Tesla's profitability exceeds expectations, where should domestic new energy vehicle makers head?

![]() 11/01 2024

11/01 2024

![]() 629

629

Original content by Insight into Digital Economy Studio

Author | Uncle You

Elon Musk has been quite busy lately, distributing million-dollar red envelopes to American voters, testing reusable rockets for Mars colonization, and keeping an eye on Tesla's profitability - "Global electric vehicle companies are all facing profitability pressures, and so is Tesla." This was his opening remark during Tesla's recent Q3 earnings call. Despite this, Tesla's gross margin performance exceeded expectations, driven by its automotive, energy storage, and carbon trading businesses, making it the best third-quarter financial report in Tesla's history and providing inspiration for domestic new energy vehicle makers that have struggled with profitability.

Not only does Tesla sell a lot, but the sales cost per vehicle has also hit a new low

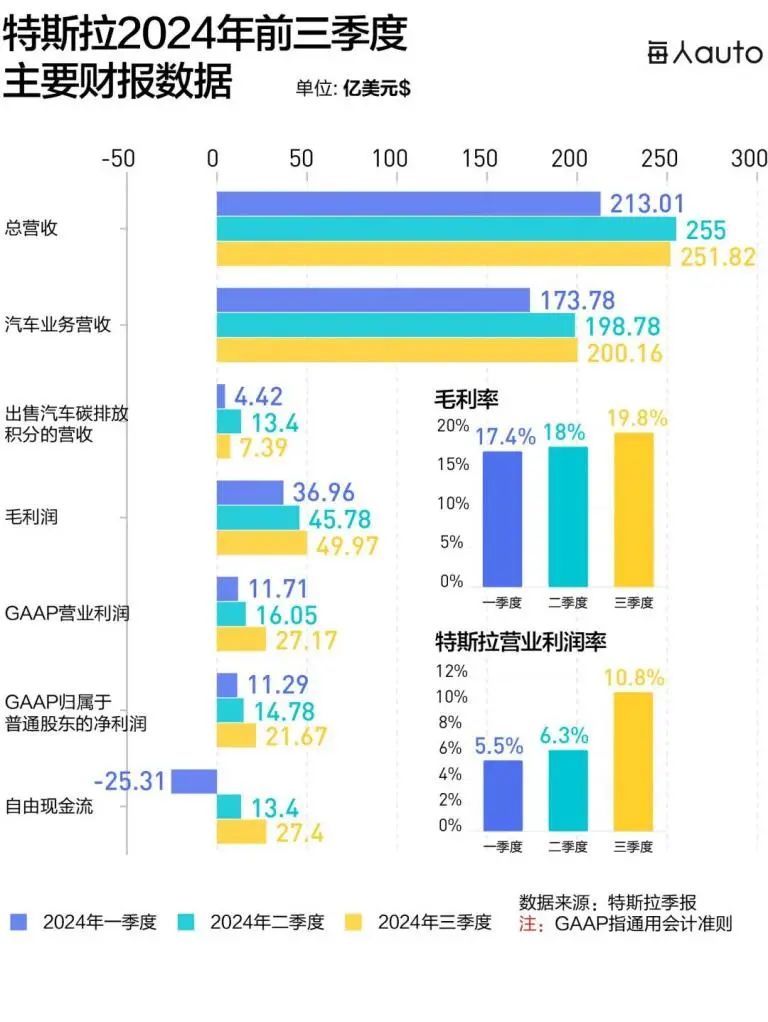

Tesla's third-quarter 2024 financial report has several highlights: The company achieved revenue of $25.182 billion, an 8% year-on-year increase; net profit reached $2.167 billion, a 17% year-on-year increase and a 46.6% quarter-on-quarter increase; and operating profit margin was 10.8%, higher than the 7.6% in the same period last year.

What surpassed expectations even more was that Tesla's gross profit for the third quarter reached $4.997 billion, a 19.6% year-on-year increase; and gross margin was 19.8%, a 1.95 percentage point increase year-on-year.

After experiencing a double decline in revenue and profit in the first quarter and an increase in revenue without a corresponding increase in profit in the second quarter, Tesla's third-quarter profit returned to the growth range, which is closely related to the improvement in its automotive business fundamentals.

In the first two quarters of this year, Tesla's deliveries declined year-on-year for two consecutive quarters, and profits also suffered continuous losses. In the third quarter, Tesla managed to stop the bleeding and rebounded, selling 462,000 vehicles globally, a 6.4% year-on-year increase and a 4.3% quarter-on-quarter increase; realizing revenue of $20.016 billion, a 2% year-on-year increase. In major markets such as the United States, China, and Europe, Tesla continued to lead in sales - in the Chinese market, the Model Y and Model 3 maintained their positions as the best-selling passenger cars and luxury sedans in September with sales of 48,000 and 24,000 units, respectively; in the U.S. market, the Tesla Model Y/3 and Cybertruck topped the list of best-selling electric vehicles; and in the European market, Tesla was the best-selling brand in September...

