Lively closing battle, how many automakers will survive next year?

![]() 11/18 2024

11/18 2024

![]() 595

595

Introduction

Introduction

There are both "successful survivors" and those who can't "survive".

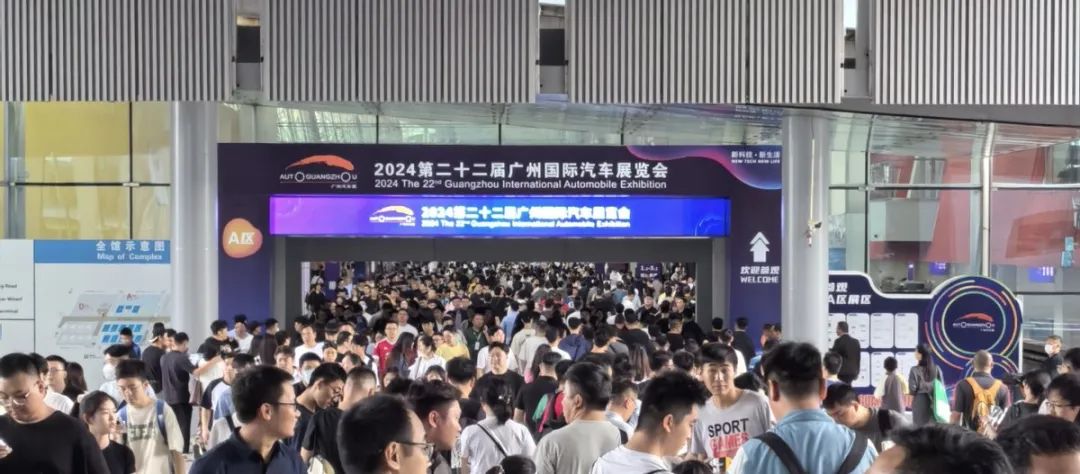

It's that time again for the annual "closing" event, the Guangzhou Auto Show, and 2024 is about to end.

The weather is similar to last year, but it feels a bit stuffy. On the way to the exhibition hall after checking in, I noticed something strange: there were an abundance of yellow taxis, and most of them had their "vacant" lights on.

It wasn't like this last year. I asked two ride-hailing drivers about it. They said that one reason is that there are too many electric two-wheelers in Guangzhou these days, so people rarely hail taxis unless it's raining. Of course, there are more vacant taxis. Additionally, there are many more ride-hailing cars and taxis now. Currently, ride-hailing drivers can only earn around 200~300 yuan a day.

"200~300? Net income?" "No, that's just the gross income from rides. They can only do about 8~10 rides a day. The platform controls it, only giving orders worth 35~40 yuan per hour." I calculated it, after deducting the 250 yuan for car rental and personal expenses (150+100), they can only earn a maximum of 100~200 yuan a day. They are truly "trapped in the system."

The atmosphere outside the venue is dull, and the atmosphere inside the auto show is even duller than last year. In fact, many automakers have already completed their major and important promotions before the auto show or will delay them until after the show. Although there are 78 globally premiered new cars this time, there are basically no impressive ones.

And the auto show is a projection of the automotive market. In terms of the market, from the explosion in the first quarter to the freezing point in the second and third quarters, and the rebound in September and October, the ups and downs of the market have made the closing battle of 2024 less pessimistic than before.

On one side are the traditionals, and on the other are Huawei and Xiaomi

This year's auto show is divided into Area A and Area D as usual, with Area D being more popular. The trend of new energy is unstoppable. As stated in "The Wave is Coming," once a technological wave gathers momentum, it will not stop.

And speaking of the top booths this time, they are Xiaomi and Huawei. The queue outside the Xiaomi booth is long and wide, with three or four rows side by side for the first time. Lei Jun is also flooded with people wherever he goes, perfectly embodying the essence of being a "top star." Of course, the high-profile Lei Jun also found time to visit the Zhuhai Airshow, where he exhibited a leader-like demeanor wherever he went.

