Nezha Auto raised over 4 billion yuan in the second quarter of this year, hitting the limit of these two banks

![]() 11/11 2024

11/11 2024

![]() 513

513

In the second quarter before Nezha Auto faced a financial crisis, it obtained various types of financing totaling over 4 billion yuan, of which about 500 million yuan was borrowed from a small bank.

Recently, media reports confirmed layoffs at Nezha Auto, and earlier reports revealed that the company had been accused of owing wages to employees and payments to suppliers.

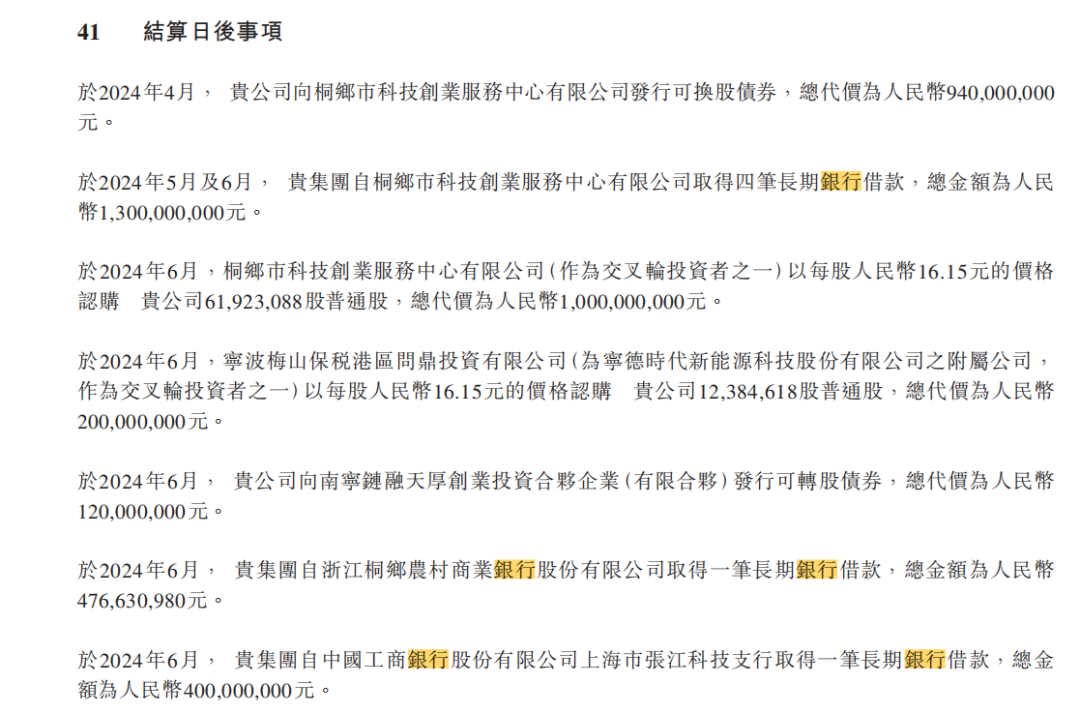

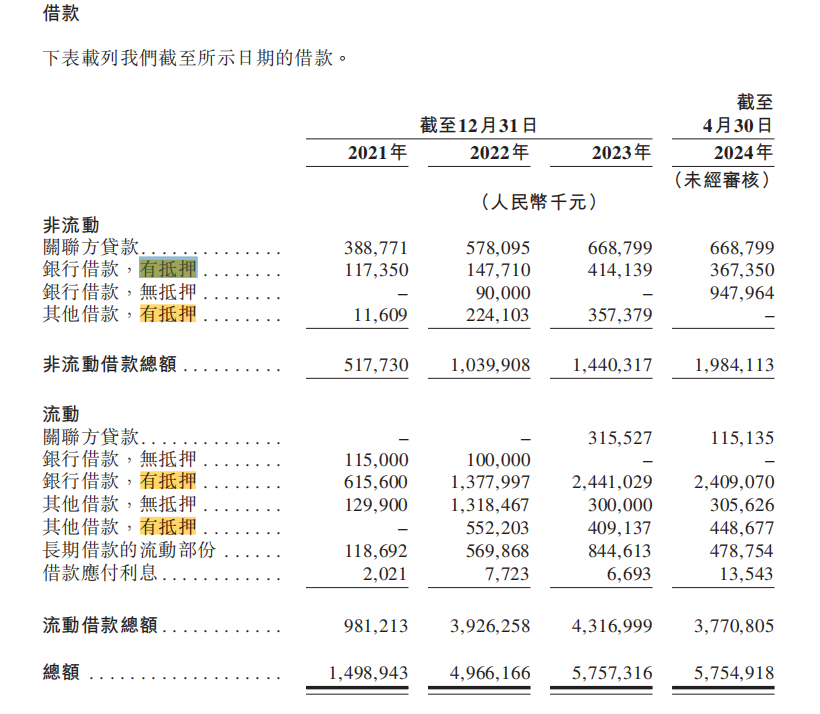

Various signs indicate that this somewhat "innocent" newcomer has encountered a major financial crisis. But did you know: At the end of last year, Nezha Auto had nearly 3 billion yuan in cash on its books, and in just the second quarter of this year, it raised over 4 billion yuan through equity and debt financing. Details are as follows:

