Surrounding Land Rover Range Rover, gasoline vehicles are hard to sell for 1 million yuan

![]() 11/14 2024

11/14 2024

![]() 470

470

During a communication meeting in late 2022, a BYD executive told me that if we could overcome Toyota, the last tough nut to crack, we would have completely taken over the consumer market.

The Toyota tough nut he referred to was, of course, the Camry. In that year, Camry sales increased by 18.7% year-on-year, with a cumulative insured volume exceeding 250,000 units, surpassing all competitors at the same price and level, setting a new record for the highest sales volume.

However, as of 2023, with an increasing number of new energy vehicles in the same segment, the championship title now belongs to three BYD models. The price of Camry, which was once very resilient, has dropped by up to 9,000 yuan at launch compared to the previous model, and further decreased by 32,000 yuan in response to the price war.

Reflecting on the sales rankings, in October of this year, the mid-size car champions were BYD Qin Plus L and Seal 06, with Camry ranking fifth.

When there is a siege phenomenon in the automotive market, it is not just a superficial increase in consumer choices and a redistribution of sales, but a convergence of trends. As the market shifts from gasoline vehicles to new energy vehicles, the discourse power shifts from multinational brands to Chinese brands, leading to a market reshuffle.

Moreover, the upcoming situation will be that not only Huawei and Li Auto have made achievements above the 400,000 yuan price point with models like AITO Askev and Li Xiang L9. With Land Rover Range Rover now under "siege," new energy vehicles are starting to encroach on the last remaining strongholds of gasoline vehicles.

Six new Range Rover-style vehicles priced below 300,000 yuan

In the automotive market in 2024, the siege involves both same-segment, same-price competition and same-segment, cross-price competition.

The former just occurred at the end of September, two months ago. At the end of September, Model Y was under siege, with Chinese brands such as Zeekr R7, ARCFOX G7X, Ledao L60, IM Motors LS6, and AVATR 07 playing leading roles.

The trend is that after acquiring the corresponding technical reserves and breakthroughs, Chinese brands have begun to challenge Tesla simultaneously. The current visible result is that Tesla China's retail sales in October decreased by 43.9% month-on-month, unexpectedly falling out of the top five. Its ranking dropped from fourth in September to seventh. However, this is only a short-term result, as some suggest that Tesla has exported most of its Model Y and Model 3 vehicles to avoid EU tariffs in advance, leading to a reduction in supply in the Chinese market and affecting sales.

From the end of November to the first half of 2025, the main target under siege will gradually become the Land Rover Range Rover. The leading Chinese brands at the end of November will be FANGCHENGBAO Leopard 8, DENZA N9, GAC Motor S7, Lynk & Co L946, as well as new SUVs from Geely and Zeekr.

The current situation that can be determined is that new Chinese models will achieve all the functions and features of million-yuan vehicles at half the price, providing a cheaper alternative or even surpassing them.

