Car makers are in a frenzy of promotions, who is most likely to achieve their annual sales KPI?

![]() 11/12 2024

11/12 2024

![]() 641

641

Competition in the domestic automobile market is visibly intensifying.

©TMT Planet Original · Author|Huang Yanhua

As the year-end approaches, car makers are really "going all in"!

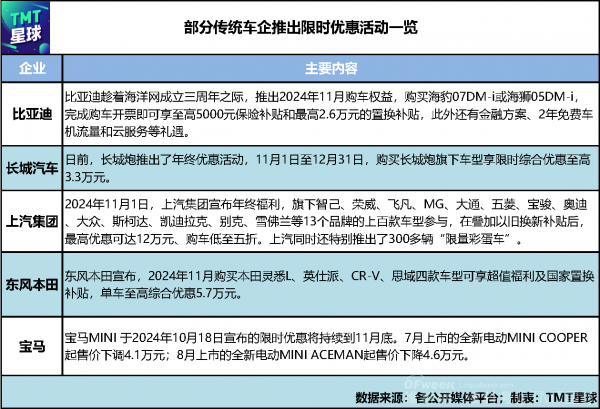

TMT Planet has noticed that since November, both traditional automakers and new force brands have unanimously launched limited-time discount promotions, involving at least hundreds of models, with some models offering discounts of up to 120,000 yuan.

Currently, how are car makers faring in achieving their annual sales targets? Amidst the crazy promotions, who is most likely to achieve their annual sales KPI?

01

Car makers are in a frenzy of promotions

Starting from November, the automotive industry has entered a new round of promotional fever. An increasing number of car makers are introducing limited-time discount promotions. According to TMT Planet's observation, more than a dozen car makers with over a hundred models are participating, with some models offering discounts of up to 120,000 yuan.

First, let's look at traditional automakers. On November 1, SAIC Motor announced year-end benefits, with over a hundred models from 13 brands participating. After combining trade-in subsidies, the maximum discount can reach 120,000 yuan, with car purchases available at up to a 50% discount;

BYD launched a November car purchase benefit, offering up to 5,000 yuan in insurance subsidies and up to 26,000 yuan in trade-in subsidies for the purchase of the Seal 07DM-i or Sea Lion 05DM-i upon completion of car purchase invoicing;

Recently, Great Wall Motors launched a year-end promotion, offering a limited-time comprehensive discount of up to 33,000 yuan for the purchase of models under the Great Wall Pickup brand from November 1 to December 31;

...

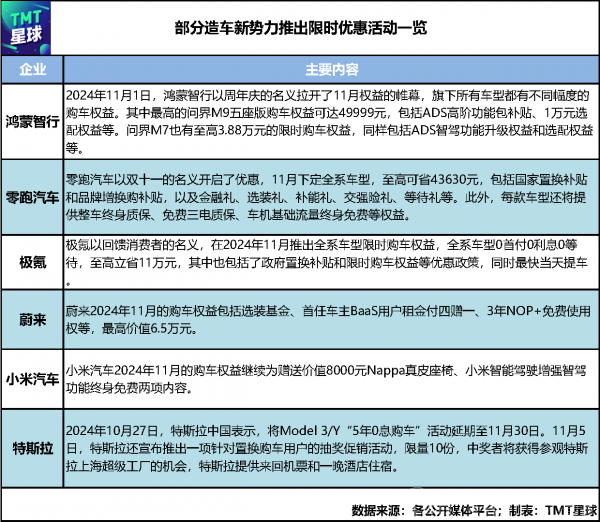

Next, let's consider the new force in car manufacturing. On November 1, Hongmeng Zhixing kicked off November benefits in the name of its anniversary, with all models offering varying degrees of car purchase benefits, such as up to 49,999 yuan for the AITO M9 five-seater version, including subsidies for the ADS advanced function package and a 10,000 yuan optional benefit;

Leap Motor initiated discounts in the name of Singles' Day, offering savings of up to 43,630 yuan for bookings of all models in November, including national trade-in subsidies, brand trade-in and upgrade subsidies, as well as financial gifts, optional gifts, energy replenishment gifts, compulsory traffic insurance gifts, and waiting gifts;

ZEEKR launched limited-time car purchase benefits for all models in November 2024 in the name of rewarding consumers, offering 0 down payment, 0 interest, and 0 waiting time for all models, with savings of up to 110,000 yuan;

...

So, why are car makers rushing to launch crazy promotions at this time?

In TMT Planet's view, there are three main reasons: Firstly, consumer demand for car purchases is usually stronger at the end of the year, as they are aware that buying a car during this period is relatively more cost-effective, and car makers can meet this psychological demand of consumers by launching promotional policies.

