After 20 years of seeking an IPO with no results, will Chery finally 'not be polite' and go public next year?

![]() 11/20 2024

11/20 2024

![]() 552

552

"We continuously strive to be 'not polite' to ourselves, constantly challenge 'not being polite,' and consistently deliver on 'not being polite.'" Yin Tongyue spoke confidently to the media at this year's Guangzhou Auto Show, stating that Chery will be less polite in its strategies for new energy and intelligence next year, but he did not continue discussing the unsuccessful IPO efforts spanning two decades.

However, Chery Holdings recently announced that it has chosen CICC, GF Securities, and Huatai International to handle matters related to its potential IPO, with the goal of listing in Hong Kong in 2025, with a valuation potentially exceeding $14 billion (approximately RMB 100 billion).

This news has not yet been officially responded to by Chery, but it aligns with public statements made by Chery's leader, Yin Tongyue.

Why has Chery chosen to list in Hong Kong in 2025?

Currently, the IPO market in Hong Kong is active, with a relatively short listing cycle, providing a rare opportunity for Chery.

According to the Hong Kong Stock Exchange, as of November 15, the number of enterprises listed in Hong Kong this year has reached 55. In the latest Filing Status Table on domestic enterprises' overseas securities issuance and listing filings released by the CSRC, the number of enterprises with IPO filings at the Hong Kong Stock Exchange reached 83, which is 2.8 times the total of other overseas exchanges.

As a traditional automaker, how Chery can impress investors poses an intangible challenge in its IPO process.

Secondly, it is necessary to avoid the uncertainty of Trump's strategy adjustments regarding the Russia-Ukraine war after he takes office next year, to prevent large fluctuations in sales in the Russian market from affecting export data and financial statements.

Most importantly, over the past two years, Chery's presence in the market has become increasingly strong, with rapid growth in scale, sales, revenue, profits, overseas markets, and other aspects, laying a solid foundation for a high-market-value IPO.

Considering the conditions in place, does Chery's sprint toward an IPO present a promising outlook?

However, it is well-known that the capital market has less interest in traditional automakers. Compared to new energy giants such as Tesla and BYD, as a traditional automaker, Chery has limited advantages to attract investors.

The main one is that for many consecutive years, it has maintained its position as the top domestic automaker in terms of exports.

