchmark for Chinese luxury automotive brands.

While low costs, affordable prices, richer configurations, and more advanced intelligence features are the strengths of Chinese luxury brands, it must be acknowledged that there are still some gaps between domestic luxury brands and traditional luxury brands like BBA in certain aspects. Only by learning from others' strengths and leveraging our own advantages can we go further. Nonetheless, amidst the inevitable trend of the new energy wave sweeping the globe, the share of domestic brands in the luxury car market will continue to expand. By then, Chinese luxury brands will no longer be mere "alternatives" to traditional luxury brands but true competitors on an equal footing.