Luxury brands have run out of reserves, too

![]() 11/11 2024

11/11 2024

![]() 704

704

"If you don't work hard to make money, you'll only be able to afford BBA (BMW, Benz, Audi) in the future."

Early this year, a netizen's joke reflected the fact that the popularity of traditional luxury brands is being overshadowed by Chinese premium cars. However, the real situation is even worse than he described. Not only have traditional luxury brands lost their popularity, but their sales have also plummeted. This is true for Jaguar Land Rover, Porsche, and even BBA, which was still growing last year.

Porsche plans to cut down its dealerships.

Recently, Porsche's Chief Financial Officer Lutz Meschke revealed that Porsche's sales in China are expected to stagnate by 2025 and plans to significantly reduce its dealership network in the country.

In the first three quarters of this year, Porsche delivered 43,280 new vehicles in the Chinese market, a year-on-year decrease of 29%. This market performance was achieved despite significant price reductions. Under huge sales pressure, Porsche has launched price reduction promotions for multiple models. Recently, it was even rumored that a Porsche dealership in Shenzhen offered an ultra-low price of 358,000 yuan for the entry-level Porsche Macan. Although the news was denied, multiple dealerships confirmed that the bare car price of the entry-level Macan has dropped to the 400,000 yuan range.

In May, it was reported that due to unsatisfactory sales, Porsche China pressured dealerships to meet sales targets by overstocking inventory. However, some Porsche dealerships that are selling cars at a loss are no longer willing to bear the huge financial pressure and have stopped taking delivery of vehicles to "force" headquarters to provide subsidies and replace senior executives. Some Porsche showrooms have also chosen to close. Media reports have stated that multiple Porsche showrooms in Erdos, Guangzhou, Xi'an, and other locations have closed recently. Porsche dealership services in Lanzhou, Yinchuan, and other places have also been downgraded. Industry insiders have predicted that due to the profitability issues faced by luxury brand dealerships, some Porsche dealerships in certain regions will definitely close. Now, Porsche is making its intentions clear. Porsche's Chief Financial Officer Lutz Meschke stated, "Porsche needs to re-evaluate its product lineup, budget, and costs in the Chinese market." He also revealed, "All of this is to further improve our flexibility and resilience. We will not abandon the Chinese market, but we need to face reality."

BMW is also facing reality.

A week ago, news spread that BMW's largest production base globally, the Tiexi Plant in Shenyang, would reduce production. Multiple BMW employees revealed that since the beginning of this year, the Tiexi Plant has gradually increased the number of long vacations, with production line workers only working half the month and receiving basic salaries during this period, with social security contributions made as usual. Some production line operators with less than three years of service were also informed that their contracts would not be renewed upon expiration. Analysts pointed out that the main reason for the production reduction at BMW's plant is the decline in sales in the Chinese market.

In the third quarter of this year, BMW sold 147,700 new vehicles in China, a year-on-year decrease of 29%. In the first three quarters, BMW's cumulative sales in the Chinese market were only 520,000 units, a year-on-year decrease of 13%. It is worth mentioning that to boost sales, BMW offered significant subsidies and discounts to dealerships in May, including a 3% price reduction, to compete in the market and reduce prices across its model range. However, in July this year, BMW announced its withdrawal from the price war, and the prices of all BMW products were increased.

Subsequently, BMW's sales in August were only 34,800 units, a year-on-year decrease of 42%. The continuous decline in sales has dragged down BMW's financial statements and overwhelmed dealerships. Recently, BMW's first global 5S store, Beijing Xingdebao, announced its closure. The official announcement stated, "Currently, the store is facing severe financial pressure and is actively seeking capital injection or group trusteeship. Meanwhile, BMW's brand authorization has also been terminated on October 20, and new car sales and after-sales services have been suspended."

Before the closure of Beijing Xingdebao, another BMW 4S store in Beijing, Beijing Shunbaohang, had also ceased operations. The display cars in the store had disappeared, sales staff were nowhere to be found, and only partial after-sales services were available. It was recently reported that an established BMW 4S store in Xiamen experienced a sudden crisis, and employees live-streamed within the store to defend their rights. Car critic Sun Shaojun stated that BMW dealerships have been withdrawing from the network since last year and can no longer endure this year. The latest news is that during the week of October 21-27, BMW's sales reached 12,900 units, surpassing Benz and Audi to reclaim the top spot. However, this does not mean that the pressure facing BMW will decrease in the future.

Mercedes-Benz is also struggling.

