The lowest-ever price for gasoline vehicles marks the prelude to large-scale production halts

![]() 11/04 2024

11/04 2024

![]() 588

588

After six months of negotiations, tears, and tantrums, Europeans have imposed tariffs of up to 45.3% on Chinese electric vehicles.

The decline in gasoline vehicle sales is not just in China but a sharp drop worldwide.

A year ago, when the Citroen C6 sparked a price war with its price of 160,000 yuan, OEM executives were still claiming at the launch event that gasoline vehicles were profitable while new energy vehicles were not. However, now, a year later, few people are concerned about whether gasoline vehicles are profitable. As sales continue to plummet, despite criticism, Zero Run CEO Zhu Jiangming directly predicted at the Paris Motor Show that pure gasoline vehicles would disappear within three years.

However, as more and more new energy vehicle companies transition from losses to profits, more gasoline vehicle companies are experiencing sharp drops in profits. A turning point in consumer perception has already arrived. Allowing Chinese electric vehicles to accelerate their entry into the EU market will only put all EU automakers in a dead-end situation.

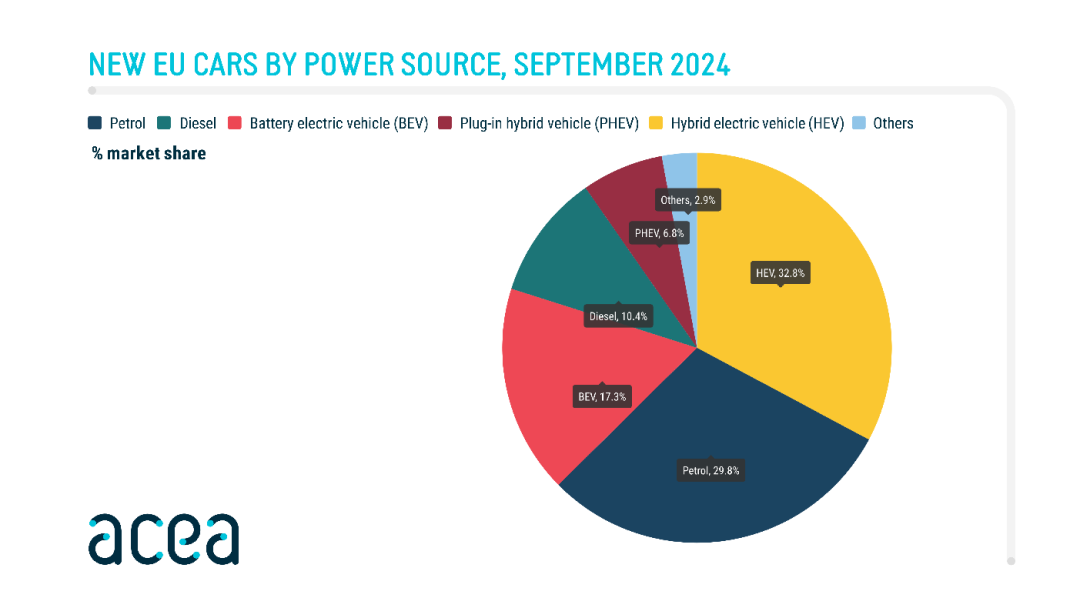

ACEA data shows that for the first time in September since the birth of the automobile, hybrid vehicle sales in Europe surpassed gasoline vehicle sales, with a market share of 32.8%, exceeding gasoline vehicles at 29.8% and new energy vehicles at 24.1%.

GEVT data shows that the United States, which previously showed no interest in new energy, sold 344,000 electric vehicles in the third quarter of this year, surpassing the historical record for the same period in 2023. Undergoing a transformation, it has now surpassed the EU in sales.

Many gasoline vehicles in China have already dropped to rock-bottom prices. First, Porsche Macan offered promotions dropping its price below 400,000 yuan. Then, there were Chang'an, Geely, Buick, and more. Unlike previous price wars that traded volume for price or price reductions to compete with new energy vehicles, more automakers have chosen the same strategy, no longer believing that gasoline vehicles have a chance to counterattack. Therefore, they have chosen to enter a clearance phase, either to free up capacity, adjust product mix, or for other reasons.

