Have consumers completely abandoned century-old brands BBA in the wave of electrification?

![]() 11/07 2024

11/07 2024

![]() 533

533

Original by New Energy Outlook (ID: xinnengyuanqianzhan)

3540 words in full text, 6 minutes reading time

Recently, there have been two interesting events in the automotive circle. One is that BMW's high-performance M series couldn't stop during a performance and ended up in a rear-end collision. The other is that Xiaomi SU7 Ultra topped the "fastest four-door car in the world at Nürburgring" with a time of 6 minutes, 46 seconds, and 874 milliseconds.

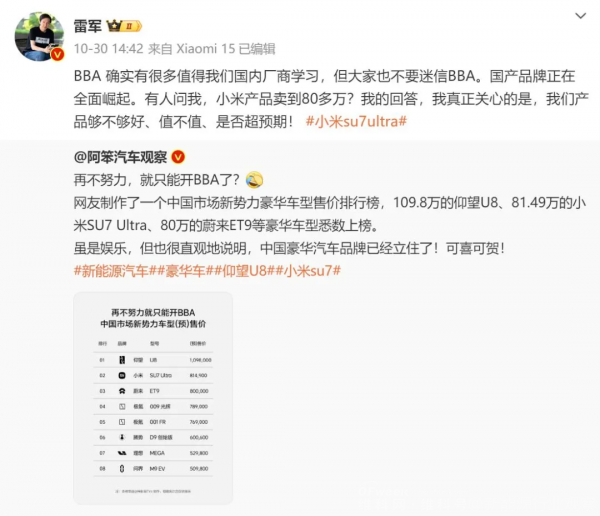

Xiaomi Chairman Lei Jun warns everyone to "not be superstitious about BBA" because domestic brands are rising comprehensively.

Photo/Lei Jun believes domestic brands offer more value than their price

Source/Screenshot from Weibo New Energy Outlook

Judging from recent sales, it's not just luxury car brands like Maserati and Porsche in the ultra-luxury market that are struggling. Even in the price range of 300,000 to 400,000 yuan, consumers' willingness to choose domestic brands has far exceeded that of BBA.

This has caused BBA, which has a history of over a hundred years and was once regarded as a symbol of wealth and success by countless consumers in the domestic market, to face an unprecedented market winter.

Can they return to their peak?

1. Century-old BBA, "halved" in the era of electric vehicles

According to data from the Passenger Car Association, BMW's new energy vehicle wholesale sales in October were 6,527 units. In the first nine months of this year, BMW Group delivered 76,000 new energy vehicles in the Chinese market.

This achievement is obviously far inferior to NIO, Xpeng, Li Auto, AITO, Tesla, etc., but it is still quite good compared to Mercedes-Benz and Audi.

"I bought a BMW i3 because I'm sure it won't go bankrupt within 10 years." Some BMW owners contacted by "New Energy Outlook" said.

Indeed, with a history of over a hundred years, the BMW Group will not easily go bankrupt. However, BMW's first global 5S store, Beijing Xingdebao Automobile Sales and Service Co., Ltd., is now deserted.

According to the notice issued by the store, due to severe financial pressure, the company is seeking capital injection or other group trusteeship. The BMW brand authorization was terminated on October 20, 2024, and the company suspended new car and after-sales related businesses.

Photo/Notice from Beijing Xingdebao Automobile Sales and Service Co., Ltd.

Source/Screenshot from Internet New Energy Outlook

A major reason for the severe financial pressure is, of course, the overall decline in BMW Group's sales. Data shows that in the third quarter of this year, BMW sold 540,000 vehicles in the global market, a year-on-year decrease of 13%. Among them, China saw the largest decline, reaching 29.8%.

In fact, as the global automotive industry transitions from the era of internal combustion engines to the era of new energy vehicles, especially after the rapid rise of China's new energy vehicle enterprises, it is not just BMW that is in a sorry state. Both Mercedes-Benz and Audi, as well as Porsche, which was once the most profitable brand, have not escaped the fate of sales being "halved".

