Negotiate separately with the EU? Geely and SAIC refute rumors

![]() 11/01 2024

11/01 2024

![]() 566

566

The EU's policy of imposing tariffs on Chinese electric vehicles has aroused widespread concern among Chinese people. The final ruling imposed a final countervailing duty for a period of five years, with rates ranging from 17.8% to 45.3%. Meanwhile, online rumors emerged claiming that three brands from SAIC Motor and Geely Group were negotiating separately with the EU.

Such countervailing investigations make people feel helpless, as they more or less create obstacles to the export of Chinese electric vehicles. What is even more infuriating is that "during the negotiation process, the European side used 'dual tactics', attempting to bypass the Chinese government and negotiate separately with individual companies, while also employing other means to delay the negotiations."

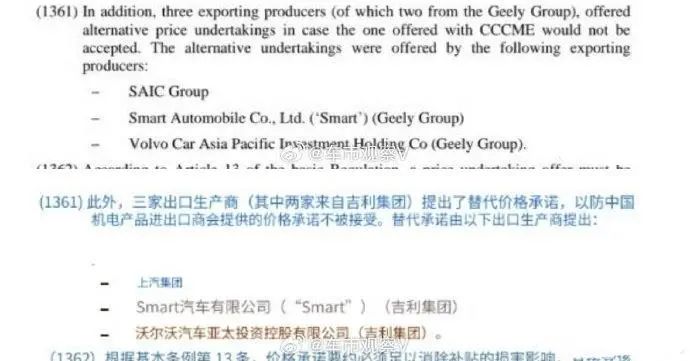

Compared to the final imposition of high tariffs, this news is even more infuriating. In fact, both insiders and outsiders are curious about which automakers are involved in these separate negotiations, and who dares to take such a bold step? Recently, a media outlet reported, citing the views from the EU's "Final Ruling Report on Countervailing Investigation", that SAIC Motor, smart, and Volvo participated in "separate negotiations".

A single stone casts a thousand ripples.

Previously, there were rumors that "XPeng Motors participated in separate negotiations". It was later proven to be "maliciously edited content from an interview with He Xiaopeng". GAC Group was also rumored to have had separate contacts with the EU, but both automakers officially refuted the rumors. Such news was also perceived as the EU's attempt to "woo" and "divide".

Compared to previous rumors, this time the information comes from the EU's official "Final Ruling Report on Countervailing Investigation", making it difficult to refute its credibility. Moreover, such behavior is considered a "betrayal", as the tariffs imposed on both Geely and SAIC are not insignificant. In response to such actions, SAIC Motor and Geely Group promptly issued statements.

SAIC Motor responded: "After an internal investigation and communication with relevant authoritative national departments, SAIC Motor confirms that the above report seriously deviates from the facts and is purely a rumor." SAIC Motor emphasized that in the EU countervailing investigation case, SAIC Motor has always been a major participant in the "price commitment plan" of the China Chamber of Commerce for Import and Export of Machinery and Electronic Products and has never had separate communication or negotiations with the European Commission on the SAIC plan.

