Will the next 'NVIDIA' emerge from the wave of autonomous driving IPOs?

![]() 11/04 2024

11/04 2024

![]() 489

489

Companies at the forefront of technological innovation are always favored by capital. Since the 20th century, from IT to the internet, technology giants such as IBM, Intel, Microsoft, Apple, and others have taken turns shining.

In recent years, artificial intelligence has become the birthplace of new legendary stories in the capital market. In October this year, NVIDIA's market capitalization surpassed $3.5 trillion for the first time, making it the second-largest technology giant after Apple, revealing the trend of AI reshaping the market landscape.

It seems both fate and the inevitable development of the industry have conspired. This October, the autonomous driving industry, a fusion of AI and the automotive industry, has also ushered in a new stage of capitalization.

Within just one month, multiple autonomous driving unicorn companies have submitted IPO filings or successfully gone public. On October 18, Pony.ai officially submitted an IPO prospectus to the U.S. Securities and Exchange Commission (SEC), planning to list on Nasdaq under the ticker symbol "PONY". On October 24, Horizon Robotics officially listed on the Hong Kong Stock Exchange, becoming the largest technology IPO in Hong Kong this year. On the last Friday of October, WeRide successfully listed on Nasdaq, with its share price triggering two circuit breakers on the first day.

Undoubtedly, this is the result of a two-way rush between emerging technology fields and the capital market.

On the one hand, with the explosion of popularity of Robotaxi (driverless taxis) this year, autonomous driving has become one of the most eye-catching and rapidly implemented fields, demonstrating huge potential and value. New investors have flocked with hot money to buy "tickets" for the new era.

On the other hand, autonomous driving companies also need capital support to accelerate the commercialization of Robotaxi. In this regard, Pony.ai's co-founder and CEO Peng Jun mentioned in an interview with the media, "Research and development companies actually need capital support. Fundraising is a win-win situation with the capital market. With financial support, companies can perform better and create more excellent products. With better products, they can gain more investor support. This is a positive cycle."

So, against the backdrop of accelerating capital and technology, can autonomous driving startups experience their "NVIDIA moment"?

The tide of technological advancements and capitalization runs parallel, heralding the future of high-level autonomous driving.

Behind the wave of IPOs by autonomous driving companies lies the recognition of the industry's value, with an outbreak period gradually approaching.

Autonomous driving is a high-investment, long-cycle industry that requires policy support, technological progress, and financial input for development. Only when various factors accumulate and converge will the industry inflection point arrive, where intelligent driving triggers a transformation in global transportation modes.

From a policy perspective, the concentrated implementation of autonomous driving policies in recent years has promoted a new stage of high-level autonomous driving applications. This year, China has successively launched pilot projects for high-level autonomous driving access and road trials, as well as "vehicle-road-cloud integration" application pilots. Nine consortia have been approved to conduct access and road trial pilots, and 20 cities (consortia) have been selected for the "vehicle-road-cloud integration" application pilot list.

Image source: Southwest Securities

Meanwhile, in the technology sector, "end-to-end" and "world models" have become breakthroughs for high-level autonomous driving.

World models make high-level autonomous driving more cost-effective and mass-production-friendly, facilitating the technological leap from ADAS (Advanced Driver Assistance Systems) to autonomous driving. In this regard, Pony.ai's co-founder and CTO Lou Tiancheng mentioned that for autonomous driving, the world model is an exceptionally important concept, perhaps the most important. He stated, "The mass production of L4 is related to cost, operations, policies, etc. If there is a world model, it may further reduce costs, making it even better.""Therefore, both new energy vehicle companies and autonomous driving technology companies are exploring end-to-end and data-driven algorithmic technology paths. For example, Tesla adopts an "end-to-end" approach and released Robotaxi and Robovan in October; NIO introduces the "world model" to provide more comprehensive training data, significantly enhancing the iteration speed of its system; and as a global top-tier L4 autonomous driving technology company, Pony.ai has integrated the three traditional modules of perception, prediction, and planning into a unified One Model end-to-end autonomous driving model, which is currently deployed in both L4 Robotaxi and L2 mass-produced intelligent driving systems.

