Third Quarter Profits of Auto Companies: 'State-owned Team' Fading Away, 'Private Team' Soaring

![]() 11/15 2024

11/15 2024

![]() 498

498

Author | Zhen Yao

Editor | Li Guozheng

Produced | Bangning Studio (gbngzs)

On November 14, Geely Automobile Holdings Limited (referred to as "Geely Auto", 0175.HK) released its third-quarter financial report for 2024. During the period, total revenue, sales volume, and net profit all hit record highs.

The financial report stated that revenue for the first three quarters increased by 36% year-on-year to 167.684 billion yuan; profit attributable to equity holders of the company increased by 358% year-on-year to 13.053 billion yuan; and cumulative sales volume for the first three quarters reached 1.4897 million vehicles, an increase of 32% year-on-year.

▲Trend of Geely Auto's Net Profit

After releasing its impressive financial report, Geely Holdings also announced a major news:

Geely Holdings will transfer its 11.3% stake in Zeekr Intelligence Technology (hereinafter referred to as "Zeekr", stock code: NYSE: ZK) to Geely Auto.

After the completion of the transaction, Geely Auto's shareholding in Zeekr will increase to approximately 62.8%. At the same time, equity structure optimization was conducted for Link&Co. to promote comprehensive strategic synergy between Zeekr and Link&Co. Zeekr will hold a 51% stake in Link&Co., and the remaining 49% stake in Link&Co. will continue to be held by a wholly-owned subsidiary of Geely Auto.

'In order to stand out in the fierce market competition, Geely Holdings issued the "Taizhou Declaration" in September this year, announcing that the enterprise has entered a new stage of strategic transformation,' said Li Shufu, chairman of Geely Holdings.

This equity optimization brings two significant advantages to Geely Auto.

On the one hand, it rationalizes equity relationships, reduces related party transactions, eliminates horizontal competition, and promotes in-depth integration and efficient integration of internal resources.

On the other hand, Zeekr and Link&Co. will strengthen synergy in technology, products, supply chains, manufacturing, marketing and services, and international market expansion, enhance technological innovation capabilities, stimulate economies of scale, and aim to transform Zeekr and Link&Co. into a globally leading high-end luxury new energy vehicle group with annual production and sales reaching millions by the end of 2026.

'If no integration is carried out, the two brands will face the dilemma of repeated investment and additional expenses in many areas that should be shared, such as research and development, architecture, and sales. As the major shareholder of these two brands, if the above-mentioned repeated investment situation really occurs, it will undoubtedly show Geely Auto's great misjudgment and stupidity in management,'

said Gui Shengyue, CEO of Geely Automobile Holdings, during a conference call. In the context of the highly competitive Chinese auto market, Geely is more urgently in need of efficiently sharing resources, reducing costs by expanding scale, and thereby enhancing competitiveness. If no integration is carried out, the comprehensive competitiveness of both Link&Co. and Zeekr will be difficult to effectively improve.

Bangning Studio believes that this joint effort by Zeekr and Link&Co. reflects an auto market that is facing both heated competition and icy challenges.

Recently, the third-quarter financial reports of various listed auto companies have been released successively. Overall, the auto industry is facing operational difficulties, and profits are gradually thinning. Affected by price wars, product structure adjustments, and the performance of main businesses, market share has further concentrated towards industry leaders, leading to intensified profit differentiation.

