Ideal: Mixed feelings, can the new pure electric model continue to support Ideal?

![]() 11/05 2024

11/05 2024

![]() 653

653

Ideal Automobile released its Q3 2024 financial report after Hong Kong stock market trading and before US stock market trading on October 31, Beijing time. Judging from the results, Ideal has survived the Mega electric vehicle's setback period, and the strong sales of the L6 model in this quarter drove overall solid performance:

1. Automotive gross margin exceeded expectations: The Q3 automotive gross margin was 20.9%, exceeding market expectations of 20.2% and Ideal's previous guidance for the Q3 automotive business gross margin of 19%+. The key to exceeding expectations was that the decline in average vehicle price was less than market expectations.

2. The decline in average vehicle price was lower than expected, driving automotive business revenue and gross margin above expectations: This quarter, due to the increasing proportion of low-priced L6 models, the market's expectations for the average vehicle price had already declined to RMB 266,000. However, Dolphin Insights speculates that due to Ideal's breakthroughs in intelligent driving, the proportion of higher-priced Max and Ultra versions increased, offsetting the impact of the increased proportion of L6 models, ultimately driving both automotive business revenue and gross margin above expectations.

3. Operating expenses remained under control, and operating profit significantly exceeded expectations: In terms of profit quality, the main difference in operating profit expectations this quarter was due to automotive gross profit exceeding expectations by approximately RMB 600 million, while R&D expenses were RMB 700 million lower than market expectations, resulting in an expected difference of approximately RMB 1.3 billion. Finally, operating profit was RMB 3.4 billion, significantly exceeding market expectations of RMB 2.2 billion.

4. However, the issue lies in revenue guidance: Since Q3 has passed, the market is also concerned about Q4 performance expectations in the absence of new products. Q4 sales expectations are modest, but the implied average price in revenue expectations continues to decline, falling to less than RMB 260,000.

Dolphin Insights' overall viewpoint:

Overall, Ideal performed well in Q3, successfully navigating the Mega setback period thanks to the strong sales of the L6 model.

However, recent stock prices have risen due to: ① The strong sales of the L6 model driving continuous record-high deliveries; ② The widening sales gap with AITO, which the market perceives as reduced competitive pressure from AITO. Currently, the stock price corresponds to a P/S multiple of approximately 1.5 times for the automotive business in 2024. Therefore, the market has higher expectations for Ideal's financial report. It not only requires Q3 financial report performance to exceed expectations but also places importance on Q4 earnings expectations.

However, based on current Q4 expectations, sales expectations are modest during the peak season, but are still acceptable due to the lack of new product stimuli. The main issue lies in the expected average price, which has declined to less than RMB 260,000 in Q4.

This expected average price implies two aspects: ① The proportion of L6 models will continue to increase, but the Q3 proportion of L6 models is already close to 50%, leaving little room for further significant increases; ② The possibility of continuing the price war is rising. Combined with modest sales expectations, this reflects significant order pressure on Ideal and potential further intensification of market competition.

The launch date for AITO M8 is currently uncertain. If it is launched before the end of the year (possibly delivered next year), it will intensify wait-and-see sentiments and have a negative impact on the sales and pricing of direct competitors like Ideal's L7/L8 models.

As the new pure electric model is expected to be launched in the first half of the year, Q4 is expected to see continued increases in R&D preparations and capital investments in supercharging stations. Coupled with continued pressure on average vehicle selling prices, Q4 profitability will be weakened.

Given such valuations and pressured Q4 earnings expectations, the product launch schedule and expectations for the new pure electric model next year are particularly important. Dolphin Insights will focus on Ideal's earnings call disclosures.

Below is a detailed analysis:

Since Ideal's sales figures have already been released, the most important marginal information lies in: 1) Q3 gross margin; 2) Q4 2024 performance outlook.

