Traditional automakers compete at the Guangzhou Auto Show: some go all in, some give up

![]() 11/18 2024

11/18 2024

![]() 621

621

The 22nd Guangzhou Auto Show was held as scheduled, with a total of 1,171 vehicles on display, including 78 global premieres and 512 new energy vehicles. The exhibition area set a new record, and the proportion of new car premieres is also increasing, sending a signal that automakers are paying more attention to the Chinese market.

Unsurprisingly, Lei Jun was the star attraction at the Guangzhou Auto Show. The Xiaomi Automobile exhibition area was surrounded by media, all eager to see Lei Jun's press conference. After the conference, Lei Jun visited other exhibitors, drawing a large crowd of media. In contrast, Yu Chengdong at the HarmonyOS Smart Exhibition Area was overshadowed.

(Photo by Dianchetong)

This "famous scene" was similar to the earlier Beijing Auto Show, though not as dramatic.

Lei Jun is rarely seen visiting joint venture brands; he mainly visits independent brands. However, this year's Guangzhou Auto Show saw a change as Lei Jun visited the BMW booth and tried out the second locally produced M Performance model, the M235L, giving BMW a boost from Lei Jun's popularity.

Leaving Lei Jun aside, Dianchetong spent almost the entire day "immersed" in the traditional brand exhibition areas and noticed some changes from previous years. Overall, this year's traditional brand exhibition area was livelier than last year, with more active marketing activities and substantial moves targeting the Chinese market. On the other hand, some traditional brands were absent from corners not easily visible.

Before the Guangzhou Auto Show, we had heard news of many traditional brands "hitting a rough patch." After wandering around the traditional brand exhibition areas for tens of thousands of steps, Dianchetong found that they preferred to rely on their own awakening rather than on Lei Jun's popularity. Therefore, we focused on the moves of traditional brands at the Guangzhou Auto Show to see what new answers they provided.

Catching up on new energy, traditional brands avoid gimmicks

Unlike new-energy vehicle (NEV) startups, traditional automakers have a solid manufacturing advantage and can still launch a large number of new products at the last international auto show of the year.

Especially BYD, with monthly sales of 500,000, has proven its top-tier status. With the premieres of multiple models like the BYD Atto 3 Hybrid, Denza Z9, and N9, it garnered significant attention. The new cars launched by leading brands indeed attract huge traffic and naturally draw media attention. This is not because BYD has made remarkable advancements in intelligence; as a leading NEV brand, BYD has always been highly regarded in the industry, and each new car launch brings groundbreaking technological progress, which is why it is closely watched.

Take the BYD Atto 3 as an example; just its complex and innovative CloudRacer-Z electromagnetic suspension system has garnered considerable attention.

For GAC Group, the Guangzhou Auto Show is like a "home-court advantage." The exhibition area is evenly split between joint venture and independent brands, with one side featuring Trumpchi, Aion, and Hooper, and the other side featuring GAC Toyota and GAC Honda. Joint venture brands are no longer conservative; GAC Toyota's Bozhi 3X is aggressively promoting end-to-end intelligent driving, and Honda is shifting public attention to two new models from the new brand "Ye."

(Photo by Dianchetong)

In fact, the first models like Trumpchi S7, Hooper UT, and Hooper HL show the influence of new-energy vehicle startups. Range-extender powertrains, AI lighting, LiDAR, and other visible configurations are markedly different from traditional approaches. There is also a concept car jointly developed by GAC and Huawei at the center of the Trumpchi booth, indicating a significant shift in mindset.

Dongfeng Nissan also has a premiere model, the N7, and previously announced a high-profile collaboration with Huawei to create an intelligent cockpit.

Geely's booth was impressive, showcasing Flyme as its core competitiveness in the intelligent era. More models are equipped with the Flyme Auto cockpit system, and the rear of the booth displays achievements in Antora chips, multi-device ecosystem collaboration, and other aspects, emphasizing technology output.

