The Tragic Song of Foreign Luxury Cars: The Death Knell for Arrogant Capital

![]() 11/04 2024

11/04 2024

![]() 601

601

TEAM

Typesetting: Yuni Machu

Image: From the Internet, delete upon infringement

Produced by Qiancheng Digital Intelligence (Effect Marketing Intelligence Agency)

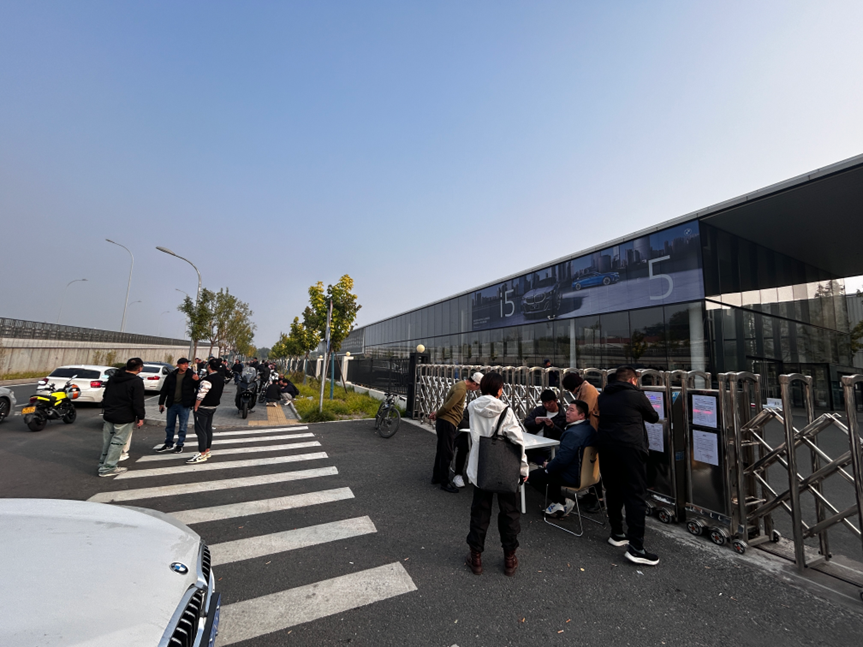

After being empty for two to three months, BMW's first global 5S store, Beijing Xingdebao Automobile Sales and Service Co., Ltd., has been crowded with people in front of its door these two days.

This time, they are not coming to spend money, but to demand it.

'I recharged 20,000 yuan to my prepaid card here. I just had a maintenance last month, and there's still over 10,000 yuan left on the card. But these two days, I heard that Beijing Xingdebao went bankrupt, so I came to check it out immediately,' a BMW X3 owner told CarTalks.cn.

Another BMW X1 owner originally had 10 coupons in the app, but they were all used within a day without her knowledge.

In addition to car owners, a large number of employees of the company have also gathered in front of the store. It is understood that most employees of the company have been owed salaries for two to three months. In fact, since June and July, the company has only been paying employees 30% of their salaries. Some employees have already jumped ship to work at other 4S stores.

Suning Bangke, a company contracted by Beijing Xingdebao to install charging piles for car buyers, has two employees who told CarTalks.cn that Beijing Xingdebao owes their company 568,800 yuan. Before the store closed, they came multiple times to demand payment, but Beijing Xingdebao refused each time, citing the reason that BMW Group had not yet made the payment.

This all started last week. Recently, the closure of Beijing Xingdebao Automobile Sales and Service Co., Ltd., BMW's first global 5S store, sparked heated discussions online. On October 25, CarTalks.cn conducted an on-site visit and found only security and cleaning staff inside the tightly closed doors, with an eye-catching i5 poster on the large storefront wall.

Unlike the previous two days, starting from the afternoon of the 24th, a table was set up in front of the store with a staff member registering information for car owners who came to protect their rights. It is understood that this person is a former administrative assistant at Beijing Xingdebao and has already resigned.

According to the former administrative assistant, the turning point for Beijing Xingdebao's development was after it exited the 'price war.' In mid-July, BMW Group announced its exit from the 'price war' and further implemented a policy of 'reducing volume to maintain prices.' In July and August, there were very few consumers visiting the store to look at cars. One car owner said that when they came for maintenance in July, there was only one salesperson in the store, and they had to be called out from the back.