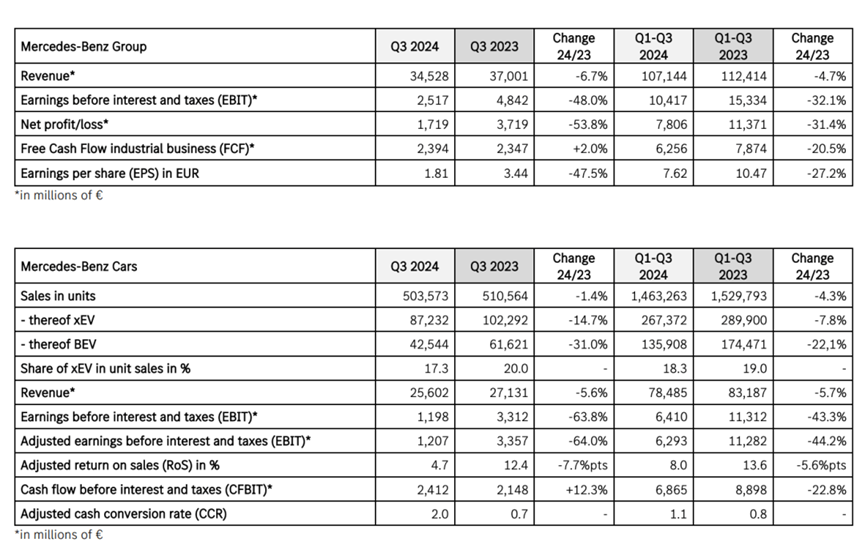

A week ago, Mercedes-Benz released its third-quarter financial report for this year. The report revealed that in the third quarter, Mercedes-Benz's net profit was only 1.72 billion euros (approximately 13.25 billion yuan), a year-on-year decrease of 54%. More notably, the adjusted EBIT of the Mercedes-Benz Cars business sector was only 1.2 billion euros (approximately 9.25 billion yuan), a year-on-year decrease of 64%.

Mercedes-Benz attributed the decline in performance to the additional costs associated with model updates and the increasingly competitive environment in the Chinese market. In the third quarter, Mercedes-Benz's revenue in the Chinese market was only 5.09 billion euros, a year-on-year decrease of 16.6%, making it one of the most significantly impacted markets. In the third quarter, the brand's sales in China were only 170,700 units, a year-on-year decrease of 13%. This market performance was achieved despite "the group spending hundreds of millions of euros in the third quarter to reduce dealer inventory through discounts and support sales in China through subsidies." Like other luxury brands, Mercedes-Benz is also selling at significant discounts. The latest market conditions on multiple platforms show that the starting prices for the Mercedes-Benz A-Class and C-Class have reached a 40% discount, the GLC-Class has a discount of less than 30%, the E-Class has a smaller discount but is still below 20%, and the S-Class has no discounts.

Over a longer time frame, in the first three quarters of this year, Mercedes-Benz delivered a cumulative total of 512,200 vehicles in the Chinese market, a year-on-year decrease of 10%. This indicates that the decline in sales of discounted Mercedes-Benz vehicles in China is still expanding. Ola Kaellenius, CEO of Mercedes-Benz, stated, "How long will this situation last? I don't know, but I am cautious about the Chinese automotive market in the foreseeable future." It is reported that the Mercedes-Benz management will seriously consider how to find opportunities in the Chinese market, and one of the important measures is cost reduction.

Jaguar Land Rover has already started implementing this.

Recently, news spread that Jaguar Land Rover and its Integrated Marketing and Sales & Service (IMSS) organization were laying off employees. Jaguar Land Rover China confirmed that it is undergoing structural adjustments and personnel optimizations. Insiders revealed that the layoff ratio at IMSS is approximately 20%. It is reported that personnel adjustments at IMSS began before the National Day holiday. After the adjustments, IMSS will be led by Jaguar Land Rover China. Chery will no longer participate in the management of IMSS and will focus on factory operations, prioritizing the implementation of the "Freelander" project.

In June this year, Jaguar Land Rover and Chery Holding announced a cooperation to jointly launch and manufacture a series of electric products based on Chery's electric platform and use the "Freelander" brand authorized by Jaguar Land Rover. Various indications suggest that this is an adjustment to Jaguar Land Rover China's channel management aimed at reversing the declining trend. Data shows that from January to September this year, Jaguar Land Rover's cumulative retail sales in China were only 70,283 units, a year-on-year decrease of 10.5%.

Previously, data released by the China Passenger Car Association showed that Jaguar Land Rover's inventory index was as high as 2.55, double the reasonable inventory range. What's more frustrating is that Jaguar Land Rover has been selling at discounts in China. Currently, the Jaguar XFL can be purchased for around 300,000 yuan; the bare car price of the Jaguar XEL is offered at a nearly "halved" price of 165,000 yuan; the terminal price of the 2025 Range Rover Sport has reached more than 100,000 yuan off; and the Range Rover Velar, which once required a premium, now offers discounts of nearly 200,000 yuan.

Due to continuous significant price reductions, some Jaguar Land Rover dealerships are "selling at a loss the more they sell." Dealers that cannot withstand the pressure of losses have chosen to withdraw. Currently, there are no Jaguar Land Rover sales outlets in some regions of China. Some analysts believe that after this channel adjustment, it is a general trend for IMSS to focus on imported car business in the future.

Summary

Over the past few years, the Chinese automotive market has undergone profound changes. Driven by the trends of electrification and intelligence, Chinese local automakers have generally performed strongly in the market, while overseas brands in China have shown a slight downturn. During this process, many Chinese local premium brands have also risen rapidly, continuously eroding the market share of traditional luxury brands. As a result, even though luxury brands have resorted to price wars, they still face significant competitive pressure. As a result, traditional luxury brands have begun to reflect and adjust their market strategies. Currently, it is unclear whether the adjustments made by the above-mentioned luxury brands will achieve the expected results. However, it can be expected that the era of "easy wins" in China is likely gone for good. With the shift in market position, BBA, Porsche, Jaguar Land Rover, and others will also have to compete head-on with Chinese local premium brands in the future.

(Images sourced from the internet. Please delete if there is any infringement.)