Chao Cao Travel Resubmits IPO Application to Hong Kong Stock Exchange: What Are Its Chances?

![]() 11/13 2024

11/13 2024

![]() 547

547

Source | Bidu Finance, part of the New Economy Observer Group

Author | Yanye

In recent years, as competition in China's ride-hailing market has intensified, related companies have turned to Hong Kong stocks for financing. Following the successful Hong Kong listings of DiDa Travel and Ruqi Travel in June and July 2024, respectively, Chao Cao Travel has recently updated its prospectus and is making another attempt at a Hong Kong listing.

In fact, Cao Cao Travel had already submitted an application to the Hong Kong Stock Exchange half a year ago but failed to go public as planned.

Source: Screenshot from Cao Cao Travel's prospectus

The latest prospectus reveals that compared to DiDa Travel and Ruqi Travel, Cao Cao Travel outperforms them in revenue scale but also suffers from alarming losses. From 2021 to the first half of 2024, Cao Cao Travel accumulated losses of nearly 8 billion yuan.

What worries the market even more is that in the era of ride-hailing stock competition, Cao Cao Travel insists on a heavy-asset model that not only fails to solve profitability issues but also heavily relies on third-party aggregation platforms for customer acquisition. Cao Cao Travel's IPO attempt may still face many uncertainties.

01

Positive First-Half Performance, Capital Relay, and Scale 'Foundation'

It is understood that Cao Cao Travel was "incubated" by Geely Holding Group in 2015, with ride-hailing services as its main source of income. Its main businesses include ride-hailing, carpooling, etc. Specifically for ride-hailing, it is further divided into value services and premium services.

According to Cao Cao Travel's updated prospectus, compared to six months ago, the company's core performance indicators such as revenue, gross profit, and net profit have improved.

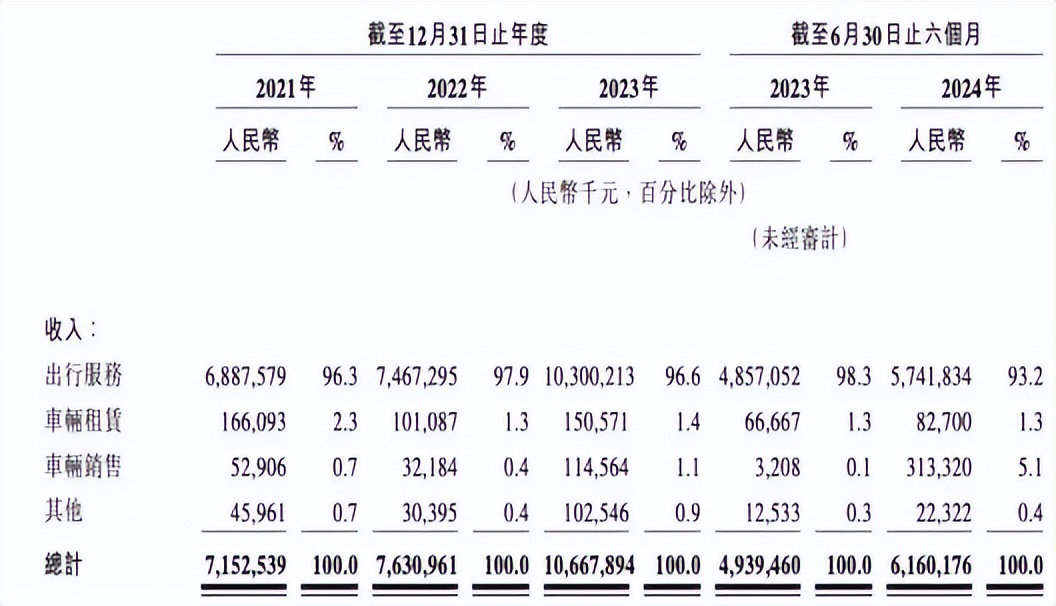

First, in terms of revenue, Cao Cao Travel has maintained double-digit growth. Prospectus data shows that from 2021 to the first half of 2024, Cao Cao Travel's revenues were 7.153 billion yuan, 7.631 billion yuan, 10.668 billion yuan, and 6.16 billion yuan, respectively. In the first half of 2024, its revenue scale increased by 24.7% year-on-year.

