Thalys, neglecting its main business?

![]() 11/05 2024

11/05 2024

![]() 646

646

R&D needs this money more than financial management

text

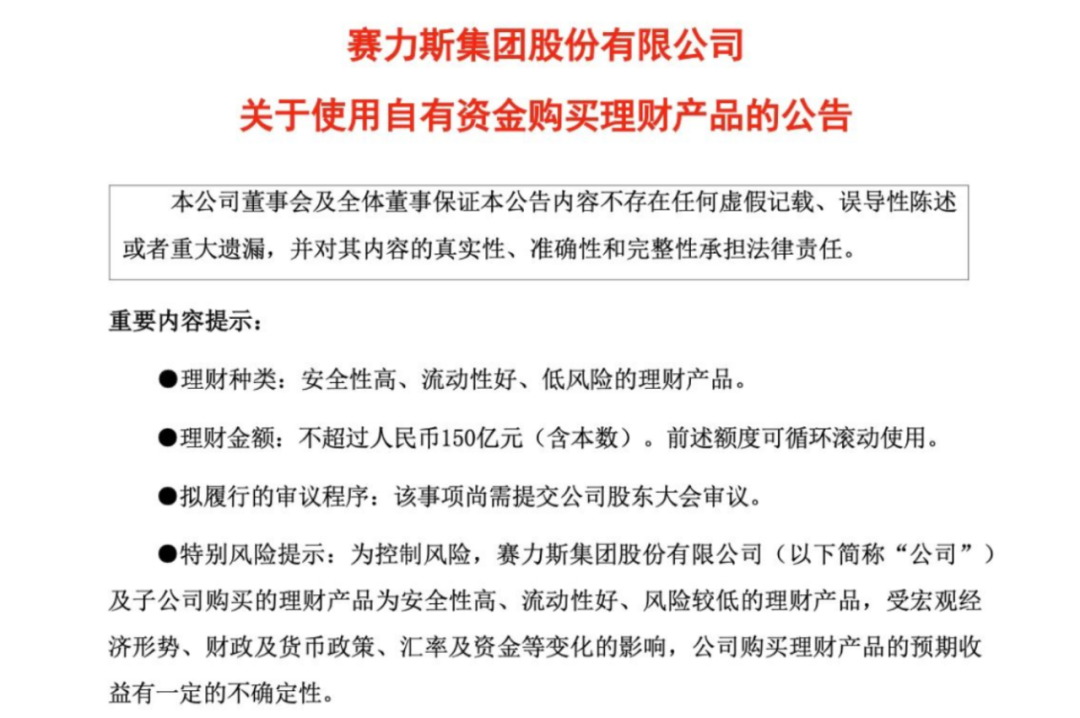

Recently, Thalys announced that it would use 15 billion yuan for financial management.

Public opinion erupted at once.

Many people find it strange that Thalys, with so much money, chooses to invest in financial products rather than R&D. Is it because Thalys believes that the returns from R&D investments are inferior to those from financial investments?

Well, such questions are understandable. After all, Thalys has been losing money for four consecutive years, amounting to tens of billions of yuan. It's only natural for people to be concerned about how the money is being spent after Thalys has finally started making profits.

However, Thalys may have noticed investors' concerns and later responded to the media, stating that the 10 billion yuan used for financial management was originally allocated for short-term accounts payable. This money could only be deposited in the bank, but now by investing in financial products, Thalys can earn extra profits.

This sounds more reasonable now.

However, it must be said that Thalys has been quite lavish with its spending this year.

Many investors are now feeling anxious.

So, what is the current state of Thalys?

AITO is selling well, and Thalys' warehouses are full of surplus.

The prerequisite for financial management is that the company has money on its books.

Thalys has to thank its major shareholder, AITO, for its success.

Huawei and Thalys began their cooperation in 2018, and officially launched the AITO M5 in 2023. Since then, AITO has released the M7, embarking on a rapid growth trajectory.

However, due to early-stage investments, Thalys remained in a financial loss until last year.

What truly brought significant profits to Thalys was the delivery of the AITO M9, which began this year.

The M9 is priced starting at 460,000 yuan, and currently, over 160,000 orders have been placed, generating at least 70 billion yuan in revenue. Even more astonishingly, according to third-party data, the gross margin of the M9 exceeds 30%.

What does this mean in terms of Thalys' finances?

In the first half of the year, Thalys' revenue exceeded 65 billion yuan, a year-on-year increase of approximately five times, with a profit of 1.625 billion yuan, which is quite impressive.

With this financial strength, Thalys has the confidence to invest 15 billion yuan in financial management.

In fact, this is not Thalys' first foray into financial management.

Last August, Thalys invested 2 billion yuan of idle funds in financial management. As of June this year, the financial management income was approximately 1.5 million yuan.

This return is quite low.

The funds for this round of financial management by Thalys mainly come from monetary funds on its balance sheet. In other words, this money is not Thalys' profit but temporarily occupied upstream and downstream funds, essentially "other people's money."

According to Choice data, Thalys' scale of financial management is far ahead in the entire A-share listed company sector.

However, it must be noted that while Thalys is generous with its investments, financial management is still a financial product with investment risks. Many listed companies have suffered losses from financial management.

For example, in May this year, Zhengzhou Coal Mining Machinery Group announced that the 300 million yuan it had invested in financial products not only failed to generate interest income but also resulted in losses exceeding 90% of the principal. Hengdian East Magnet, which invested 300 million yuan in financial products this year, lost almost a year's worth of profits. 263.net also invested 200 million yuan in financial products and ended up losing 180 million yuan...

These are all painful lessons.

So, Thalys is investing 15 billion yuan, and it's even using accounts payable for investment. This shows great confidence.