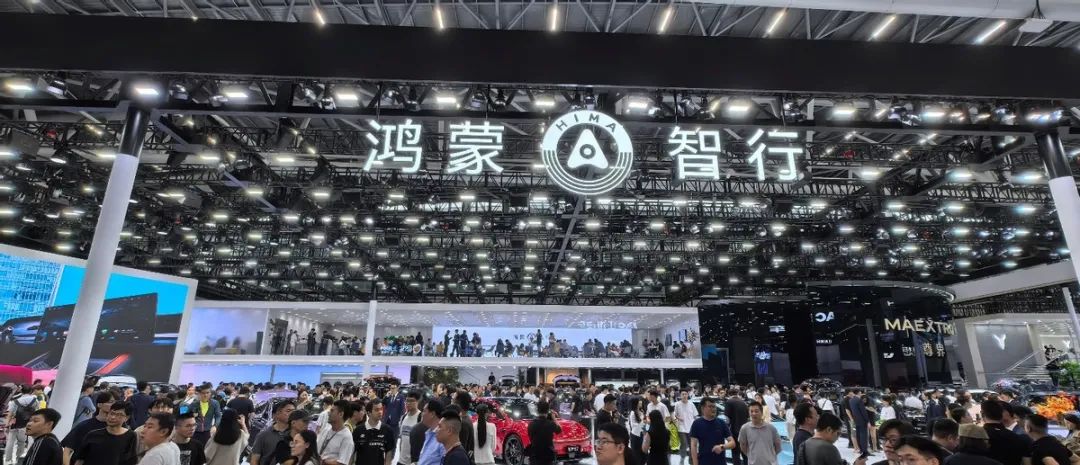

In addition to the Xiaomi SU7 ULTRA, which has been priced at 814,900 yuan, the Smart New S7 and HarmonyOS Intelligent Driving, which are said to "reach real consumers with price and product," are also mobilizing for the inevitable battle. Huawei's HarmonyOS Intelligent Driving placed five Smart New S7s in a prominent position at the center of the booth, and silence spoke louder than words.

After all, the 200,000~300,000 yuan pure electric market is the most competitive segment, and the models that show their swords are the ones that best reflect the overall strength of automakers. But to seek growth, one must "break the circle" and surpass user needs. The saying goes, "Only paranoiacs can survive."

Huawei's magic doesn't stop there. During the auto show, Yin Tongyue, Chairman of Chery Holdings, also said that he strongly recommends that Yu Chengdong change his name to "Yu Chenggong" because everything he does succeeds. This is also a clear statement of Chery's attitude after a long battle with Huawei over the Smart New S7.

Other brands are also vigorously promoting at the Guangzhou Auto Show. For example, on the morning of the 16th, as soon as I reached the entrance of Hall 1.2, a pretty girl came up to strike up a conversation and guided me to the Volvo booth. After I refused, she walked with me for a while before giving up her slightly awkward smile.

Fierce competition takes place in every corner. For example, because Cadillac implements a "one-price" policy, I inquired about preferential policies with a sales consultant. The XT5 luxury version has a "one-price" of 265,900 yuan, plus taxes and fees and an 8,700 yuan insurance premium, then minus a provincial subsidy of 15,000 yuan and a new car replacement subsidy of 20,000 yuan (for the same brand, only 10,000 yuan for different brands), the final price is around 276,000 yuan.

However, an industry insider who knows GM well has this opinion on the "one-price" policy: Although this approach may not be as extreme as killing the goose that lays the golden eggs, compared to the previous market guidance price of around 390,000 yuan, which is directly 130,000 yuan cheaper, the "one-price" policy actually has no benefits. Because consumers will only negotiate the price down from this basis, not up. To put it bluntly, Cadillac has no other choice.

Another change is that this year's auto show does not have a luxury hall, which has been a feature of previous auto shows. NIO doesn't even bother to come. Ultra-luxury brands are scattered across various halls, completely losing their previous air of superiority. Without Rolls-Royce, and with Lamborghini, which has released its first plug-in hybrid super SUV "Urus SE," quietly sitting in the corner of Hall 5.2, they may have to think about their future "way of life" amidst their loneliness.

