Passenger car sales rose 10.7% in October: a false boom or a trend?

![]() 11/12 2024

11/12 2024

![]() 636

636

Author | Shen Tianxiang

Editor | Li Guozheng

Produced by | Bangning Studio (gbngzs)

On November 11, the China Association of Automobile Manufacturers released sales data for October 2024: In that month, China's automobile production and sales were 2.996 million and 3.053 million vehicles, respectively, representing month-on-month increases of 7.2% and 8.7%, and year-on-year increases of 3.6% and 7%.

Passenger cars performed particularly well, with sales of 2.755 million vehicles, a year-on-year increase of 10.7%. Among them, 2.289 million were domestic sales, and 465,000 were exports, both increasing by 10.7% year-on-year.

Double-digit growth was expected.

As early as the National Day Golden Week, signals of hot sales of new cars continued to emerge: BYD led the way with more than 160,000 orders in seven days, while Ideal, Wenjie, NIO, Li Auto, XPeng, and other brands also saw orders exceeding 10,000 units.

Since entering November, automakers have released hot sales posters. Notably, BYD's monthly sales exceeded 500,000 units for the first time, a year-on-year increase of 66.5%; Chery sold 272,000 new vehicles in October, a year-on-year increase of 35.9%, and its cumulative sales exceeded 2 million units for the first time this year.

Sales of new forces and new powers in the automotive industry have also surged. Ideal led the way with stable monthly sales of 50,000 units, followed by Huawei AITO, Aion, Li Auto, ZEEKR, XPeng, NIO, and Xiaomi, all exceeding 20,000 units. Notably, ARCFOX, VOYAH, AVATR, and IM Motors have all entered the 10,000-unit club.

In contrast, the commercial vehicle market appeared somewhat weak. In October, China's commercial vehicle sales were 298,000 units, a year-on-year decline of 18.3%. Among them, bus production declined but sales increased, while truck production and sales both fell by double digits. The core reason is insufficient demand for commercial vehicles across various industries.

The passenger car market was bustling in October. Is this a flash in the pan due to promotional sales, or a sign of a sustained warming in the automotive market?

Bonus in Intense Competition

A few days ago, XPeng announced a "Chip Renewal Plan" for old users, allowing them to upgrade their intelligent driving and cockpit chips through crowdfunding.

For intelligent driving, models with a single Orin chip can be upgraded to dual Orin chips for a fee; for the cockpit, models with an 820A chip can be upgraded to an 8295 chip for fees of 19,999 yuan and 4,999 yuan, respectively.

In August 2023, Mr. Zhen from Beijing purchased an XPeng G6 Pro for 235,000 yuan. As of November 10 of this year, it had traveled over 21,000 kilometers. According to the above policy, he spent 19,999 yuan to upgrade the intelligent driving chip and could now enjoy features such as City NGP and AI valet parking.

Attracted by the policy, he specifically inquired with XPeng sales and learned that his used car was worth about 150,000 yuan. With a same-brand trade-in subsidy of 5,000 yuan, a Beijing trade-in subsidy of 15,000 yuan, and a 3,000-yuan reduction for a 99-yuan small deposit, he only needed to add 20,000-30,000 yuan to trade in for the latest P7+ (priced at 198,800 yuan), which is not much different from the price of upgrading the chip.

Although the original price of the XPeng P7+ is lower than that of the XPeng G6, it has strong product capabilities. It is equipped with XPeng's AI Eagle Eye vision solution and comes standard with Turing AI advanced intelligent driving (NGP), covering both urban and highway scenarios. It is currently XPeng's most advanced intelligent driving solution.

With a similar cost of around 20,000 yuan, should one choose to upgrade the chip or buy a new car? Mr. Zhen's answer was, "If not now, when?"

It is indeed a good time to trade in or buy a new car.