Traditional luxury brands are also worth mentioning; they prefer to place NEVs in prominent positions at their booths. FAW-Volkswagen Audi premiered two new models at the Guangzhou Auto Show: the Q6L Sportback e-tron and the new-generation A5L. Although they use different energy forms, both have made significant progress in platform capabilities and intelligent driving. The latter has confirmed the use of Huawei's advanced intelligent driving capabilities, while the former's solution is unknown but rumored to be from Huawei as well.

(Photo by Dianchetong)

The Q6L Sportback e-tron is currently the most intelligent NEV product among BBA brands, hands down.

Additionally, the new brand AUDI, jointly created by SAIC-Volkswagen Audi and Audi, made its debut at the auto show. The exhibition area only featured the AUDI E concept car, equipped with a full suite of Chinese NEV technologies and intelligent solutions. Essentially, AUDI can be considered Audi's new-energy vehicle startup brand, proving that Audi is striving to become the "desired form in the Chinese market."

For traditional brands, new cars are their way of showcasing technology.

Price remains the final factor influencing consumer decisions. As the traditional luxury brand effect fades, consumers are unlikely to accept overly premium joint venture smart electric vehicles. Therefore, GAC Toyota's Bozhi 3X is smart in understanding consumers' real demand for "low-price, high-intelligence" vehicles.

Besides traffic, intelligence and electrification have inevitably become a consensus at auto shows. Both new-energy vehicle startups and traditional brands have primarily focused on these aspects, even if they need to adopt Chinese solutions.

Moreover, some traditional brands have unique presences, such as Great Wall Motors. Although the exhibition lists Haval, Tank, and Ora, all 23 cars at the booth are WEY Blue Mountain intelligent driving versions. The same is true for Changan Mazda, where the vast exhibition area only features the EZ-6 NEV model.

It's not surprising; the Blue Mountain intelligent driving version and EZ-6 are the best electrified and intelligent products under Great Wall Motors and Changan Mazda, so it's reasonable for the brands to showcase them prominently. Whether the exhibition lineup will change during subsequent public days remains to be seen.

At this moment, traditional joint venture and independent brands are no longer "traditional" in their approach to intelligence. They have provided clear actions and timelines for intelligent implementation, avoiding gimmicks and concepts, proving the market wave of intelligence and intelligent driving. Many traditional brands have experienced significant profit declines and market share losses in the Chinese market this year. The market has indicated the direction for automotive development in 2025, and traditional automakers at the Guangzhou Auto Show are gradually awakening.

If electric vehicles are "not on the table," have some traditional brands given up?

At this Guangzhou Auto Show, many traditional brands have adjusted their strategies and achieved self-awakening, but some have gone to extremes.

During Dianchetong's visits, it was found that many imported brands are conservative in their electrification progress, with some even "reversing course." Lamborghini, which we admired years ago, now has a smaller booth than NIO.

