BYD's Quarterly Revenue Surpasses Tesla for the First Time, Momentum Expected to Continue

![]() 11/05 2024

11/05 2024

![]() 440

440

Preface:

With the continuous increase in the penetration rate of new energy vehicles, this rapid growth momentum may be difficult to sustain, and competition in the new energy vehicle industry has inevitably entered an intense phase.

At the same time, the Chinese automotive market has bid farewell to the period of rapid growth and entered an era of stock competition, where a monthly delivery volume of 20,000 units is no longer sufficient to rank among the top tier.

Author | Fang Wensan

Image Source | Network

BYD's Quarterly Revenue Surpasses Tesla for the First Time

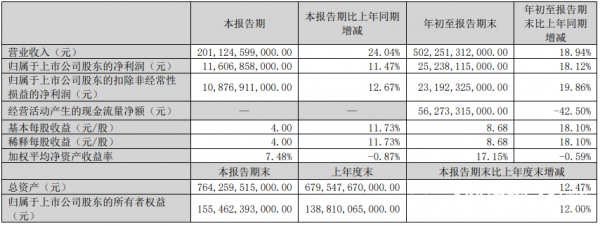

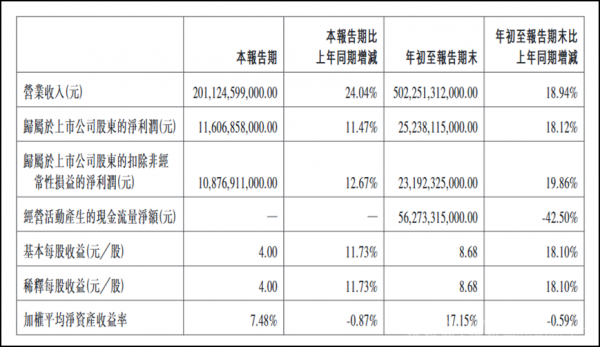

Recently, BYD released its third-quarter financial report.

The report revealed that the company's operating revenue for the quarter reached RMB 201.1 billion, a 24% increase from the same period last year, surpassing Tesla's revenue of RMB 179.4 billion for the same period for the first time.

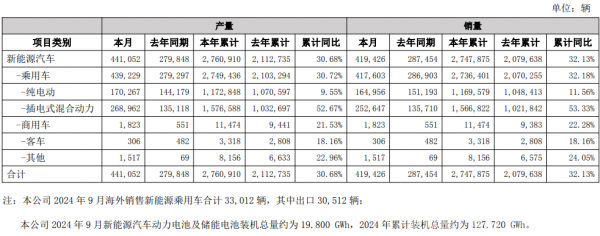

According to official production and sales data, BYD sold a cumulative total of 2.7479 million new energy vehicles from January to September this year, representing a year-on-year increase of 32.13%.

As of the close of trading on October 30, 2022, BYD's A-share price closed at RMB 305.55, with a cumulative increase of 56.22% since the beginning of the year, and the company's market value reached RMB 850.6 billion.

In the third quarter, BYD sold 1.12 million electric and plug-in hybrid vehicles, with September's monthly sales setting a new record high of 419,400 units.

In terms of sales data, BYD sold a cumulative total of 2.7479 million new energy vehicles in the first nine months of this year, a year-on-year increase of 32.13%.

In the third quarter, BYD's cumulative sales reached 1.1349 million units, a year-on-year increase of 37.7%.

Among them, sales in September reached 419,400 units, a year-on-year increase of 45.6%, setting a new record for monthly deliveries.

BYD has set a sales target of 3.6 million units for the entire year of 2024, and has already sold 2.748 million units in the first three quarters, achieving 76% of the target.

Based on the current development trend, achieving this sales target seems to be a foregone conclusion.

BYD's Net Profit Has Not Yet Surpassed Tesla

Tesla achieved a non-GAAP net profit of USD 2.5 billion in the third quarter of this year, equivalent to approximately RMB 17.8 billion.

In comparison, BYD's net profit attributable to shareholders of the parent company for the third quarter was RMB 11.607 billion, representing an 11.47% year-on-year increase.

This disparity is mainly attributed to Tesla's low-cost manufacturing advantages achieved through continuous technological innovation and efficient localized production facilities.

In the third quarter of 2024, Tesla achieved year-on-year growth in both global production and deliveries, with deliveries setting a new quarterly record.

Tesla is not content with merely developing in the electric vehicle sector but is continuously expanding its business scope.

In addition to enhancing vehicle production capacity, the company is further consolidating its competitiveness in the electric vehicle market by strengthening autonomous driving technology and energy storage business.

Moreover, Tesla's energy business is also showing strong growth momentum, with cumulative installed capacity in the first three quarters of this year continuing to grow rapidly.

Based on data from the first three quarters, BYD's revenue reached RMB 502.251 billion, a year-on-year increase of 18.94%, and its net profit was RMB 25.238 billion, a year-on-year increase of 18.12%.

In contrast, Tesla's revenue for the same period was RMB 504.4 billion, with a non-GAAP net profit of RMB 41.366 billion.

If BYD can maintain a higher revenue growth rate than Tesla in the fourth quarter, there is a possibility that it will surpass Tesla in annual revenue.

However, in terms of net profit, BYD still faces significant challenges in surpassing Tesla.

BYD's rapid growth in sales performance and operating revenue reflects the rapid popularization of new energy vehicles in the Chinese market.