On the one hand, as competition in the automotive market intensifies, more and more new cars compete on cost-effectiveness, with "high configuration at a low price" or "high configuration becoming standard" becoming the norm. Take intelligent driving as an example; what used to be available only on cars priced above 300,000 yuan is now available on cars priced around 200,000 yuan, which is a significant benefit for consumers.

On the other hand, driven by national policies for scrapping and replacing old vehicles with new ones, car buyers can receive subsidies of around 20,000 yuan, further lowering the threshold for car purchases.

According to data released by the Ministry of Commerce, as of October 24, 1.57 million applications for subsidies for scrapping and replacing old vehicles had been submitted nationwide, and 1.26 million applications for subsidies for replacing old vehicles with new ones had been submitted in various regions, with the number of subsidy applications growing rapidly.

At the Annual Conference of the China Automobile Dealers Association held on November 7, Xu Changming, a senior economist at the State Information Center, stated that the subsidy policy for replacing old vehicles with new ones has had a significant effect, and domestic automobile consumer demand is gradually recovering. It is expected to bring about 1.4 million units of market increment throughout the year. He suggested continuing the subsidy policy for replacing old vehicles with new ones in 2025.

From multiple perspectives, the hot sales trend of passenger cars is expected to continue in the last two months of this year.

First, following past precedents, car purchase demand is strong in small cities and townships from the end of the year to the Spring Festival. As the weather turns colder and migrant workers gradually return home, car purchase enthusiasm in rural areas will gradually increase, and the new energy vehicle and low- to mid-range gasoline vehicle markets will usher in a wave of excitement.

Second, consumer confidence has been greatly enhanced due to pro-consumption policies and recent strong growth in the stock market. At the same time, as the subsidy policies for scrapping and replacing old vehicles with new ones enter their final stages, provincial trade-in subsidy policies may further relax requirements, which is conducive to the continuous increase in current automobile retail sales.

Third, at the end of the year, to boost sales, manufacturers will launch various promotional policies. For example, during this year's "Double 11" shopping festival, manufacturers and dealers offered significantly larger promotions than in previous years. Car buyers can enjoy not only national and local subsidies but also various forms of concessions from manufacturers.

It should be noted that when buying a car, one should not blindly seek low prices but should pay more attention to whether the quality and brand are sustainable. Otherwise, once the production enterprise encounters difficulties, the ultimate loser will be the consumer.

Differentiation is becoming more pronounced

Whether it is national policy support or manufacturers' crazy concessions, they are not fundamental solutions to maintaining automobile sales. Looking ahead to 2025, the differentiation in the automotive market will become increasingly apparent, and the elimination race will become increasingly brutal.

First, new energy vehicles versus gasoline vehicles.

The shrinking share of gasoline vehicles is irreversible. According to data from the China Passenger Car Association, in October, conventional gasoline vehicle retail sales were 1.066 million units, a year-on-year decrease of 16.1%; from January to October, retail sales were 9.508 million units, a year-on-year decrease of 16%.

In contrast, the retail penetration rate of domestic new energy vehicles in October was 52.9%, an increase of 15% from the same period last year. From January to October, new energy vehicle retail sales were 8.327 million units, a year-on-year increase of 39.8%. BYD, which only sells new energy vehicles, has become China's largest automaker.

From the market perspective, it is difficult for new gasoline vehicles to become bestsellers, while new energy vehicles frequently become hits. For example, BYD Song family sales exceeded 100,000 units in a single month, setting a new market record; XPeng P7+ received over 30,000 large orders on its first day of availability; AION RT received over 40,000 orders within 18 hours of its launch...

Second, domestic brands versus joint venture brands (including luxury brands).

Amid the waves of new energy, intelligence, and accelerated overseas expansion, the sales share of Chinese brand automobiles has further expanded, while the share of joint venture brands has gradually shrunk. According to data from the China Association of Automobile Manufacturers, in October, domestic brand passenger car sales were 1.931 million units, a year-on-year increase of 30%; their share reached 70.1%, a year-on-year increase of 10.4%.