With technological advancements and policy support, the certainty of high-level autonomous driving becoming a reality is growing stronger, and the attention of the capital market is once again on the rise. In this regard, Hua Fu Securities analyst Lu Yufeng stated that high-level autonomous driving technology has entered a new stage in terms of regulations, technology, and capital operations.

Standing at this industry inflection point, autonomous driving companies are rushing to the secondary market, and capital is also beginning to seek the next potential industry leader with a market value of hundreds of billions or even trillions, hoping to reap another "NVIDIA"-level investment opportunity amidst the AI wave. Reviewing the capital stories of NVIDIA and other technology giants, it is not difficult to find that they share similar investment logics: the explosion in the market capitalization of these companies often precedes the realization of performance expectations, that is, during the commercialization acceleration phase.

Therefore, the commercialization process of autonomous driving companies will determine when the optimal investment moment arrives. The company that can take the lead in achieving a closed commercial loop is likely to become the next "dark horse" in the capital market.

From a commercialization perspective, exploring the investment logic of autonomous driving unicorns

This year, autonomous driving unicorns have rushed to the secondary market, and the investment value of these companies has attracted the attention of a large number of investors.

Judging from the autonomous driving industry chain companies that went public in October, Horizon Robotics is currently valued at approximately HK$55 billion (approximately RMB 50.4 billion based on the latest exchange rate); WeRide was valued at $4.491 billion on its first day of listing (approximately RMB 32 billion).

From conventional valuation indicators (such as the price-to-sales ratio), these companies generally have high valuation levels, indicating that the capital market's pricing logic for autonomous driving tends to favor growth potential. In other words, the current high valuation of autonomous driving companies is underpinned by expectations of accelerated commercialization and judgments about future growth potential.

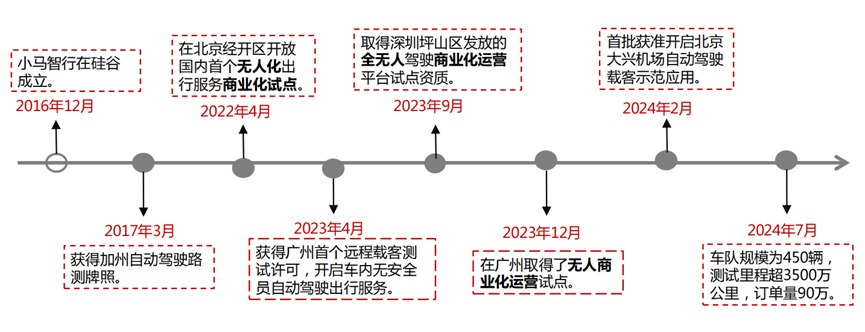

Taking Pony.ai as an example: in terms of commercialization capabilities, Pony.ai is continuously achieving commercial transformation based on its technical accumulation and engineering capabilities.

Pony.ai has always aimed for the more challenging but economically significant "leapfrogging route," focusing on L4 autonomous driving and accumulating extensive road testing and AI large model training in this field. As of now, the company has accumulated nearly 40 million kilometers of global autonomous driving road tests, including nearly 4 million kilometers of driverless miles. The company has reached the L4 technology threshold of 10,000 hours.

At the same time, Pony.ai has built a global cooperation ecosystem to accelerate the mass production of autonomous driving. Its partners include automakers such as Toyota, GAC, SAIC, and FAW, as well as mobility platforms and taxi operators like Qichu, Alipay, Gaode Maps, Jinjiang Automobile, and ComfortDelGro in Singapore, along with core component suppliers like NVIDIA and RoboSense. This ecosystem is expected to facilitate the large-scale mass production and service deployment of autonomous driving. For example, Pony.ai has joined forces with Toyota China and GAC Toyota to establish Zui Feng Intelligent Technology. Leveraging the combined advantages of all parties, it is estimated that by 2025-2026, the company will roll out pure electric Robotaxi models pre-installed with sensors.

Based on technological precipitation and engineering capabilities, Pony.ai has stood out in commercialization, becoming the L4 autonomous driving technology company with the highest revenue scale in China. The prospectus shows that in the first half of 2024, the company's revenue was $24.72 million, a year-on-year increase of 101.2%; the net loss was $51.78 million, a year-on-year narrowing of 25.6%.

