How much time can traditional luxury brands still have in the Chinese market?

![]() 11/07 2024

11/07 2024

![]() 625

625

According to the latest data, BMW's sales in the Chinese market declined by 13% to 520,000 units in the first three quarters of this year. Under the influence of the strategy of "reducing volume to maintain price" in July, sales in August almost halved to 37,000 units.

The decline in sales is gradually forcing production capacity. Reports have indicated that the vacation time at BMW's largest production base globally, Tiexi Plant and Dadong Plant in Shenyang, has gradually been extended, and operators with more than three years of experience cannot renew their contracts upon expiration. The day after the news of layoffs broke, BMW's first global "5S store," Beijing Xingdebao, also faced withdrawal due to financial pressure.

In fact, it's not just BMW that is gradually losing ground in the Chinese market. Recently, rumors have circulated that Jaguar Land Rover's Integrated Marketing & Sales Service (IMSS) is undergoing massive layoffs, potentially affecting over 50% of its staff. Although officially denied, insiders revealed that the actual layoff rate at IMSS is approximately 20%, with severance pay calculated as "N+3." In recent years, the cooling performance of luxury brands in the Chinese market has gradually become the norm. It's worth noting that since the Chinese automotive market gradually transitioned from an incremental to a stock market in 2018, the growth rate of new car sales in China has gradually slowed from 11%-12% to 4%-3%. Data shows that BMW China's sales trends from 2019 to 2023 increased by 14.1%, 4.8%, 9.1%, and 3.5% year-on-year, respectively. Despite fluctuating growth, there is an overall downward trend.

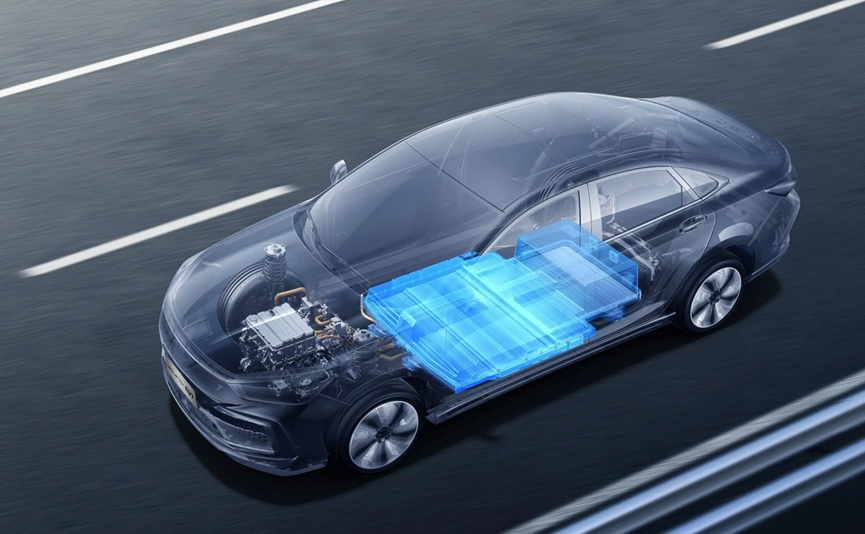

Amidst the overall slowdown in the growth rate of Chinese joint venture luxury brands, they are now facing an even more critical factor. The state's support for new energy policies has enabled domestic automakers to ride the wave of the times. Data shows that from January to September 2024, the cumulative retail sales of new energy passenger vehicles reached 7.132 million units, a year-on-year increase of 37.4%, accounting for 71.34% of the domestic new energy passenger vehicle market. It is evident that despite facing the same saturated market environment, domestic new energy vehicle makers, starting from scratch, have still managed to carve out a market share of nearly 12 million vehicles in a tightening market.

Moreover, among these new energy vehicle makers, there are emerging high-end brands such as Wenjie, Lixiang, and NIO that are benchmarked against BBA. Data from the China Passenger Car Association shows that in the luxury brand sales rankings for September, Lixiang sold 53,709 vehicles, an increase of 48.95%, while Wenjie sold 35,852 vehicles, a year-on-year increase of 434.47%. In contrast, Audi sold 51,175 vehicles, a year-on-year decrease of 24.26%; Mercedes-Benz sold 48,700 vehicles, a year-on-year decrease of 11.94%; and BMW sold 43,959 vehicles, a year-on-year decrease of 28.85%. More importantly, domestic new energy vehicle makers are gradually revolutionizing consumers' traditional car usage experience in terms of electrification and intelligence. These are precisely what traditional luxury brands lack.

Facing the accelerating tightening of market share and the continuous efforts of Chinese automakers in their electrification transformation, the first step for luxury brands to break the deadlock is to trade price for volume. For luxury brands, repeated price reductions irreversibly weaken their brand positioning. More importantly, the continuous reduction in profits makes it difficult for downstream dealers to sustain their operations, frequently facing the risk of collapse. It's crucial to understand that once downstream dealers collapse, luxury brands will face a precarious situation.

Financial report data shows that Jaguar Land Rover's retail sales in China were 70,283 units from January to September this year, a year-on-year decrease of 10.5%. Previously, news broke that multiple Jaguar Land Rover dealers reported experiencing increasing losses despite selling more cars due to the impact of price wars. In response, Adrian Mardell, Global CEO of Jaguar Land Rover, is planning to significantly reduce and phase out some existing models to optimize the brand structure and enhance overall profitability. Currently, the most critical task for luxury brands is how to break the deadlock on the path of electrification transformation.

Previously, BMW Group announced that it would start producing its new-generation models from the second half of 2025. At least six new-generation models will be mass-produced within the subsequent 24 months. "50% of sales will be pure electric vehicles by 2030," "global cumulative sales of pure electric vehicles will reach 10 million units," and "six new-generation models in two years." Jaguar Land Rover has also announced its electrification transformation plan, with the launch of its first pure electric Range Rover model in 2025. By 2030, all four of Jaguar Land Rover's brands (Jaguar, Range Rover, Defender, Discovery) will offer pure electric models. However, based on the current situation, luxury brands still need to accelerate their electrification transformation.

(Images sourced from the internet, remove if infringement occurs)