Will the Dow Jones return to 6000 points with the return of the self-proclaimed expert?

![]() 11/11 2024

11/11 2024

![]() 734

734

Reviewing the week's auto stock performance and observing the dynamics of the automotive market.

This week was arguably the most tumultuous of 2024, with the US presidential election, the Standing Committee of the National People's Congress (NPC) meeting to announce a new round of fiscal policies, the Federal Reserve announcing adjustments to fund rates, and the latest monetary policy.

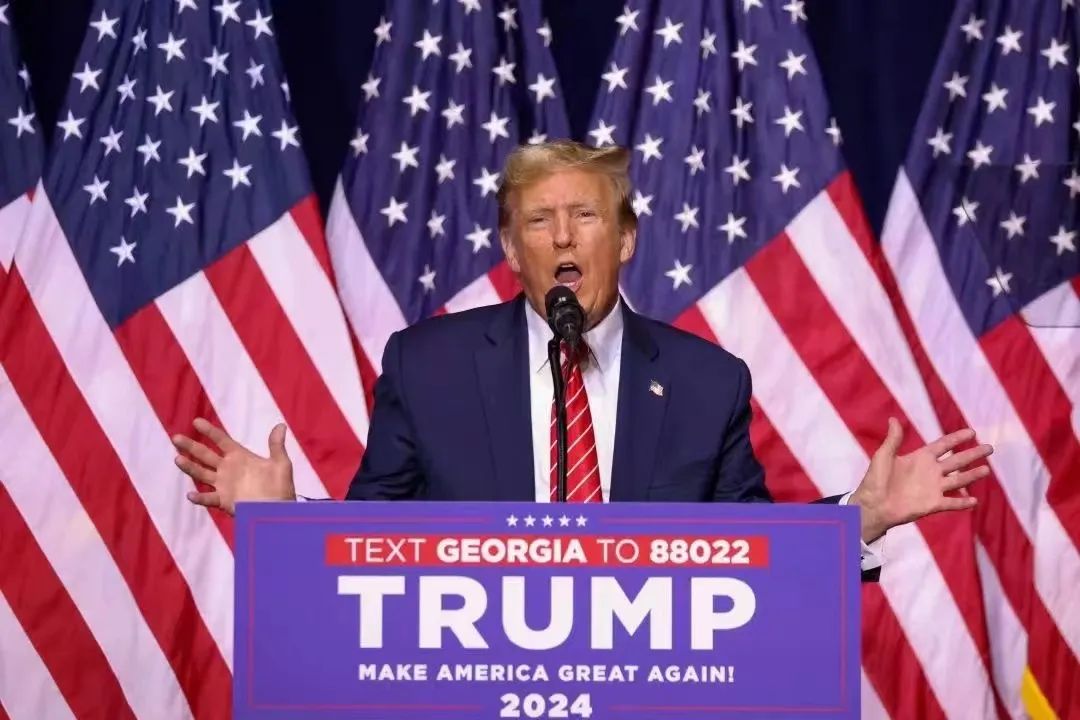

Let's start with the conclusion: Trump is likely to be elected as the 47th President of the United States, and Musk has successfully placed his bet and may even enter the White House in the later stages.

In the early hours of November 8, the Federal Reserve concluded its two-day monetary policy meeting and announced a 25-basis-point cut in the target range for the federal funds rate to between 4.50% and 4.75%, marking the second rate cut by the Fed since September. Some analysts believe there is a direct link between the September 19 rate cut and the significant market movement in A-shares on September 24, and this rate cut will also stimulate A-shares.

In the afternoon of November 8, the NPC Standing Committee revealed the highly anticipated fiscal policies. Whether it's the newly added 6 trillion yuan over three years or the total of 10 trillion yuan, the new debt relief policy is undoubtedly the core content of the current fiscal policy. Perhaps investors have experienced significant ups and downs, and their expectations are quite high, so some people find this new policy not aggressive enough. But objectively speaking, it is a genuine positive development.

Of course, A-shares have also surged in this turbulent era.

On Monday of this week, before any major events were officially announced, A-shares remained silent amidst the calm before the storm. The trading volume of A-shares on that day was 1.72 trillion yuan, a decrease of approximately 544.3 billion yuan from the previous trading day. Although a total of 4,495 stocks rose in the entire A-share market, with 186 stocks hitting their daily price limits, most investors were still on the sidelines. After all, trading volumes had been above 2 trillion yuan for several days, and everyone was preparing their ammunition to bet on the side with greater potential.