I. Automotive business gross margin of 20.9%, higher than market expectations of 20.2%

As Ideal previously provided Q3 automotive business gross margin guidance, due to the L6 model driving a sequential increase in deliveries, the automotive business gross margin also rebounded to over 19%. The market's expectations for Q3 automotive business gross margin were more optimistic, reaching 20.2%.

From this quarter's actual performance, Ideal's Q3 automotive business gross margin was 20.9%, exceeding market expectations and Ideal's previous guidance. The reason for exceeding expectations was mainly due to the average vehicle price exceeding market expectations.

(Note: Q3 2022 automotive sales gross margin data excludes the impact of a RMB 800 million contract loss, and Q4 2023 data excludes a RMB 400 million quality assurance deposit.)

Analyzing from the perspective of average vehicle economics:

1. The decline in average vehicle price was not as large as market expectations

The average vehicle price in Q3 was RMB 270,000, a decrease of RMB 9,000 from the previous quarter but exceeding market expectations of RMB 266,000. The decline in average vehicle price was not as large as market expectations.

Market expectations for a decline in average vehicle price were due to the model mix, where the proportion of lower-priced L6 models continued to increase, rising by 13 percentage points to 49% quarter-on-quarter, while the proportion of higher-priced, higher-margin L9 models declined by 4 percentage points.

However, Dolphin Insights speculates that due to improvements in Ideal's intelligent driving capabilities, the selection ratio of higher-priced Max and Ultra versions may also be increasing, offsetting the adverse impact of the increased proportion of L6 models to some extent, resulting in an average vehicle price exceeding expectations.

2. Sales rebound and declining battery costs led to a RMB 13,000 quarter-on-quarter decline in average vehicle cost

Ideal's Q3 average vehicle cost was RMB 214,000, a decrease of RMB 13,000 from the previous quarter, mainly due to:

① Sales rebounded by 41% quarter-on-quarter due to strong L6 sales, releasing economies of scale and reducing average vehicle cost per unit;

② The proportion of relatively low-cost L6 models increased this quarter;

③ Upstream lithium carbonate costs continued to decline, driving a further decrease in battery costs this quarter.

3. Finally, the gross profit per vehicle in Q3 was RMB 57,000

In terms of profitability per vehicle, Ideal earned a gross profit of RMB 57,000 per vehicle sold in Q3, an increase of RMB 4,000 from Q2. The overall automotive business gross margin increased by 2.2 percentage points quarter-on-quarter from 18.7% in Q2 to 20.9% in Q3.

II. However, Q4 sales guidance is modest, and revenue expectations imply a continued significant decline in average price

a) Q4 automotive sales target: 160,000-170,000 units, guidance is basically within expectations

In Q3, driven by continued strong sales of the Ideal L6, deliveries reached 153,000 units, a 41% increase from the previous quarter.

Ideal's Q4 delivery guidance is 160,000-170,000 units, basically within market expectations (164,000 units). The sales guidance is an increase of 7,000-17,000 units quarter-on-quarter from actual Q3 deliveries.

Based on current weekly sales, October sales were approximately 51,000 units, implying an average monthly sales volume of 55,000-60,000 units in November and December. Completion during the sales peak season will not be difficult, but compared to Q4 2023, when sales increased by 27,000 units quarter-on-quarter during the sales peak season, this sales guidance is relatively modest.

b) However, the implied average price in the guidance continues to decline quarter-on-quarter, with a significant decline

In addition to sales guidance, Q4 revenue guidance is RMB 43.2-45.9 billion. Estimating other business income contributions at RMB 1.8 billion in Q4, the implied automotive business average price is less than RMB 260,000 (RMB 259,000), a further decline of approximately RMB 10,000 quarter-on-quarter.

This continued decline in the average price implies two aspects:

① The proportion of L6 models in Q3 has already reached close to half, and the proportion of L6 models in the model mix may continue to increase in Q4;

② Due to the lack of new models in Q4, there may still be a possibility of continuing the price war to boost sales.