Fundamentally speaking, Beijing Xingdebao is just a victim of BMW Group's 'price war.' It is not Beijing Xingdebao or BMW that is lost in the fog, but the entire foreign luxury car industry.

Through the fog, a fact is emerging: As Chinese consumers disenchant with foreign luxury cars, they have fallen just as far as they once held their heads high.

5S store closes, 4S stores panic

The closure of Beijing Xingdebao and the rights protection efforts of nearly 300 car owners once sent BMW trending on social media. Although it was caused by the bankruptcy of the company's parent company, G.A. Group, is BMW Group really innocent behind this?

Tracing the history of Beijing Xingdebao, as BMW's first global 5S store, it opened in June 2012 with a total investment exceeding 320 million yuan and is affiliated with Singapore's G.A. Group. The latter once owned 9 BMW 4S stores, 2 BMW quick repair shops, 1 city showroom, and 5 MINI showrooms, making it one of BMW's earliest five agents in China.

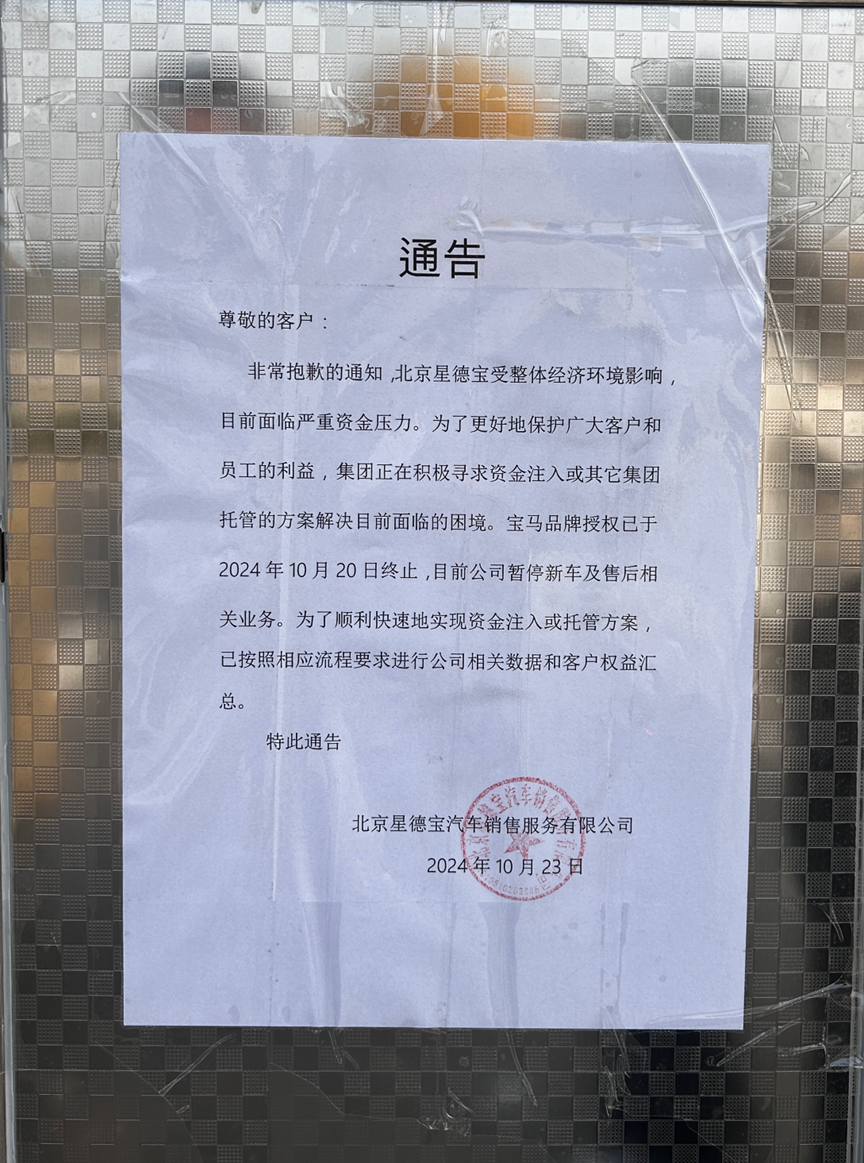

In September 2024, BMW issued a termination notice to G.A. Group, which took effect eight days later. The reason given was that G.A. Group's poor management of dealerships had led to a break in the capital chain, making it impossible to redeem qualification certificates for customers and causing a series of issues such as overdue payments to BMW and its affiliates.