'Way of Life' and 'Survival'

During the pre-auto show topic discussion meeting, I proposed the keyword "way of life" for group contributions. Why did I think of this word?

To be honest, whether one can "survive" or not is indeed a critical moment. From the various "equality" battles at the beginning of the year, automakers have exerted all their skills, and the test is their "way of life." Fortunately, the golden September and silver October have finally arrived, and the automotive market in October has shown a hot growth trend, slightly alleviating the crisis. However, whether the "way of life" is clear or not is indeed testing the wisdom of each automaker.

For example, to reduce internal friction and establish a more reasonable shareholding structure, on the eve of this year's Guangzhou Auto Show, Geely Holdings completed the merger of Zeekr and Lynk & Co. After a long union, there must be a separation, and after a long separation, there must be a union. Automakers have taken many detours.

However, while Geely is contracting, Chery is expanding. After the rumored "Yueji" brand was halted, new information has emerged that Jetour's new brand will be released in the first quarter of next year, with specific details unknown. This is just a small ripple in the ever-changing tide of the intelligent and electric era.

The ripples of the "way of life" are also evident in the "record high" data. According to the China Passenger Car Association, 2.261 million passenger cars were retailed in the Chinese market in October, a year-on-year increase of 11.3%. Cui Dongshu, Secretary-General of the China Passenger Car Association, mentioned that in October, China's passenger car retail sales, wholesale sales, production, and exports all reached record highs for the month. Among them, exports drove wholesale sales to a record high since data statistics began.

Of course, besides internal competition, the breakthrough for the "way of life" lies in exports. At the Guangzhou Auto Show, Yin Tongyue, Chairman of Chery Holdings, also stated that exports this year are expected to reach 6 million units, with an additional 1 million units.

From the perspective of sales of sub-automakers, the top brand setting a "record high" is BYD, with monthly sales exceeding 500,000 units for the first time, setting a record for monthly sales by a Chinese automaker and global new energy automakers. Geely Auto's total sales in October exceeded 226,000 units, of which 108,700 were new energy vehicles, also setting a record high. These are the ones that are doing well.

There are also those who are doing poorly. Compared to the 2023 Guangzhou Auto Show, a total of 12 automakers or brands were absent, including Jetta, Chevrolet, Jaguar Land Rover, Polestar, Subaru, Genesis, HiPhi, Hozon Auto, Venucia, Voyah, Rolls-Royce, Dayun New Energy, and Blue Power Auto, among which it is uncertain whether the poor ones can survive 2025.

At last year's Chery Technology Day, Li Xueyong, Deputy General Manager of Chery Automobile and General Manager of Chery Automobile Marketing Company, said that next year will be the most competitive year because it will be clear who is still in the game. In about a year and a half, joint venture brands and independent brands on the "cliff" will surely bring out their respective strengths, and competition will be extremely fierce. Just before the auto show, NIO Auto was exposed to issues of layoffs and being sued by suppliers for unpaid debts. This is not an isolated case; WM Motor has already experienced this before.

Moreover, for every price war, there is a "value war." For example, Ford China, which released the plug-in hybrid Territory S and Territory X, as well as the Mondeo high-power E-Hybrid version this time, insists on not engaging in a price war, preserving its strength, and maintaining good dealer channels, thus becoming a model for other joint ventures to learn from.

Of course, behind the "way of life" is the wave of new energy that every automaker must face. As 2024 comes to a close, the trend is gradually becoming apparent. Pure electric vehicles have stopped their "crazy" growth, while plug-in hybrids and extended-range vehicles are catching up, and will gain even more market share in 2025.

According to data from the China Passenger Car Association, the domestic retail penetration rate of new energy vehicles has exceeded 50% for four consecutive months. Cui Dongshu believes that this is a manifestation of the explosive growth of new energy vehicles, reflecting the market's positive response to the national scrapping and replacement policy.