It is worth noting that on November 4, Trump's popularity was not particularly high, and even the offshore RMB appreciated by more than 400 basis points against the US dollar, briefly breaking through the 7.1 level. The New York Times and Siena College jointly released a poll at that time, indicating that in the seven crucial "swing states" in the 2024 US presidential election, Harris had a narrow lead with 48% to 47%.

By November 5, hot money could no longer be contained by investors, and the A-share market was buzzing with activity, with over 5,000 stocks rising across the market. The Shanghai Composite Index closed up 2.32% by the end of the day.

On the eve of the US presidential election, A-share investors on the other side of the ocean were also exceptionally excited, driving up market sentiment. The most popular trend was a series of homophonic stock tickers. One stock, "Chuanda Zhisheng," ranked in the top ten of the hottest lists for multiple days, and its share price neared the daily limit intraday on Tuesday.

Although the market was puzzled by such emotional trading, outsiders were also "greatly shocked," and even Morgan Stanley followed the trend and bought Chuanda Zhisheng, ranking eighth among its circulating shareholders.

Similarly, "Chuanfa Longmang" hit its daily price limit for two consecutive trading days, and its share price has risen by 135.43% in the past month. The homophonic stock ticker for Harris, "Haers," has also attracted significant attention, rising by 22.25% in the past month but declining as Harris' popularity waned.

Even more outrageously, Shapu Aisi's share price also nearly hit its daily limit, with some believing it represented "screw Trump, love Harris"... This stock has risen by 19.66% in the past month.

However, as the election drew to a close, speculators began to abandon these emotionally driven stocks and turned to topics and memes with more buzz.

On November 6, spurred by the previous day's surge in trading volume, the Shanghai and Shenzhen stock exchanges both opened higher. However, the uncertainty surrounding the US presidential election left investors on the other side of the Pacific unsure how to place their bets.

It was not until the afternoon, close to the market close, that multiple US media outlets announced their calculations, showing that Trump had secured over half of the electoral votes, securing victory in the US presidential election. At this point, the RMB exchange rate fell rapidly, and the overall market fell back.

In the eyes of outsiders, Trump is still likely to curb and hinder our development through measures such as increasing tariffs, restricting imports and exports, technology wars, and financial wars.

If China's exports are subject to an additional 60% tariff, it will have a short-term impact on exports. However, it is believed that the upcoming important domestic meetings will likely introduce more forceful fiscal policies to expand domestic demand and offset the impact of declining exports, which could be a potential positive for A-shares.

If Harris is elected, it would be a short-term positive but a long-term negative for A-shares, while Trump's election would be the opposite—a short-term negative but a long-term positive. This is how the US presidential election impacted A-share trends in the short term this week.

While Trump was still preparing his inauguration speech, the Federal Reserve had already cut interest rates by 25 basis points, fully in line with previous market expectations. At the current pace, the US federal funds rate is likely to gradually decline to around 3% by the end of next year.

For the global market, this indicates that liquidity is gradually easing, and hot money is starting to flow out of the US. After this Fed rate cut announcement, the three major US stock indices hit all-time highs during the session, and international crude oil, gold, and silver prices also rose across the board.

In fact, after the Fed's September rate cut, the Chinese market welcomed some overseas funds. Therefore, as the US dollar interest rates further decline, it is expected that more funds will enter the A-share market, although the amount will not be significant compared to other funding sources for A-shares.

On November 7, after the dust settled on the US presidential election, various conceptual homophonic meme stocks began to "recede," with many falling by the daily limit, forming a sharp contrast with the overall market. A-shares as a whole experienced a significant uptrend, with the securities sector performing particularly impressively, rising by 6.2%.

Of course, besides the upheaval in the A-share market, as Trump's top flag bearer, Tesla can be said to have made a fortune from this round of bets. While others are betting on wealth, they are betting on survival.

Starting from November 6, Tesla's share price has followed a nearly wild zigzag pattern. On November 6, Tesla closed up 14.75% in US markets, hitting a new high since July 2023 and increasing its market value by approximately $120 billion in a single day.