In terms of revenue structure, its sources of income are mainly divided into vehicle services, vehicle leasing, and vehicle sales. From 2021 to the first half of 2024, the revenue contribution of its travel services accounted for 96.3%, 97.9%, 96.6%, and 93.2%, respectively.

By comparing the data from the first half of 2023, it can be seen that in the first half of 2024, the revenue contributions of travel services and vehicle sales shifted, with the former decreasing and the latter increasing. The revenue contribution of vehicle leasing remained flat compared to the same period in 2023.

Source: Cao Cao Travel Prospectus

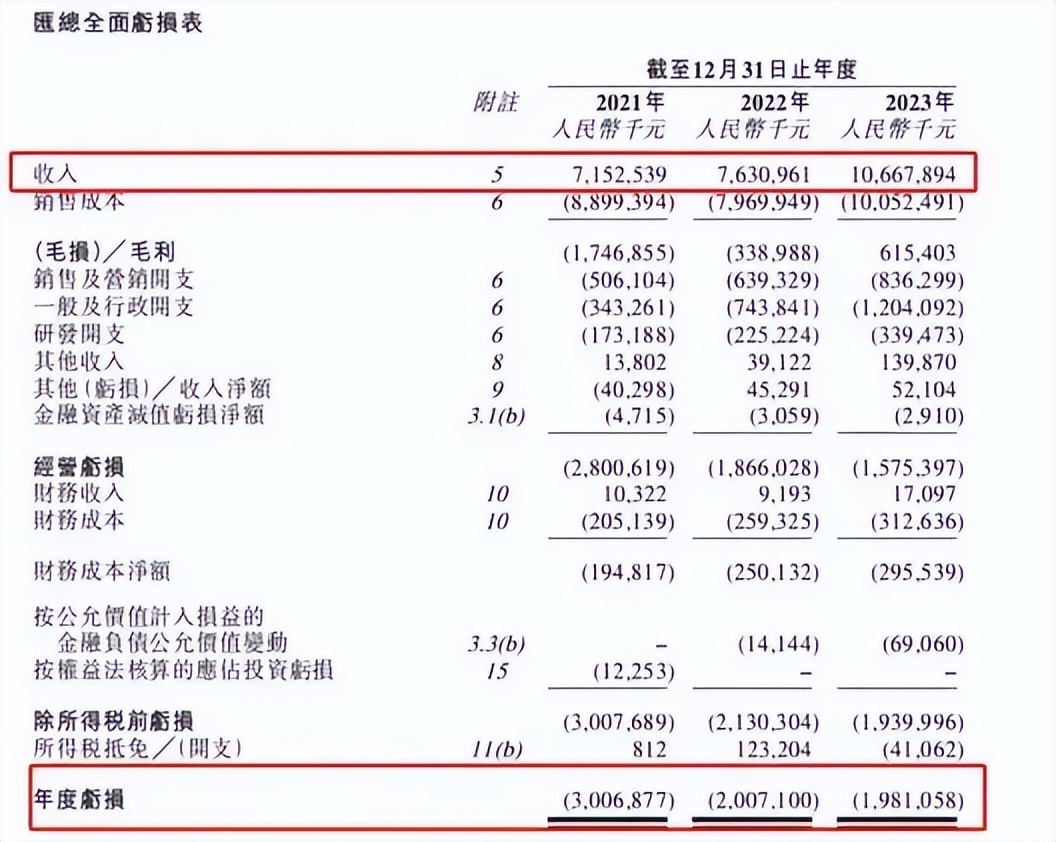

Secondly, Cao Cao Travel's gross profit "turned positive" in 2023. In the first half of 2024, its gross profit also increased significantly. Data shows that from 2021 to the first half of 2024, its gross profits were -1.747 billion yuan, -339 million yuan, 615 million yuan, and 428 million yuan, respectively; the corresponding gross profit margins were -24.4%, -4.4%, 5.8%, and 7%, respectively.

Thirdly, in terms of net profit, although Cao Cao Travel is still incurring huge losses, its losses in the first half of 2024 were 778 million yuan, narrower than the 1.272 billion yuan in the same period of 2023.

In terms of market size, Cao Cao Travel's position is also very solid. According to Frost & Sullivan, based on Gross Transaction Value (GTV), Cao Cao Travel has consistently ranked among the top three ride-hailing platforms in China in 2021, 2022, and 2023. For example, in 2023, Cao Cao Travel ranked third in the industry with a 12.2% market share.