Not only financial management but also aggressive acquisitions

In fact, besides financial management, Thalys has made some solid asset acquisitions this year.

First, in July this year, Thalys spent 2.5 billion yuan to acquire the AITO trademark from Huawei.

At that time, some questioned whether Thalys was being exploited by Huawei just as it started making profits. However, Yu Chengdong lamented on several occasions, "If not for policy restrictions, we wouldn't have wanted to sell the AITO trademark." In his view, this trademark is worth billions.

To be fair, Yu Chengdong was telling the truth this time. As can be seen from Thalys' subsequent second and third-quarter financial reports, the popularity of AITO M9 has made Thalys the most profitable automaker in China.

In August, Thalys invested 11.5 billion yuan in cash to acquire a 10% stake in Invision Auto, a wholly-owned subsidiary of Huawei that focuses on intelligent automotive solutions.

Note that it was cash.

A few years ago, Thalys was still continuously losing money, but now it can easily invest billions of yuan in cash for acquisitions.

So, what does Invision Auto do? It is a wholly-owned subsidiary of Huawei, focusing on intelligent automotive solutions.

In a word, Thalys is serious about investing heavily in intelligent automotive solutions.

In September, Thalys made another significant move, acquiring Longsheng New Energy with over 8 billion yuan. Longsheng New Energy is a smart manufacturing plant, and the main purpose of the acquisition is to support the production of the AITO series.

It can be said that Thalys has been actively making acquisitions throughout the second half of the year.

And most of the money went to Huawei, giving the impression that Thalys has suddenly become a major shareholder.

Why such lavish "spending"?

It's evident that Thalys is eager to address its shortcomings and have its own aces besides Huawei.

To win in the end, one must rely on their own brand

It can be said that without Huawei, AITO would not be what it is today.

However, Huawei also has other brands like Zunjie, Xiangjie, Zhijie, and more X-series brands on the horizon. Therefore, it will be difficult for Thalys' AITO to succeed solely relying on Huawei.

In this regard, Thalys is well-aware and is already preparing.

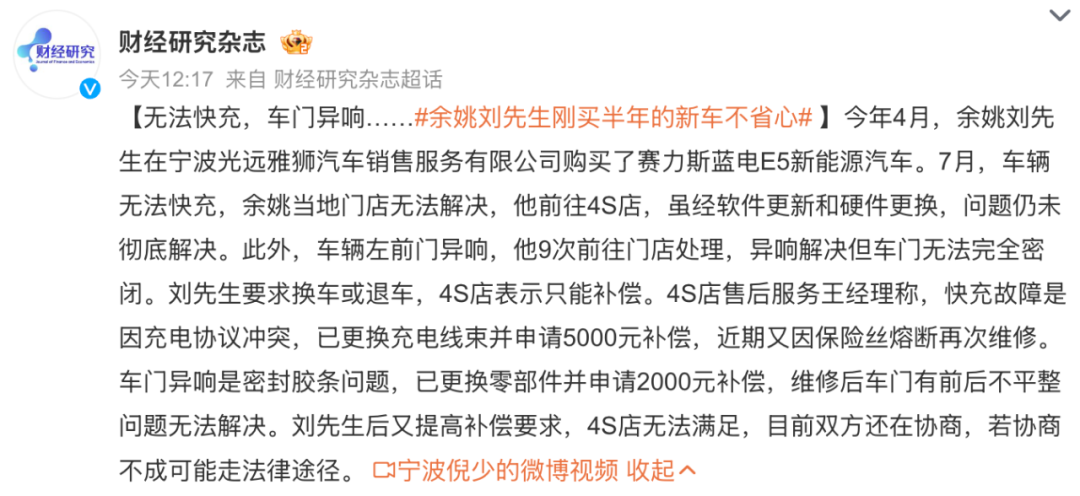

The Blue Electricity brand was officially launched in 2023, with the first model, the Blue Electricity E5, priced in the 150,000 yuan range and marketed as the youth version of the AITO M7.

However, in terms of sales, it is significantly colder, with only around 1,000 units sold per month. Compared to AITO's sales of 17,000 units, this is almost negligible.

Currently, Blue Electricity seems to be lagging behind.

Why is it weaker? Clues can be found in its products.

Take configurations as an example. The recently launched Blue Electricity E5, as a new energy vehicle, lacks even basic intelligent driving assistance features such as ACC adaptive cruise control, lane departure warning, and active braking. These are common configurations in its class but are absent in the Blue Electricity E5.

Moreover, quality control also seems unstable so far.

According to media reports, after the launch of the Blue Electricity E5, consumers have reported issues such as exaggerated battery life and slow charging. Various malfunctions have occurred shortly after delivery.

Yes, we understand. Blue Electricity has only been around for a little over a year and is still relatively new. However, Thalys is a large manufacturer with mature experience in vehicle manufacturing, so this is unexpected.

At least for now, Blue Electricity has a long way to go.

We have always said that for automakers, vehicle manufacturing is the foundation. Now that AITO has become independent, and Huawei is supporting more and more brands, Thalys, without Huawei's past support, will face greater challenges in continuing its successful streak. This will be a more rigorous test of the company's own strength.

In fact, Electric Drive is optimistic about private automakers like Thalys. Many people believe that Thalys' success is entirely due to Huawei, but in fact, throughout its journey, whether it was with minivans in its early days or its judgment on the new energy trend later on, Thalys has demonstrated its dedication and foundation in vehicle manufacturing.

Now, after a series of accumulations, Thalys must have gained some experience in complete vehicles, system architecture, extended-range technology, and intelligent manufacturing.

We believe that Thalys can find its own path forward.

Best wishes.