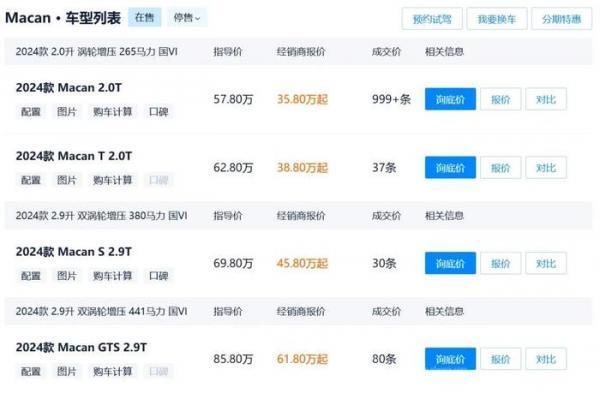

For example, recently, an article titled "Porsche's price has fallen below 400,000 yuan" has attracted industry attention. Although multiple Porsche sales staff have subsequently debunked the rumor, stating that "the above price was a mistake made by the store, and the lowest-configured Porsche price will still be over 500,000 yuan,"

Photo/Porsche price breaks 400,000 yuan

Source/Screenshot from Internet New Energy Outlook

However, there is no doubt about the sales and operational pressures faced by Porsche in China.

Data shows that Porsche's sales in China declined by 15% year-on-year last year. In the latest third-quarter report, Porsche's global sales decreased by 7% year-on-year. The Chinese market fared the worst, with sales plunging by 29%. Among them, the Taycan, one of the most popular models among Chinese consumers, also saw the most exaggerated sales decline, plummeting by 50% year-on-year.

The other two century-old luxury car brands, Mercedes-Benz and Audi, are also struggling.

Among them, Mercedes-Benz delivered its worst performance in nearly three years. Mercedes-Benz's third-quarter report shows that the company's total revenue decreased by 6.7% year-on-year to 34.53 billion euros, the lowest in nearly three years. Net profit was "halved" year-on-year, leaving only 1.72 billion euros, a decrease of over 40% from the previous quarter.

In the first half of 2024, Audi sold 301,600 vehicles in China, a year-on-year decrease of 1.9%. Among them, FAW-Audi, the main sales force, sold 301,600 vehicles, while SAIC-Audi only sold 18,300 vehicles.

However, the situation was very different two years ago.

According to Gangtise Investment Research and Analysis, defining luxury cars as models priced above 400,000 yuan, the total market share of Porsche, BBA, and Land Rover in the domestic luxury car market was approximately 94% in 2022, with Chinese automakers accounting for only single-digit shares. However, by the end of May this year, the share of Chinese automakers in the luxury car market had increased to 21%.

Whether it's price, sales, or market share, BBA is far inferior to its past performance in China. Behind this is the rapid development of domestic new energy vehicles, which has "revolutionized" the "fate" of century-old luxury car brands.

According to data from the Passenger Car Association, from 2021 to 2023, the retail penetration rate of new energy vehicles in China was 14.8%, 27.6%, and 35.7%, respectively, achieving the goal of a 20% penetration rate for new energy vehicles by 2025 ahead of schedule. From July 2024 to date, the domestic retail penetration rate of new energy vehicles has exceeded 50% for three consecutive months.

2. Behind the "fall" of giants

In the era of internal combustion engines, since entering the Chinese market, BBA has long occupied China's high-end luxury car market with its brand advantages, product performance, and other factors. With the advent of the electrification era, these once giant luxury car brands seem to be overtaken by domestic automakers.

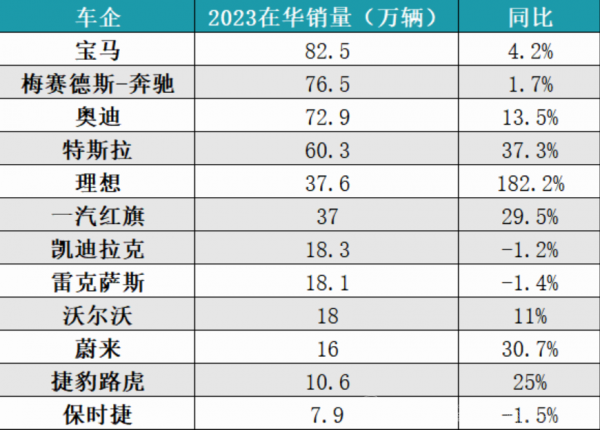

Photo/Sales of various automakers in China in 2023

Source/Screenshot from Internet New Energy Outlook

However, neither consumers nor industry insiders seem surprised by this phenomenon.

A fundamental factor that cannot be ignored is strategic issues. As domestic new-energy vehicle startups and traditional automakers turned to new energy, BBA hesitated due to their difficulty in letting go of realistic interests and ultimately chose to enter the electrification era in a "speculative" manner through "oil-to-electricity" conversions.