Currently, Cao Cao Travel's market operations are still further expanding. Its operations cover 83 cities, and it has the largest customized fleet in China with over 33,000 vehicles in 29 cities.

Over the past few years, under the industry trend of the sharing economy, Cao Cao Travel's performance scale effect and model innovation, coupled with continuous improvement in its profitability indicators, have also enabled it to obtain multiple rounds of capital support before its IPO attempt. The prospectus shows that between 2017 and 2021, Cao Cao Travel conducted a total of three rounds of financing, raising approximately 2.8 billion yuan in total, with a pre-Series B valuation of 17 billion yuan.

It can be seen that Cao Cao Travel's revenue scale exceeding 10 billion yuan in 2023 and its pre-IPO valuation provide a solid foundation for its updated prospectus and another attempt at a Hong Kong listing.

02

Heavy-Asset Model: Cao Cao Travel Moves Forward with a Heavy Load

However, despite Cao Cao Travel's not insignificant GTV and revenue scale in the industry, it has consistently been in a state of loss. The reason is that Cao Cao Travel entered the ride-hailing market using Geely's automotive resources and a unique custom fleet model, which is relatively asset-heavy.

Facts have shown that this unique model, while quickly opening up the market for Cao Cao Travel, has also brought high operating costs. Over the past three years, Cao Cao Travel has paid a high price for this: excessive investment has swallowed up its profits, leaving Cao Cao Travel in a long-term loss state.

From 2021 to 2023, its losses were 3.007 billion yuan, 2.007 billion yuan, and 1.981 billion yuan, respectively, accumulating to nearly 7 billion yuan in losses over three years, with net loss rates of -42%, -26.3%, and -18.6%, respectively. Coupled with the losses in the first half of 2024, the total losses have approached 8 billion yuan.

Public data shows that Cao Cao Travel's custom vehicles were deployed in 2022, all of which are rechargeable and replaceable pure electric vehicles. The two custom vehicles operated are the Fengye 80V and Cao Cao 60. At the end of 2022 and 2023, custom vehicles accounted for 28.6% and 50.7% of Cao Cao Travel's operating fleet, respectively. As of the end of 2023, Cao Cao Travel had a fleet of about 31,000 custom vehicles, ranking first among ride-hailing platforms.

The large-scale custom fleet has also driven up Cao Cao Travel's operating costs. The prospectus shows that in 2023, the cumulative value of Cao Cao Travel's own vehicles among its non-current assets reached 2.469 billion yuan, an increase of over 300 million yuan compared to 2021's 2.166 billion yuan.

The corresponding purchase amounts paid to Geely Group and related parties for vehicle procurement (including custom vehicles) were 256 million yuan, 1.323 billion yuan, and 1.77 billion yuan, respectively, totaling approximately 3.3 billion yuan over three years. It is evident that since deploying custom vehicles, Cao Cao Travel's vehicle purchase costs have surged.

Although Cao Cao Travel has differentiated itself from other industry players through this approach and enhanced passenger riding experience through customized smart cars, achieving positive profitability may still rely on scale effects.

According to analysis, the main way for Cao Cao Travel to improve the unit economic benefits of its platform is to provide Total Cost of Ownership (TCO) optimization for drivers. According to Frost & Sullivan data, the estimated TCO of the Fengye 80V and Cao Cao 60 can be reduced by 30-40% compared to typical battery-swapping electric vehicles. However, TCO optimization has not yet resolved Cao Cao Travel's profitability issues.

In stark contrast, DiDa Travel, which operates with an asset-light model, achieved positive profitability as early as 2021, although its profitability scale is far less than that of Cao Cao Travel. According to DiDa Travel's prospectus data, from 2021 to 2023, DiDa Travel's revenue ranged between 560 million yuan and 820 million yuan, but its annual profits were 1.731 billion yuan, -188 million yuan, and 300 million yuan, respectively.

Source: Cao Cao Travel Prospectus

A horizontal comparison also reveals the pressure on Cao Cao Travel. For example, both Didi Chuxing, which rose through a platform model in its early years, and DiDa Travel, which operates with an asset-light model, have achieved profitability due to their lighter asset bases.

