BAIC BJEV's loss dilemma: Over 50 billion yuan of 'blood transfusions' lost more than half in four years

![]() 11/19 2024

11/19 2024

![]() 623

623

In early November, BAIC BJEV (600733.SH) saw a surge in its share price, gaining two daily limit-ups, driving its share price back to its high point for the year. However, due to the lack of performance support, the share price struggled to maintain its momentum, and since November 12, BAIC BJEV's share price has retreated. As of November 15, when this article was written, BAIC BJEV was trading at 9.09 yuan per share, down 0.76%.

Securities Star has noticed that in the first three quarters of this year, BAIC BJEV remained deeply entrenched in losses, with revenue growth failing to translate into actual profits. Behind the losses, BAIC BJEV's cost pressures are difficult to alleviate, and the fiercely competitive market environment further compresses profit margins. Even with sales growth in the first three quarters, it failed to change the reality of losses. More critically, BAIC BJEV is also burdened with tens of billions of yuan in interest-bearing liabilities, exacerbating financial pressures amidst losses. Since 2018, BAIC BJEV has relied on capital market financing and government subsidies to stay afloat, receiving over 50 billion yuan in financial support. However, since 2020, losses have totaled 27 billion yuan, more than half of the 'blood transfusions' received.

In terms of brand operations, BAIC BJEV is also under significant pressure. The highly anticipated ARCFOX S9 performed modestly after its launch, with sales figures remaining low-key. So far, only 2,169 deliveries were clearly disclosed in September, but this also signals that sales performance fell short of expectations. Additionally, the current sales growth engine, the ARCFOX brand, also faces issues related to safety and insolvency.

01. Revenue increased but profits decreased in the first three quarters

According to the disclosed third-quarter report, BAIC BJEV achieved revenue of 9.818 billion yuan in the first three quarters, an increase of 5.49% year-on-year, primarily driven by sales growth.

Production and sales data for September showed that BAIC BJEV's subsidiary, Beijing Electric Vehicle Co., Ltd. (hereinafter referred to as "BAIC BJEV"), produced 55,500 vehicles in the first three quarters, up 377.81% year-on-year; sales during the same period totaled 67,800 vehicles, up 23.92% year-on-year. Among them, ARCFOX sales exceeded 10,000 vehicles in consecutive months recently, with cumulative sales of 46,700 vehicles in the first three quarters, up 210% year-on-year, driving sales growth.

It is worth mentioning that despite a significant year-on-year increase in sales, revenue only achieved single-digit growth. BAIC BJEV explained that on the one hand, ARCFOX S9 was launched in August 2024 and is still in the sales growth phase, having a minimal impact on third-quarter revenue. On the other hand, competition in the new energy vehicle market has intensified, leading to an increasingly fierce price war.

However, the revenue growth did not translate into increased profits, resulting in a situation where BAIC BJEV's revenue increased but profits did not. In the first three quarters, BAIC BJEV's net profit attributable to shareholders was a loss of 4.491 billion yuan, down 38.14% year-on-year. BAIC BJEV stated that the decline in profits was mainly due to a year-on-year decrease in gross profit and increasing investments in research and development and brand channel construction.

A closer look reveals that in the competition for market share, BAIC BJEV places high importance on marketing, with sales expenses being the largest expenditure item. Its sales expenses in the first three quarters amounted to 1.524 billion yuan, up 0.62% year-on-year. During the same period, the company's research and development expenses also increased significantly by 44.57% year-on-year to 1.098 billion yuan.

In addition to periodic expenses, BAIC BJEV's profitability is constantly being compressed amidst the price war among automakers. In the first three quarters, its comprehensive gross profit margin declined by 1.74 percentage points year-on-year, falling from -4.94% in the same period last year to -6.68%.

Securities Star has noticed that although BAIC BJEV achieved revenue growth in the third quarter, its quarterly loss further worsened. In Q3, it achieved revenue of 6.077 billion yuan, up 71.78% year-on-year, with quarterly revenue 1.6 times that of the previous two quarters; net profit attributable to shareholders was a loss of 1.92 billion yuan, down 50.99% year-on-year, following losses of 1.016 billion yuan and 1.555 billion yuan in Q1 and Q2, respectively.

02. Relying continuously on 'blood transfusions' to relieve pressure

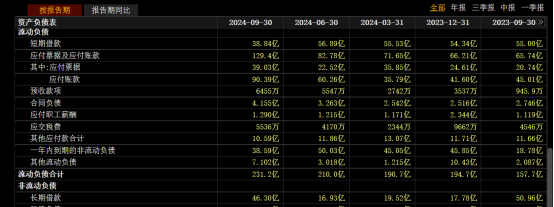

Amidst deep losses, BAIC BJEV is also facing financial tightness. As of the third quarter, BAIC BJEV had 3.716 billion yuan in monetary funds on its balance sheet, along with 3.884 billion yuan in short-term loans and 3.859 billion yuan in non-current liabilities due within one year. At the same time, BAIC BJEV's long-term loans amounted to 4.63 billion yuan, and its total interest-bearing liabilities reached tens of billions of yuan, creating a huge funding gap that is difficult to fill.