Is it a done deal to cut unsalable gasoline vehicles?

Starting in late September, Cadillac XT5's replacement model was launched with a limited-time fixed price of 265,900-335,900 yuan, a drop of over 130,000 yuan from the guide price, offering a one-stop solution.

Starting in late October, Chang'an introduced a fixed-price policy for six of its models, with promotions of at least 30,000 yuan.

When Geely launched the Xingrui and Xingyue L Dongfang Yao versions, it ostensibly talked about the evolution of Chinese car quality and Geely's integration of Chinese and global aesthetics. However, in reality, what most impressed consumers was the 2.0T+8AT combination priced below 130,000 yuan for the first time.

Buick first introduced an annual refresh for the LaCrosse, with a limited-time fixed price 50,000 yuan lower than the guide price, launching at 159,900-189,900 yuan. Additionally, if a used car is traded in, there can be a subsidy of up to 25,000 yuan, with a minimum bare car price of less than 135,000 yuan. Subsequently, the Buick GL8 Luzun was launched with a 48,000 yuan price drop from the guide price, directly entering the price range of the discounted Toyota Sienna at 269,900-339,900 yuan.

Previously, there were also Teana priced at 120,000 yuan and Qashqai at 99,800 yuan.

At the end of October, several mainstream automakers almost made the same moves in the Chinese auto market, launching new cars and significantly reducing prices or promotions. Of course, this phenomenon has not been uncommon since 2023, but combined with special time nodes and the latest corporate plans, it has more special representative significance.

If we look for superficial reasons, it is undoubtedly that the price war continues, not just to boost sales but to counteract adjustments in new energy price reductions. As for the effect, due to the move by SAIC Volkswagen when the Passat was refreshed, with a limited-time fixed price starting at 159,900 yuan, sales exceeded 23,000 units in both August and September.

However, besides this, the same corporate actions actually have other meanings. Actions at the end of 2024 are generally preparations for the push in 2025. Given that selling gasoline vehicles is increasingly becoming a drag on profits, mainstream Chinese brands have already released relevant follow-up plans. Besides price reductions, cutting unsalable gasoline vehicles has become a done deal.

Few people would have expected that during the two years of the price war, the trend of profitability has flipped between gasoline vehicle-focused automakers and new energy automakers.