However, products under this model have limited competitiveness in terms of pure electric range, comfort, safety, intelligence, and other aspects, making it difficult to gain favor with consumers.

This has caused BBA to not only miss the best "entry timing" but also be left far behind in the core "three-electric" technologies of new energy vehicles—batteries, motors, and electronic controls. Especially in terms of endurance, refueling, and the combination of charging and battery swapping, domestic brands have surpassed BBA.

Secondly, in terms of intelligence and driving experience, which are increasingly becoming factors influencing consumers' car purchases, BBA's disadvantages are even more pronounced. Zhou Lijun, Chief Analyst at Yiche Research Institute, once analyzed that the main problem with BBA is that their product competitiveness cannot keep up with Chinese competitors. Domestic automakers are constantly introduction new models with attractive appearances, interiors, configurations, and more.

A consumer considering replacing their car said their current alternative brands are NIO and Audi. The dilemma is mainly whether to prioritize brand value or practical value. The netizen bluntly stated, "Although I really like Audi, and the Audi A6 is a good car, in terms of the current development of new energy vehicles, Audi is outperformed by NIO in every aspect except for the logo."

However, compared to the following car owner who bought a Mercedes-Benz EQE, the above consumer is much luckier.

Li Meiling (pseudonym), the owner of a Mercedes-Benz EQE, said she previously drove a Mercedes-Benz gasoline car for four or five years without any issues with the driving experience or car quality. "Later, I traded it in for a Mercedes-Benz electric car, but I didn't expect the new car to break down four times in four months. It was either the charging gun couldn't be removed or the car wouldn't start. What's even more bizarre is that there wasn't even a tow mode."

It is quite ironic that while BBA's new energy vehicles are already lacking in product competitiveness, they still maintain a "noble" price when domestic brands have achieved "same price for oil and electricity" or even "electricity cheaper than oil".

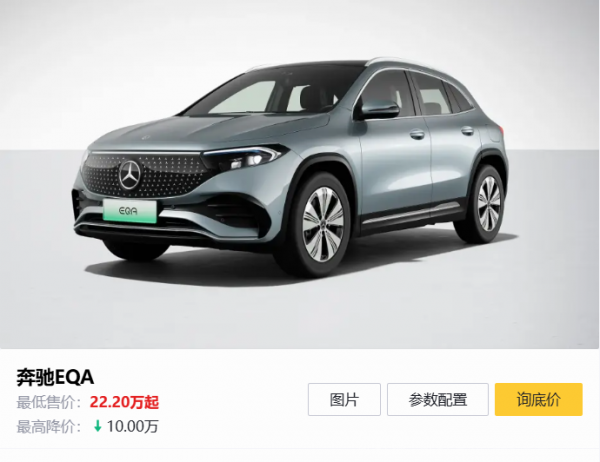

According to data from Dongchedi, the manufacturer's guided price of the Mercedes-Benz EQA, a compact SUV, is still as high as 322,000 yuan, and even the dealer price exceeds 200,000 yuan. However, whether in terms of configuration, parameters, or price, domestic brands such as Ledao L60, LanTu Zhiyin, and Zeekr 7X are more "appealing".

Photo/Mercedes-Benz EQA price

Source/Screenshot from Internet New Energy Outlook

Of course, not all netizens and consumers sneer at BBA electric cars.

A netizen with the ID "Ultraman Tiga Manman" bluntly stated, "I highly recommend the Mercedes-Benz EQE. It's super good-looking, easy to drive, and has an excellent interior. Those who bought it really love it." Another netizen said, "I not only bought a BBA electric car, but I also drive it around the world."

Even though there are still fans, BBA undoubtedly faces challenges in its electrification transformation, and must conduct profound reflection and adjustment from strategic choices, product competitiveness, to market positioning and consumer perception.

3. Does BBA still have a chance to turn the tables?

As century-old automakers, BBA is obviously aware of its brand predicament in the electrification era.

In fact, BBA has not been idle.

For example, BMW, which announced its withdrawal from the "price war" in July this year, had to "slap itself in the face" and rejoin to save sales.

According to public data, the price reduction of the BMW i7 in many domestic 4S stores has reached 38%, with a maximum reduction of 555,000 yuan; the landing price of the 2024 BMW i3 eDrive 35 L version is once again below 200,000 yuan.