Not only does Tesla sell a lot, but the cost of manufacturing has also decreased, and you have to admit that the cost reduction brought about by economies of scale is undeniable. Along with the increase in deliveries, Tesla's sales cost per vehicle has reached an all-time low of approximately $35,100 (around RMB 250,000). Tesla's Chief Financial Officer explained that this is thanks to the reduction in raw material costs, freight costs, tariffs, and other one-time expenses, as well as the company's cost reduction and efficiency enhancement measures.

The Shanghai Gigafactory is Tesla's largest and most efficient factory globally, with an automation rate of 95%. On average, more than half a minute passes between each electric vehicle rolling off the assembly line. The Shanghai Gigafactory produced its 3 millionth vehicle in October and exported its 1 millionth vehicle in September, with the cost per vehicle reaching an all-time low. In the U.S., production volumes of the Model 3 have increased in California, Nevada, and Texas, leading to cost reductions; Cybertruck production has increased, achieving positive gross margin for the first time; and the cost per vehicle has also decreased at the Berlin-Brandenburg Gigafactory in Europe.

The decrease in costs ultimately allowed the automotive gross margin to exceed everyone's expectations. Despite the continued decline in automotive ASPs, the automotive gross margin (excluding the impact of carbon credits) increased by 2.4 percentage points quarter-on-quarter to 17.1%.

In contrast, among domestic new energy vehicle manufacturers, BYD and Geely have relatively good gross margin control. Geely's gross margin is 15.1%, while BYD's is even higher at 20.01% for the first half of 2024. Supported by such gross margins, these two automakers have the confidence to compete with Tesla.

Highly profitable carbon trading adds icing on the cake to net profits

Beyond its main automotive business, Tesla's energy and services business is becoming an increasingly profitable component, which is somewhat surprising.

In the energy storage business, as a new growth pole for Tesla, the installed capacity of Tesla's energy storage products reached 6.9 GWh in the third quarter, a 73% year-on-year increase; revenue was $2.376 billion, a 52% year-on-year increase; and gross margin was as high as 30.5%, a record high.

Services and other businesses (primarily carbon credit sales) also made significant progress this quarter and contributed significantly to Tesla's substantial profit increase. Tesla's services and other revenue for the quarter were $2.79 billion, a 29% year-on-year increase, contributing $739 million in net profit to Tesla in the third quarter.

First, let's talk about the concept of carbon credit sales. For automakers, if the total carbon emissions of vehicles produced throughout the year exceed a specific threshold, they must pay a high fine. For automakers that produce a large number of fuel vehicles, it is not easy to meet the standards. One of the short-term buffer solutions provided by the government is to allow these excess emission automakers to purchase "carbon rights" from low-emission automakers to offset their excessive carbon emissions.

Carbon emissions trading is relatively mature abroad, while domestic development lags somewhat. However, relevant domestic policies and standards have been continuously improved in recent years. On July 16, 2021, the national carbon emissions trading market officially launched, with eight pilot regions, including Beijing, Tianjin, Shanghai, Chongqing, Guangdong, Hubei, Shenzhen, and Fujian. Although the trading scale is not large, the maturity of the market system will significantly promote the development of the domestic low-carbon industry.

As the first entrant into the new energy vehicle sector, Tesla faced difficulties in mass production due to market acceptance and other factors, and its early profitability was relatively poor. Selling carbon rights was once Tesla's main source of profit. From 2009 to the present, Tesla has earned approximately $9 billion through carbon credit trading, helping the company stay afloat during its most difficult times. Nowadays, Tesla's electric vehicles generate billions of dollars in revenue, and carbon credit trading, which incurs almost no cost, can further enhance profits.

With increased sales, reduced costs, and revenue from energy and carbon credit sales, Tesla's third-quarter gross margin reached 19.8%, a 1.95% year-on-year increase, with multiple indicators exceeding previous market expectations.

Of course, the return to positive gross margin growth is also attributable to layoffs. Starting in April this year, Tesla announced global layoffs of 10%, but the final layoff rate was between 15%-20%, with more than a dozen executives leaving during this wave of layoffs, including Drew Baglino, Senior Vice President of Energy and Powertrain, Rohan Patel, Vice President, and Rebecca Tinucci, Senior Director of Supercharging. According to public information, as of the end of 2023, Tesla had a total of 140,500 employees globally. Based on this figure, more than 21,000 employees were laid off. This is also one of the important reasons for Tesla's profit returning to the growth range.