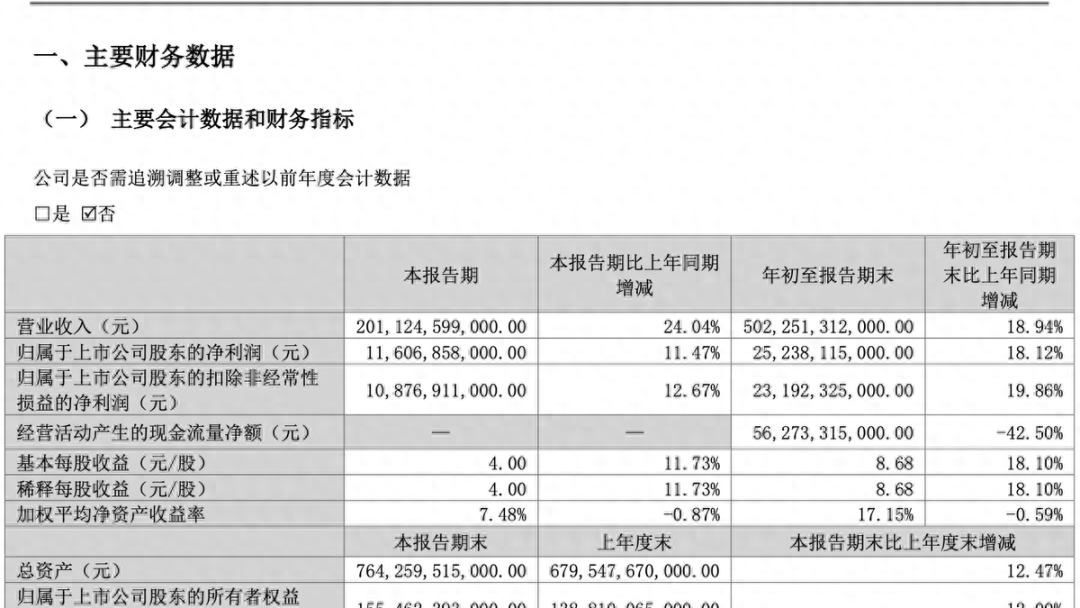

In the new energy sector, BYD's third-quarter financial report showed revenue of 201.1 billion yuan, surpassing Tesla. Li Auto reported third-quarter revenue of 42.9 billion yuan and a net profit of 2.8 billion yuan. Thalys reported third-quarter revenue of 41.582 billion yuan, a surge of 636.25%, with a net profit of 2.4 billion yuan.

In contrast, for companies primarily focused on gasoline vehicles, Chang'an Automobile reported third-quarter revenue of 34.237 billion yuan, a decline of 19.85%, with a net profit of 748 million yuan, a decrease of 66.44%. SAIC Motor reported third-quarter revenue of 142.56 billion yuan, a year-on-year decline of 25.58%, with a net profit of 280 million yuan, a decrease of 93.53%. Volkswagen, once China's number one automaker, reported global sales of 2.176 million units in the third quarter, a decrease of 7.1%, with revenue of 74.87 billion euros, a decrease of 0.5%. However, due to high costs, third-quarter profit was 2.855 billion euros, a decrease of 41.7%, nearly halved.

Leading new energy companies have seen growth in sales, revenue, and profits, while most leading gasoline vehicle companies have seen significant declines in sales and profits, with only a few companies reporting revenue growth. Therefore, although the automotive industry is making adjustments towards long-termism, the fact that gasoline vehicles need to lose money to sell is currently difficult to change.

Clearing out gasoline vehicles to immediately make way for plug-in hybrids

The automotive industry is not a charity. It is unrealistic to stabilize the basic sales plateau with extremely low profits or even losses, or to seek to boost sales growth. The development path for 2025 is clear. Unlike 2023-2024, when attempts were made to achieve a gradual transition through price reductions, most automakers want to make money, maintain market share, and increase brand awareness.

In other words, as many automaker CEOs and executives often say at press conferences, it's time to enter the finals of elimination. Of course, opinions vary on this matter. Some believe that the automotive industry has never been a winner-takes-all scenario, while others believe that only five automakers will remain in the end. The significance of this debate is minimal. On the clear development path for automakers, many gasoline vehicles will be unavailable for purchase due to production halts, while more new energy vehicles, especially plug-in hybrids, will enter the market.

Those that will be halted or potentially cut include:

In 2017, Chang'an Automobile announced its new energy strategy, the "Shangri-La Plan," stating that it would cease sales of traditional gasoline vehicles by 2025, later updated to 2030.

In 2017, Toyota announced that it would cease production of traditional gasoline vehicles by 2025 and instead focus on the development and production of electric, hybrid, plug-in hybrid, and fuel cell vehicles.

In 2018, BAIC Group announced that it would cease the production and sales of its own-brand traditional gasoline passenger vehicles in China by 2025.

In 2020, Nissan announced plans to offer only hybrid and pure electric models in China from 2025, ceasing sales of traditional gasoline models.

In 2020, Bentley announced that it would cease sales of traditional gasoline models by 2026.

In 2021, Jaguar Land Rover announced that the Jaguar brand would become a pure electric brand from 2025.

In 2022, Lynk & Co. officially announced at its Spring and Summer press conference that all its products would be equipped with smart hybrid technology by 2025, achieving full electrification of its product line.

The plans made seven years ago are now affected by the global black swan events, which inevitably impact the pace. It is questionable whether automakers can fulfill their commitments on time. For example, Volvo's previous plan for full electrification by 2030 was adjusted to have plug-in hybrids and pure electric models account for 50%-60% of sales by 2025 and 90%-100% by 2030, with mild hybrids accounting for 0-10%.