While commercialization is accelerating, Pony.ai's growth potential is also highly favored: the company focuses on scenario-based implementation, taking the lead in creating a "bucket" that can hold more water.

Pony.ai has always focused on the two main areas of Robotaxi and Robotruck. Among them, the most notable is undoubtedly Robotaxi, which is the most challenging but has huge application potential.

As one of the first companies in China to obtain licenses for driverless Robotaxi operation services and all regulatory approvals in Beijing, Shanghai, Guangzhou, and Shenzhen, Pony.ai provides public Robotaxi services in these first-tier cities. As of June 30, 2024, the number of registered users of the "Pony.ai" app exceeded 220,000, with an average of over 15 daily orders per fully autonomous Robotaxi within six months.

Image source: Southwest Securities

By targeting the Robotaxi sector, Pony.ai's commercialization capabilities and strategic vision are evident: Firstly, Robotaxi is not a "futures contract" but can quickly generate considerable revenue with vehicle deployment. In this regard, Peng Jun once analyzed that from a final perspective, L4 technology will initially enable large-scale customized applications in Robotaxi. Because as long as it can operate in a few cities, Robotaxi already has commercial value. Pony.ai meets the necessary and sufficient conditions for commercialization such as regulatory approval, safety verification, technological reserves, and mass production. It has already started fully autonomous commercial charging for Robotaxi in Beijing, Guangzhou, and Shenzhen. In the first half of this year, revenue from autonomous driving travel services increased by 86.0% year-on-year.

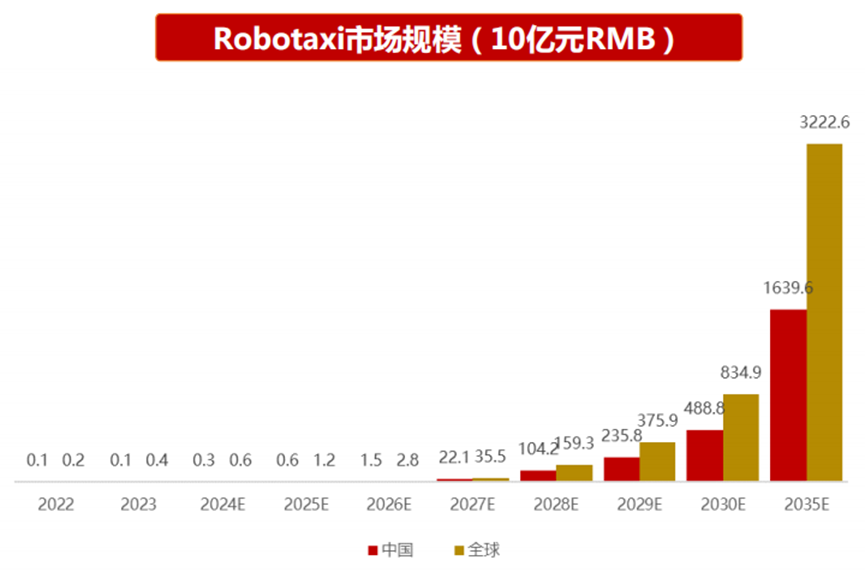

On the other hand, autonomous driving in different scenarios corresponds to different value spaces, and the ceiling for Robotaxi is sufficiently high. Taking urban travel as the business scenario, Robotaxi represents a trillion-yuan market. According to Frost & Sullivan's forecast, it is expected that by 2030, the market size of Robotaxi in China and globally will reach 488.8 billion yuan and 834.9 billion yuan, respectively, with CAGRs of 248% and 239% from 2024 to 2030, respectively.

Image source: Southwest Securities

Undoubtedly, under the growth dividends of the Robotaxi market, a global-level technology giant is expected to emerge. During the large-scale commercialization of autonomous driving companies, several key issues will determine who will be the frontrunner.

The mandatory questions on the Robotaxi commercialization timeline

There are still many questions to be answered for the true implementation of high-level autonomous driving. For example, how to ensure safety under long-term operation and where the profitability inflection point of the business lies.

Among them, safety is the "meatiest" issue in the transportation sector.

