Guangzhou Auto Show still has fuel vehicles, provided they have good transmissions

![]() 11/18 2024

11/18 2024

![]() 458

458

As the 2024 Guangzhou Auto Show approaches, users have grown accustomed to new energy vehicles being the main attraction. However, fuel vehicles have not yet disappeared. For instance, in the price range of around RMB 200,000, there is the traditional economical Volkswagen Tanyue L. Expanding to the RMB 300,000 range, there are also the newly upgraded Audi A4L (newly named Audi A5L) and the new Lexus ES, among others. But there's a prerequisite: these fuel vehicles that can still stir up the market are backed by sufficiently reliable and high-quality conventional transmission technology. Those fuel vehicles that struggled with transmissions in the past have already "voluntarily" exited the Guangzhou Auto Show stage. Even in the future, if fuel vehicles engage in price wars, will they still be eligible to participate?

Fuel vehicles: Only Volkswagen under RMB 200,000, and Toyota disrupts the market above RMB 200,000?

Internal combustion engine technology has been extended with plug-in hybrids and extended-range electric vehicles, and chassis technology remains essential as long as cars need to run on roads. Among the three major components of traditional cars, transmission technology is often seen as the first to be phased out. However, because it's a stagnant technological field, automakers with technological advantages don't have to worry about being surpassed by similar models. In other words, in this era of rapid iteration, fuel vehicles have become the clearest choice.

For example, in the economical fuel vehicle segment under RMB 200,000, Volkswagen's dual-clutch technology, represented by its models, has basically surpassed those equipped with CVT and AT transmissions in the same class. From the initial backlash against the DQ200's jerkiness, earning it a spot on the "315" list, and the DQ250's oil leakage issues, to its current standing after over a decade of market testing and continuous improvements. In fact, Volkswagen's dual-clutch technology focuses on two core aspects.

First, it's sufficiently fuel-efficient. The 7-speed dual-clutch can engage 7th gear at speeds up to 60 km/h, showcasing aggressive upshifting and high transmission efficiency that hydraulic torque converter AT transmissions struggle to match. Moreover, within the RMB 200,000 range, AT transmissions typically have a maximum of 6 forward gears, capping their potential.

Second, repairs are relatively inexpensive. Taking the DQ200 as an example, replacing the entire assembly costs just over RMB 10,000. And if issues are caught early, and only involve the valve body, seals, etc., it can be even cheaper. Of course, this is partly due to the marginal effects of Volkswagen's sales volume. But compared to the replacement cost of Nissan's CVT, renowned for its economy, Volkswagen's dry dual-clutch even has certain advantages. This demonstrates that after switching to DSG, Volkswagen's control over vehicle costs has aligned with Japanese CVT products, and with its technological advantages, it has more confidence in engaging in price wars.

However, Volkswagen once "abandoned" the high-priced Aisin 6AT solution from Toyota. Today, Toyota products primarily use THS power split technology in the economical segment. However, their deeply entrenched AT transmission technology has not been abandoned. Specifically, the torque converter of the AT transmission is removed to make it more efficient and better suited for the role after the addition of an electric motor.

On a smaller scale, Toyota might have been inspired by Mazda's 6AT, which uses a semi-torque converter design. On a larger scale, Mercedes-Benz and BMW's AT technologies have also started integrating P2 motors at the front end of their transmissions. However, like Toyota, integrating a P2 motor into a transversely mounted AT transmission is rare. Currently, this technology can only cover some Crown series models in the RMB 300,000 range or more expensive Lexus transversely mounted platform models like the Lexus RX. The new Lexus ES at this auto show technically has no issues with using this transversely mounted 2.4T+6AT setup, indicating that Toyota still has aces up its sleeve. As for longitudinal mounting, it's even simpler. The Prado's longitudinal 2.4T+8AT uses the same technical logic, which is even closer to Mercedes-Benz and BMW's approach in terms of framework.

Is it easier for fuel vehicles to adopt hybrids if they have good transmissions?

