Audi and Nissan "slim down", how do multinational automakers survive the winter?

![]() 11/13 2024

11/13 2024

![]() 537

537

Lead

Recently, multinational automakers and parts giants have been laying off employees continuously, and the global automotive industry is experiencing a cold spell.

Produced by|Heyan Yueche Studio

Written by|Zhang Dachuan

Edited by|Heyan

2054 words in full text

4 minutes to read

Since the beginning of this year, multinational automakers have joined the ranks of layoffs successively.

Recently, media reports have claimed that Audi plans to reduce the number of non-production jobs in the future. This will result in Audi cutting 4,500 jobs in Germany alone. In addition, Audi will also shut down its Brussels plant, which produces the Audi Q8 e-tron, by the end of February next year. Apart from Audi, another shock to the world is Nissan, which has also publicly announced plans to reduce global production capacity by 20% and lay off up to 9,000 employees. Earlier, layoff plans from German automotive parts giants such as Schaeffler, Bosch, and ZF have also been made public. The continuous layoffs indicate that the winter in the global automotive industry has arrived.

△The Brussels plant producing Audi Q8 e-tron will be closed by the end of February next year

Significant decline in Audi and Nissan's performance

The root cause of Audi and Nissan's layoffs lies in their significant performance decline. According to Audi's financial report, in the just-concluded third quarter, its operating profit plummeted by 91% to €106 million.

Nissan shares Audi's plight. As of September, Nissan's sales for the first half of the fiscal year were 5.98 trillion yen, a year-on-year decrease of 1.3%; operating profit fell by 90.2% to 32.91 billion yen, and net profit decreased by 93.5% to 19.22 billion yen. To reverse this situation, Nissan not only canceled its interim dividend for 2024 but also plans to sell its stake in Mitsubishi Motors from the current 34% to 24%, thereby obtaining 68 billion yen in liquidity. Nissan's President Makoto Uchida even voluntarily took a 50% pay cut to demonstrate his determination to stand with the company through thick and thin.

△Nissan's President Makoto Uchida voluntarily took a 50% pay cut to appease shareholder and employee dissatisfaction

Judging from the current situation, the trend of global multinational automakers focusing on full-stack independent research and development of core technologies or seeking strategic partners to increase independent research and development efforts is unlikely to change in the short term. This means that major automakers will continue to invest heavily in the research and development of underlying technologies such as pure electric platforms, intelligent driving, power batteries, and new electronic and electrical architectures. Investments in these areas often exceed tens of billions and are not accomplished overnight. With a significant decline in profits, if companies want to continue such investments, the financial report pressure on each company will be enormous every quarter. Poor financial performance will put pressure on stock prices.

△While profits decline significantly, automakers must maintain investment in core technologies

Pressure on major markets

The difficulties faced by multinational automakers are largely related to their poor performance in several major global markets.

Data shows that Audi's deliveries in the US market fell by 21% to 46,752 vehicles. In the Chinese market, new forces represented by Li Auto, Wenjie, Zeekr, NIO, and others have impacted luxury brands like BBA, and consumers' car-buying preferences have shifted. As for Audi's home market, the European automotive market, it is likely to struggle to make up for its decline in the Chinese and American markets due to the slow economic recovery in Europe.

△In the domestic market, new forces have diverted sales that originally belonged to luxury brands