Regarding the role of policies, Lang Xuehong, Deputy Secretary-General of the China Automobile Dealers Association, said, "The average daily number of scrapping and replacement applications in the automotive market in October was over 10,000. Currently, more than half of the customers who visit dealerships have replacement needs." This shows that policies play a crucial role in boosting the prosperity of the automotive market. A relevant person in charge of the Ministry of Commerce also revealed that as of now, the number of scrapping and replacement subsidy applications has exceeded 1.7 million, with a high average daily number of applications. It is expected that this number will continue to grow significantly in the future.

With the launch of multiple new models at the Guangzhou Auto Show, the cumulative effect of policies continues to emerge, and automakers and dealers are rushing to promote sales at the end of the year. A wave of car-buying enthusiasm is expected after the auto show. Ultimately, whether the "way of life" is good or not will be clear next year.

Facing the annual "final exam" submission moment

In terms of automakers' annual targets, the Guangzhou Auto Show is approaching the year-end countdown, and the sales pressure on automakers is at its peak.

In October, following BYD's explosion to 500,000 units, Geely, Chery, and Changan, the first-tier independent automakers, also followed suit. At this year's auto show, BYD continued to occupy an entire hall, and it seems almost certain that BYD will surpass 4 million units this year. Both Chery and Geely have surpassed the 2 million mark and are moving towards higher goals.

At this auto show, Chery also distributed "wedding candies" at Jetour's Freedom launch event, celebrating that Jetour completed its annual sales target of 500,000 units a month ahead of schedule. Next year, Jetour aims to sell 800,000 units and will launch a new brand, while the 2026 target of 1 million units also seems within reach.

Relatively speaking, Changan Automobile's current cumulative sales are 2.156 million units. Based on the sales target of 2.8 million units set at the beginning of the year, the completion rate is 76.99%, so the pressure is not too great.

Some are happy, while others are worried. For most mid-tier and lower-tier brands, 2025 could be a year of life or death. For some automakers with a completion rate of less than 60%, they are not only far from their targets set at the beginning of the year but will also face even greater pressure next year. Examples include SAIC Motor and Great Wall Motors.

SAIC Motor's cumulative sales from January to October were 3.0512 million units, with a target completion rate of 55%. In the first half of the year, only the IM brand achieved growth in the new energy sector, but its total volume was not significant. Great Wall Motors' cumulative sales in the first 10 months were 970,000 units, only 51.08% of its target. Only Haval and Tank brands maintained good momentum, so it seems unlikely to achieve its goal of 1.9 million units this year.

As the "landlord" of the auto show, GAC Group sold 1.52 million units in the first three quarters, with a current completion rate of only 55.3%. In addition, GAC Aion has also bid farewell to high growth, and there was no rebound during the "golden September and silver October." It urgently needs new models like the Trumpchi S7 and Aion UT for assistance.

Among the new-energy vehicle startups, NIO continues to lead with an average monthly sales volume of over 50,000 units. After experiencing a setback with its pure electric MEGA this year, NIO has lowered its sales expectations for the whole year. However, the launch of the mid-to-large SUV NIO L6 has boosted sales again, giving NIO a "blood transfusion." In the first 10 months, NIO delivered a total of 393,000 vehicles, completing 78.6% of its annual target.",

Among the second-tier new energy vehicle makers, only Leap Motor, which released the Leap B10, has successfully "gone viral". Leap Motor delivered over 38,000 vehicles in October, setting a new monthly delivery record for the fifth consecutive month. Compared to NIO, which is about to fade away, the key to Leap Motor's success lies in maximizing the advantages of cost-effectiveness without making any "blunders". Additionally, both Voyah and AITO have surpassed the 10,000-unit milestone, ensuring their temporary safety.

In reality, after the Guangzhou Auto Show, there isn't much time left for automakers to rush to meet their annual KPIs. From price wars to marketing competitions, extending to configuration and intelligent driving technology battles, and finally to traffic volume competitions, the auto market this year has had to intensify promotional efforts towards the end of the year. This has increased the pressure on automakers. However, it is gradually becoming clear who will still be at the table in 2025 and who will be off the menu after attending the auto show.