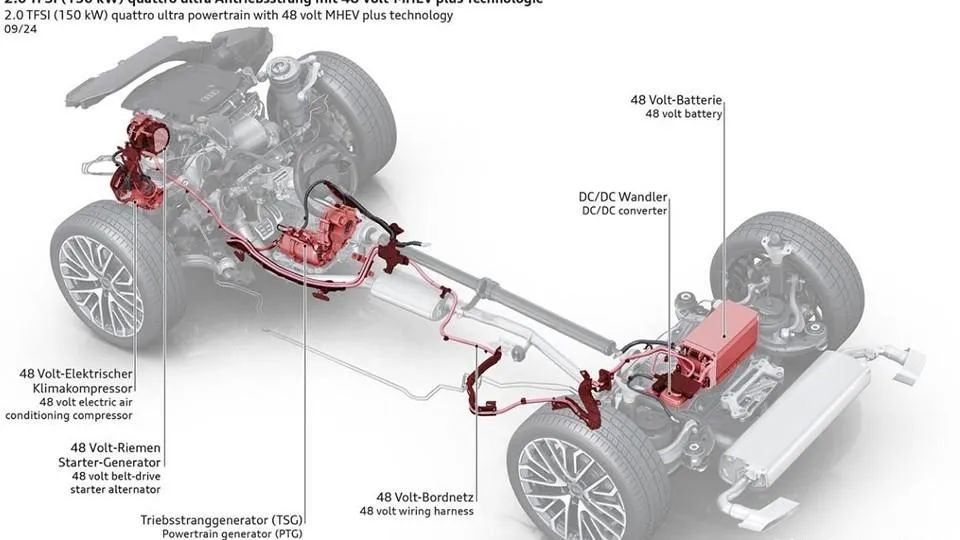

The emphasis on transmissions is because this issue may not be avoidable in the short term. After all, even if opting for electrification, a good transmission foundation can reduce many headaches. As mentioned earlier, the P2 architecture must be based on a conventional transmission. BMW has the ZF 8AT, and Mercedes-Benz has its own 9AT. Even Audi, like BMW, holds a position in tuning the ZF 8AT source code for its high-performance vehicles. The new Audi A4L (A5L) and the all-new Audi Q5, which use longitudinal dual-clutch transmissions, are also expected to use a P0+P3 architecture on a special longitudinal 4WD platform, bypassing the constraints of P2. We will provide a detailed analysis of this technology when the new plug-in hybrid models arrive.

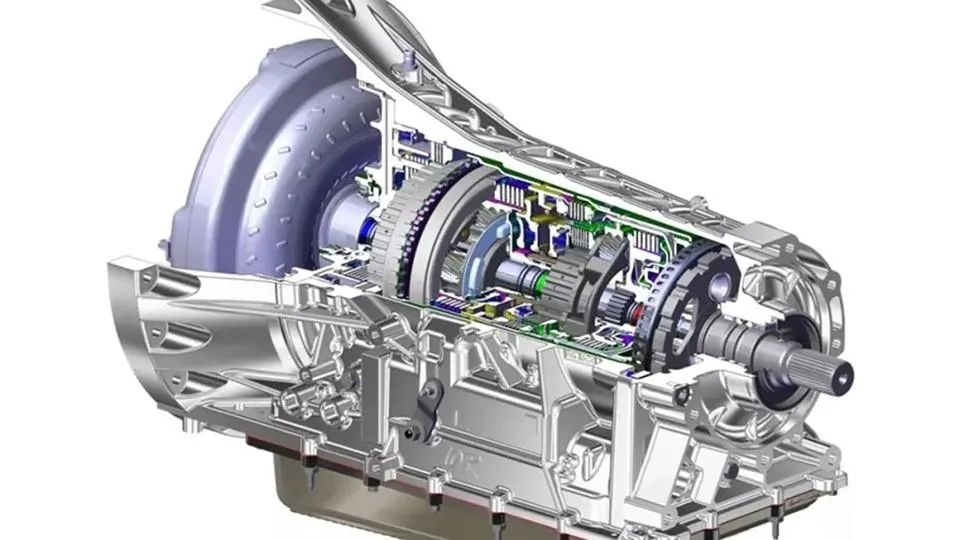

Returning to AT transmission technology, as most automakers, excluding Volkswagen's dual-clutch and Japanese CVTs, focus on AT transmissions. Taking Mercedes-Benz (9AT) and BMW (ZF 8AT) as examples, the gear ratio difference between 1st and 2nd gear is at least 1.5 for both transmissions, with Mercedes-Benz even exceeding 2. Despite having different numbers of forward gears, both transmissions land at a gear ratio of around 1.66 in 4th gear and reach a gear ratio of 1 in 6th gear. In comparison, the General Motors 9AT has a 1-2 gear ratio of just over 1.3 and doesn't reach a gear ratio of 1 until 7th gear.

Clearly, the latter's lower gears are relatively closely spaced, not fully leveraging the advantage of having many forward gears. This is mainly due to shortcomings in the transmission's low-speed shifting logic tuning, necessitating a reduction in gear ratio differences in the design to mitigate shifting jerkiness. This design logic is evident in American AT transmissions. Even though General Motors has increased the number of gears to 10AT, its gear ratio range is still on par with the ZF 8AT.

This overly dense low-gear design becomes even more awkward when the concept of a P2 motor is introduced. The characteristic of electric motors delivering maximum torque from the outset accelerates the transition through lower gears. The ZF 8AT, which can support a 2nd gear start in a fuel vehicle logic, becomes too easy in this context. Moreover, under the original condition of overly dense low gears, the ability to quickly shift gears is required, but this is not easily achievable with complex designs.

More importantly, these drawbacks are now irreversible. As AT transmissions evolve to the 10AT level, with the exception of Honda, which dared to rebuild its parallel-axis technology (Honda's 10AT is not available in China), automakers like Toyota, Hyundai, Ford, and General Motors primarily base their AT transmissions on their 6AT or even 4AT foundations.

Therefore, in blocking the P2 architecture, these automakers are more likely to adopt a 48V mild hybrid motor in the P0 position to delay the impact of emissions regulations on their products. Additionally, they may switch to the P1+P3 architecture, which is similar to China's mainstream plug-in hybrid technology path. Of course, Ford may also choose a direction similar to Toyota's THS power split technology, which is also broadly considered a P1+P3 approach. Moreover, Ford and Toyota's hybrid systems have their own historical connections, but we won't delve into that here. Ultimately, at this stage, it's more accurate to say that automakers are making passive choices due to the insufficient depth of transmission technology rather than actively selecting technologies.