Shortly thereafter, on October 20, BMW terminated its authorization to G.A. Group, followed by the closure of Beijing Xingdebao and a series of subsequent events.

The closure of Beijing Xingdebao is ostensibly due to a break in G.A. Group's capital chain, but delving deeper, BMW Group is the culprit.

Entering 2024, BMW Group's pricing strategy in the Chinese market has been unstable, and the OEM's pricing strategy directly affects dealer profits.

In the first half of the year, BMW Group joined the price war amidst frequent 'internal competition' among Chinese brands, and news of the BMW i3 being available for just over 100,000 yuan sparked heated discussions online. The OEM officially announced price reductions, and dealers also competed internally on prices to boost sales.

'Beijing Xingdebao sells cars for over 10,000 yuan cheaper than us, and they also give away a lot of maintenance coupons. Many of our customers have gone there to buy cars,' a salesperson from a BMW 4S store not far from Beijing Xingdebao told CarTalks.cn. 'They frequently accept low-price orders to boost sales, but in the end, they can't deliver the cars on time, repeatedly delaying delivery.'

Frequent price reductions directly squeezed dealers' profit margins, ultimately resulting in them even losing money. And when BMW announced its withdrawal from the price war in July, a series of issues began to surface. On the one hand, consumers who purchased vehicles at low prices were unable to receive their cars; on the other hand, consumers holding onto their money were even more reluctant to buy vehicles during high-price periods.

It is understood that in the first half of 2024, G.A. Holdings recorded revenue of approximately HK$843 million, a year-on-year decline of 17.22%, with losses continuing to widen.

The closure of BMW's first global 5S store has caused some to sigh, some to wonder, and some to worry. BMW's 4S stores have also begun to panic.

'Now our store is also very worried. In the past, when selling cars, we would recommend prepaid maintenance cards and coupons, but now we don't actively recommend them to customers unless they ask, for fear of such problems arising,' the aforementioned 4S store salesperson told CarTalks.cn.

Price War: Fight or Not?

When all automakers were engaged in a 'price war,' on July 12, BMW made a high-profile announcement of its withdrawal from the 'price war,' solemnly stating that the Chinese market would focus on business quality in the second half of the year and support dealers in taking a steady approach.

To this end, BMW Group also issued concrete policies, announcing a 30% reduction in wholesale tasks for dealers and taking other measures such as relaxing rebate thresholds to reduce the burden on dealers with real money.

However, within less than three months, BMW quietly reduced prices again. The BMW i7 saw a steep price drop of 550,000 yuan, with the bare car price dropping to as low as 660,000 yuan, and some dealers quoted prices as low as 900,000 yuan for delivery. Some 4S stores also stated that the BMW i3 low-end bare car could be obtained for 183,000 yuan.

'The old BMW i3 is currently discounted by 50%, and the new i3 by 60%,' a salesperson from a BMW 4S store in Beijing told CarTalks.cn, adding that there is no expiration date for this discount for now.

Why couldn't BMW, which once proudly announced a price increase, hold out for even three months? The reason is that after the price increase, dealers not only failed to turn a profit but also saw the group's performance and share price start to decline.

Data shows that after the price increase in August, BMW's sales in China were 34,800 units, a year-on-year decline of 42% from 60,100 units in the same period last year and a month-on-month decline of 28.8%.

More importantly, BMW has already begun to sense that it is no longer making money. On September 10, BMW Group adjusted its 2024 financial year performance guidance, expecting profit margins to fall from 8-10% to 6-7%, failing to meet even market expectations of 8.37%; the return on capital employed (RoCE) also fell from 15-20% to 11-13%.

Upon the announcement, multiple banks began urgently downgrading BMW Group's ratings. Royal Bank of Canada downgraded its target price for BMW from 98 euros to 81 euros, Deutsche Bank from 119 euros to 90 euros, and Citigroup from 80 euros to 74 euros.

Even so, BMW is still unwilling to lower its proud head and admit that its brand influence in the Chinese automotive market is no longer what it once was, attributing its performance downgrade to the high warranty costs incurred by the recall and repair of 1.5 million BMW vehicles.