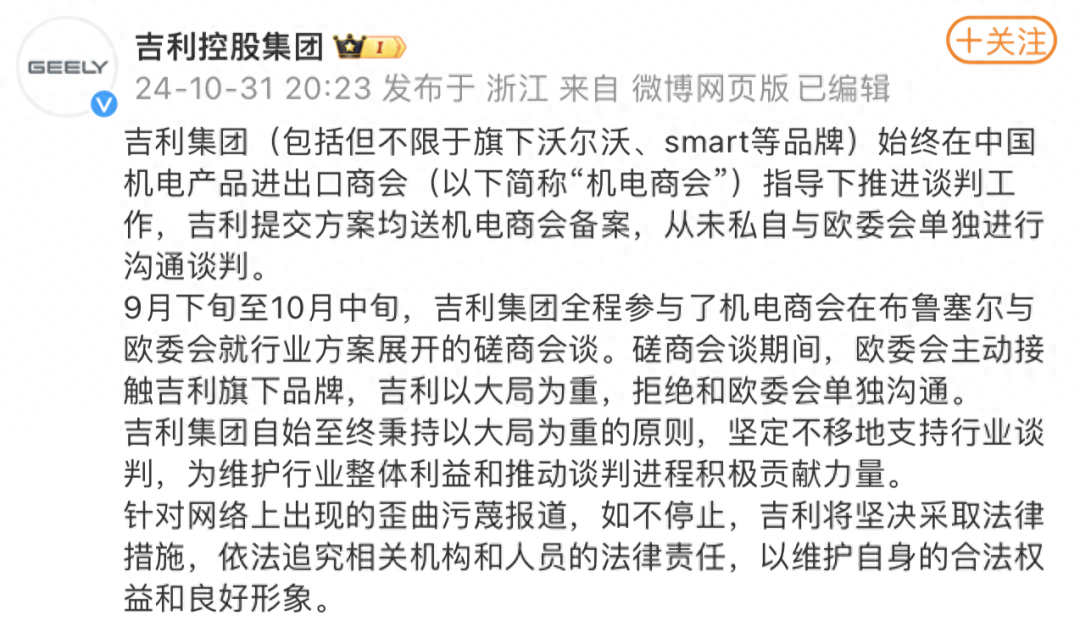

Subsequently, Geely Holding Group also issued a statement refuting the rumors. The statement indicated that Geely Group (including but not limited to its brands such as Volvo and smart) has always advanced negotiation efforts under the guidance of the China Chamber of Commerce for Import and Export of Machinery and Electronic Products. All proposals submitted by Geely were sent to the Chamber for record-keeping, and no private communication or negotiations were held with the European Commission.

At this point, many people probably have a clear understanding of the situation. This time, the EU unilaterally disclosed the "Final Ruling Report on Countervailing Investigation" and deliberately mentioned the names of three automakers. Both SAIC Motor and Geely Group have substantial automotive businesses in the EU. After the exposure of the EU's draft tariff in early July, the MG brand immediately issued a strong opposition statement.

As a state-owned enterprise, SAIC Motor's attitude is undoubtedly unproblematic, and Geely Group has also indicated that it will prioritize the bigger picture. This behavior of the EU cannot be ruled out as another attempt at "division". However, the EU has overlooked the firm stance of Chinese automakers, which will ultimately backfire.

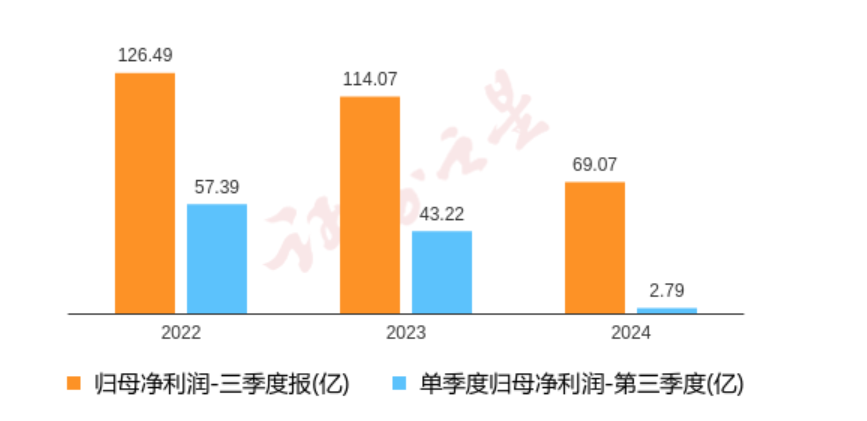

SAIC Motor's third-quarter report for 2024 shows that its primary operating revenue was 430.482 billion yuan, a year-on-year decrease of 17.74%; net profit attributable to shareholders was 6.907 billion yuan, a year-on-year decrease of 39.45%; and non-GAAP net profit was 1.05 billion yuan, a year-on-year decrease of 88.92%.

In the third quarter of 2024 alone, the company's primary operating revenue for the quarter was 145.796 billion yuan, a year-on-year decrease of 25.91%; net profit attributable to shareholders for the quarter was 280 million yuan, a year-on-year decrease of 93.53%; non-GAAP net profit for the quarter was 29.1661 million yuan, a year-on-year decrease of 99.23%; the debt ratio was 63.33%; investment income was 10.27 billion yuan; financial expenses were 1.783 billion yuan; and the gross profit margin was 8.91%.