Dolphin Insights has observed that in September, Ideal began to intensify promotional efforts, increasing the L6 optional fund from RMB 5,000 in August to RMB 8,000 in September. At the same time, subsidies of RMB 5,000 were newly provided for L7 and L8 models, and subsidies of RMB 7,000 were provided for L9 and Mega models.

In the next two months, driven by the lack of new models and increased competition (the launch date for AITO M8 is currently uncertain. If launched before the end of the year, it will also have a negative impact on the sales and pricing discounts of direct competitor L8 models), Ideal may continue the price war.

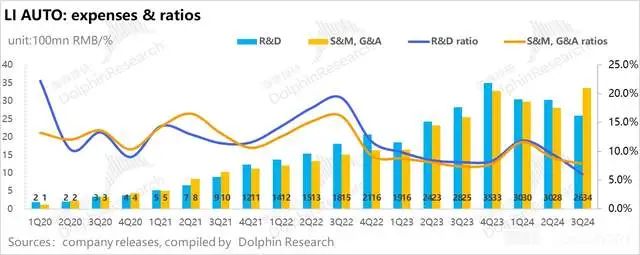

IV. Operating expenses demonstrated relative restraint under cost reduction measures

1) R&D expenses: Significantly lower than market expectations

Ideal's Q3 R&D expenses were RMB 2.59 billion, a decrease of RMB 440 million from the previous quarter and significantly lower than market expectations of RMB 3.29 billion.

The main reasons for the quarter-on-quarter decrease in R&D expenses this quarter may be:

① Ideal laid off employees in Q2, reducing the number of R&D personnel and resulting in lower personnel compensation. In intelligent driving algorithms, Ideal will also shift its focus from rule-based algorithms to end-to-end large model solutions adopted by Tesla. End-to-end algorithms require fewer personnel compared to rule-based algorithms. Therefore, the current number of Ideal's intelligent driving team has been reduced from 2,000 to less than 1,000.

② There were no new product launches in Q3, leading to a decline in R&D expenses for new products and technical design.

2) Selling and administrative expenses: SBC expenses increased, slightly exceeding expectations

Ideal's Q3 selling and administrative expenses were RMB 3.36 billion, an increase of RMB 540 million from the previous quarter and slightly exceeding market expectations of RMB 3.03 billion. The reason for exceeding expectations was that approximately RMB 700 million in SBC expenses were recognized this quarter due to the potential achievement of performance targets. Excluding SBC expenses, selling and administrative expenses for this quarter were RMB 2.63 billion, basically flat quarter-on-quarter from the previous quarter.

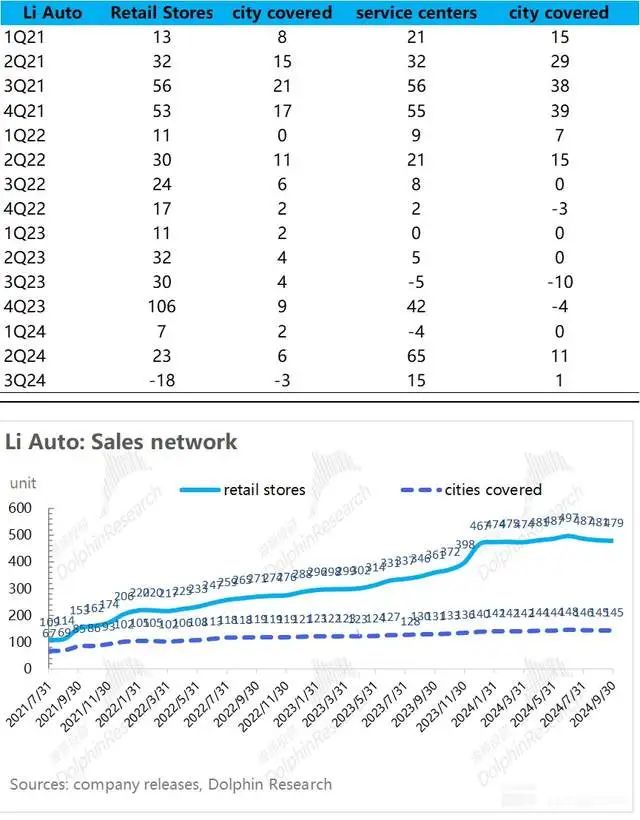

In terms of channel development, Ideal was also restrained. In Q3, Ideal optimized its channels, reducing the number of stores by 18 and focusing on increasing single-store sales revenue and after-sales service (the number of after-sales service centers increased by 15 in Q3).