Photo/Price of the 2024 BMW i3 eDrive 35L version

Source/Screenshot from Internet New Energy Outlook

A consumer who bought a BMW I3 in August 2023 bluntly stated that what surprised him the most was that BMW's price reduction could be so significant. In just 10 months, the price of his 250,000-yuan BMW I3 bare car dropped to 180,000 yuan.

Mercedes-Benz and Audi have also been busy, launching unprecedented price reductions. According to Dongchedi data, the maximum price reduction of the Mercedes-Benz EQS exceeds 660,000 yuan, with a reduction rate of up to 50%; the Mercedes-Benz EQA has a reduction rate of 47% to 170,000 yuan; the Mercedes-Benz EQB has a reduction rate of up to 44% to about 200,000 yuan. The Audi e-tron also has a maximum price reduction of over 200,000 yuan, with a reduction rate of 40%.

According to data from Wilson Consulting, in the first seven months of 2024, Audi's terminal discount rate approached 30%, BMW reached 25%, and Mercedes-Benz was close to 20%; over the same period, the average discount rate in the Chinese automotive market was 14%.

However, with supply far exceeding demand, especially when there are more cost-effective product options available, BBA cannot win back the market by relying solely on price reductions.

As a result, BBA has adjusted its market strategies in China to adapt to the needs of the electrification era.

Among them, BMW's R&D system in China is undergoing a comprehensive upgrade. It plans to put new-generation models into production in China by 2026 and strive to increase the sales proportion of electric vehicles to 33%.

Mercedes-Benz plans to invest 14 billion yuan in the Chinese market. Starting from 2025, it will successively put into production exclusive new pure electric long-wheelbase CLA models, long-wheelbase GLE SUV models, and new luxury pure electric MPVs based on the VAN.EA platform in China.

Audi is transforming the A6L, which has a good reputation among domestic consumers, adopting a "fuel + pure electric" dual-car strategy and jointly attacking the market with the new pure electric version A6 e-tron. It is reported that the Audi A6L e-tron will be further upgraded in terms of appearance design, space, intelligence, intelligent driving, and other areas, and is planned to be officially launched in 2025.

Regarding this, industry insiders said that for BBA to achieve better development in China, in addition to the brand's own efforts, it can also choose to cooperate with domestic independent brands like Volkswagen and Stellantis Group to quickly make up for technological shortcomings and thereby expand market share.

In fact, the current situation of BBA is just a microcosm of joint venture luxury brands in the domestic market.

Luxury car models from brands such as Cadillac, Lincoln, Land Rover, Jaguar, and Infiniti, which were once highly sought after by domestic consumers, have all "fallen out of favor".

In 2021, Cadillac China achieved a record annual sales volume of 233,100 units, but in the first half of this year, Cadillac sales fell to 62,000 units, a year-on-year plunge of 28%.

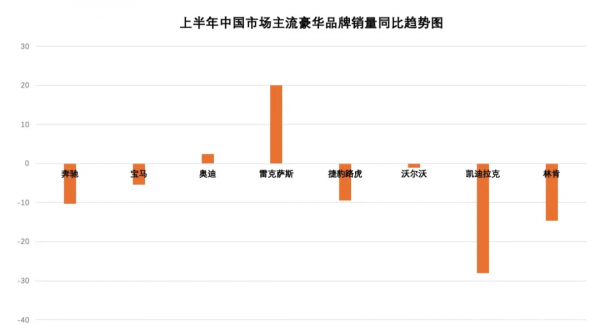

Photo/Year-on-year sales of mainstream luxury brands in the Chinese market in H1 2024

Source/Screenshot from Internet New Energy Outlook

Lincoln's current situation is also not optimistic. According to data from the Passenger Car Association, Lincoln imported 10,274 vehicles from January to August, with a year-on-year decrease of 39%, making it the brand with the highest decrease in imported cars.

"As far as I know, the Volvo store next door and the Cadillac store 200 meters away are both doing very poorly," said a salesperson at a 4S store near the Fourth Ring Road in Beijing.

Of course, even if the current situation of joint venture luxury car brands is not good, these brands still have significant advantages in supply chain management, quality control, and sales channel construction. Especially BBA, with a hundred years of experience in car manufacturing and profound technical accumulation.

However, even though there is indeed a chance for a turnaround, the challenges are greater compared to the era of internal combustion engines, and the process will not be easy.