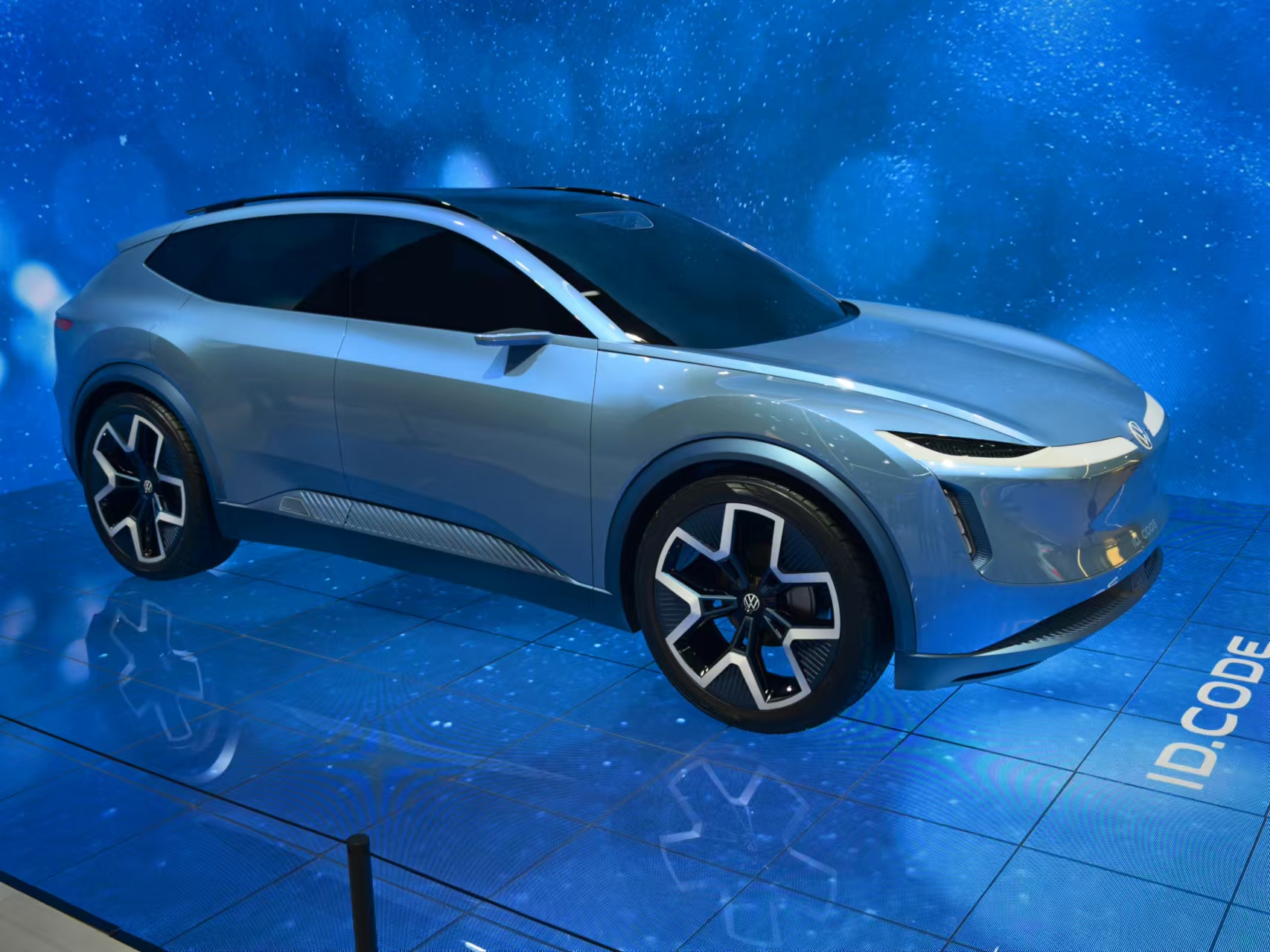

Unlike Audi, which actively embraces the NEV market, Volkswagen's exhibition lineup at this year's Guangzhou Auto Show is almost unchanged from last year, with the only difference being the addition of the "YuZhong" brand under Volkswagen (Anhui). Volkswagen's lineup of fuel vehicles is larger, and the electric ID series remains the same. The ID.BUZZ, which appeared for the second time at the Guangzhou Auto Show, still has no news of launch.

(Photo by Dianchetong)

Volkswagen's pure electric concept car for the Chinese market, the ID.CODE, is placed in a corner and can only be seen by entering the exhibition area, which is somewhat too low-key. The progress of Volkswagen's collaboration with XPeng Motors is also unknown. Similarly, the Bozhi 7 concept car at the GAC Toyota exhibition area is also hidden, barely visible from outside the exhibition area.

The Cadillac exhibition area is the same, with fuel vehicles taking center stage and electric vehicles "not worthy of the table."