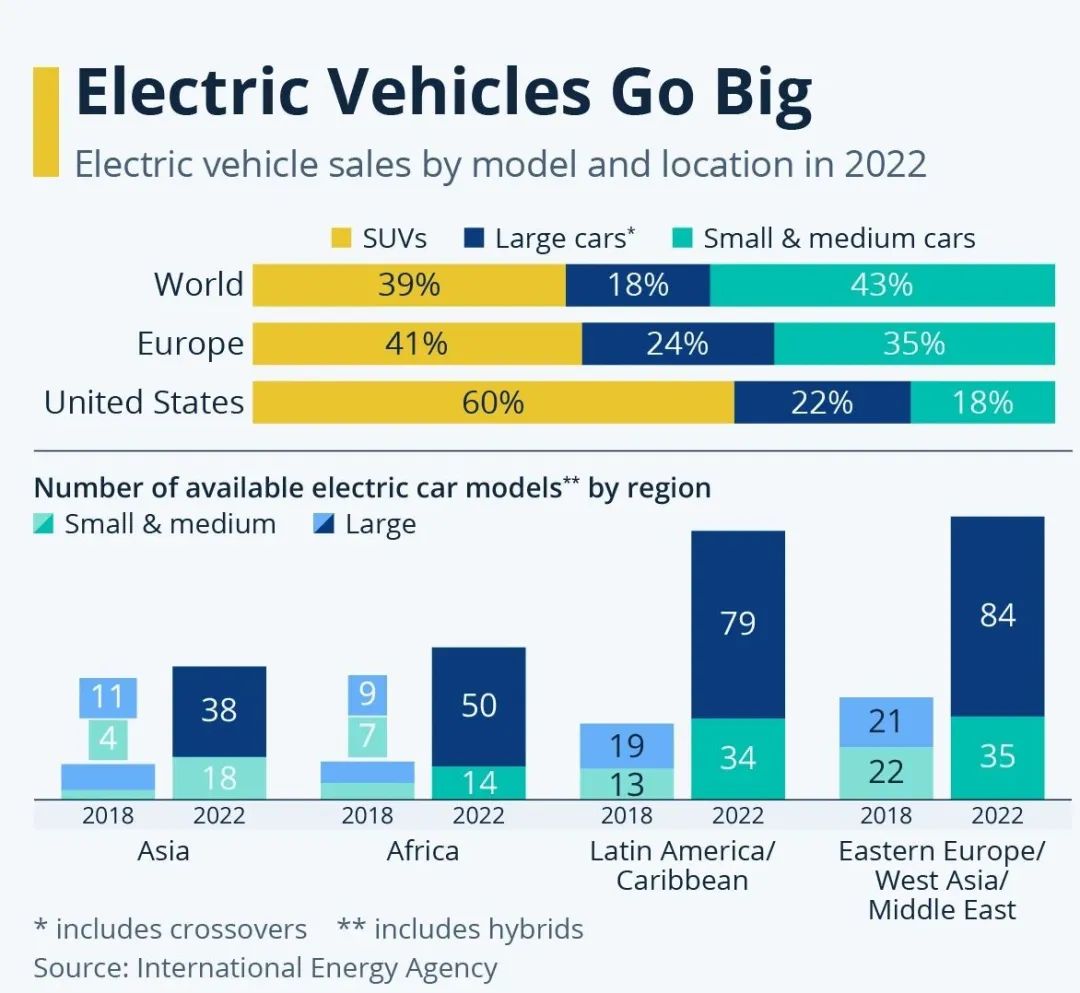

Upon closer inspection, the overseas markets chosen by Chery are primarily Central Asia, South America, the Middle East, and other regions. These regions are generally characterized by a reliance on automobile imports, with fuel vehicles being the mainstream.

(Image: Electric vehicle sales by model and region in 2022, and the number of available electric vehicle models by region in 2018 and 2022)

Once marketing affects export sales, Chery's heavy reliance on the fuel vehicle market and lack of new energy options will become apparent, along with frequent issues in the company's talent development and overtime management systems.

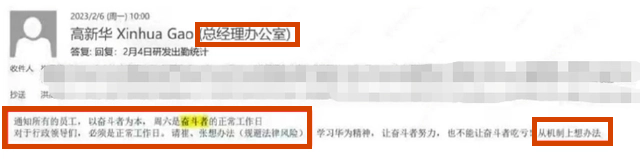

For example, there was once a controversial "email gate incident" where senior executives at Chery required overtime work on Saturdays.

Gao Xinhua wrote in the email, "Those who strive are our foundation, and Saturday is a normal workday for those who strive. For administrative leaders, it must be a normal workday. Please find a way (to avoid legal risks); learn from Huawei's spirit, let those who strive work hard, and don't let them suffer! Find a way from a mechanism perspective."

Subsequently, a netizen certified as a "Chery employee" posted on the MaiMai app confirming that forced overtime does indeed exist within Chery Automobile, with a weekly overtime requirement of more than 20 hours without overtime pay, only a meal allowance of 10 yuan. Additionally, there are strict restrictions on time off in lieu for overtime, with some departments prohibiting time off applications and leave, and implementing a last-place elimination system based on overtime hours.

Topics such as "Chery exposed for forced overtime and inflated working hours" quickly became trending topics on various hotlists and search engines.

By not adhering to the "Labor Law of the People's Republic of China" and the "Provisional Regulations on Wage Payments," will Chery's IPO be affected? Yin Tongyue should be well aware of this.

Abandoning systemic and management issues, how Chery tells its future new energy story is the key to its IPO.

As a traditional mainstream automaker facing the capital market, continuing to promote the concept of fuel vehicles will no longer be effective. The market now demands to hear something new. How Chery New Energy can build a classic new energy brand or produce a "hit product" after ramping up production will play a more significant role in the capital market, which is precisely what Chery lacks.

However, looking at the current sales of Chery ICAR and recalling Chery CEO Yin Tongyue's bold statement that Chery will catch up in the new energy sector, entering the top three by the middle of 2024 and claiming second place by the end of the year, directly chasing BYD,

the result is that BYD's sales have surged, while Chery New Energy has fallen further behind.

This also implies that while sprinting towards an IPO, it is crucial for Chery to continue addressing the weaknesses in its new energy sector, balancing it with the fuel vehicle sector, and gradually supporting its sub-brands to break the perception of low-end products and pursue premiumization. This may be the key to Chery obtaining a good valuation in the capital market.

However, it should be noted that the capital market environment is not a stable factor. Chery once missed an IPO opportunity due to the 2008 financial crisis, and environmental risks still exist at this stage. Whether this IPO attempt will be successful may only be revealed at the last moment when the bell rings.