The value of Robotaxi lies in providing users with a safe travel experience, and autonomous driving companies must consider making users feel safe to build trust. To achieve this goal, the key is to speak with data, as Lou Tiancheng said, safety has the issue of feeling secure, and L4 requires at least 10,000 hours without accidents.

Currently, the safety of Pony.ai's "virtual driver" has reached more than 10 times that of human drivers. To achieve this step, Pony.ai looks at whether there are fewer brakes, whether turns are smooth, and sets up a complete set of quantifiable indicators for all these technical products, then uses this ruler to "measure" all data.

It is worth mentioning that real roads are constantly changing, and autonomous driving must be more like an "experienced driver." To this end, building a "world model" as an excellent coach to allow autonomous driving to find a better driving strategy than "human driving" is Pony.ai's solution.

On the basis of safety verification, when Robotaxi achieves profitability is also a key issue for fully realizing commercialization.

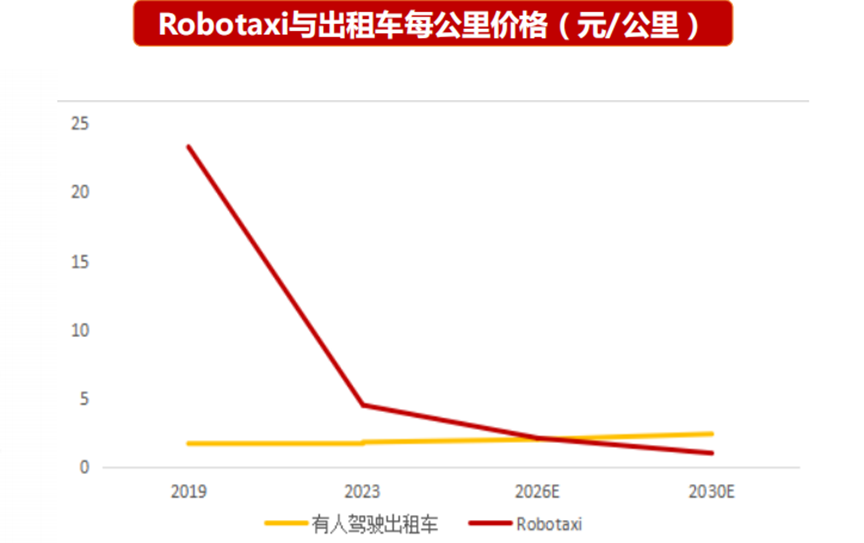

According to a research report by Southwest Securities, currently, the operating cost of Robotaxi (4.5 yuan/km) is higher than that of taxis and ride-hailing services with drivers (1.8 yuan/km). However, with continuous technological advancements, improved operational efficiency, and expanding scale, the cost of Robotaxi is expected to continue to decline.

In this regard, Zhang Ning, vice president of Pony.ai and head of the Robotaxi autonomous driving travel business, once stated, "In cities like Beijing, Shanghai, Guangzhou, and Shenzhen, when the deployment of Robotaxi reaches 1,000 units, operations will reach the break-even point. Beyond this point, the cost will be lower and the gross margin higher for each additional vehicle, entering a stage of positive and continuous self-sustainability.""According to Frost & Sullivan's forecast, by 2026, the unit price of Robotaxi will be on par with that of taxis, and after 2026, it will be lower. However, the profitability inflection point for the Robotaxi business will come earlier. Pony.ai stated that it will achieve profitability for single-vehicle operations in 2025; Luobo Kuaipao has also proposed that next year will be a period of full profitability.

Image source: Southwest Securities

The timeline for reaching the profitability inflection point undoubtedly has a self-evident impact on the development of autonomous driving companies at a new stage of commercialization. When Robotaxi can generate profits, autonomous driving companies will form a positive cycle of "technological iteration - commercial realization.""This means that autonomous driving will continue to evolve, revolutionizing urban and even outdoor travel experiences. By grasping the most valuable application areas, autonomous driving companies will also extend from the C-end to the B-end, continuously improving their business ecosystem and further opening up long-term growth space.""Looking ahead, with the successful commercialization, the autonomous driving sector will inevitably give rise to the next "Microsoft," "Apple," or "NVIDIA."

Source: US Stock Research Institute