Secondly, with the continuous development of the automotive market, competition is intensifying, prompting car makers to introduce promotional policies to a certain extent. More importantly, such promotions can not only attract potential consumers but also enhance the brand awareness and even market share of car makers.

In addition, as everyone knows, each car maker usually sets an annual sales target, and the end of the year is an important time node for evaluating sales performance. Therefore, to achieve sales targets, car makers often launch a series of promotional activities at the end of the year to stimulate sales growth.

02

Who is most likely to achieve their annual sales KPI?

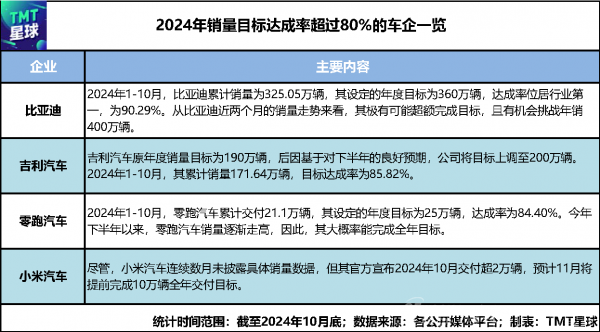

According to the schedule, car makers should typically complete more than 80% of their annual sales targets in the first ten months.

However, TMT Planet's review found that as of the end of October 2024, only a handful of car makers, such as BYD, Geely, and Leap Motor, had completed 80% of their annual sales targets.

Among them, BYD had the highest sales target achievement rate at 90.29%. Moreover, judging from BYD's sales trend in the past two months, it is highly likely to exceed its target and has the opportunity to challenge annual sales of 4 million vehicles.

Close behind is Geely Auto, with cumulative sales of 1.7164 million vehicles in the first ten months of this year, achieving a target completion rate of 85.82%.

Leap Motor ranks third in sales target completion rate, with cumulative deliveries of 211,000 vehicles from January to October 2024, achieving a rate of 84.40%. Since the second half of this year, Leap Motor's sales have gradually increased, so it is highly likely to achieve its annual target.

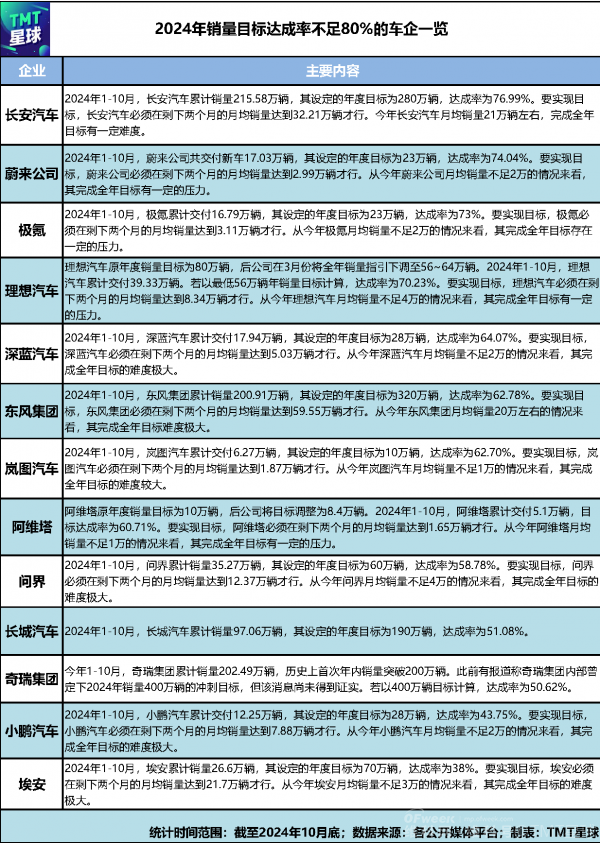

The vast majority of car makers have not completed their sales targets on schedule.

Specifically, car makers with sales target achievement rates between 50% and 80% include Changan (76.99%), NIO (74.04%), ZEEKR (73%), Lixiang One (70.23%), ARCFOX (64.07%), Dongfeng (62.78%), Lantu (62.70%), AVATR (60.71%), and AITO (58.78%). Car makers with sales target achievement rates below 50% include XPeng (43.75%) and Aion (38%).

03

Conclusion

At the end of the year, it is understandable for car makers to resort to "mega promotions" to accelerate sales, but they should not become overly obsessed with sales figures.

After all, for most car makers, especially new force brands, compared to impressive sales figures, how to "survive" in the increasingly fierce market competition may be more important.

If car makers want to win in the marketing battle, in addition to building concepts around scenarios, they must still return to the product itself. Only marketing that meets consumer needs can ultimately convert traffic into sales.

*The lead image in the article is from the official website of Leap Motor.