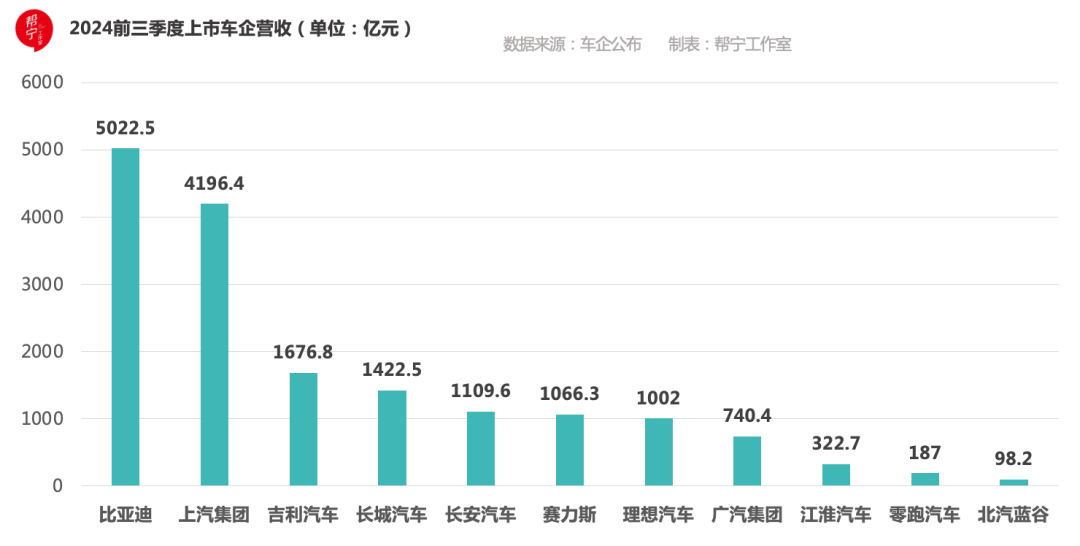

Bangning Studio summarized the first three-quarter financial reports of 11 listed vehicle manufacturers. Among them, six companies showed profit growth, namely BYD, Geely Auto, Great Wall Motors, NIO, Thalys, and JAC Motors.

However, SAIC Motor, GAC Group, and Changan Automobile experienced double declines in revenue and net profit. Although Zero-Run and BAIC BJEV are still in a loss state, their revenue has increased, and the loss margin has narrowed compared to the same period last year.

Deep in the profit quagmire

On November 11, the Shanghai Municipal Party Secretary and Mayor visited SAIC Motor to conduct a special survey and hold a symposium to deepen research and promote SAIC Motor's firm commitment to transformation and development.

This news attracted attention in the automotive industry.

As one of the pillar industries of the national economy, the automobile industry plays an important role in taxation and employment, and it is not uncommon for local officials to conduct inspections. However, this inspection by Shanghai leaders revealed an unusual sense of urgency.

Previously, on October 31, SAIC Motor released a rather bleak third-quarter report, showing that core financial indicators such as sales volume, revenue, and net profit were all under significant pressure and showed a clear downward trend.

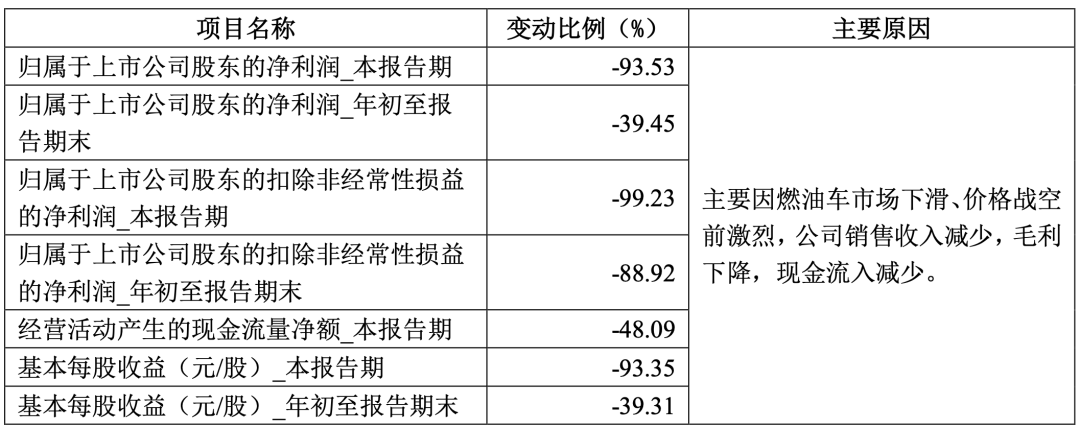

Specifically, in the third quarter, SAIC Motor's total operating revenue was 145.796 billion yuan, a year-on-year decrease of 25.91%. The net profit attributable to shareholders of the listed company was only 280 million yuan, a sharp year-on-year decrease of 93.53%. Even more surprisingly, the net profit after deducting non-recurring gains and losses was almost negligible, at only 29 million yuan, with a year-on-year decrease of 99.23%.