However, in terms of revenue scale, Didi, which comprehensively covers express, premium, carpooling, taxi, and other services, achieved a total revenue of 192.4 billion yuan in 2023, while DiDa, which mainly focuses on carpooling, achieved 815 million yuan. Ruqi Travel and Cao Cao Travel can be considered a pair of "troubled brothers."

Compared to Didi's more diversified revenue through its platform model, DiDa's profitability mainly relies on "tight budgeting." For example, in the first half of 2024, DiDa's sales and marketing expenses were 77.93 million yuan, a 49% decrease from the 150 million yuan in the same period of the previous year.

It can be seen that in terms of revenue scale and profitability, Cao Cao Travel is neither the best nor the worst. Cao Cao Travel's unique "custom fleet" model is a double-edged sword. While differentiating itself from other players, it also weakens its profitability.

03

Intensifying Competition in the Ride-Hailing Market: How Can Cao Cao Travel Break the Impasse?

As is well-known, with the integration of Didi and Kuaidi in the early years, major players have successively clustered for listings. The current ride-hailing market has entered its second half, and competition has become increasingly fierce.

It is noteworthy that in addition to DiDa Travel and Ruqi Travel, which completed their IPOs in 2024, Gaode Maps, which recently launched carpooling services nationwide, is also gaining momentum. At the same time, Xiangdao Travel, backed by SAIC Motor Corporation Limited, has also announced plans to prepare for an IPO in the second half of the year.

It is not difficult to foresee that while major players in the ride-hailing market compete for the terminal market, they are also engaged in a high-dimensional showdown at the capital level. The intensity of future industry competition is also conceivable.

In contrast, Cao Cao Travel, which is seeking an IPO at this time, may already have its arrow drawn and have no choice but to release it. Even if going public is difficult, not going public is even harder.

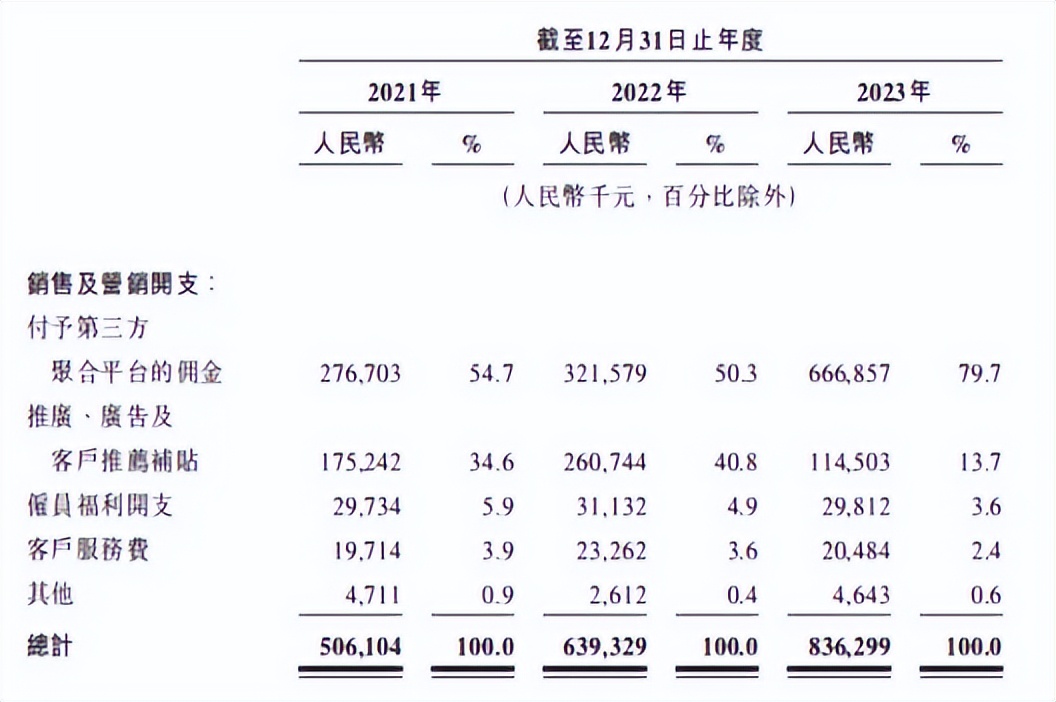

First, the intensifying industry competition has also forced Cao Cao Travel to increase its marketing and driver subsidies.