Among domestic new energy vehicle makers, who can turn losses into profits and emerge victorious?

As automakers, they all face an industry-wide development curve - significant investments in research and development, human resources, and supply chains are required during the initial stages of a startup, and losses in the first few years are inevitable. After new vehicles are well-received in the market, sales gradually increase, achieving economies of scale to reduce the cost per vehicle. Coupled with the expansion of energy and service businesses, revenue and profits also increase simultaneously.

Tesla's annual report data from 2017 to the present fully reflects this trend in net income, with a turning point from losses to profits occurring in 2020.

Among the domestic new energy vehicle makers, five have successfully gone public. Comparing their 2024 semi-annual reports, we can see that Lixiang is the only profitable automaker among the new forces.

Although most automakers incur significant losses, upon closer inspection, the main reason is the substantial investment in research and development. NIO and Lixiang both invested over RMB 6 billion in the first half of the year. Zeropin has the lowest R&D expenses but still saw a 48.4% year-on-year increase, indicating continued investment. In terms of gross margin, Lixiang Auto even surpassed Tesla in the same period, ranking first among the new forces; while Zeekr and Xpeng have gross margins higher than 10%, retaining a certain level of competitiveness.

The fierce competition in the domestic new energy vehicle industry forces the industry to face common challenges: high R&D investments, intensifying market competition, and supply chain fluctuations.

Faced with these challenges, to win market share, price reductions and internal competition have become unavoidable competitive tactics. In April this year, the launch of Xiaomi's SU7 had a "catfish effect," prompting brands such as Xpeng, AITO, Zeekr, Jiyue, and HAOPAI to either reduce prices or offer time-limited benefits. According to relevant data, approximately 136 models reduced their prices in the first five months of 2024, with the scale of price reductions exceeding 90% of the total for the entire year of 2023.

The new energy vehicle industry is becoming increasingly competitive, with some automakers attempting to squeeze out competitors through price wars. However, this vicious competition harms the automotive industry. Although price reductions can lead to increased sales, overall profits diminish, and many automakers either operate at a loss or even teeter on the brink of bankruptcy. To reduce costs, automakers may compromise on materials or safety performance, lowering the overall quality of vehicles and increasing user safety risks.

Vicious price wars are definitely not the desired state of a thriving industry. Meaningful and healthy competition lies in the pursuit of technological, scientific, and qualitative excellence.

From the perspective of the source and definition of internal competition, technological homogenization is a significant factor leading to price wars among domestic automakers. In the "herd effect" under industry development and transformation, leading companies seem rarely to emerge in Chinese manufacturing. Under passive followership, whether stagnating at a certain level of technological imitation or being restricted by internal competition for the title of "top student" in the industry, which stifles creativity, are both dilemmas faced by the manufacturing industry due to internal competition.

To break this dilemma, only genuine external breakthroughs, continuous innovation, and creation will suffice. In the process of exploring industrial upgrades, instead of merely following the herd, one must become the leader, transforming from homogeneous competition to differentiated competition.

In this regard, Tesla's disruptive innovations are worth learning from. In the electric vehicle sector, Tesla has consistently led industry development and recently introduced a series of groundbreaking new products at its launch event, including the self-driving taxi Cybercab, self-driving van Robovan, and humanoid robot Optimus. These products not only offer commercial value but also serve as indicators of future transportation and artificial intelligence trends.

Faced with the vicious cycle of internal competition among automakers, the domestic new energy vehicle industry should seek a balance in fierce competition. Rather than engaging in low-price wars or attracting attention with in-car refrigerators and TVs, it would be better to create cutting-edge and ultimate differentiated innovative products through continuous technological innovation and increased R&D investments, capturing consumers' attention, achieving profitability, and gaining market recognition.

Postscript...

In this rapidly changing era, the future of electric vehicles may resemble the mobile phone market, with three or four giants dominating most of the market share and continuously expanding overseas based on the domestic market.

Under such circumstances, short-term losses due to factors such as R&D investments are acceptable. However, to sustain competition, it is crucial to identify profit growth points and break through the encirclement of losses. Otherwise, one may be forced to exit the game. In 2023, cross-border automakers such as WM Motor, AITO, ENNOVATE, Baoneng, and Evergrande successively encountered financial troubles, serving as a stark reminder to the market.

Therefore, competition among new energy vehicle makers is no longer merely about technology and products but also about ecosystem building and brand shaping. Additionally, Tesla's contributions to gross profit growth through its derivative development in related industries such as energy storage and carbon trading will undoubtedly provide insights for new energy vehicle makers as they approach their net profit turning point.