This may be one reason, but the most important reason is that Chinese consumers have begun to disenchant with foreign luxury cars, and the days when BMW Group could easily make money by resting on its laurels are gone for good.

'The configuration is terrible. The X5, which costs 850,000 yuan, doesn't have independent rear air conditioning, the rearview mirror needs to be folded manually, and there's no keyless entry. If I had to choose again, I would go for an AITO M9, and with the remaining money, I could buy a Tesla Model 3,' complained one netizen.

Other netizens directly pointed out BMW Group's pricing strategy mistakes. 'I wanted to buy one in the first half of the year, but the price kept dropping. When I went to the 4S store, they played games with me, making me guess the price. Customers wanted to wait and see as prices kept falling, but then they suddenly announced a price increase to force sales. After the price increase, they couldn't even deliver the cars, and sales didn't go up, so they dropped the price again. If this continues, the sales system will be directly killed by the new energy direct sales system,' they said.

In short, BMW's arrogance can no longer be maintained. In a price war, fighting will lead to death, but not fighting will lead to an even quicker death.

Traditional luxury cars are being abandoned

BMW is just one case, but it is not an isolated one. In this new era, Chinese new energy brands such as Li Auto, AITO, and NIO are gradually meeting the exciting needs of Chinese consumers for cost-effective and engaging products. Traditional luxury cars are being abandoned, and they no longer have the energy to put on airs.

A set of data proves everything. In 2023, sales of mainstream luxury cars in China reached 4.5279 million units, a year-on-year increase of 14.9%, of which sales of new energy vehicles reached 1.4504 million units, a year-on-year increase of 64.2%.

The increase in sales of new energy luxury cars came from automakers such as Tesla, Li Auto, NIO, Zeekr, and AITO. In 2023, the cumulative sales of these five automakers exceeded 1.35 million units.

Taking AITO as an example, its cumulative sales from January to September this year were 316,700 units, a year-on-year increase of 364.23%. Among them, the AITO M9 has accumulated over 160,000 orders in the 10 months since its launch and has ranked first in sales of luxury models priced above 500,000 yuan for six consecutive months.

Due to the growth in sales of high-value products, Thalys' revenue for the first three quarters was 106.627 billion yuan, a year-on-year increase of 539.24%, with a net profit of 4.038 billion yuan. Thalys, which was once considered a 'contract manufacturer' for Huawei, now has a market capitalization exceeding that of SAIC Motor, which relies on German Volkswagen.

Looking at NIO, its second-generation technology platform now has up to 8 models on sale, covering the price range of 300,000 to 600,000 yuan, which has already covered 80% of the main sales market where BBA (BMW, Benz, and Audi) have their sales.

The scenery here is uniquely beautiful, while traditional luxury cars, which once required a price increase to purchase, have taken up the 'price axe' and turned it against themselves. The discount rate for the Mercedes-Benz A-Class is higher than 35%, the Audi A6 offers terminal discounts exceeding 130,000 yuan, and a Porsche can be purchased for 400,000 yuan... The reason is simple: they know that it is better to take decisive action than to wait until it is too late.

Without exception, foreign luxury car companies are all facing significant financial pressure. Financial reports show that in the third quarter of this year, Mercedes-Benz Group recorded sales of 34.53 billion euros, the lowest in the past three years, with a net profit of 1.72 billion euros, a year-on-year decrease of 54% and a quarter-on-quarter decrease of over 40%.

Even Porsche, which was considered a model for making money last year, has fallen into a 'quagmire.' Data shows that in the first three quarters of this year, Porsche delivered a total of 226,000 vehicles globally, a year-on-year decrease of 7%; sales in China fell by 29% year-on-year, with only 43,300 vehicles delivered. China, which has been Porsche's largest global market for many years, has become its largest single market with the largest decline globally. Other ultra-luxury brands such as Maserati, Rolls-Royce, Bentley, and Ferrari are also struggling.

It is clear that it is not that Chinese consumers are no longer buying luxury cars, but that they are no longer buying BBA (BMW, Benz, and Audi).

Suddenly, the protagonists in China's luxury car market have changed. Once upon a time, foreign luxury car companies held their heads high, but now their prices have fallen just as sharply.