China's L3 Autonomous Driving Era Has Truly Dawned: Hands-Off and Eyes-Off Driving Becomes Feasible, Yet with Specific Conditions

![]() 12/16 2025

12/16 2025

![]() 527

527

Autonomous Driving Steps into the 'Licensed Age': China Issues First Batch of Road Approvals for L3 (Conditional Autonomous Driving) Vehicles

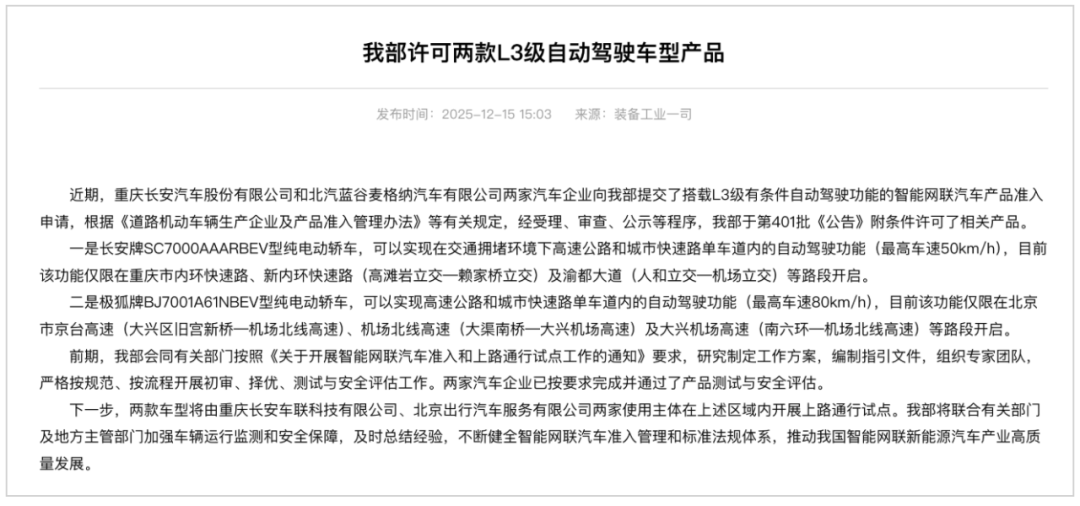

On December 15, the Ministry of Industry and Information Technology (MIIT) announced on its official website that, within the 401st batch of the 'Road Motor Vehicle Production Enterprises and Products Announcement,' it had granted conditional approval to two L3 autonomous driving vehicle products—one from Changan and the other from ARCFOX.

This milestone signifies that China's advanced autonomous driving models have officially transitioned from the stages of technological R&D and road testing to a new phase where they can obtain official market access and operate on roads under specific conditions.

01

Restricted Scenarios, Professional Operations: Changan and ARCFOX Lead the Way as 'Pioneers'

According to the information released by the MIIT, the two approved products come from Chongqing Changan Automobile and BAIC BluePark Magna, respectively.

These two models are equipped with autonomous driving solutions based on distinct technical routes.

Changan Automobile revealed that its SC7000AAARBEV pure electric sedan adopts a self-developed L3 system. Meanwhile, the ARCFOX BJ7001A61NBEV pure electric sedan, a new model of the ARCFOX Alpha S6, was launched in April 2025. Its high-end variant is outfitted with Huawei's Qiankun Intelligent Driving ADS3.3 system.

Based on the approval, the activation scenarios and regions for the autonomous driving functions of both models are precisely defined.

MIIT Approves Two L3 Autonomous Driving Vehicle Models

Specifically, the Changan model is permitted to engage in autonomous driving at speeds up to 50 km/h in a single lane on expressways and urban express routes during traffic congestion. The activation of this function is explicitly limited to certain express routes and arterial roads in Chongqing.

The ARCFOX model, on the other hand, is approved for autonomous driving at speeds up to 80 km/h in a single lane on expressways and urban express routes, with the activation restricted to specific intervals on expressways in Beijing.

This also underscores the defining characteristics of L3 'conditional autonomous driving': the system undertakes driving tasks in specific environments, while the driver must remain prepared to take over vehicle control when necessary.

The operational model for these vehicles involves collaboration with ride-hailing companies. The Changan model is operated by Chongqing Changan Vehicle Connectivity Technology Co., Ltd., whereas the ARCFOX model is managed by Beijing Mobility Car Services Co., Ltd.

This is essentially a 'quasi-Robotaxi' model that incorporates safety officers.