Consolidating the Core Business and Expanding Overseas Markets Are the Main Drivers of Growth

By continuously launching new models, BYD has established a dominant position in the Chinese automotive market within the price range of RMB 100,000 to 200,000.

Since the beginning of 2024, BYD has been active. The company first launched a series of Honor Edition models, kicking off the first salvo in the 2024 price war.

Subsequently, the company unveiled its fifth-generation DM technology and E-Platform 3.0 technology, and models equipped with these new technologies have been successively unveiled and launched on the market.

The dual-path product strategy combining pure electric and hybrid vehicles continues to consolidate BYD's leading market position.

Guosheng Securities mentioned in its research report that the company is promoting intelligent driving technology through a combination of independent research and development and cooperation.

Among them, the FANGCHENGBAO BAO 8 is equipped with Huawei's Kunpeng Intelligent Driving System (ADS) 3.0, and the SEAL is equipped with a LiDAR for the first time. It is expected that under the background of reducing costs through large-scale production, the popularization of intelligent driving technology will be accelerated.

In addition to the new energy product line, the comprehensive implementation of the high-end product matrix composed of DENZA, FANGCHENGBAO, and NIO, is expected to drive BYD's high-end transformation and bring significant growth and profits.

In overseas markets, from January to September 2024, BYD exported 298,000 new energy passenger vehicles, representing a year-on-year increase of over 100%.

In September, BYD sold a total of 33,012 new energy passenger vehicles in overseas markets, including 30,512 exported units, with sales exceeding 30,000 units for three consecutive months.

According to a research report by Shengan Securities, as of June 2024, BYD's new energy passenger vehicles have entered 77 countries and regions, including Brazil, Germany, Japan, and Thailand.

In January 2024, BYD's Uzbekistan plant started production, and in July, its Thailand plant was officially completed and put into operation.

Additionally, BYD's plant construction in Brazil and Hungary is progressing steadily.

BYD's Sales and Revenue Momentum Expected to Continue

A report released by Citibank believes that due to strong market demand, BYD's profits are expected to rise in the fourth quarter, and it may still maintain strong sales momentum during the sales off-season in the first quarter of next year, coupled with potential stimulus policies that may continue into next year.

The report further points out that based on mainland retail order data, BYD received approximately 570,000 orders in October.

If exports can be increased to between 35,000 and 40,000 units, the actual monthly demand (including exports and domestic sales) will exceed 600,000 units.

Additionally, if BYD's net profit for the third quarter reaches RMB 11.5 billion to 11.8 billion, and with 1.56 million deliveries in the fourth quarter, the potential net profit is expected to range between RMB 15 billion and 16 billion;

This would bring the annual net profit to potentially reach RMB 41 billion to 42 billion, exceeding the bank's forecast by 15%.

CLSA also released a research report maintaining its net profit forecast for BYD over the next two years, namely RMB 39.6 billion this year and RMB 55.5 billion next year.

Dongwu Securities predicts that BYD will maintain a growth rate of over 20% in 2025.

With the traditional sales peak season approaching, BYD's sales are expected to continue to grow throughout the year, potentially exceeding 4 million units in 2024, a year-on-year increase of 32%.

Structurally, exports are expected to grow by over 65% year-on-year in 2024, while sales in 2025 are projected to exceed 800,000 units, potentially doubling.

Market Penetration Rate of New Energy Vehicles Exceeds 50%

According to data from the Passenger Car Market Information Joint Meeting of the China Automobile Dealers Association, the total retail sales of narrow-sense passenger vehicles nationwide reached 2.109 million units in September 2024, a year-on-year increase of 4.5%.

Despite the overall upward trend in sales, there is a significant difference between the sales of fuel vehicles and new energy vehicles.

Specifically, the retail sales of fuel vehicles in September were 986,000 units, a year-on-year decrease of 22.7%, while the retail sales of new energy passenger vehicles reached 1.123 million units, a year-on-year increase of 50.9%.

The Passenger Car Association predicts that retail sales of new energy vehicles in China are expected to reach 1.15 million units in October 2024, with a market penetration rate of 52.3%. This will mark the fourth consecutive month that the market penetration rate of new energy vehicles has exceeded 50%.

A research report by Guohai Securities points out that in most cases, the average price of electric vehicles is still higher than similar products for fuel vehicles.

Therefore, the parity in acquisition costs between electric vehicles and fuel vehicles will be a crucial turning point for further significant growth in the market share of electric vehicles.

Conclusion:

The new energy vehicle industry has inevitably entered a fiercely competitive deep-water zone. Currently, the Chinese automotive market has ended its period of rapid growth and entered an era of stock competition.

Looking ahead, major automakers are expected to accelerate the launch of new models, and competition within the new energy vehicle industry is expected to intensify.

Some References: Dutenews: "BYD's Third-Quarter Revenue Exceeds RMB 200 Billion, Surpassing Tesla for the First Time in a Single Quarter", Nandu Weekly: "'King of Di', a Historic First", Caijingtianxia WEEKLY: "RMB 201.1 Billion! BYD's Quarterly Revenue Surpasses Tesla for the First Time", Xingui NewGeek: "Revenue Surpasses Tesla, BYD's Fourth Victory", Keji Xinzhi: "BYD's Quarterly Revenue Makes a Comeback, But Tesla's Market Value Remains Elusive", Jike Park: "BYD's Revenue Surpasses Tesla for the First Time, but Its Market Value is Only One-Sixth of the Latter's"