Tesla's soaring market value also catapulted Musk's net worth by over $20 billion (approximately 150 billion yuan) in a single day. According to Forbes' list of billionaires, Musk's total assets have reached $285.6 billion, far surpassing Jeff Bezos, who ranks second on the global rich list.

As of November 8, US time, Tesla's opening gain expanded by over 6%, hitting a new high since September 2022, with its total market value reaching $1 trillion again.

After Trump officially takes office, Musk is expected to enter the White House to participate in the government downsizing plan. At this point, after the Iron Man of Silicon Valley, Musk will add a series of titles, such as "Director of the Washington Development and Reform Commission," "Imperial Walker of America," "Chief Eunuch and Secretary," and "Iron-capped Prince"... In short, he's a total winner.

Turning to the domestic impact, although the A-share market still has muscle memory of the stock market volatility caused by Trump's tariff policy in 2018, the current domestic policies, liquidity, and valuation safety margins are better than they were in early 2018.

In addition, when the US further expanded the scope of tariff imposition in 2019, the A-share market only experienced a brief decline, followed by a sideways vibration in the Shanghai Composite Index, while the ChiNext Index even embarked on an uptrend, with domestic substitution and technological autonomy logic leading the electronics, computer, and other sectors to embark on a technology bull run. This was inseparable from domestic policy support and the improvement of the global liquidity environment at that time.

After the previous round of US tariff increases, China's export industry layout underwent corresponding adjustments, enhancing China's export competitiveness. As a result, China's share in global trade may not decline in the future. On the other hand, export diversion and corporate overseas expansion can help mitigate the negative effects of tariff policies on the profitability of export chain enterprises, and the impact on corporate profitability will be weaker than that on export performance.

To be pragmatic, domestic asset performance will still be "self-driven," and policy-driven economic stabilization will remain the main theme of the market.

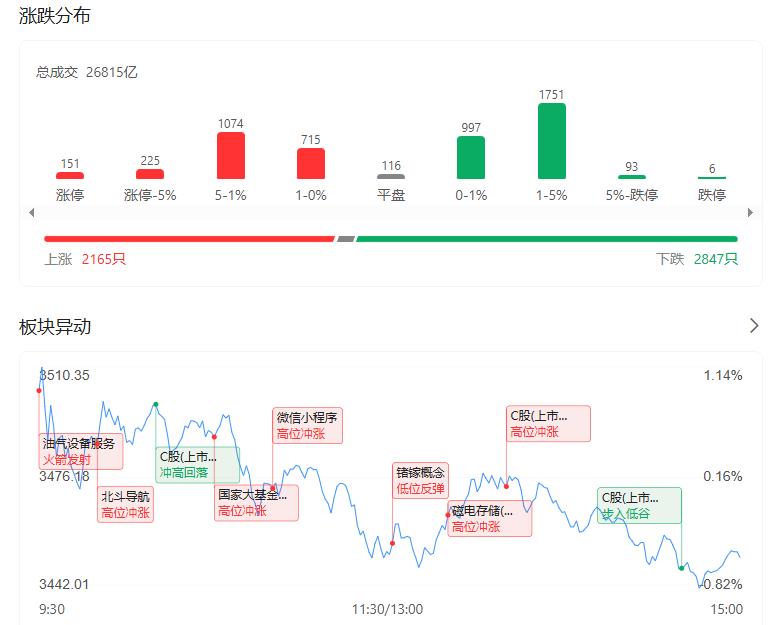

As this week drew to a close on Friday, A-shares also experienced a volatile trend. From a broader market perspective, on November 8, A-shares opened higher but closed lower, with the three major stock indices closing slightly down collectively. By the end of the trading day, the Shanghai Composite Index fell by 0.53%, holding above the 3400-point mark; the Shenzhen Component Index fell by 0.66%, the ChiNext Index fell by 1.24%, and the Beijing Stock Exchange 50 Index fell by 1.25%.

The total market trading volume was 2.7323 trillion yuan, an increase of 169.2 billion yuan from the previous day, with over 3,000 stocks falling across the market.

In the eyes of investors, today's 25-basis-point rate cut by the Fed is still too small, and the newly added 6 trillion yuan local government debt limit in China is also insufficient to satisfy appetites.

I believe investors will regain their senses after listening to a round of financial influencers on Douyin and will patiently wait for Monday's market opening.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.

-END-