Its core advantage lies in systematically addressing a series of key challenges in the early stages of L3 deployment through professional and controlled fleet management. This includes ensuring professional training and unified supervision of safety officers, building real-time vehicle monitoring and remote support capabilities, efficiently collecting high-quality driving and takeover data for technology iteration, and exploring sustainable business models in restricted scenarios. These efforts lay the groundwork for a future transition to the private market after technology cost reductions.

The establishment of this model is not accidental but the result of continuous policy promotion.

MIIT's 2023 Joint Circular with Multiple Ministries

MIIT's 2023 Joint Circular with Multiple Ministries

As early as November 2023, the MIIT, in collaboration with four other ministries, jointly issued the 'Circular on Conducting Pilot Projects for the Market Access and Road Operation of Intelligent Connected Vehicles,' setting the tone for a system design where 'automobile production enterprises and usage entities form a consortium for application.'

In this announcement, the MIIT also made it clear that the next step would be to 'promptly summarize experiences and continuously improve the market access management and standard regulatory framework for intelligent connected vehicles.'

This implies a gradual expansion of scenarios and regions: it is anticipated that more cities and road types (such as urban arterial roads) will be progressively opened up to qualified vehicle models based on successful pilot projects. It also points to an accelerated construction of a standard system: national and industry standards in areas such as data security, performance evaluation, accident investigation, and cybersecurity for autonomous driving will be expedited, forming a more comprehensive industrial 'traffic code.' Additionally, there will be a shift in the focus of industrial competition: competition will transition from 'algorithm competition' and 'road test mileage races' to a comprehensive capability showdown in 'safety and reliability certification,' 'mass production cost control,' and 'ecosystem service construction.'

02

Policy Paves the Way, Pilot Projects Lead the Charge: L3 Gradually 'Secures Licenses'

The approval of L3 autonomous driving vehicles for road operation did not occur overnight but is the result of a nearly three-year, step-by-step standardized process.

As early as November 2022, the MIIT issued the 'Circular on Conducting Pilot Projects for the Market Access and Road Operation of Intelligent Connected Vehicles (Draft for Comments),' which, for the first time, explicitly proposed market access management and pilot projects for L3 and L4 autonomous driving vehicles.

Policy Development Initiated in 2022

After a year of refinement, in November 2023, the MIIT and four other ministries jointly issued the 'Circular on Conducting Pilot Projects for the Market Access and Road Operation of Intelligent Connected Vehicles.' This official document clearly stated that autonomous driving vehicles with Level 3 (conditional autonomous driving) and Level 4 (highly autonomous driving) automation functions, after selection by the four ministries, could obtain market access and conduct pilot road operations in restricted areas.

The 'Circular' formally established the joint application model of 'automobile production enterprises + usage entities' and clarified the responsibilities of all parties.

Pilot automobile enterprises are required to possess vehicle production qualifications, capabilities in autonomous driving product design and verification, an enterprise platform for intelligent connected vehicle product safety monitoring services, and a user notification mechanism. The requirements for pilot automobile enterprises are, in essence, the core of market access supervision, imposing detailed and stringent requirements on both the enterprises and their vehicle products.

Pilot usage entities are required to be registered within China, possess independent legal person status, have a pilot vehicle operation safety monitoring platform, and employ vehicle safety officers.

Although the draft for comments did not specify the exact types of usage entities, practical experience indicates that these entities are primarily autonomous driving operation companies, ride-hailing platforms, or mobility service companies affiliated with automobile enterprises. This laid the foundation for the subsequent operational model.

Fast forward to June 2024, the MIIT announced the list of pilot projects for the market access and road operation of intelligent connected vehicles, with nine automobile enterprises selected: Changan, BYD, GAC Group, SAIC Motor, BAIC BluePark, FAW Group, SAIC Hongyan, Yutong Bus, and NIO.

List of Nine Selected Automobile Enterprises Announced in 2024

The list did not feature individual automobile enterprises but strictly adhered to the 'automobile production enterprises + usage entities' pairing, in line with the requirements of the 'Circular.' Moreover, the legal entities paired with the automobile enterprises were mostly directly controlled or participated in by the automobile enterprises themselves.

This arrangement sends a clear signal: in the early stages of autonomous driving vehicle operation, the primary focus will be on B2B markets such as Robotaxi, autonomous passenger transport, and freight transport. This is not only for safety and controllability but also provides a buffer period for technology verification and business model exploration.

It should be noted that at that time, inclusion in the pilot project list only represented passing the initial selection and did not mean final road operation approval had been obtained.

Now, with these two models quietly operating on pilot sections in Beijing and Chongqing, another reality of China's intelligent driving is becoming evident: the commercialization of L3 autonomous driving is now within reach and is no longer a distant concept.

-END-