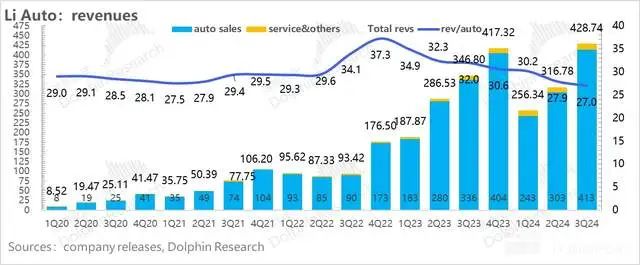

V. Both revenue and gross margin exceeded market expectations

With sales figures already announced, Ideal's total Q3 revenue was RMB 42.9 billion, a 35% increase from the previous quarter and slightly higher than market expectations of RMB 41.1 billion.

Revenue exceeded market expectations primarily due to the average vehicle price in the automotive business being slightly higher than market expectations. In terms of other businesses (insurance, used cars, etc.), this quarter's performance saw an increase in sales of services and accessories due to the cumulative increase in vehicle sales, with a quarter-on-quarter increase of RMB 19,000, slightly higher than market expectations of RMB 153,000.

The overall gross margin for this quarter also exceeded market expectations, primarily driven by the automotive business gross margin exceeding expectations. However, the gross margin for other businesses was 36.9% this quarter, lower than market expectations of 42%. It was basically in line with expectations. Although the automotive business gross margin slightly exceeded expectations, the gross margin for other businesses declined by 6.7 percentage points quarter-on-quarter to 36.3% this quarter, lower than market expectations of 44.9%. Finally, the Q3 gross margin was 19.5%, basically in line with market expectations of 19.6%.

VI. With the rebound in gross margin and restrained investment in operating expenses, operating profit increased significantly quarter-on-quarter

In terms of operating profit, which has a relatively high gold content, Ideal's Q3 operating profit increased significantly, with an absolute value increase of approximately RMB 3 billion to RMB 3.43 billion this quarter, significantly exceeding market expectations of RMB 2.19 billion. The operating profit margin also increased from 1.5% in the previous quarter to 8% this quarter.

Core reasons for exceeding expectations were the sequential rebound in automotive business gross margin and relatively restrained investment in operating expenses, especially R&D expenses, coupled with the release of operating leverage, leading to operating profit exceeding market expectations.

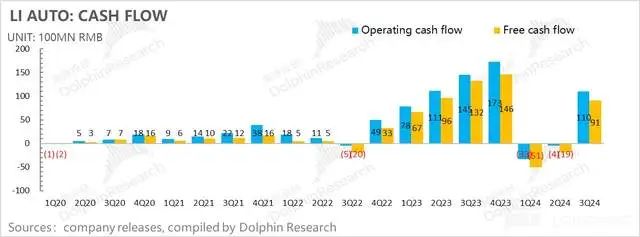

VII. Operating cash flow increased significantly quarter-on-quarter

Q3 operating cash flow was RMB 11 billion, a rebound of approximately RMB 11.5 billion from the negative RMB 400 million in the previous quarter, resulting in a continued increase in Ideal's cash on hand. Q3 cash and cash equivalents reached RMB 106.5 billion, an increase of RMB 9.2 billion from the previous quarter.

