Under the impact of the auto price war, the profit per vehicle has been squeezed down to 16,000 yuan!

![]() 11/14 2024

11/14 2024

![]() 491

491

According to data from the China Passenger Car Association (CPCA), the profit per vehicle in China's auto industry has dropped to 16,000 yuan in the first nine months of this year, with an even worse situation in September, at only 11,000 yuan.

@Original by TechXplore

Triggered by the rapid rise of new energy vehicles, the "price war" in the automotive industry ignited in 2023 and has since intensified, leading to an unprecedented level of industry competition.

Profit margin is a crucial indicator of an automaker's operating performance. CPCA data shows that from 2020 to 2023, the profit margin of China's auto industry was 6.2%, 6.1%, 5.7%, and 5%, respectively, demonstrating a clear downward trend. In the first three quarters of this year, the profit margin was only 4.6%, still lower than the average profit margin of 6.1% for downstream industrial enterprises, marking a decade-low for the industry.

It's worth noting that domestic auto sales have been steadily increasing from 2020 to 2023. According to the China Association of Automobile Manufacturers, China's overall auto sales from January to September totaled 21.571 million units, a year-on-year increase of 2.4%. Despite record sales, profit margins continue to decline.

More and more automakers are complaining about selling cars at a loss.

The AITO new M7 Pro, priced starting at 249,800 yuan, loses nearly 30,000 yuan per unit sold at its lowest configuration, according to Yu Chengdong. The IMARC R7, priced starting at 259,800 yuan, also loses around 30,000 yuan per unit sold this year, according to Yu. Xiaomi Auto reported a loss of 1.8 billion yuan in the second quarter, equivalent to a loss of over 60,000 yuan per Xiaomi SU7 sold. Polestar roughly estimates a loss of over 270,000 yuan per vehicle sold in the first quarter of this year...

According to monitoring data from the China Automobile Dealers Association's "Market Pulse," the "price war" resulted in a cumulative retail loss of 138 billion yuan for the new vehicle market from January to August this year, significantly impacting the healthy development of the industry.

Under the impact of this "price war," the profit per vehicle in the auto industry is being increasingly squeezed. CPCA data shows that the profit per vehicle in China's auto industry has dropped to 16,000 yuan in the first nine months of this year, with an even worse situation in September, at only 11,000 yuan.

Automakers face a difficult choice between pursuing profits and increasing sales. Comparing the third-quarter financial reports of listed automakers, BYD continued to show significant growth in the first three quarters, Great Wall Motor set a new revenue record and doubled its profits, while companies like GAC Group, SAIC Motor, and Changan Automobile, although profitable, saw declines in profits.

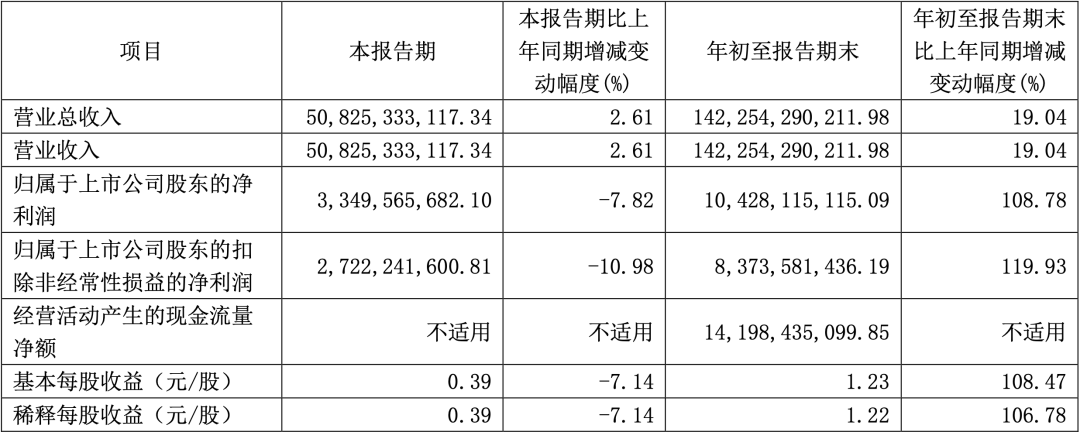

It's worth mentioning that Great Wall Motor, which has moved away from a "sales-only" mindset, has seen a decline in sales for six consecutive months. In the third quarter of this year, Great Wall Motor reported a revenue of 50.825 billion yuan, a year-on-year increase of 2.61%; its net profit attributable to shareholders was 3.35 billion yuan, a year-on-year decrease of 7.82%, indicating a situation of increased revenue but decreased profits. The reasons behind this deserve deep consideration. Great Wall Motor has not disclosed the specific factors behind the decline in net profit in the third quarter, but some institutions speculate that it is due to unsatisfactory production and sales performance.

Compared to Great Wall Motor, GAC Group's situation is less satisfactory. The company's revenue in the first three quarters decreased by 24.18% year-on-year; its net profit attributable to shareholders of the listed company decreased by 97.34% year-on-year. In the third quarter, GAC Group reported a net profit loss of 1.396 billion yuan, a year-on-year decrease of 190.40%, marking its largest quarterly loss since going public.

Faced with an increasingly competitive environment, many independent automakers that have adhered to a multi-brand strategy are beginning to show signs of strategic retrenchment.

In early October, Geely Auto announced the merger of its Geometry brand into Geely Galaxy. Great Wall Motor's Ora app will cease operations and migrate to the Great Wall Motor app, and there are rumors that the Ora brand may be integrated into the Haval brand in the future. On October 25, GAC Group announced that it would strengthen management of its independent brands. On October 28, SAIC Motor officially announced that Feifan, which had been operating independently for three years, would officially return to SAIC Passenger Vehicles.

Chen Shihua, Deputy Secretary-General of the China Association of Automobile Manufacturers, told the Economic Observer that strategic retrenchment and brand integration are positive developments with minimal impact on enterprises. With fewer models after brand integration, companies can focus more on product research and development, increasing sales volume per brand and reducing costs. At the same time, industry competition will not be as fierce as it is now.

If the performance of automakers in the first three quarters can be described as a mixed bag, the profitability of listed dealerships is not optimistic. According to the Securities Daily, none of the six A-share dealership companies surveyed reported revenue in the first three quarters that exceeded the same period last year. The China Automobile Dealers Association stated in September that only 35.4% of dealerships were profitable in the first half of this year, with 13.8% breaking even and 50.8% incurring losses.

Cui Dongshu, Secretary-General of the National Passenger Car Information Joint Meeting, stated that the current profits in the auto industry mainly come from exports and the upstream industrial chain.

As the upstream of the auto industry chain, auto parts enterprises have shown impressive profit performance. To date, 18 listed auto parts companies have released their third-quarter financial reports for this year, with 14 of them reporting year-on-year increases in net profit in the first three quarters. Among them, auto parts companies like Shuanglin Co., Ltd. have seen their net profit increase by over 100% year-on-year. Lithium battery companies like Contemporary Amperex Technology Co. Limited (CATL) have also benefited from the increased sales of downstream new energy vehicles, resulting in substantial profits.

Cui Dongshu predicts that as new drivers of growth continue to develop and strengthen in the auto industry, leading battery companies will continue to enjoy substantial profits, while most other companies will see sharp declines in profitability, and some may face increased pressure to survive.

- The end -