Clear the timetable for listing: What hurdles does AITO need to overcome?

![]() 11/21 2024

11/21 2024

![]() 533

533

Time waits for no man, like cooking fish

Editor: Yiran

Writer: Chuyi

Source: Shoucai - Shouchao Finance Research Institute

Persistence pays off. Since November, AITO has had a string of good news.

On November 6, the official microblog of the Shanghai United Assets and Equity Exchange released an article titled "Capital Increase Project of AITO Technology (Chongqing) Co., Ltd.", mentioning that "AITO has made clear plans to go public in 2026." Prior to this, Changan Automobile had repeatedly stated that AITO had plans for an independent listing, but had not provided a specific timetable.

On November 19, the Shanghai United Assets and Equity Exchange released another article on the capital increase project of AITO Technology (Chongqing) Co., Ltd. AITO plans to raise no more than 12 billion yuan through a private placement to attract investment.

On November 1, AITO also announced strong sales figures, with October deliveries surpassing 10,000 units to reach 10,056, a doubling year-on-year and month-on-month, demonstrating the market appeal of the AITO 07 model and fueling speculation about future performance.

With so much good news, it seems AITO is on the verge of success. Is this really the case?

1

Debt-to-asset ratio exceeds 94%

Will the annual sales target be missed again?

At least based on the latest half-year report, the situation remains mixed, with much work ahead. Revenues for the first half of 2024 continued to grow strongly, reaching 6.152 billion yuan, exceeding the full-year revenue of 2023 (5.645 billion yuan). However, losses amounted to 1.395 billion yuan. Over a longer period, losses for 2022 and 2023 were 2.015 billion yuan and 3.693 billion yuan, respectively, totaling 7.103 billion yuan in losses over just two and a half years.

Obviously, as one of Changan Automobile's three smart electric vehicle brands and a representative of high-end models, AITO's performance has been unimpressive. How to overcome losses and achieve economies of scale is a serious challenge.

In response, Changan Automobile, the controlling shareholder, explained that AITO is in a strategic investment phase, with significant resource investments in product development, brand promotion, channel development, and the recruitment of technical talent.

With weak self-sufficiency and high investment, the company relies heavily on financing to sustain its operations. According to the Huaxia Times, AITO has completed three rounds of financing from 2021 to 2023, raising a total of about 8 billion yuan. On October 11, 2024, Chen Zhuo, President of AITO Technology, revealed that the company is currently conducting its C round of financing, aiming to raise 10 billion yuan, with a post-investment valuation exceeding 30 billion yuan.

Financing is imperative. As of the first half of 2024, the company's asset-liability ratio was as high as 94.46%.

According to the Huaxia Times, Chen Zhuo stated that in accordance with board requirements, AITO's sales volume should increase by three to four times this year, while controlling losses to remain consistent with the previous year, aiming to achieve break-even in the third and fourth quarters of 2025, which is the goal set by the board.

While the ideal is appealing, reality is often harsh. At least based on the current completion rate of key sales targets, more effort is needed. Although 10,100 units were delivered in October, a year-on-year and month-on-month increase of 256% and 121.6% respectively, cumulative sales for the first ten months were only 51,000 units, compared to the company's annual target of 84,000 units, with a completion rate of only 60.71% as of October. The pressure to meet the target in the remaining two months is immense.

Looking back at 2023, AITO failed to meet its target. Cumulative sales for the year were 27,600 units, only 27.6% of the annual sales target of 100,000 units. Therefore, whether the second-year target will be met is crucial, and whether it will be missed again is a major focus.

To boost morale, AITO has made various efforts. At the beginning of 2024, managers at the director level and above collectively signed new compensation agreements, directly linking the monthly income of management to sales volumes. The aim is to stimulate operational enthusiasm and drive sales growth.

Furthermore, Zhu Huarong, Chairman of Changan Automobile, personally took charge, replacing Tan Benhong as Chairman of AITO Technology in December 2023. Wang Xiaofei, Vice President of Changan Automobile, assisted him in business operations, major project advancements, and key business operations at AITO. Chen Zhuo, the former Senior Executive Vice President of AITO, was promoted to President, taking full responsibility for operational management.

Such attention is justified. As an important part of Changan Automobile's "Third Entrepreneurship - Innovation and Entrepreneurship Plan," and with the responsibility of building an international high-end new energy vehicle brand, AITO is held in high regard. Chairman Zhu Huarong once boldly stated, "As long as AITO needs it, Changan Automobile will fully support it, providing funds, personnel, and technology as needed."

It can be said that AITO, founded in 2018, made a splash with a golden spoon. It boasts the industry's best "CHN" strategic layout, namely Changan Automobile, Huawei, and CATL. In product design, intelligence, battery technology, and funding, it possesses high-end genes. Unfortunately, despite having so many resources, after six years, AITO has yet to fully mature and shoulder the banner of new growth, at least based on the above-mentioned losses. Is it really easier to stay under the big tree?