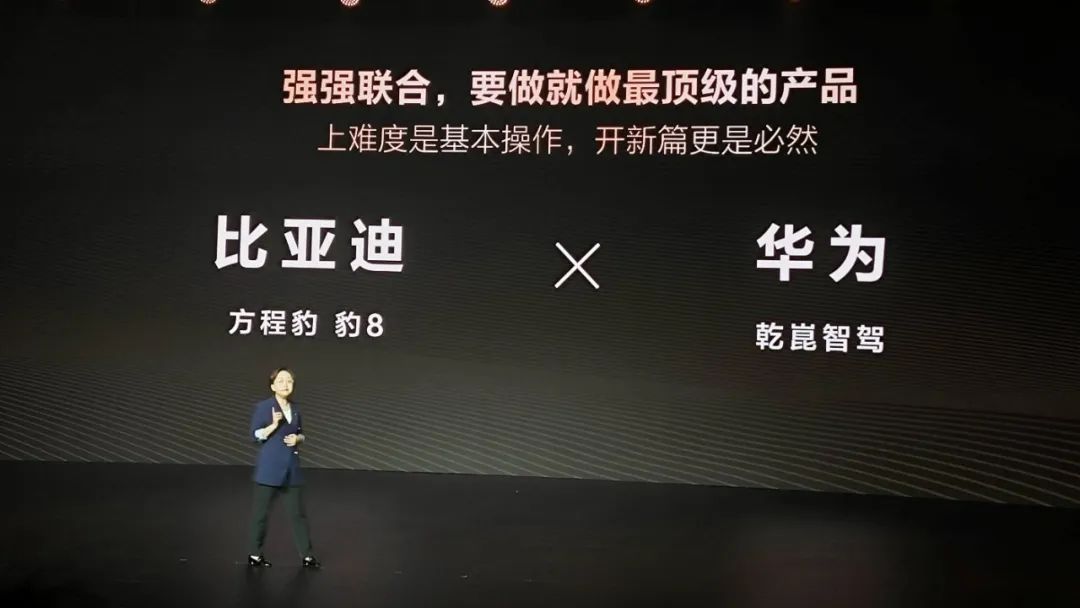

Taking the launch of FANGCHENGBAO Leopard 8 as an example, its highlights are clearly visible. It marks the first collaboration between China's two technology giants, bringing the latest and most advanced technologies to fruition. These include but are not limited to BYD's DM-o longitudinal plug-in hybrid, which combines all the highlights of DM-i and DM-P, Huawei's Kunlun Intelligent Driving ADS 3.0, an AI smart cabin, a BYD 9000 chip with a 4nm process, and BYD CloudRide-P suspension.

In terms of power, it boasts a combined power output of 550kW, a maximum torque of 760N·m, a 0-100km/h acceleration time of 4.8 seconds, and a fuel consumption of 8.5L/100km in electric mode.

Ultimately, with a price range of 379,800 to 407,800 yuan, coupled with its luxury features, it directly competes with BBA and Toyota Prado, and may even threaten higher-priced models like the Land Rover Range Rover in the future.

The reason is similar to BYD's repeated success in recent years, first defeating models like the Corolla, Lavida, and Sylphy, and then surpassing the Camry and Magotan.

As long as it can achieve a comparable or superior experience at a favorable price, this is the iron law of market competition. Apart from FANGCHENGBAO Leopard 8, the other new models can also bring about similar changes in experience.

DENZA N9 will make its debut at the Guangzhou Auto Show. Its design is no longer a secret, with a commanding presence reminiscent of the Land Rover Range Rover. It features a spacious interior, advanced intelligent driving, and a smart cabin. If FANGCHENGBAO Leopard 8's competitive model is off-road with luxury assistance, then DENZA N9 is luxury with off-road assistance.

The launch of GAC Motor S7 is similar. The official image is a side view, which has been directly compared to the Range Rover. It will feature the third-generation hybrid technology. Considering GAC Motor's brand positioning, it is likely to be priced between 200,000 and 300,000 yuan. As for why it won't be higher, it's because GAC Motor's more premium AION brand has already unveiled its HL model, which is expected to compete with AITO Askev M9.

Geely has three major moves up its sleeve. One is a large SUV showcased at the April auto show, possibly called Geely Galaxy L9. Another is the Lynk & Co L946, which is already in the bidding process and expected to be launched in March-April next year. The third is Zeekr, which officially announced its entry into the electric hybrid market this year, possibly with an extended-range model.

Geely's three models are targeted at AITO Askev M9, Land Rover Range Rover, and Rolls-Royce Cullinan, respectively. It is highly likely that all four-motor models will be priced below 500,000 yuan.

Luxury vehicles depreciate, making it difficult to sell for 1 million yuan in the future?

With AITO Askev M9 as a precedent, the subsequent expectations are not difficult to analyze.

After maximizing configuration and technology expectations, newly launched Chinese vehicles, having been set up with traditional key indicators (performance, acceleration, space, seat comfort) in mind, indeed live up to the slogans shouted by Yu Chengdong and Li Xiang at various press conferences, such as "the best under 5 million" and "redefining luxury under 10 million."

However, it's not a complete picture. Adding elements like being the best for family use and defining luxury vehicles' intelligence would be closer to the truth.

Regardless, when there are substantial changes in market sales figures, consumer perceptions will quickly be reshaped.

For example, taking the locally produced BMW X5 as a sample, in January of this year, its sales volume was 11,935 units. However, after AITO Askev M9 started delivery in February, there was a noticeable shift in their sales trends.