The reasons for the quarter-on-quarter increase were due to both the improvement in net profit (Non-GAAP net profit after adding back SBC adjustments increased by RMB 2.4 billion quarter-on-quarter) and the increased occupation of upstream cash flow due to increased sales (an increase of RMB 5.2 billion quarter-on-quarter).

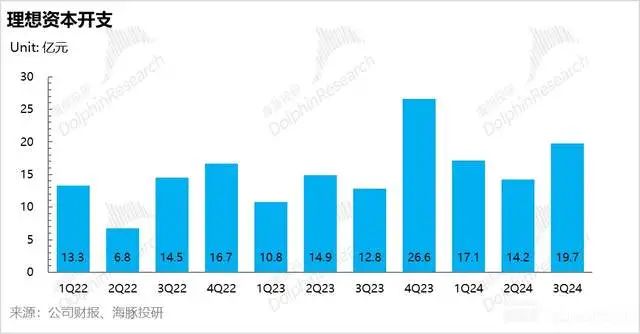

In terms of capital expenditure, the capital expenditure for this quarter was 1.97 billion yuan, an increase of 550 million yuan compared to the previous quarter. Since there were basically no new stores added this quarter, the expenditure was mainly used for the construction of supercharging piles. In the third quarter, the number of supercharging stations increased by 280 to reach 894, and the progress is steady, but it is still lower than the planned 2,000 stations at the beginning of the year. Currently, the number of supercharging stations is still lower than that of pure electric vehicle peers. However, as new pure electric models will be launched in the first half of next year, the fourth quarter may enter a strategic preparation period for pure electric vehicles, and capital investment in supercharging piles may increase accordingly.

For Dolphin's historical articles on Lixiang, please refer to:

August 28, 2024 Financial Report Commentary "Friction from Huawei, Can Lixiang Still Have a Good Day?"

May 20, 2024 Financial Report Commentary "Lixiang: Profit Collapse! The Moment of Testing Faith Has Arrived"

February 26, 2024 Financial Report Commentary "Lixiang: Not a 'Big Mouth', Just a Workaholic"

November 9, 2023 Financial Report Commentary "New Noble vs. Old Pro, Can Lixiang Compete with Huawei?"

August 8, 2023 Financial Report Commentary "Analyzing Lixiang: Is the 'Explosion' Behind It Really So 'Ideal'?"

May 10, 2023 Financial Report Commentary "Lixiang: Capable and Competitive, Setting the Standard for New Forces"

February 27, 2023 Financial Report Commentary "Lixiang Fierce as a Tiger? Competition Steady as a Dog"

December 9, 2022 Financial Report Commentary "Lixiang Profit Collapse? Not Fatal, but Very 'Awkward'"

August 16, 2022 Financial Report Commentary "Lixiang Throws a Thunderous Bomb, L9 Cannot Support the 'Collapsing Ideal'"

May 10, 2022 Financial Report Commentary "Lixiang's Ideal, All Hopes on the Second Half of the Year?"

February 25, 2022 Financial Report Commentary "Maximizing 'Cash' Ability, Li Xiang's Ideal Becomes Reality"

November 29, 2021 Financial Report Commentary "In Terms of Making Money, Xpeng and NIO Are Not as Good as It, Is Lixiang a Speculator or a Long-term Investor?"

August 30, 2021 Financial Report Commentary "Lixiang Auto: Stable Performance, Strong Momentum?"

June 30, 2021 Comparative Study of the Three Idiots - Part 2 "New Forces in Auto Manufacturing (Part 2): Doubling in Fifty Days, Can the Three Idiots Continue to Rush Ahead?"

June 23, 2021 Comparative Study of the Three Idiots - Middle Part "New Forces in Auto Manufacturing (Middle Part): Market Enthusiasm Waning, What Do the Three Idiots Rely on to Consolidate Their Position?"

June 9, 2021 Comparative Study of the Three Idiots - First Part "New Forces in Auto Manufacturing (First Part): Investing in the Right People, Doing the Right Things, Taking Stock of People and Events in New Forces"