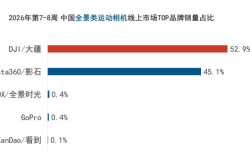

Taking the latest monthly sales as an example, Changan Automobile's independent brand new energy vehicles sold 85,300 units in October and 532,900 units cumulatively in the first ten months, an increase of 46.37% year-on-year. However, the sales share of new energy vehicles accounted for only about 24.72% of total sales, while national retail sales of new energy passenger vehicles reached 1.196 million units in October, with a market penetration rate of 52.9% in the domestic market.

2

A Comprehensive View of Channel Transformation

As an emerging brand focusing on the mid-to-high-end market, AITO initially chose a direct sales model upon establishment. This was beneficial for product quality control, ensuring a unified and stable brand image across stores and enhancing the brand's high-end "aura."

However, the disadvantages are also apparent, as the asset base is heavier, with significant burdens from store construction costs, subsequent rent, labor, and operating costs. As of the first half of 2024, AITO's total assets far exceeded its revenues, reaching 12.746 billion yuan. Coupled with sales falling short of annual expectations and economies of scale still a long way off, AITO is bearing a heavy load.

Therefore, the company made an important decision to lighten itself through channel transformation. According to ECNS, Chen Zhuo once stated that channels are shifting from self-operated to third-party operated, with some self-operated stores retained, making the channel lighter and costs lower.

According to the National Business Daily, AITO will only retain the direct sales model in flagship stores in core first-tier cities, gradually transitioning other cities to a dealer cooperation model. The manager of an AITO center in Liaoning stated, "In my region, all offline AITO stores have switched to third-party operation (dealer model)."

On May 24, the Economic Observer Online confirmed with AITO insiders: "Channel reforms began in early April and have now been largely completed." At that time, over 80% of employees chose to stay at the transformed dealer stores.

It is worth mentioning that AITO's dealer cooperation model differs from the traditional model. Future product prices will still be unified nationwide, and consumers will still place orders and pay through the official app. The difference is that the dealer model will integrate sales and after-sales services.

Regarding this adjustment, Lang Xuehong, Deputy Secretary-General of the China Automobile Dealers Association, stated that AITO's channel adjustment model is similar to that of Xiaopeng Motors previously, namely "direct sales + agency." In addition to factory-built direct sales stores, traditional dealers build stores, with the latter still invoiced by the factory. Dealers are responsible for delivery and after-sales service. Therefore, dealers are authorized for after-sales service, while the sales process follows an agency model.

Industry analyst Wang Yanbo believes that for automakers with both direct sales and dealer agency channels, balancing the interests of both is an unavoidable issue. Additionally, vigorously developing dealers and ensuring subsequent service quality can keep pace with high-end positioning is also a challenge.

From an industry perspective, there are both transformers and adherents. For example, in September 2023, Xiaopeng Motors launched the "Jupiter Plan," with the core measure being to gradually replace the direct sales model with a dealer model. Additionally, NIO plans to open its dealer model to its sub-brand LeDao, while ZEEKR has significantly reduced its direct investment in building official direct sales stores.

Companies like Great Wall Motors and Li Auto are firm adherents to the direct sales model. Li Xiang, CEO of Li Auto, once stated that they would not authorize any agents or dealers and would adhere to the direct sales model to better and faster obtain consumer feedback on products, which is beneficial for product improvement and upgrading, while also effectively controlling prices and profits.

Which approach will ultimately prevail, and where AITO's bold move will lead and how much it will contribute to turning losses into profits, remains to be seen.

3

Behind the Aggressive Push for New Products - Cold Reflections on Cost-effectiveness and Quality-price Ratio

Industry analyst Wang Tingyan believes that changing the channel model can make AITO lighter. However, at a deeper level, continuous losses are still due to weak sales volumes, which are insufficient to support the "heavy asset" model. Therefore, finding ways to boost sales is of paramount importance.

As of the first half of 2024, the company had only launched two models: the AITO 11 introduced in 2022 and the AITO 12 in 2023. Chen Zhuo once stated in a media interview, "In the second half of the year, four products will be available for sale simultaneously through our channels, and the number and capacity of channels will be able to support the sales of new products."

This is not an empty claim. Since the third quarter, Changan Automobile has accelerated the launch of new energy products to boost sales. On September 26, the AITO 07 was officially launched; on October 18, the Changan Qiyuan A07, A05, and Q05 "Zhenxiang" editions were launched; on October 20, the Deep Blue S05 was unveiled; on October 21, the Changan Qiyuan E07 was officially launched; and on November 2, the dual-power version of the AITO 12 was launched. Additionally, a medium-sized sedan (internal code: AITO E16) and new large five-seat and six-seat SUVs will be introduced.