Whether Chinese brands will fulfill the flags they set in 2017 remains uncertain. However, joint venture brands are highly likely to halt production. Typical cases include rumors that the Nissan Teana will cease production in 2025 and become a pure electric model in 2026. The Honda Fit has also been rumored to cease production multiple times, although there have been many side denials. However, in August this year, Honda announced plans to further reduce its annual car production capacity in the Chinese market by 250,000 units.

Changes will include:

Brands like Geely, Chang'an, Chery, and Volkswagen will accelerate their transition from gasoline to plug-in hybrids. A notable player is Geely, which, in addition to announcing the EM-i hybrid at the launch of its new Leishen hybrid, also hinted at the inclusion of a dual-motor rear axle setup.

Moreover, following the launch of the Leishen hybrid, Lynk & Co.'s tender documents were also exposed. It is expected that the Lynk & Co. L946 will be launched in December, and a large SUV with a three-motor hybrid system, code-named Lynk & Co. L946, will be launched next year, from March to June, to compete with the Range Rover. The electric hybrid SUV previously announced by Zeekr is poised to compete with the Rolls-Royce Cullinan. Volkswagen's newly developed plug-in hybrid, based on SAIC technology, will be available in the Passat by December 2025 at the latest. Other joint venture brands, such as GAC Toyota's plug-in hybrid SUV, will be launched at the Guangzhou Auto Show, and Honda's plug-in hybrid models will gradually be introduced on vehicles like the BREEZE.

The performance of domestic vehicles can be inferred. Mainstream extended-range vehicles priced above 200,000 yuan have a CLTC pure electric range of over 200 kilometers and can accelerate from 0 to 100 km/h in 6-7 seconds. Mainstream plug-in hybrids have gradually increased their pure electric range to around 150 kilometers and can accelerate from 0 to 100 km/h in less than 8 seconds. It is not worth playing if they do not meet these standards. As for new joint venture brand vehicles, the biggest issue is not just configuration. Honda Accord and BREEZE have a CLTC pure electric range of only 90 kilometers or more, which is inferior to domestic vehicles when looking at the numbers alone. Nor is it just the price. For example, BYD and Zero Run have reduced the prices of mid-sized and large SUVs to below 180,000 yuan, while joint venture A-segment plug-in hybrid SUVs are still priced above 220,000 yuan.

The biggest issue is that some models are available in both gasoline and plug-in hybrid versions, with the same size and even the same name. Geely, BYD, and Great Wall Motors have all suffered losses in the past due to this issue. BYD's solution is to ban the sale of gasoline vehicles, Geely's solution is to establish a separate Galaxy series and sales channels, and Great Wall Motors' solution is to discontinue models like Chitu and Chulian and reorganize the system.

Final Thoughts

The simple truth is that it is difficult for gasoline vehicles to achieve good sales performance in the current market without offering a competitive price. From Geely to Changan, to Cadillac, Buick, and SAIC Volkswagen, limited-time fixed-price policies are all attempts to address this issue. If the expected sales cannot be achieved, then profitability remains distant.

For mainstream brands like SAIC Volkswagen, their flagship products are currently not a problem, with the Passat family selling 21,700 units in August and 23,500 units in September. However, many other companies are facing pressure. For example, the Cadillac XT5 was launched with a price reduction of 134,000 yuan from the pre-sale price, and the October delivery figure was 3,992 units.

In addition to these, there is good news for gasoline vehicle enthusiasts. Some mainstream automakers are still in a clear transition phase, and they must update their gasoline vehicle offerings according to their original plans, rather than canceling them in 2025. For example, the next-generation Audi A4L will be renamed as the Audi A5 or Audi A5L in China by two Audi manufacturers, while the next-generation Audi A6 will continue to be known as the Audi A6L at FAW-Volkswagen Audi, and SAIC Audi will adopt the name A7. The Audi Q5L and BMW X3 will also undergo generational changes.

However, only gasoline vehicles with strong competitiveness, popularity, and sales volume will continue to undergo generational changes, engage in price wars, and make modifications. For others, automakers' executives have already placed them on the list of potential layoffs. This logic is similar to that of layoffs.