The display lineup of Daolangge, a premium brand under General Motors, has also shrunk this year. Last year's pure electric Hummer and Cadillac luxury pure electric vehicle Celestiq are absent this year, replaced by two full-size SUVs, the Tahoe and Yukon.

Walking past the Porsche exhibition area, their latest 911 series is at the front of the booth, but Dianchetong did not see the Taycan present. Only one electric vehicle product, the Macan EV, is on display, and most people are only interested in the 911, showing little interest in Porsche's electric vehicles.

Whether it's full-size SUVs or sports cars like the 911, some traditional automakers are gradually losing their sense of urgency for the transition to new energy and are focusing on importing cars. Frankly, when neither electrification nor intelligence can cater to the mainstream market, continuing the brand and sentiment of imported cars has become one of their few options.

(Photo by Dianchetong)

However, it should be noted that the situation for traditional imported brands is not optimistic.

First, Porsche China dealers are facing a decline in both sales and profits, and there has been an uproar due to inventory issues. The NEV business is not favored, and the price war in the Chinese market is fierce. The Macan EV and Taycan have little advantage, so emphasis must be placed on imported sports car business.

Daolangge does not display electric vehicles but focuses on imported full-size SUVs. Like Porsche, Dianchetong believes they have a clearer understanding of their target audience. Electrification may not be the way out, but continuing the story of imported fuel vehicles can at least stabilize brand influence.

In fact, such brands are constantly being marginalized at large exhibitions. Few may notice that as many as 13 brands were absent from this year's Guangzhou Auto Show, including Jaguar, Land Rover, Subaru, Genesis, Chevrolet, etc. Ultimately, the market and sales are key. Without the Guangzhou Auto Show, the influence of traditional imported brands will inevitably decline further.

The automotive landscape in the Chinese market has changed. To rebuild brand glory, sentiment alone is no longer sufficient. This is why traditional brands are striving for intelligence and electrification.

Products can't keep up with the market, and even inviting Lei Jun to promote them doesn't work

You may have noticed that the wind direction of large auto shows is completely different from the past. Cars are no longer judged by their engines and brands but by their intelligence and electrification. Additionally, the appearance of top influencers like Lei Jun has ignited a battle for traffic among automakers.

In fact, traditional automakers are slow to transform and use traditional marketing methods, often losing the spotlight at auto shows. It is evident that at the Guangzhou Auto Show in the past two years, traditional automakers have received much less attention than domestic independent brands. With declining sales and profit margins, they have had to resort to various means to survive. As the price war intensifies and the halo of traditional brands fades, they must not only strive to advance with Chinese NEV technologies but also use them to shake off the negative impact of being labeled as "no-name electric vehicles."

(Photo by Dianchetong)

Don't say that traditional automakers are just missing a "Lei Jun." The self-awakening of traditional brands is necessary. The essence of auto shows should return to selling cars. A carmaker's technological prowess is its capital for survival. Standing still and relying on past successes won't work, even with Lei Jun promoting them.

The demand in the Chinese market changes rapidly, and cars are moving closer to fast-moving consumer goods, with demands changing daily. Automakers that value the Chinese market must learn from each other's strengths and weaknesses to please the market; there are basically no shortcuts. Overall, traditional automakers are striving to prove that they can maintain their advantages in 2025, but there aren't many new cars.

Sentiment may be priceless, but market value is even higher. When the domestic market gains confidence in independent brands and imported cars no longer "add face" for consumers, imported brands will also have their day of departure.

(Photo by Dianchetong)

Ironically, this year's Guangzhou Auto Show was the largest ever, but there were fewer participating brands. No one wants to see any brand miss a major exhibition, but the market is cruel. Without sufficient revenue and cash flow, automakers simply don't have the capital to participate and create momentum.

In 2025, intelligent vehicles will experience a complete explosion. Dare any traditional automakers not strive?

Source: Leitech