The aggressive push for new products has boosted market performance, as evidenced by the October sales figure exceeding 10,000 units. However, in the remaining two months, both AITO and Changan Automobile's overall new energy vehicle sales targets still face significant challenges.

Ultimately, product experience speaks volumes. Taking the AITO 07 as an example, it is the company's first extended-range electric vehicle. In the new energy vehicle industry, there is a saying that pure electric vehicles can never outsell hybrid vehicles. Whether traditional automakers or new forces, hybrid or extended-range models often sell better than pure electric models. Ideal, AITO, NIO, and others have proven this point with facts.

The significant increase in October sales was a good start for AITO's new product launches, but it does not mean it is flawless. For example, product pricing has started to decline. According to Ecoche.com, the AITO 07 launched a total of six models, including pure electric and extended-range versions, with extended-range versions priced between 219,900 and 279,900 yuan, and pure electric versions priced between 229,900 and 289,900 yuan.

As mentioned above, AITO previously followed a high-end route, with the starting price of its first product, the AITO 11, exceeding 300,000 yuan. Now, with prices starting at the 200,000 yuan range, while expanding the consumer base, it is also worth examining whether this undermines the high-end route.

Furthermore, the hotter the sales, the more it tests a company's comprehensive supply and service capabilities. On October 17, an error in the expected production schedule for the AITO 07 appeared on the lock-in interface of the app. The next day, Chen Zhuo apologized on Weibo, stating, "This is a very serious and basic mistake that has caused misunderstanding and inconvenience. I deeply apologize."

Browsing Black Cat Complaints, as of 18:00 on November 20, 2024, there were a total of 311 complaints related to AITO, with 27 complaints in the past 30 days, mainly focusing on after-sales service. There are also questions about unfulfilled deliveries and bundled insurance sales on Chezhixin.com.

After all, AITO focuses on a high-end positioning and bears the responsibility of Changan Automobile's electric transformation. Facing increasingly fierce market competition, consumers have many choices.

Industry analyst Wang Yanbo stated that for the difficulty in scaling sales, there has been industry voice suggesting that AITO's high-end positioning, with a price range of 300,000 to 600,000 yuan, has led to a lack of resonance. If we follow this logic, the decline in AITO 07 prices is a good thing, but the key is to truly execute it well. In the fiercely competitive and rapidly evolving market, newcomers must focus on cost-effectiveness and quality-price ratios, deliver exceptional product services, and strive to catch up with the industry and secure a share of the pie.

4

A Long Slope with Deep Snow - The Right Time and the Urgency

Few enterprises develop smoothly without setbacks, and temporary difficulties do not mean there is no chance for recovery.

In the long run, relying on the three pillars of Changan, Huawei, and CATL remains AITO's greatest strength. For example, in terms of product details, according to Taiyuan Daily, AITO and CATL recently announced a significant news: The AITO 12 will be the first to equip the latest XiaoYao super hybrid battery from CATL. This 39kWh battery has a peak charging rate of 3C, allowing it to charge to 80% in 15 minutes, 20% faster than similar hybrid models. The refueling experience is comparable to pure electric vehicles, while also demonstrating advantages in power performance, making its future market performance worth anticipating.

Furthermore, relying on Huawei, the HarmonyOS-based intelligent cockpit developed on HarmonyOS 4 provides a more intelligent human-machine interaction experience. The rich online ecosystem can meet a wide range of scenario-based needs for life and work.

In August 2024, AITO announced that it would invest in Huawei's subsidiary, Shenzhen Yinwang Intelligent Technology Co., Ltd., acquiring a 10% stake for a transaction amount of 11.5 billion yuan.

It is foreseeable that as the tie-up deepens, AITO's technological advancements and digital and intelligent driving experience will become important drivers for boosting sales and breaking through the market.

From an industry perspective, China's vast market is still in its infancy, providing AITO with the time and space to catch up. On November 15, 2024, the China Association of Automobile Manufacturers released data showing that China's annual production of new energy vehicles exceeded 10 million for the first time, making China the first country in the world to reach this milestone.

With a long slope and deep snow, the IPO and private placement fundraising mentioned earlier are timely. However, capital is not a panacea, and boosting sales is a systematic project. From technology to channels, from brand cultivation to unique experiences and quality control, AITO still has a long journey ahead, with many hurdles to overcome. Time waits for no man, like cooking fish.

A series of aggressive new product launches, channel transformations, and significant investments are commendable, but whether they can lighten the load and explode the market, achieve annual sales targets in the short term, and overcome losses in the long term remains to be tested by time and the market.

This article is original content from Shoucai

For reprints, please leave a message