Image source: Nezha Auto prospectus

And then, Nezha Auto suddenly ran out of money.

Is it because Nezha Auto was burning through cash too quickly, or are there other hidden factors? We won't speculate, but the companies that lent money to Nezha Auto in the second quarter may be in for a tough time.

The largest creditor among these loans is Tongxiang Science and Technology Business Incubator Co., Ltd. (hereinafter referred to as Tongxiang Tech Incubator). Nezha Auto obtained a total of 1.3 billion yuan in long-term bank loans from the company in four installments, issued 940 million yuan in convertible bonds to the company in April, and subscribed to 1 billion yuan in ordinary shares in June.

In addition, Nezha Auto also obtained 400 million yuan and 477 million yuan in long-term loans from Zhejiang Tongxiang Rural Commercial Bank (hereinafter referred to as Tongxiang Rural Commercial Bank) and ICBC Shanghai Zhangjiang Technology Sub-branch, respectively, in June this year. After all, ICBC is a large bank, and even if there is a risk with the 400 million yuan loan, it will not significantly impact the overall situation, at most causing discomfort at the sub-branch level. However, this is not the case for Tongxiang Rural Commercial Bank.

According to the official website of Tongxiang Rural Commercial Bank, the bank was established on December 9, 2004, officially inaugurated on February 21, 2005, and transformed into a rural commercial bank on March 10, 2016. Currently, the bank has 16 sub-branches and one business department, with a total of 59 business outlets. As of the end of 2022, the bank had a deposit balance of 58.646 billion yuan and a loan balance of 48.125 billion yuan, making it a relatively large financial institution in terms of deposit and loan scale in the city.

Based on the data at the end of 2022, these loans accounted for approximately 0.81% of Tongxiang Rural Commercial Bank's loan balance.

Attentive readers may have noticed that a large portion of Nezha Auto's financing in the second quarter of this year came from Tongxiang Tech Incubator and Tongxiang Rural Commercial Bank. What is the magic of Nezha Auto for Tongxiang City?

On the one hand, the Tongxiang City Finance Bureau indirectly holds a 4.44% stake in Nezha Auto. The major shareholder of Tongxiang Tech Incubator, which frequently extended assistance to Nezha Auto in the form of equity and debt in the second quarter of this year, is also the Tongxiang City Finance Bureau.

On the other hand, Nezha Auto's vehicle manufacturing plant is located in Tongxiang City. It is conceivable that for a county-level city with a permanent resident population of just over 1 million, Nezha Auto, which once appeared as a promising newcomer in the automotive industry, was quite attractive. Perhaps there were also hopes that Nezha Auto could boost local employment and the economy.

However, based on the current situation, it seems like a misplaced bet.

Before the crisis erupted, Nezha Auto's executives were calmly engaging in "slacking off" activities. It's unclear how shareholders and creditors feel about this.

However, the extent to which Nezha Auto's financial crisis will impact Tongxiang Tech Incubator and Tongxiang Rural Commercial Bank remains unclear. The good news is: Based on past data, Nezha Auto had pledged bank loans of approximately 2.776 billion yuan at the end of April 2024. The bad news is: From 2021 to 2023, Nezha Auto's pledged bank loans and other loans have been increasing continuously, reaching 3.225 billion yuan by the end of April 2024.

So, will the loans issued by Tongxiang Tech Incubator and Tongxiang Rural Commercial Bank in April 2024 be secured? We really don't know.

In the article "How Much Money is Needed to Save Nezha Auto?", we arrived at a conservative conclusion through estimation that "(Nezha Auto) will need a multi-billion yuan capital injection to safely navigate through 2024."

However, as mentioned above, despite raising over 4 billion yuan in financing in just the second quarter, Nezha Auto still faced a financial crisis in October. Therefore, we need to apologize here: Sorry, although we knew that a multi-billion yuan injection would be a conservative estimate for Nezha Auto to survive 2024, it was indeed too conservative.