Data shows that from 2021 to 2023 and the first half of 2024, Cao Cao Travel's cost of sales were 8.899 billion yuan, 7.97 billion yuan, 10.052 billion yuan, and 5.732 billion yuan, respectively, accounting for 93%, 94.2%, 93%, and 93% of revenue, respectively. This means that most of the revenue is used to cover sales costs, leading to the company's persistent losses.

Most of these costs are spent on driver income and subsidies. Specifically, since its inception, Cao Cao Travel has paid over 30 billion yuan in service compensation to 3 million drivers.

Secondly, as the industry enters an era of stock competition, ride-hailing aggregation platforms represented by Didi and Gaode gradually dominate the industry. Cao Cao Travel's excessive reliance on third-party aggregation platforms cannot be ignored.

Especially when such platforms are also players in the ride-hailing market, Cao Cao Travel may even contribute to their growth and development, potentially even benefiting its competitors.

According to Cao Cao Travel's data, from 2021 to 2023, the commissions paid by Cao Cao Travel to third-party aggregation platforms were 270 million yuan, 320 million yuan, and 670 million yuan, respectively, accounting for 54.7%, 76.9%, and 79.7% of sales and marketing expenses. In the first half of this year, this expenditure increased from 300 million yuan in the same period last year to 430 million yuan this year, accounting for up to 83.6% of sales and marketing expenses.

Source: Cao Cao Travel Prospectus

Thirdly, under the heavy-asset model, Cao Cao Travel's growing fleet and driver scale also face potential risks related to driver compliance.

According to its financial reports, from 2021 to 2023 and the first half of 2024, the number of vehicles under the Cao Cao Travel brand that had not yet obtained transportation licenses accounted for 23.0%, 15.8%, 15.7%, and 8.7% of the total active vehicles, respectively.

As a result, Cao Cao Travel has been interviewed by relevant departments multiple times due to compliance issues.

For example, on November 1, the main responsible persons of four platforms, including Zibo Branch of Hangzhou Youxing Technology Co., Ltd. (Cao Cao Travel) and Zibo Branch of Nanjing Lingxing Technology Co., Ltd. (T3 Travel), were jointly interviewed by the Zibo Transportation Comprehensive Administrative Law Enforcement Detachment and the Zibo High-tech Zone Transportation Department.

On October 15, the special governance action work team for prominent issues in the road transportation field of Henan Province held a platform enterprise interview meeting in Zhengzhou. Relevant responsible persons from 35 ride-hailing (aggregation) platform companies, including Cao Cao Travel, T3 Travel, Bangbang Travel, and Gaode Dache, attended the meeting.

There are countless similar interview incidents.

Industry insiders generally believe that a relatively high proportion of drivers without transportation licenses poses certain compliance risks and may also become one of the factors affecting its IPO approval.

Accompanying Cao Cao Travel's N³ strategy released in earlier years, customized vehicles, new energy, and new ecosystems became its three development pillars, but this also burdened the company heavily.

Data shows that at the end of 2021 to 2023 and the first half of 2024, Cao Cao Travel's short-term debt and the short-term portion of long-term debt were 2.4 billion yuan, 3.5 billion yuan, 5.2 billion yuan, and 5.6 billion yuan, respectively, while the long-term portion of long-term debt was 1.4 billion yuan, 2.1 billion yuan, 2.4 billion yuan, and 2.9 billion yuan, respectively. This also means that Cao Cao Travel's strategy of breaking the impasse by connecting the industry ecosystem may face numerous challenges.

Conclusion

The development of the ride-hailing market has a long history. The industry has evolved into a market structure of "one superpower and multiple strong players." Didi Chuxing's industry position is unshakable, leaving mid-tier ride-hailing platforms reliant on third-party ride-hailing aggregation platforms for orders and struggling to survive in the cracks. Cao Cao Travel, backed by Geely and with a unique model, is no exception.

Facing the intense competition among major players in the industry, there are still many uncertainties regarding whether Cao Cao Travel, backed by Geely, can successfully go public. On the path to an IPO, Cao Cao Travel may not only face opportunities brought by capital but also the storms and shoals caused by these uncertainties.

*Disclaimer: Bidu Finance publishes this article for the purpose of conveying more information and does not constitute any advice.