For the first three quarters, SAIC Motor achieved a total revenue of 430.482 billion yuan, a year-on-year decrease of 17.74%; the net profit attributable to shareholders of the listed company decreased to 6.907 billion yuan, a year-on-year decrease of 39.45%.

Eight years ago, in 2018, SAIC Motor's net profit reached 36 billion yuan, making it a veritable "money-printing machine."

Unfortunately, since then, SAIC Motor's performance has fluctuated and declined. Nowadays, it is less than one-third of BYD's net profit for the same period.

SAIC Motor explained that the reason for the decline in performance was the decline in the gasoline vehicle market, unprecedented fierce price wars, a decrease in the company's sales revenue, a drop in gross profit, and a reduction in cash inflows.

These reasons are, of course, general. The decline in SAIC Motor's revenue is not only a reflection of the fierce competition in the entire auto industry but also a consequence of SAIC Motor's own strategic planning.

Its changes are just a microcosm of many traditional state-owned auto groups. Other auto groups facing similar performance pressures include GAC, Dongfeng, BAIC, Changan, etc., all of which have shown a clear downward trend in performance.

They face similar dilemmas. In the context of the industry's transition to new energy, the contributions of joint venture brands have gradually weakened, and price wars have become increasingly fierce, leading to continuously declining profit margins.

However, R&D investment has grown rapidly. Under the double impact, these state-owned auto groups have had to optimize the production capacity of joint ventures to reduce redundancy and bear the resulting one-time expenses.

The financial report showed that in the third quarter of this year, GAC Group's revenue increased, but it incurred a loss. The quarter's revenue was 28.232 billion yuan, a ring-to-ring increase of 15.41%; however, the net profit turned from profit to loss, amounting to -1.4 billion yuan; the net profit after deducting non-recurring gains and losses was also negative, at -1.53 billion yuan, a year-on-year decrease of up to 216%.

For Changan Automobile, the quarter's operating revenue was 34.237 billion yuan, a year-on-year decrease of 19.85%; the net profit was 748 million yuan, a year-on-year decrease of 66.44%; and the net profit after deducting non-recurring gains and losses was 512 million yuan, a year-on-year decrease of 74.96%.

BAIC BJEV's revenue for the first three quarters of this year was 9.818 billion yuan, a year-on-year increase of 5.49%; the net loss attributable to shareholders of the listed company was 4.491 billion yuan. Among them, the third-quarter revenue was 6.077 billion yuan, a year-on-year increase of 71.78%; the net loss attributable to shareholders of the listed company was 1.92 billion yuan.

Another company incurring losses is Zero-Run. Its third-quarter revenue was 9.86 billion yuan, a year-on-year increase of 74.3%; the net loss attributable to equity holders of the company was 690 million yuan, and the cumulative loss for the first three quarters was nearly 3 billion yuan.

These data reveal the severe challenges and transformation pressures faced by various auto companies.

Increased Differentiation

'It is often not your direct competitors that overthrow you.'

From 2010 to 2020, the biggest industrial change in China was undoubtedly the rise of the mobile internet, a new industry that completely changed the economic landscape.

From 2020 to 2030, the auto industry has become the new protagonist leading the change. In addition to the transition from gasoline vehicles to new energy vehicles, the auto industry has also entered an era of deep integration of electrification and intelligence, rapid development of intelligent driving, large models, and AI technology.

This transformation has intensified fierce competition and cross-border challenges within the industry and significantly promoted industry differentiation. The strong entry of Tesla, Huawei, Xiaomi, etc., has made the originally relatively stable racetrack tumultuous.

Thalys is a typical example.

A few years ago, it was just an obscure Dongfeng Xiaokang, mainly producing minivans and pickup trucks. After partnering with Huawei, it transformed into an industry star.

Data shows that in the first three quarters of this year, Thalys' operating revenue surged significantly, reaching 106.627 billion yuan, a year-on-year increase of 539.24%, and it turned losses into profits, with a net profit of 4.038 billion yuan, a year-on-year increase of 276%.