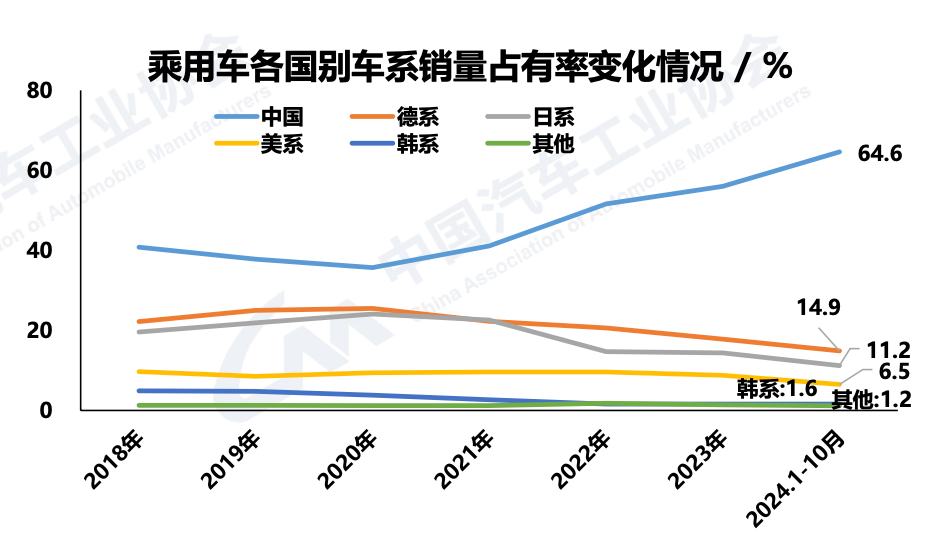

From January to October, the sales share of domestic brand passenger cars was 64.6%, a year-on-year increase of 9.3%. In contrast, the share of German brands was 14.9%, Japanese brands was 11.2%, American brands was 6.5%, Korean brands was 1.6%, and others was 1.2%.

Data from the China Passenger Car Association also shows the same trend. In October, mainstream joint venture brand retail sales were 570,000 units, a year-on-year decrease of 17%. Among them, the German brand retail share was 15.8%, a year-on-year decrease of 2.3%; the Japanese brand retail share was 12.9%, a year-on-year decrease of 4.8%; and the American brand retail share was 4%, a year-on-year decrease of 2.1%.

For luxury brands, 210,000 luxury vehicles were sold in October, a year-on-year decrease of 7% and a month-on-month decrease of 15%, with a retail share of 9.2%, a year-on-year decrease of 4%. The retail share of the traditional luxury vehicle market has declined significantly. From the terminal perspective, incidents such as dealership closures and bankruptcies have emerged one after another.

Third, price segments.

According to data from the China Association of Automobile Manufacturers, among conventional fuel passenger cars, sales in the 80,000-100,000 yuan, 150,000-200,000 yuan, and 400,000-500,000 yuan price ranges showed year-on-year positive growth, while sales in other price ranges showed negative growth. Sales are still concentrated mainly in the 100,000-150,000 yuan price range.

Among new energy passenger cars, except for the 400,000-500,000 yuan price range, which showed a year-on-year decrease in sales, sales in other price ranges showed positive growth. The price range above 500,000 yuan showed the largest increase, and sales are currently concentrated mainly in the 150,000-200,000 yuan price range.

Catalyzed by new energy and intelligence, the premiumization of Chinese brand passenger cars has become increasingly apparent, giving birth to a batch of "new luxury" brands. According to data released by AITO on November 11, sales of the Wenjie M9, priced at 469,800-569,800 yuan, exceeded 170,000 units, making it the sales champion among models priced above 500,000 yuan.

The Chinese automobile market has rapidly transitioned from the first half focused on electrification to the second half focused on intelligence. Many industry insiders believe that 2025 will be a watershed year, and smart electric vehicles will gradually gain greater influence.

Some are happy, while others are sad. Where should brands with weaker intelligence levels go from here?