Starting from April, AITO Askev M9's sales climbed from less than 6,000 units to over 15,000 units, while BMW X5's sales fell below 8,000 units starting from the same month. Additionally, AITO Askev M9 maintained its price, while BMW X5 offered discounts.

The cases of Audi Q7 and Li Xiang L9 follow the same logic. Starting from the year Li Xiang was launched in 2022, Audi Q7's sales declined, losing its core competitiveness in the market above 500,000 yuan.

However, this is not solely due to the improved product strength of Chinese vehicles but also includes the impact of the global economy due to the aftermath of the pandemic, the Russia-Ukraine war, etc., in short, a decrease in luxury consumption.

For example, in the first half of this year, sales of the Mercedes-Benz S-Class declined in all major markets. Specifically, sales in the Chinese market fell by 13% year-on-year to 10,430 units; in the US, they fell by 19% to 5,026 units; and in Europe, they fell by 27% to 4,249 units.

As a result, the latest news is that a company spokesperson told foreign media that the S-Class will be produced in a single shift at Plant 56 in Sindelfingen, which has been underutilized for months due to declining demand.

However, a few models can still stand out due to their strong product capabilities, unique product positioning, and corporate strategies. For example, in the first half of 2024, global sales of the BMW 7 Series increased by 22% year-on-year compared to 2023.

The same is true for the Range Rover under siege this time. In 2023, the cumulative sales of the Range Rover and Range Rover Sport exceeded 25,000 units, an increase of 31% year-on-year; the Defender's cumulative sales approached 20,000 units, an increase of 59% year-on-year.

In other words, as gasoline vehicles transition to new energy vehicles, although the flagship models of top luxury brands have deeper moats, the trend of being chased from behind is also evident. Usually, facing increased market competition pressure, as long as the overall cost is controlled and the price is lowered, the corresponding sales level can be maintained.

However, going forward, there will be both sieges and more variables. How long traditional million-yuan luxury vehicles can maintain their vitality will be a big topic of discussion.

For example, Huawei's fourth-generation premium model, which is likely to be unveiled during the Guangzhou Auto Show, has many technical features that have been relatively clearly dissected.

If it only features rear-wheel steering, a virtual chassis control system, longer range, a better electric platform, and a pure-blood HarmonyOS, it would not be enough to support its preset definition as a million-yuan luxury vehicle.

Even the currently speculated air imaging technology, which allows image projection without a rear screen and provides visual gaze control functions, is not sufficient to justify its million-yuan price tag.

The biggest selling point of the premium model actually lies in Yu Chengdong's public statement at the Intelligent Automobile Conference not long ago. Huawei is expected to complete the commercialization of L3 autonomous driving by 2025, with many scenarios covered on highways and pilot projects in urban areas.

So, according to another plan of Huawei's BU for vehicles, ADS3.0 is accelerating iteration after introducing end-to-end technology. Version 3.1 has already been pushed out, and 3.2 is already undergoing small-scale user testing. According to the relevant publicly announced plans, ADS4.0 is expected to be fully implemented by 2025.

Much of the above information points directly to one fact: Huawei's top-tier models are expected to gain a significant market competitive edge through autonomous driving by 2025.

For multinational automakers, regarding application efficiency and capability in this area, with the exception of Mercedes-Benz and BMW, which have already obtained licenses and achieved practical results, there are question marks over the others.

Therefore, how long can the prices of luxury cars priced at over a million yuan remain firm? Most people already have their expectations.

Final Thoughts

With advancements in motor and battery technology, the growth of extended-range and plug-in hybrid vehicles, and increasingly stringent global engine emission regulations, the premium pricing power of top-tier luxury cars derived from their engines has begun to decline significantly. As new models like the Range Rover continue to hit the market, especially hardcore competitors like the FANGCHENGBAO BAO 8, the moat surrounding driving and off-roading will gradually be filled in.

An even more interesting development will be that if fuel vehicles fall from their crown position above the million-yuan mark, based on the current competitive trends in new energy vehicle models, not many will be able to climb to the top. The reason is that after entering the smartphone competition logic, products from various manufacturers are becoming increasingly homogeneous, and substitutability is growing.

The smaller the differences, the more competitive the market, and the more transparent prices become. Therefore, the upcoming situation will not only involve the depreciation of million-yuan luxury cars but may also lead to the shrinkage of the entire million-yuan market.