In terms of sales volume, from January to September, Thalys' cumulative sales volume was 316,700 vehicles, a year-on-year increase of 364.23%. Among them, the new M7 delivered a total of 160,000 vehicles annually and has delivered 200,000 vehicles since its launch; the M9 has also exceeded 160,000 orders in just 10 months since its launch.

In the stock market, on November 13, Thalys' share price continued to rise, closing with a high open and high close, with an increase of 7.33%, closing at 144.43 yuan per share and a total market value of 218 billion yuan, surpassing SAIC Motor and ranking among the first tier of total market value of listed auto companies.

After partnering with Huawei and planning to acquire a 10% stake in Huawei's Look Up for 11.5 billion yuan, Thalys is now like a wealthy investor with a huge amount of capital and popularity, deeply favored by the market. The three core driving forces behind this are Huawei's technological empowerment, Thalys' performance "comeback", and its involvement in the promising humanoid robot racetrack.

Thalys' moves happen to coincide with the mainstream trend of the auto industry's future - the racetrack of new energy intelligent electric vehicles.

Who will be the next "Thalys"? JAC Motors can be considered a potential stock.

Recently, JAC Motors has been particularly eye-catching in the A-share market, with its share price continuously rising and its total market value exceeding 100 billion yuan. In just one and a half months, the share price doubled, from 22.04 yuan per share on September 24 to 46 yuan on November 12.

In the third quarter of this year, JAC Motors delivered impressive results, with a single-quarter net profit of 324 million yuan, a year-on-year increase of over 10 times, setting a new record for single-quarter earnings since 2017.

The rapid growth in JAC Motors' market value is also closely related to its close cooperation with Huawei.

Where there is decline, there will be rise. The changes in Thalys and JAC Motors have triggered deep reflection on the development trends of the auto industry.

First, large auto companies will face a relatively long period of transformation and adjustment. Traditional auto companies such as SAIC and GAC have seen significant declines in performance due to the impact of the new market environment, mainly attributed to their inadequate ability to flexibly adapt to transformation. In this regard, the larger the scale, the greater the challenges and difficulties faced.

Second, pricing power, as a brand's core asset, is usually held by companies with the highest profits in the industry.

In the first three quarters of this year, BYD was undoubtedly the auto company with the highest profits. During the period, it achieved revenue of 502.251 billion yuan, a year-on-year increase of 18.94%, and a net profit attributable to shareholders of the parent company of 25.238 billion yuan, a year-on-year increase of 18.12%, with a net profit far exceeding the sum of the other 10 auto companies.

In addition, both Great Wall Motors and Geely Auto's profits exceeded 10 billion yuan.

Geely's significant performance growth is attributed to the strong performance of its "oil-electric" dual-line products. Among them, the "China Star" high-end series sold nearly 300,000 vehicles with higher product value and premium capabilities. Sales of brands targeting the higher-end market, such as Zeekr, Link&Co., and Geely Galaxy, also increased significantly. These factors collectively contributed to the steady improvement of financial indicators.

Great Wall Motors explained in its financial report: "This is mainly due to the company's commitment to high-quality development, adhering to quality, creating an ultimate product experience, achieving overseas sales growth, further optimizing the domestic product mix, and driving a significant year-on-year increase in net profit attributable to shareholders of the listed company."

Guolian Securities pointed out in its research report that in the third quarter, Great Wall Motors' revenue per vehicle was 173,000 yuan, an increase of 20% year-on-year, setting a new quarterly high. After deducting non-recurring items, the profit per vehicle was 9,000 yuan, an increase of 4% year-on-year, mainly attributed to the outstanding performance of the Tank brand and exports.

BYD and Thalys are on the rise, Zeekr and Lynk & Co are integrating, and Nezha Auto is rumored to be laying off employees... It is clear that under the tide of intelligence and electrification, the automotive industry is undergoing a profound transformation.

As the saying goes, every family has its own difficulties to read. The difficulties faced by various automakers vary. The key issue for traditional automakers is how to successfully transform and upgrade, while the focus for emerging automakers is how to accurately grasp historical opportunities.

Regardless, competition and change are jointly driving the reshaping of China's automotive industry landscape.