Under the pressure of debt, BAIC BJEV's debt ratio is also rising. As of the third quarter, its asset-liability ratio reached 92.31%, an increase of 20.19 percentage points year-on-year, setting a record high since its backdoor listing in 2018. At the end of the first half of this year, BAIC BJEV's asset-liability ratio was 85.02%, having not yet surpassed the 90% threshold.

Due to continuous 'ischemia,' BAIC BJEV has resorted to financing multiple times to 'replenish blood.' From 2018 to 2023, BAIC BJEV conducted four private placements, with actual fundraising amounts of 28.662 billion yuan, 1.034 billion yuan, 5.45 billion yuan, and 6.03 billion yuan, respectively, totaling 41.176 billion yuan.

In addition, the amount of government subsidies received by BAIC BJEV in recent years has been noteworthy. According to incomplete statistics, from 2018 to 2023, BAIC BJEV received a total of approximately 10.493 billion yuan in government subsidies. On March 2 and June 13 of this year, BAIC BJEV received subsidy funds of 129 million yuan and 25.54 million yuan, respectively. The total amount of the above government subsidies reached 10.648 billion yuan.

Securities Star has noticed that since 2018, BAIC BJEV has received over 50 billion yuan in financing and government subsidies from the capital market. However, since 2020, its cumulative losses have reached 27.082 billion yuan. Despite frequent 'blood transfusions,' BAIC BJEV's continuous losses have made it difficult to solve its shortage of funds.

With a mountain of debt, BAIC BJEV finds it challenging to 'transfuse blood' to relieve the financial distress of BAIC BJEV. To this end, the company plans to introduce tens of billions of yuan in strategic investments to ease financial pressure. Among them, BAIC BJEV's shareholder, Beijing Automotive Group Co., Ltd., will directly invest an additional 2 billion yuan in BAIC BJEV, while an additional 10 billion yuan will be raised through the issuance of new shares to strategic investors via public listing on the Beijing Equity Exchange.

03. Hidden concerns regarding major brands

Having been mired in losses for more than four consecutive years, ARCFOX, a collaboration with Huawei, is seen by the outside world as the key to BAIC BJEV's return to growth. In the first three quarters of this year, Thalys (601127.SH), which holds Wenjie, has already achieved profitability.

According to data released by BAIC Group, ARCFOX S9 delivered 2,169 vehicles in September, with no official disclosure of delivery data for August and October. Regarding October deliveries, BAIC Group only stated that ARCFOX S9 had topped the sales of pure electric sedans priced above 400,000 yuan for eight consecutive weeks. Data from Dongchedi and Chezhijia show that ARCFOX S9 sold 758 vehicles in October. If the third-party data is true, the sales performance of ARCFOX S9 is hardly optimistic.

Compared to the Zhijie R7, which was launched on September 24, ARCFOX S9 performed modestly. From September 24 to 28 alone, Zhijie R7 received over 11,000 large orders, exceeding 30,000 large orders within 33 days of its launch, with 4,730 deliveries in October. In contrast, ARCFOX S9 received just over 8,000 large orders in its first 20 days on the market.

The lukewarm sales of ARCFOX S9 may be related to the current market environment. According to data from the China Passenger Car Association, models priced above 400,000 yuan accounted for 5% of domestic retail sales in 2023 and 3% in September this year, showing a declining sales share.

Some analysts have also pointed out that the currently available models of ARCFOX S9 are all pure electric, with no extended-range versions. Even though the long-range version boasts a driving range of over 800 kilometers, for practical use, the actual driving range may only reach about 70% of the stated 800 kilometers. An investor bluntly stated on an interactive platform that the reason for the sluggish sales of ARCFOX S9 is likely due to it being a pure electric executive sedan, expressing the hope that an extended-range version of ARCFOX S9 will be launched soon.

In addition to competing with similar new energy vehicles, ARCFOX S9 also faces direct competition with traditional luxury cars such as the BMW 5 Series, Mercedes-Benz E-Class, and Audi A6L, facing considerable pressure. Whether ARCFOX S9 can ultimately help BAIC BJEV emerge from its loss quagmire will depend on future market performance.

Securities Star has noticed that in addition to ARCFOX S9, BAIC BJEV's autonomous high-end brand ARCFOX, while experiencing sales growth, also harbors many hidden concerns. In July of this year, some ARCFOX models were recalled due to quality issues, involving 3,418 units of the Alpha T and Alpha S pure electric vehicles produced between November 2, 2021, and June 10, 2022. Earlier this year, ARCFOX was also exposed by ecns.cn for potential ESP pump oil leakage risks in its models.

Data shows that in the first half of this year, Beijing Blue Valley ARCFOX Automobile Technology Co., Ltd. (hereinafter referred to as "ARCFOX Automobile") had total assets of 2.904 billion yuan and net assets of -8.97 billion yuan, with a net loss of 1.45 billion yuan during the same period. Based on this, ARCFOX Automobile's liabilities in the first half of this year amounted to 11.874 billion yuan, approximately four times its total assets. Despite significant sales growth, losses and insolvency continue to cast uncertainty over ARCFOX's future development. (This article was originally published on Securities Star, written by Lu Wenyan)

- End -