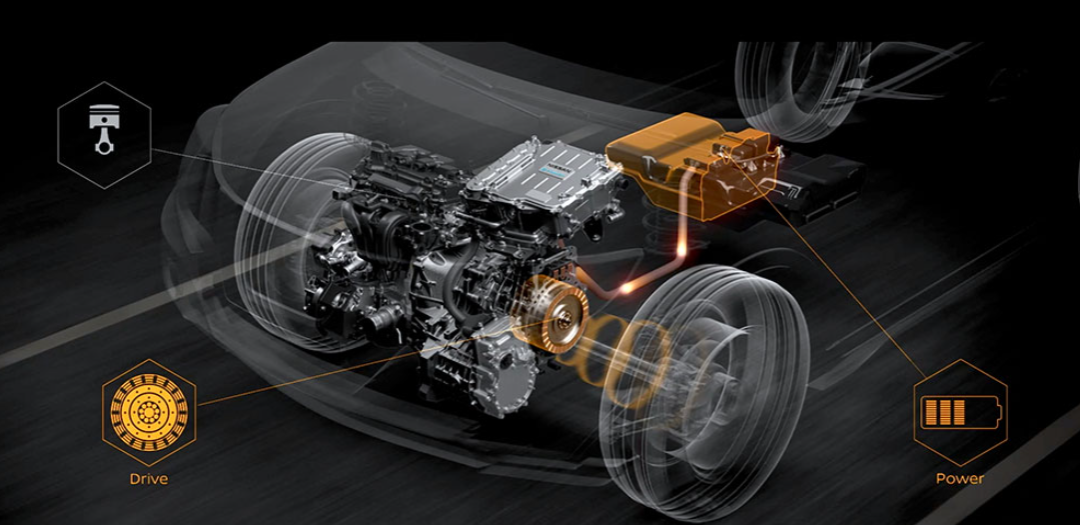

As for Nissan, it is struggling in its two most important markets, China and the US. In the domestic market, under continuous pressure from domestic brands, Nissan's sales in the first half of this year decreased by 10% year-on-year. Especially in October, sales of Dongfeng Nissan, Nissan's main joint venture in China, fell by more than 25%. In the US market, Nissan's aging models led to inventory exceeding 100 days. For the currently popular hybrid models in the US market, Nissan lacks product layout, leaving it helplessly watching competitors seize its market share. To address this, Nissan has resorted to significant discounts in the US to stimulate sales, which has become the final straw that crushed Nissan's profits.

△e-POWER is the key to Nissan's turnaround in the US market

How to reverse the situation?

The most direct way to reverse the current situation is to introduce competitive models to the market.

Taking Nissan as an example, in China, it will accelerate the introduction of new energy vehicles, while in the US, it will promote plug-in hybrid and e-POWER technology. However, before launching new vehicles, a long period is required from research and development to production and delivery. In such cases, layoffs and cost reductions can slow down the group's cash consumption and buy time for the launch of new models.

However, in the domestic market, Nissan must not only compete with local giants like BYD and Geely in terms of cost but also with Huawei and XPeng in intelligent driving technology. With giants like Volkswagen, General Motors, and Toyota struggling, it is conceivable how difficult it will be for Nissan to break through. In the US market, Nissan faces equally fierce competition. Although high tariffs prevent Chinese automakers from participating, Tesla, the Big Three American automakers, and other giants are not easy to deal with.

△Chinese automakers have obvious advantages in vehicle costs and supply chains

Perhaps adopting Chinese technology is a corporate strategy Nissan needs to consider next. To reverse the situation, Audi has leveraged its joint venture partner SAIC's platform and intelligent driving technology to launch a new Audi-branded electric vehicle, becoming its trump card against new forces in the automotive industry. Toyota has participated in multiple funding rounds for intelligent driving companies like Momenta and Pony.AI. Volkswagen and Stellantis have invested heavily in XPeng and NIO, respectively. For Nissan, it can also consider this model and seek deeper cooperation with Dongfeng or domestic new forces in the automotive industry.

△Cooperation with Chinese automakers is one way for multinational automakers to break through

Commentary

Currently, the domestic automotive market is undergoing a profound reshuffle. Not only are new forces in the automotive industry falling one by one, but traditionally weaker domestic and joint venture brands are also on the verge of collapse. Globally, this situation is no different. Under the combined impact of a weak global automotive market and the rise of Chinese automakers, if multinational automaker groups continue to cling to outdated methods and merely cut costs through layoffs, this approach is unsustainable. Especially for German companies like Audi, Schaeffler, and Bosch, dealing with powerful labor unions is challenging, and the costs involved are certainly not small. Therefore, to reverse the situation in the shortest time, directly introducing mature and competitive Chinese technology may be an effective solution.

(This article is originally created by Heyan Yueche and may not be reproduced without authorization)